West Virginia Warranty Deed where Grantor Conveys Life Estate Interest to Husband and Wife

Definition and meaning

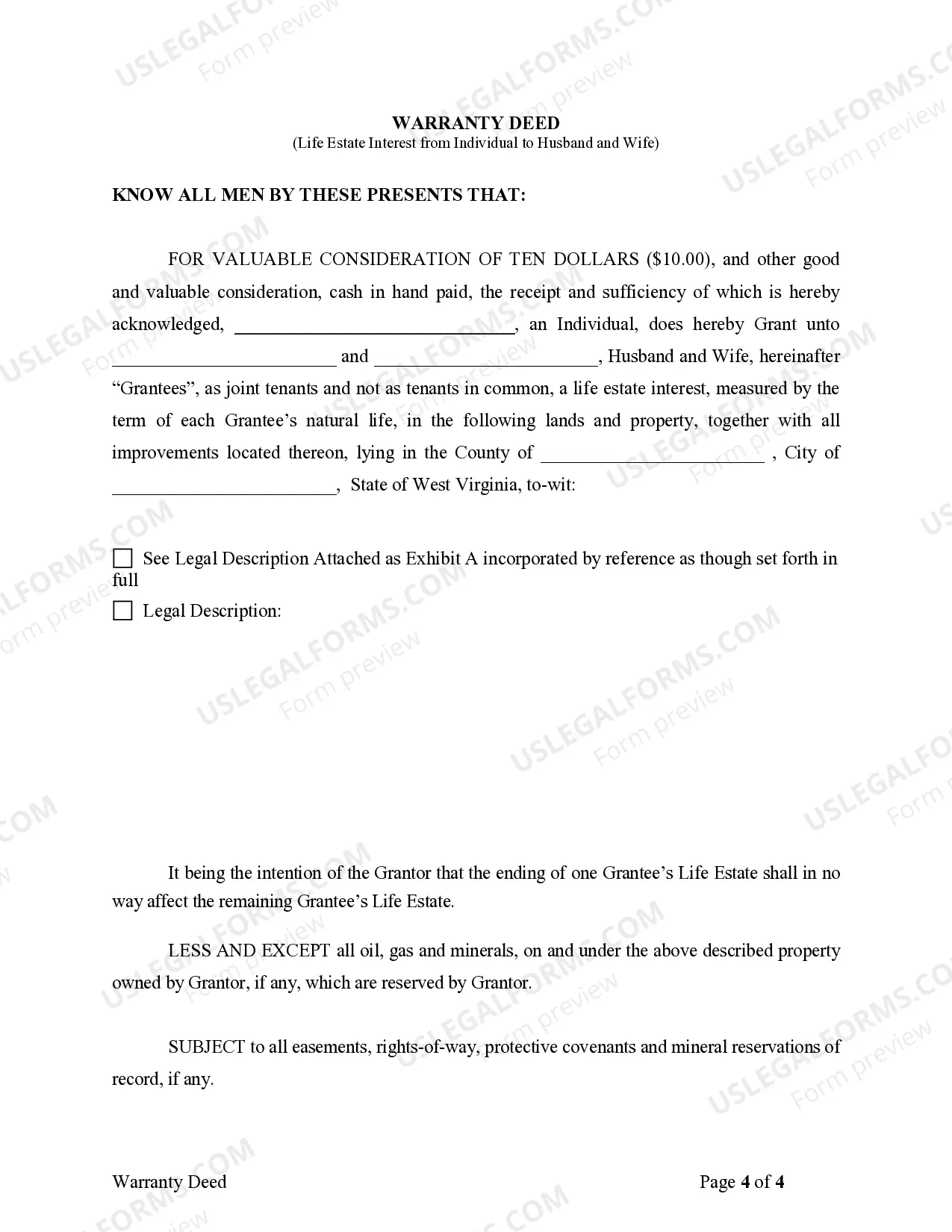

A West Virginia Warranty Deed where Grantor Conveys Life Estate Interest to Husband and Wife is a legal document that transfers ownership of real property while reserving a life estate interest for the grantor until their death. This means that the grantor can continue to live on the property or benefit from it during their lifetime, while the title passes to the grantees (husband and wife) who possess the property after the grantor's death. This deed creates a joint tenancy, ensuring both individuals hold equal rights to the property.

How to complete a form

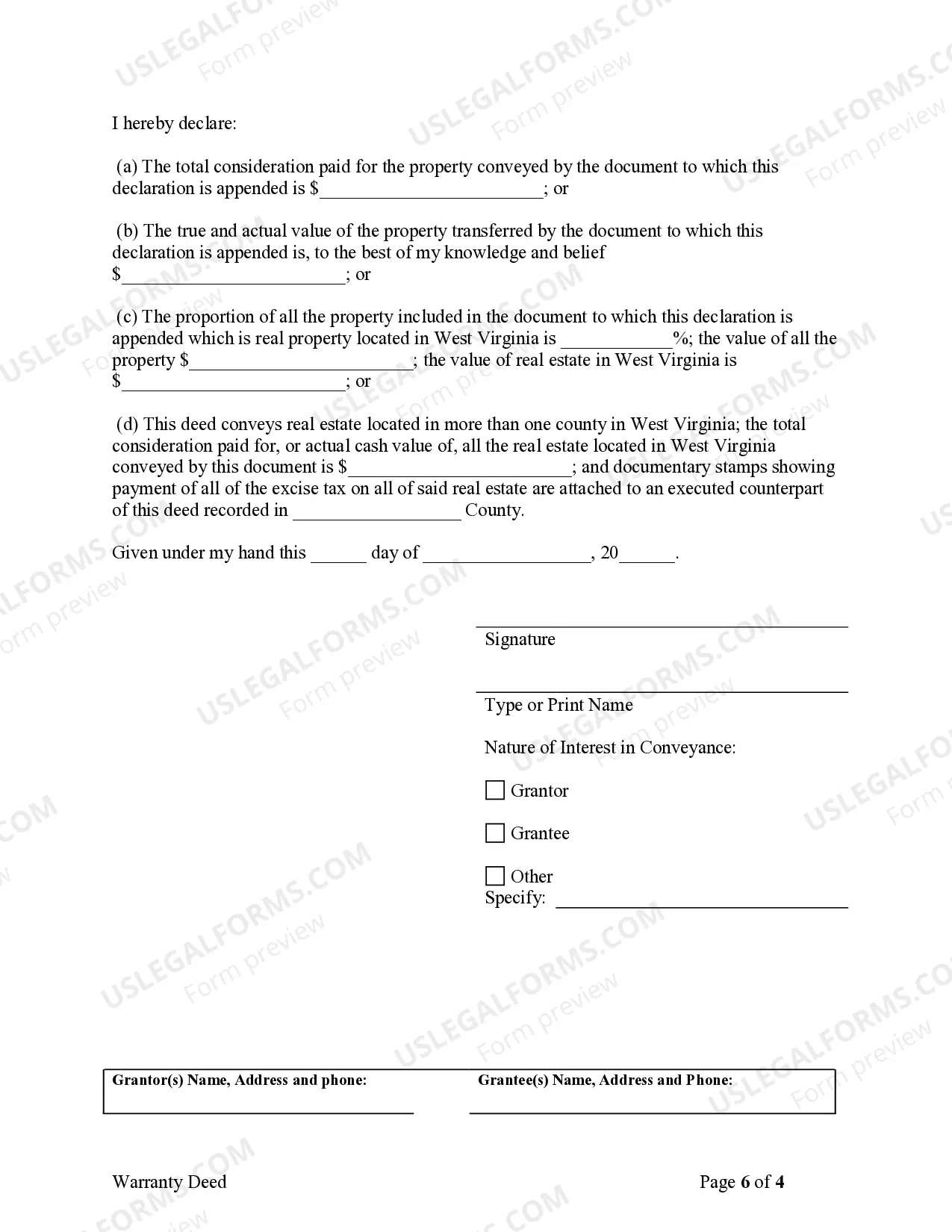

To complete the West Virginia Warranty Deed, follow these steps:

- Obtain the form from a reliable source.

- Enter the names of the grantor and the grantees in the designated fields.

- Provide the legal description of the property along with the county and city in which it is located.

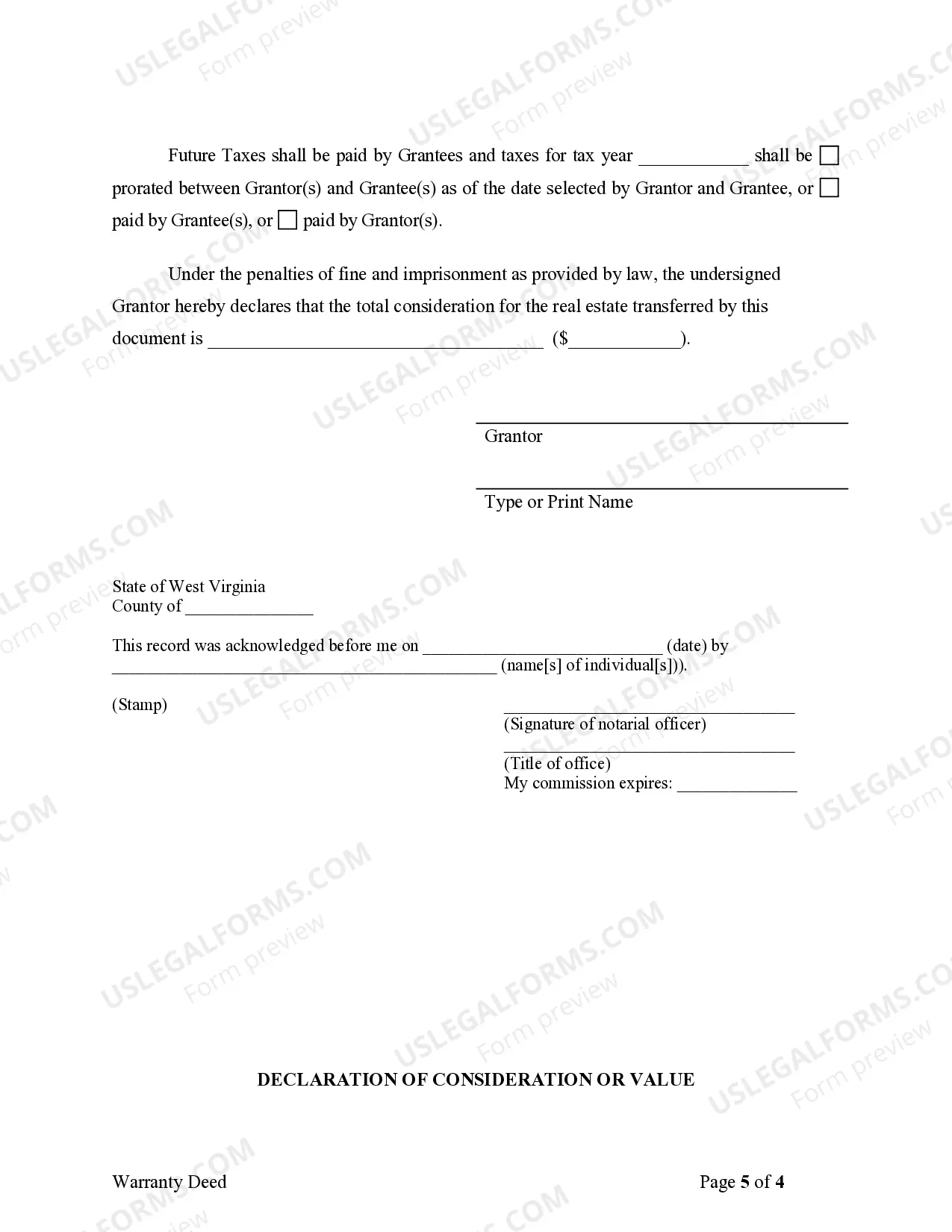

- Indicate the consideration given for the transfer (e.g., ten dollars, or nominal value).

- Sign the form in the presence of a notary public.

Ensure all fields are filled out accurately to avoid legal issues.

Who should use this form

This form is intended for individuals who wish to convey property ownership to their spouse while retaining a life estate interest. It is suitable for married couples who desire to ensure that the surviving spouse can continue to use or inhabit the property upon the death of the other. This form is particularly relevant in estate planning scenarios.

Key components of the form

The West Virginia Warranty Deed includes essential components such as:

- The grantor's name: The person transferring the property.

- The grantees' names: The individuals receiving the property.

- Property description: A detailed legal description of the property being transferred.

- Life estate clause: Specifies the terms of the life estate conferred to the grantor.

- Notary acknowledgment: A section for the notary public to verify signatures.

Each of these components must be accurately completed for the deed to be legally sound.

Benefits of using this form online

Using the West Virginia Warranty Deed online has numerous advantages:

- Convenience: Access the form anytime, from anywhere.

- Guidance: Step-by-step instructions often accompany online forms, reducing the risk of errors.

- Immediate access: Download and print forms instantly without having to visit a physical location.

- Cost-effective: Often more affordable than hiring legal assistance for simple conveyances.

These benefits facilitate easier preparation and submission of the deed.

Common mistakes to avoid when using this form

To ensure the validity of the West Virginia Warranty Deed, avoid these common mistakes:

- Failing to provide a complete legal description of the property.

- Missing the notary public’s signature or seal.

- Not including the exact consideration for the deed.

- Incorrectly listing names of the grantor or grantees.

- Leaving any fields blank.

Reviewing the form thoroughly can help prevent these issues.

Form popularity

FAQ

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

A Life Estate may be created in real property or in personal property. It is a term used to describe ownership of an asset for the duration of the person's life. The owner of a Life Estate is called a 'life tenant'. The life tenant has the right to possession and enjoyment of the asset and its income until their death.

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

A life estate deed is by far the easiest way to go. The property is controlled by the owners during their life.Immediately after their passing, the property automatically goes to the person or people listed in the life estate deed. A deed also trumps a will (I know this from personal experience).