West Virginia Deed of Trust - Multistate

Description

How to fill out Deed Of Trust - Multistate?

You might spend hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can easily obtain or print the West Virginia Deed of Trust - Multistate from the service.

If available, utilize the Preview option to view the document template as well. If you wish to find another version of your form, use the Search field to locate the template that meets your requirements and preferences. Once you have found the template you desire, click Get now to proceed. Select the pricing plan you wish, enter your credentials, and create your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of your document and download it to your system. Make adjustments to your document if needed. You can complete, modify, sign, and print the West Virginia Deed of Trust - Multistate. Download and print a vast number of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click the Download option.

- After that, you can complete, modify, print, or sign the West Virginia Deed of Trust - Multistate.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

A West Virginia deed transfers title to property from one party to another. The deed should be written for the date when the consideration (money) exchanges hands with the Grantee (buyer). The form should have the Preparer's, Grantor's, Grantee's information along with the legal description of the property.

What Is a West Virginia Quitclaim Deed? West Virginia real estate owners can transfer ownership by signing and recording a deed. 1. A quitclaim deed is a specific deed form that transfers whatever claim or interest the signer has in the property without guaranteeing the property's title is clear or valid.

The current owner transferring property must sign a West Virginia deed. The county clerk cannot record an unsigned deed. An agent acting under power of attorney can sign a deed on the owner's behalf if the owner has signed a power-of-attorney agreement giving the agent authority. Notarization.

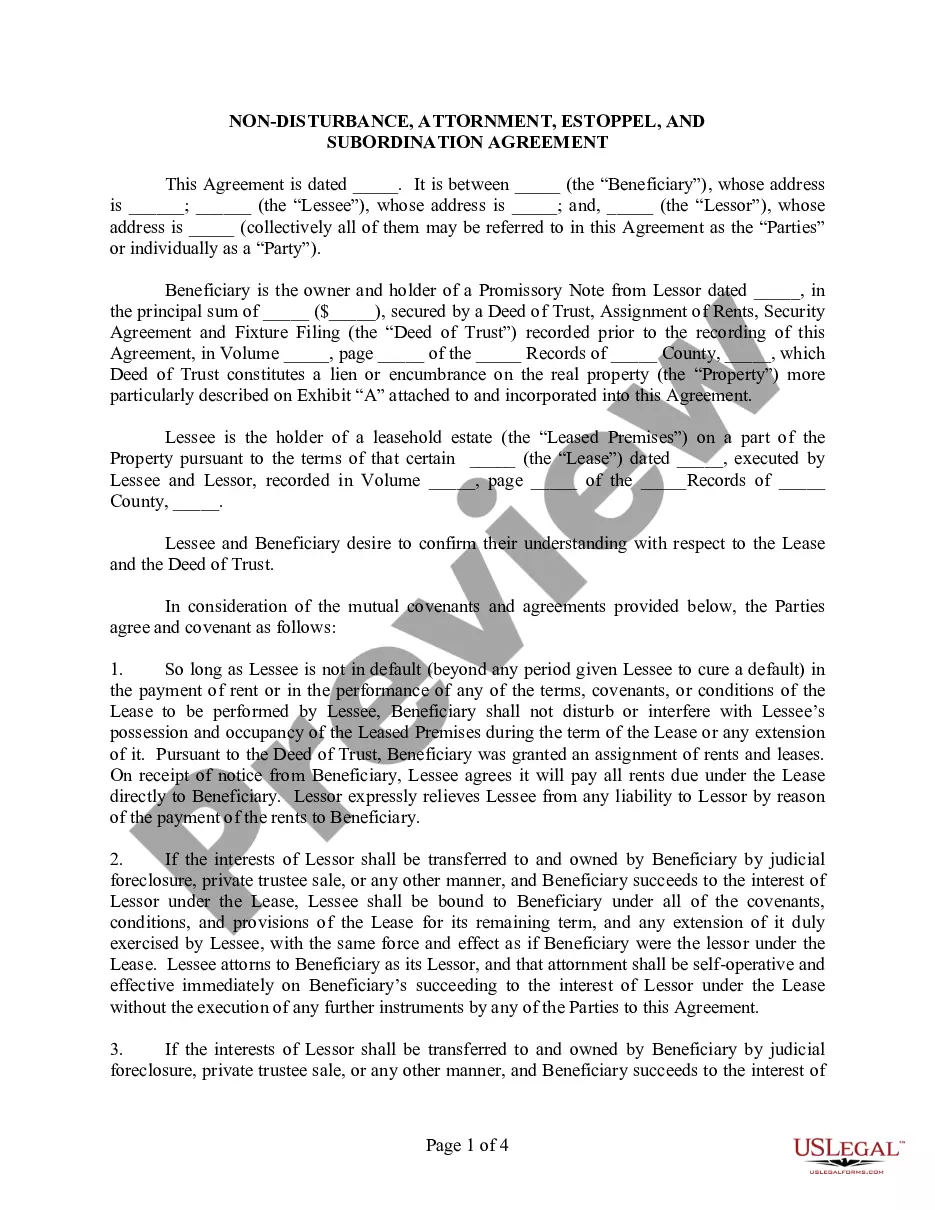

A West Virginia deed of trust transfers a borrower's real estate to a trustee to secure their financial obligation to a lender. The borrower is returned their property title upon repaying their debt to the lender.

Deeds of trust and mortgages are both acceptable under Maryland law, however, deeds of trust are used in almost every residential transaction. Under Maryland Real Property §7-105 and Maryland Rule 14-214(b)(2), corporate trustees may not exercise the power of sale.

Focusing on this geographical region, the Deed of Trust is the preferred or required security instrument for real property in the following states: Maryland, North Carolina, Tennessee, Virginia and West Virginia. Mortgages are used in Kentucky, Ohio and Pennsylvania.

Recording Requirements § 39-1-2: The quitclaim deed is to be recorded with the county clerk where the property is located, and a recording fee of $30 must be paid. Transfer Tax: Yes: $1.10 for each $500 of the property's value.

West Virginia levies a deed transfer tax (often referred to as an excise tax) on real property. The tax is $1.10 per $1,000. Each county has the authority to establish its own excise tax rate, which the majority do. West Virginia does not have a mortgage tax.