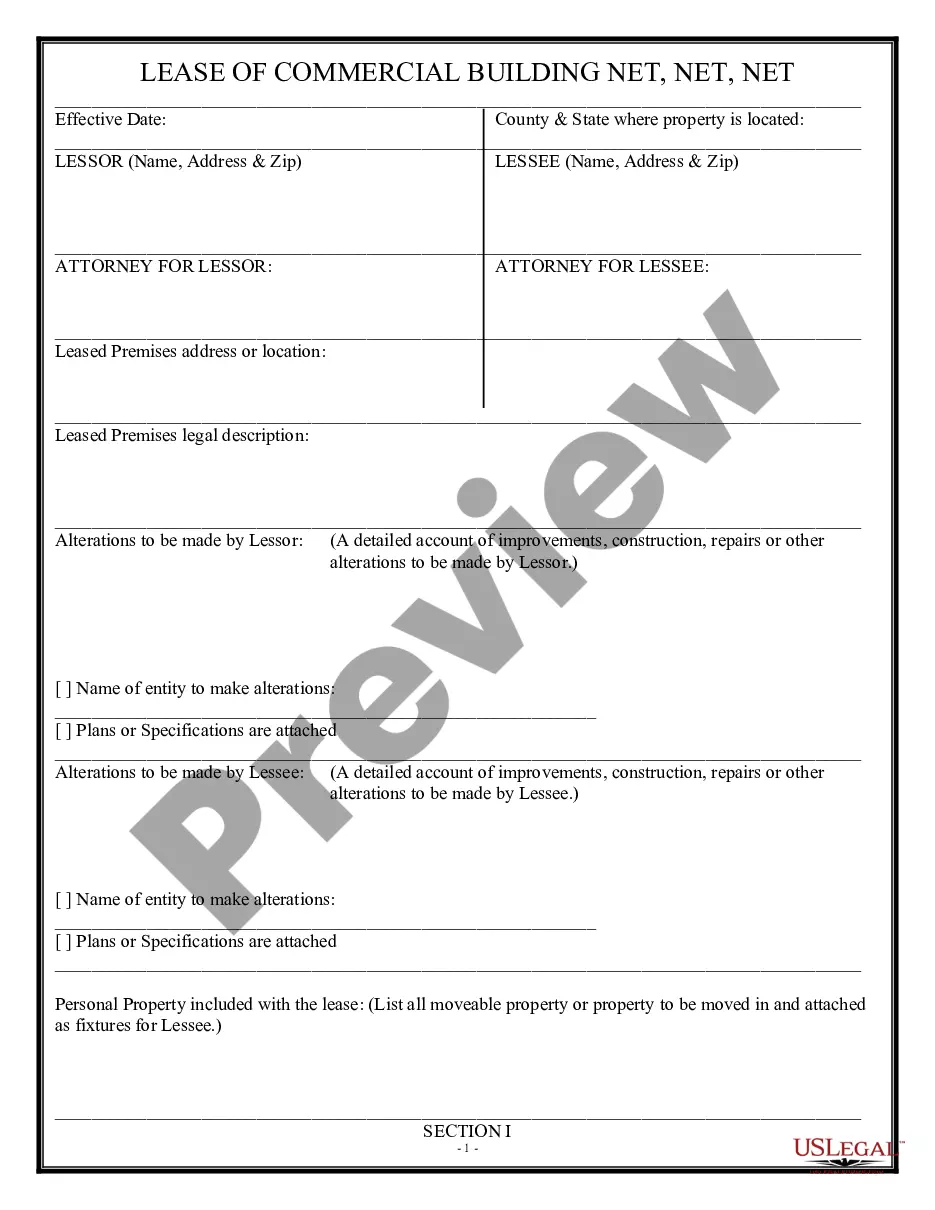

West Virginia Space, Net, Net, Net - Triple Net Lease

Description

How to fill out Space, Net, Net, Net - Triple Net Lease?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms such as the West Virginia Space, Net, Net, Net - Triple Net Lease within minutes.

If you are already a member, Log In and download the West Virginia Space, Net, Net, Net - Triple Net Lease from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Make changes. Fill out, modify, print, and sign the downloaded West Virginia Space, Net, Net, Net - Triple Net Lease.

Every template added to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you desire. Access the West Virginia Space, Net, Net, Net - Triple Net Lease with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs.

- If you want to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the appropriate form for the city/state. Click the Review button to examine the form's details. Read the form summary to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and provide your details to register for the account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

The surviving spouse deduction in West Virginia allows eligible individuals to benefit from a tax deduction in the year their spouse passes away. This deduction can significantly ease the financial burden during a challenging time. For those involved in real estate or the West Virginia Space, Net, Net, Net - Triple Net Lease market, understanding this deduction can be crucial for effective financial planning. Tools like uslegalforms can help simplify the application of this deduction.

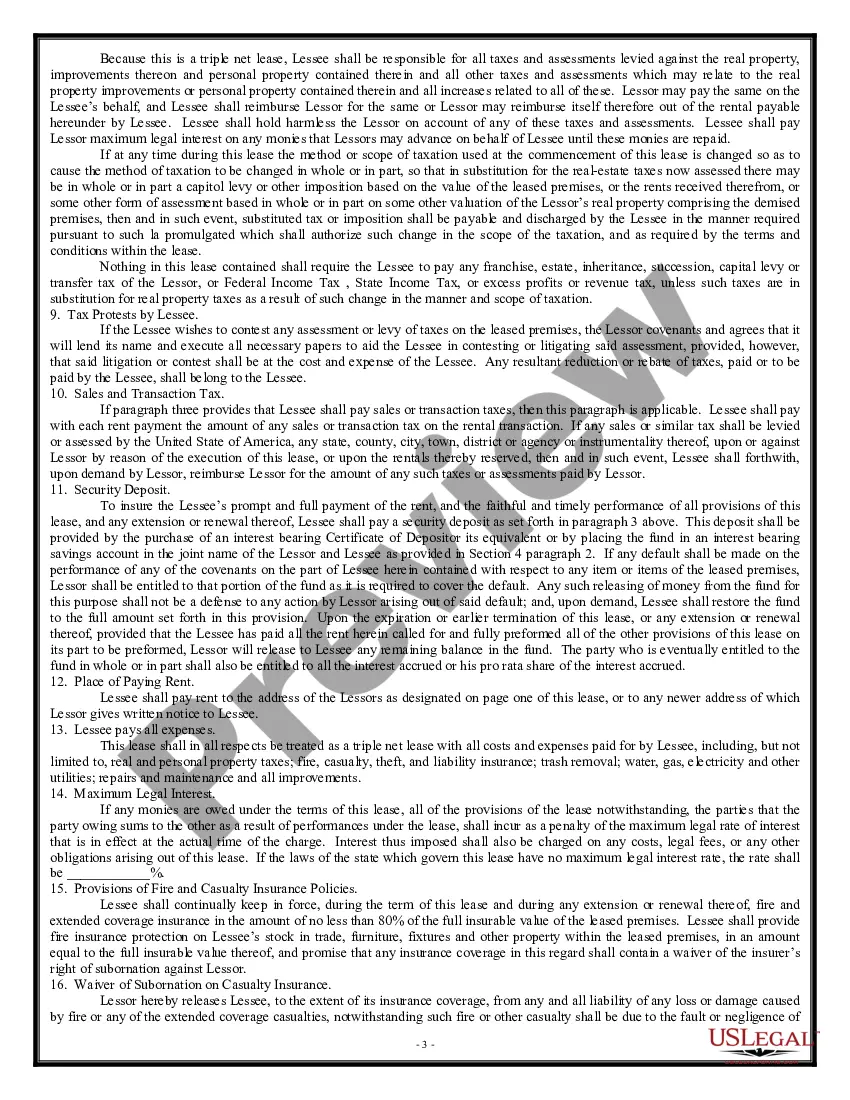

Yes, you generally need to file a West Virginia tax return if you earn income in the state, regardless of your residency status. This requirement includes rental income from properties utilizing a West Virginia Space, Net, Net, Net - Triple Net Lease structure. Filing your tax return ensures compliance and helps you take advantage of any applicable deductions. You can rely on uslegalforms for efficient filing options and guidance.

The NOL limitation, or Net Operating Loss limitation, in West Virginia restricts how much of your business losses you can claim in a given tax year. It’s essential for anyone dealing with commercial real estate, especially in the context of West Virginia Space, Net, Net, Net - Triple Net Lease investments. Being aware of this limitation can significantly affect your overall tax situation. For detailed insights, consider exploring uslegalforms for compliant tax document solutions.

In West Virginia, 86 272 refers to a legal form related to the State Tax Department's regulations. It specifically addresses tax deductions and credits for business owners and investors within the state. Understanding this form is crucial for any individual involved in the West Virginia Space, Net, Net, Net - Triple Net Lease market, as it can affect your financial strategy. Utilizing resources like uslegalforms can simplify the process of navigating these regulations.

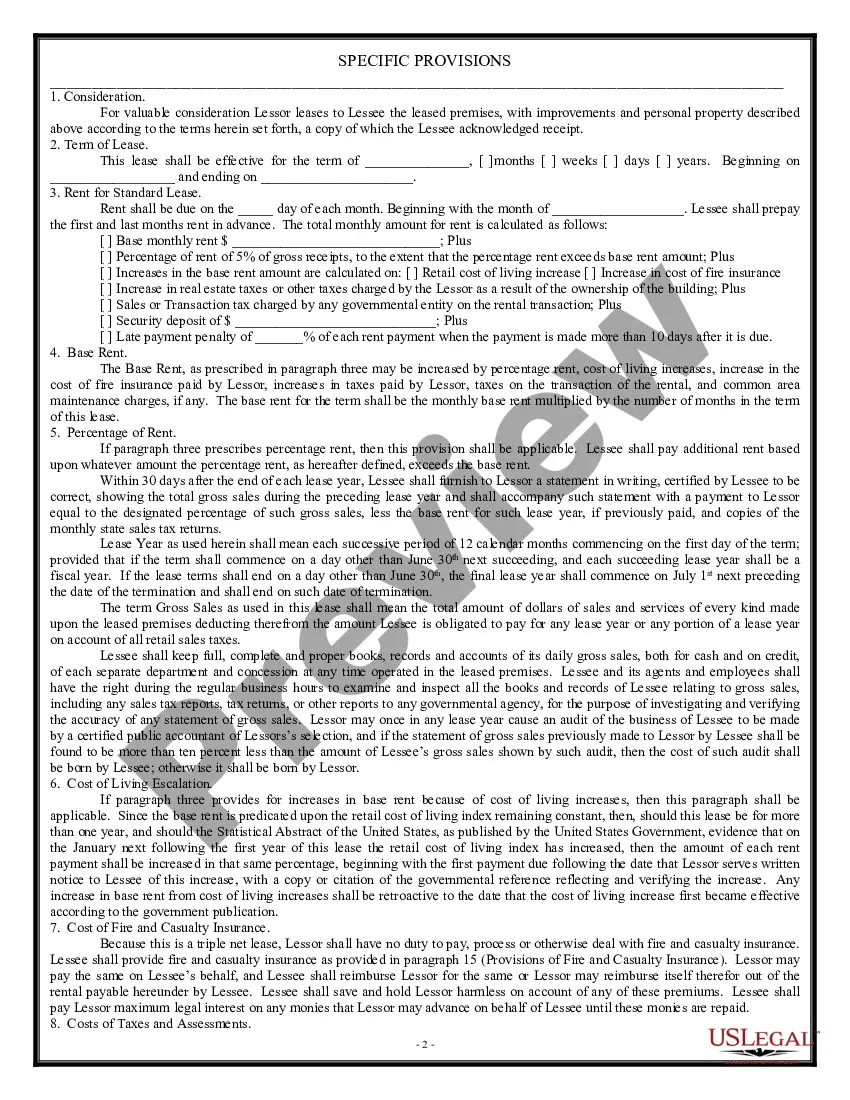

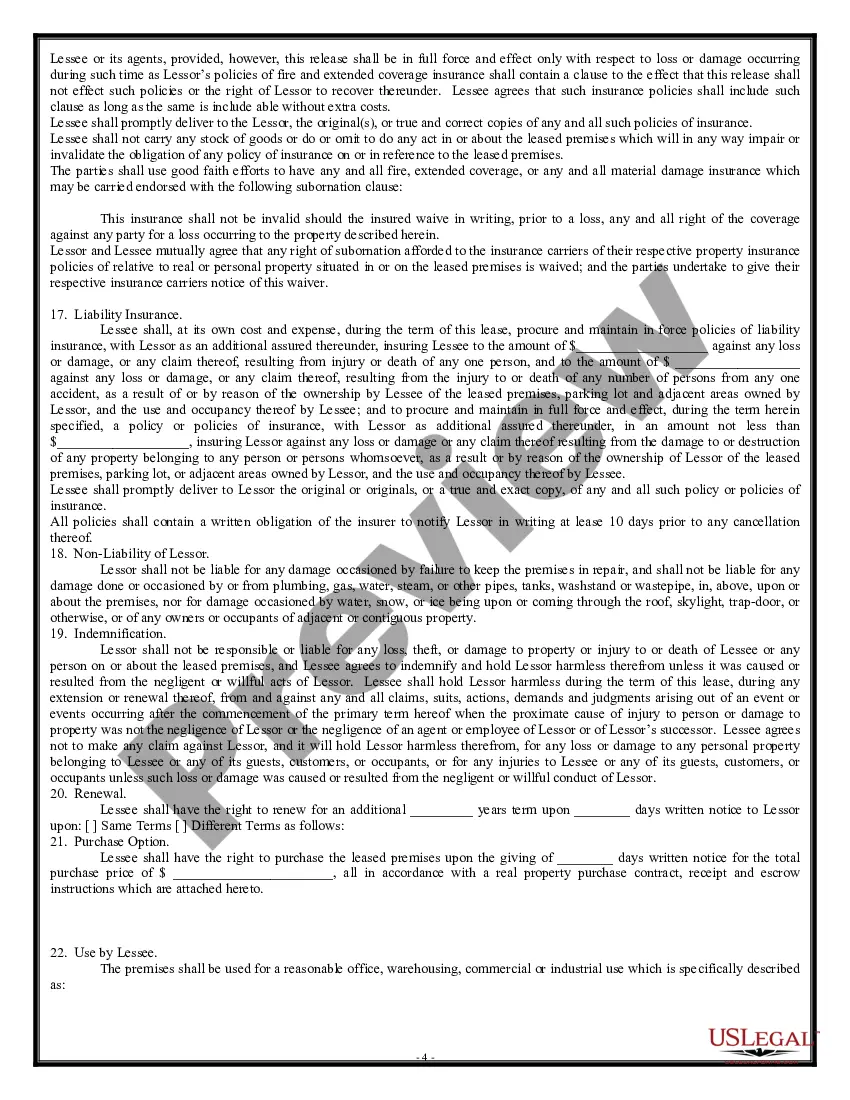

When it comes to West Virginia Space, Net, Net, Net - Triple Net Lease, the key difference lies in the responsibilities assigned to the tenant. In a net net lease, the tenant typically pays for property taxes and insurance, while the landlord remains responsible for maintenance. Conversely, a triple net lease extends the tenant's responsibilities to include maintenance costs, making it more comprehensive. Understanding these distinctions can help you make informed decisions in commercial real estate.

To structure a triple net lease, also known as West Virginia Space, Net, Net, Net - Triple Net Lease, you start by clearly defining the terms in the lease agreement. This includes the base rent, the tenant's responsibility for property taxes, insurance, and maintenance costs. It is crucial to specify which operating expenses the tenant will cover to avoid disputes. By outlining these responsibilities, both parties can have a clear understanding of their obligations.

To qualify for a triple net lease, landlords typically assess the tenant's financial stability and business track record. They look for tenants who can reliably manage the additional expenses associated with a West Virginia Space, Net, Net, Net - Triple Net Lease. Providing financial statements and references can enhance your application and showcase your ability to fulfill the lease obligations.

Finding a triple net lease can start with searching on real estate listing websites, where commercial properties are often advertised. You can also work with a real estate agent who specializes in commercial properties, specifically in the West Virginia Space, Net, Net, Net - Triple Net Lease sector. Networking within real estate investment groups may uncover opportunities that fit your needs.

To account for a triple net lease, you need to track the rent received along with any additional costs passed on to the tenant. This includes property taxes, insurance, and maintenance fees. In the case of a West Virginia Space, Net, Net, Net - Triple Net Lease, you should record these expenses separately to understand your net income clearly. Consult with an accounting professional to ensure compliance and accuracy.