This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete

Description

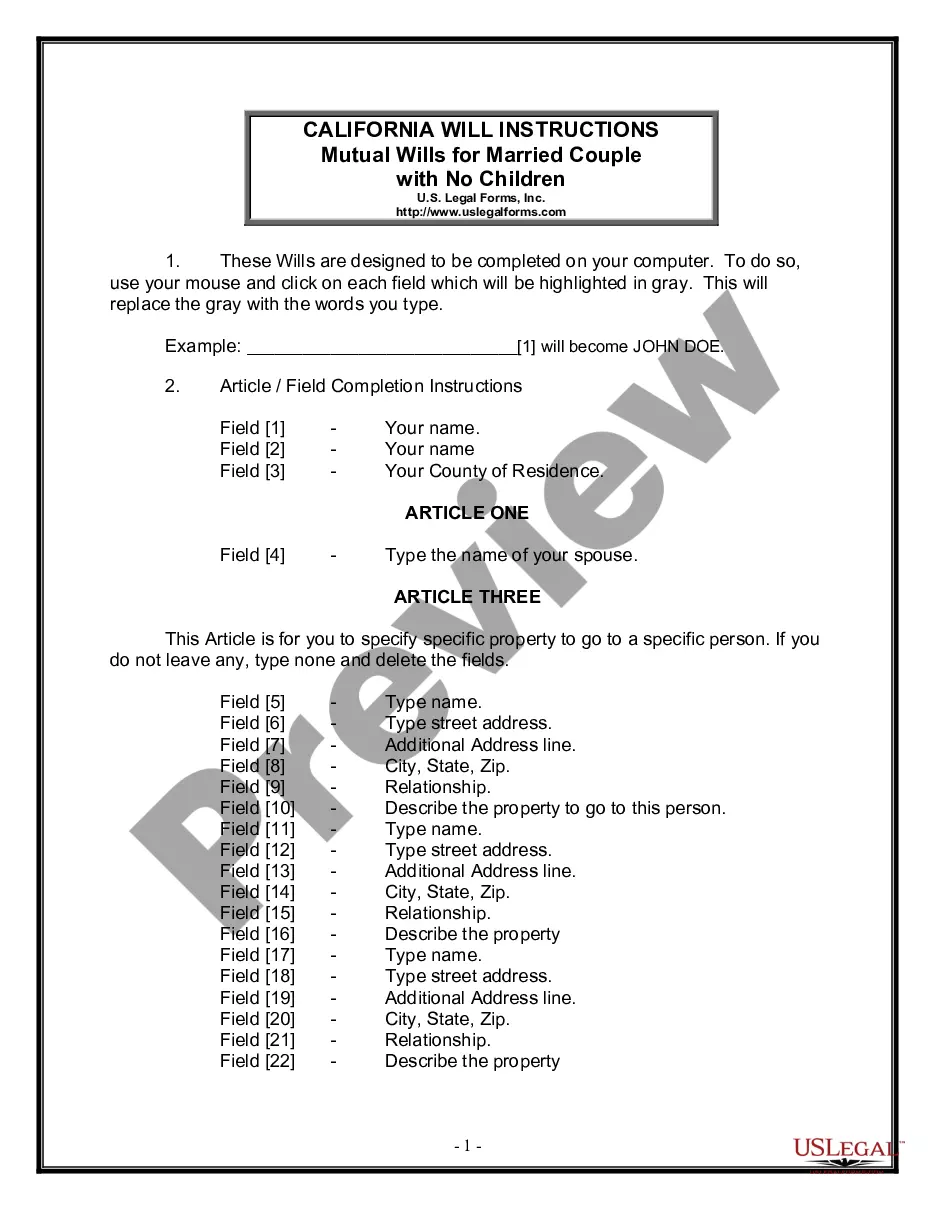

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Confidentiality Agreement And Covenant Not To Compete?

If you want to download, obtain, or print authorized document templates, utilize US Legal Forms, the leading assortment of legal forms available online.

Employ the site's straightforward and convenient search feature to find the documents you need.

Various templates for commercial and personal purposes are categorized by type and jurisdiction, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button.

Step 6. Select the format of the legal form and download it to your device.

- Utilize US Legal Forms to locate the West Virginia Contract with Consultant as a Self-Employed Independent Contractor with Confidentiality Agreement and Non-Compete Clause in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and tap the Download button to obtain the West Virginia Contract with Consultant as a Self-Employed Independent Contractor with Confidentiality Agreement and Non-Compete Clause.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, please follow the instructions below.

- Step 1. Ensure you have selected the form relevant to the correct city/region.

- Step 2. Use the Review option to assess the form's content. Remember to read the description carefully.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

The confidentiality clause for independent contractors ensures that confidential information shared during the contractual relationship remains protected. Under a West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, this clause typically requires the contractor to refrain from disclosing sensitive information to third parties. It creates a secure environment for discussing proprietary information. By clearly outlining these expectations, you can protect your business while enabling your contractor to perform effectively.

Yes, non-disclosure agreements (NDAs) apply to independent contractors, including those under a West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. These agreements protect sensitive information shared during a project. By signing an NDA, independent contractors commit to keeping your information confidential, which fosters trust. Therefore, having this clause in your contract can be essential for safeguarding your business interests.

Non-compete clauses can hold up in court, especially when outlined clearly in a West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. To ensure enforceability, these clauses must demonstrate a reasonable restriction on time and geographic area. Furthermore, courts look for the protection of legitimate business interests. Consulting legal expertise, such as that offered by uslegalforms, can help in drafting clauses that have a better chance of being upheld.

Yes, Non-Disclosure Agreements (NDAs) apply to independent contractors, including those under a West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. NDAs are essential for protecting sensitive information shared during a project. When you work as a consultant, signing an NDA helps you maintain confidentiality and ensures both parties feel secure in their business dealings. This protection is vital for fostering trust and collaboration.

In West Virginia, non-compete agreements can be enforceable under certain circumstances. For a West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete to hold up, it should protect legitimate business interests without being overly restrictive. Courts generally assess factors like duration, geographic scope, and the purpose of the agreement. It's crucial to ensure your contract meets these requirements for effective enforcement.

Yes, non-compete agreements can be enforceable for independent contractors, depending on the specifics of the West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. However, enforceability often hinges on whether the terms are reasonable and if they serve a legitimate business interest. It's wise to seek legal advice to understand your rights fully.

compete agreement may be voided if it is deemed too restrictive in time, geography, or activity scope. Another reason could be if the West Virginia Contract with Consultant as SelfEmployed Independent Contractor with Confidentiality Agreement and Covenant not to Compete was signed under duress or lacking consideration. It’s important to review these clauses carefully with legal counsel.

Getting around a non-compete clause may involve negotiating with the employer for a waiver or exploring modifications in the West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. In some cases, you might argue that the scope of the non-compete is too broad or that it negatively impacts your career prospects.

The non-compete ban can apply to independent contractors, depending on the specific terms outlined in the West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. These agreements should clarify which activities are restricted, and it’s essential to understand how the non-compete affects future job opportunities.

Yes, an independent contractor can have a non-compete clause as part of the West Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. This clause restricts the contractor from working with competitors during and after the contract period. It’s vital to ensure that the terms of the non-compete are reasonable to be enforceable.