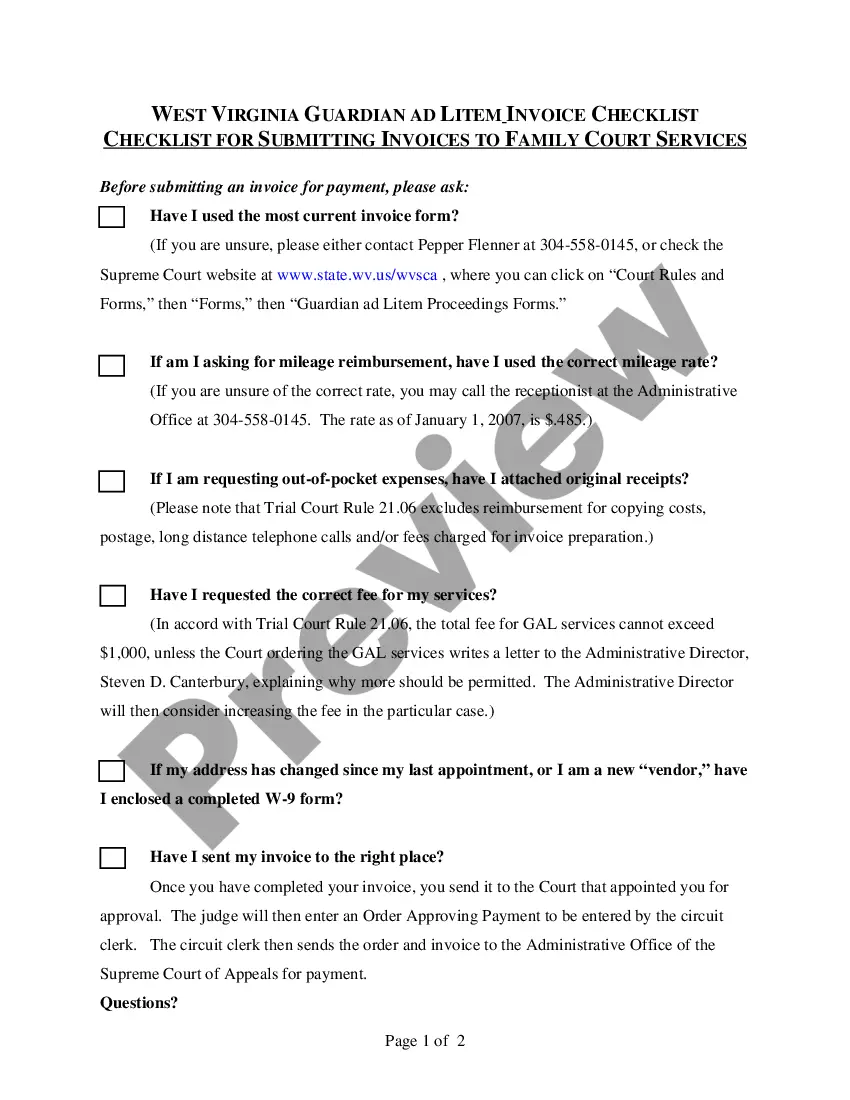

West Virginia Invoice is a document that is used by West Virginia businesses to bill their customers for goods or services rendered. It typically contains information such as the customer’s name, address, contact information, itemized list of goods or services, cost of each item, total cost, terms of payment, and the due date. There are two main types of West Virginia Invoice: a sales invoice and a service invoice. A sales invoice is used when a business sells goods, while a service invoice is used when a business provides a service. Both types of West Virginia Invoice must include the same information, but may include additional information such as a discount, taxes, and shipping charges.

West Virginia Invoice

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out West Virginia Invoice?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state laws and are examined by our experts. So if you need to prepare West Virginia Invoice, our service is the perfect place to download it.

Obtaining your West Virginia Invoice from our service is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button after they find the proper template. Later, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance verification. You should carefully review the content of the form you want and make sure whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now once you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your West Virginia Invoice and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

West Virginia has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.55 percent. West Virginia's tax system ranks 20th overall on our 2023 State Business Tax Climate Index.

West Virginia Prompt Payment Requirements For Prime (General) Contractors, payment due within 60 days after invoice received. Invoice counts as received on the earlier of date stamped as received or date postmarked.

. All Executive branch vendor payments and payments to those defined as contractors or vendors. are subject to the Prompt Payment Act with the following exceptions: (1) Payments, as defined in § 1315.2(h); and (2) Payments related to emergencies. Disaster Relief Act of 1974, Public Law 93-288, as amended.

In 1982, Congress passed the Prompt Payment Act to require Federal agencies to pay their bills on a timely basis; to pay interest penalties when payments are made late, and to take discounts.

The Act requires departments (unless expressly exempted by statute) to pay properly submitted, undisputed invoices, refunds or other undisputed payments due not more than forty-five (45) days after: The date of acceptance of goods or performance of services; or. Receipt of an undisputed invoice, whichever is later.

INTEREST ON LATE PAYMENT: The Prompt Payment Act of 1990 (West Virginia Code §5A-3-54) entitles a vendor to interest on legitimate and uncontested invoices that have not been paid from the 61st day after the invoice was received until the date when the check was mailed to the vendor.

To check the status of your West Virginia state refund online, go to . Then, click ?Search? to find your refund. 1-304-558-3333 or 1-800-982-8297.

The state of West Virginia has both a state sales tax and a state income tax, along with some of the lowest property taxes in the U.S. The income tax system here consists of five brackets, with rates from 3% to 6.5%. The sales tax is 6% statewide, with a handful of cities collecting additional local taxes of 1%.