West Virginia Contract between General Agent of Insurance Company and Independent Agent

Description

In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

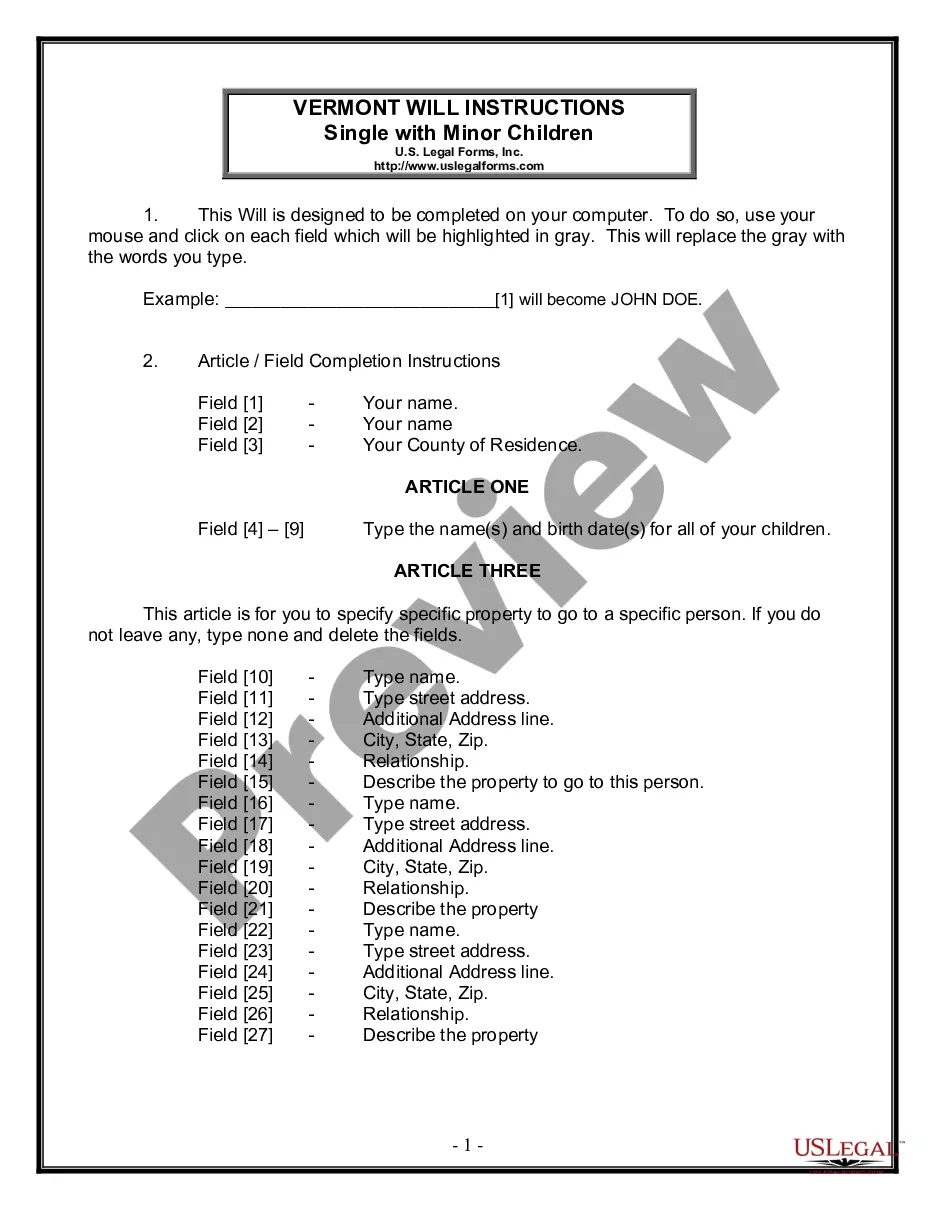

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

If you need to compile, obtain, or print legal document templates, utilize US Legal Forms, the premier compilation of legal forms accessible online. Use the site’s straightforward and user-friendly search to find the documents you require.

Various templates for commercial and personal applications are categorized by type and state, or keywords. Use US Legal Forms to locate the West Virginia Contract between General Agent of Insurance Company and Independent Agent in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the West Virginia Contract between General Agent of Insurance Company and Independent Agent. You can also access forms you previously downloaded in the My documents section of your account.

Every legal document template you purchase is yours indefinitely. You will have access to all types you have downloaded within your account. Click the My documents section and choose a form to print or download again.

Stay competitive and acquire, then print the West Virginia Contract between General Agent of Insurance Company and Independent Agent with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the page to find alternative models in the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the West Virginia Contract between General Agent of Insurance Company and Independent Agent.

Form popularity

FAQ

In West Virginia, the legal requirements for insurance include obtaining the appropriate licenses, completing pre-licensing education, and passing a state exam. Additionally, insurance agents must adhere to the state’s laws and regulations, ensuring compliance in their operations. Understanding the West Virginia Contract between General Agent of Insurance Company and Independent Agent is also essential, as it outlines the obligations and relationships between agents and insurance companies.

While different people find various exams challenging, many believe that the property and casualty insurance exam tends to be among the hardest to pass due to its breadth of topics. This exam requires a strong understanding of multiple insurance systems and regulations. In contrast, knowing the nuances of the West Virginia Contract between General Agent of Insurance Company and Independent Agent might give you an advantage, as it shows a comprehensive understanding of the state's insurance processes.

The state insurance exam in West Virginia typically includes 100 questions, covering various topics pertinent to insurance practices. These questions evaluate your understanding of insurance principles, state laws, and ethical practices. Adequate preparation is key to passing, especially when considering the nuances of the West Virginia Contract between General Agent of Insurance Company and Independent Agent, which may be relevant in your answers.

The West Virginia Insurance Commissioner is appointed by the Governor and must be confirmed by the state Senate. This individual is responsible for overseeing the insurance market, protecting consumer interests, and ensuring compliance with state regulations. Their role also includes managing the relationship between general agents and independent agents through mechanisms such as the West Virginia Contract between General Agent of Insurance Company and Independent Agent.

Getting a life insurance license in West Virginia starts with completing a pre-licensing education course tailored for life insurance. Next, you will need to pass the life insurance examination administered by the West Virginia Insurance Commissioner. Afterward, submit your application along with any supporting documents, including your West Virginia Contract between General Agent of Insurance Company and Independent Agent, to finalize the licensing process.

To obtain an insurance license in West Virginia, you must first complete an approved pre-licensing education course. Once you have fulfilled the education requirement, you can apply to take the state insurance examination. After passing the exam, you will submit your application and the required fees to the West Virginia Insurance Commissioner. Proper documentation of your West Virginia Contract between General Agent of Insurance Company and Independent Agent may also be necessary to streamline this process.

Surplus lines insurance protects against a financial risk that is too high for a regular insurance company to take on. Surplus line insurance can be used by companies or purchased individually. Unlike normal insurance, this insurance can be bought from an insurer not licensed in the insured's state.

You must first earn your insurance adjuster license to practice claims adjusting in the state. To obtain your claims adjuster license, you will need to pass the West Virginia insurance adjuster exam.

A brokerage general agent is an independent firm or contractor working for an insurance company. A brokerage general agent's main role is to sell one or more insurance products to select insurance brokers. Brokers then sell the policies to their clients.

The main difference between a broker and an agent has to do with whom they represent. An agent represents one or more insurance companies. He or she acts as an extension of the insurer. A broker represents the insurance buyer.