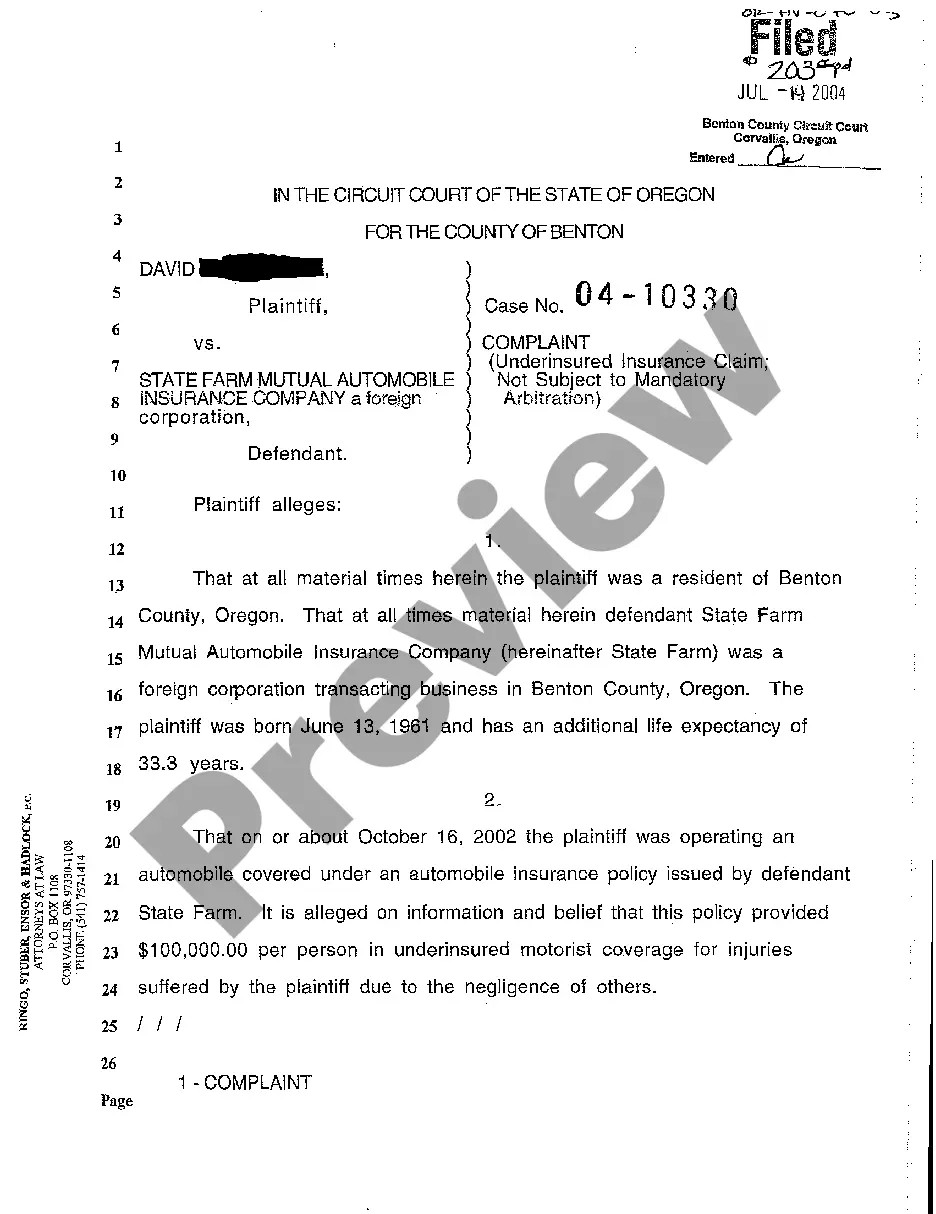

Oregon Complaint for Insurance Subrogation When Defendant's Wrecked Motor Vehicle

Description

How to fill out Oregon Complaint For Insurance Subrogation When Defendant's Wrecked Motor Vehicle?

When it comes to submitting Oregon Complaint for Insurance Subrogation When Defendant's Wrecked Motor Vehicle, you most likely think about an extensive procedure that requires finding a appropriate sample among a huge selection of similar ones and after that being forced to pay an attorney to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific template in a matter of clicks.

In case you have a subscription, just log in and click on Download button to have the Oregon Complaint for Insurance Subrogation When Defendant's Wrecked Motor Vehicle form.

If you don’t have an account yet but need one, stick to the point-by-point guideline listed below:

- Make sure the document you’re downloading is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and by visiting the Preview option (if accessible) to find out the form’s information.

- Click on Buy Now button.

- Pick the suitable plan for your financial budget.

- Join an account and select how you want to pay out: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Professional lawyers work on drawing up our samples so that after saving, you don't have to bother about editing and enhancing content material outside of your personal information or your business’s info. Join US Legal Forms and get your Oregon Complaint for Insurance Subrogation When Defendant's Wrecked Motor Vehicle example now.

Form popularity

FAQ

A health insurance company or benefits plan with subrogation rights relative to an injury settlement is not required to negotiate their subrogation interest in the claim.While the insurer may refuse to negotiate, the insurer's ability to actually collect the settlement proceeds from the insured may be very limited.

Personal injury claims in Oregon have a statute of limitations requiring you to either settle your claim or file a lawsuit within two years. This means you have two years from the date of the injury to settle your claim with the insurance company or go to civil court and file a lawsuit.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault.It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault. Here's an example of how auto subrogation works: You get rear-ended and the other driver is at fault.

You or your personal injury attorney may be able to negotiate with your health insurance provider to reduce the amount being claimed by subrogation. Because attorneys are more experienced in dealing with these situations, they often get better results than attempting to negotiate the subrogation claim yourself.

Policyholders benefit from subrogation, since it keeps premiums low for good drivers and helps insurance companies pay claims quickly. A waiver of subrogation is an agreement not to collect funds from the at-fault party. Drivers should always consult their insurance company before signing one.

The subrogation process can take anywhere from 30 days to several years.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

What happens if you don't pay a subrogation claim? If you choose to not pay a subrogation, the insurer will continue to mail requests for reimbursement. Again, they may file a lawsuit against you. One way to avoid an effort to subrogate from the victim's insurance company is if there is a subrogation waiver.