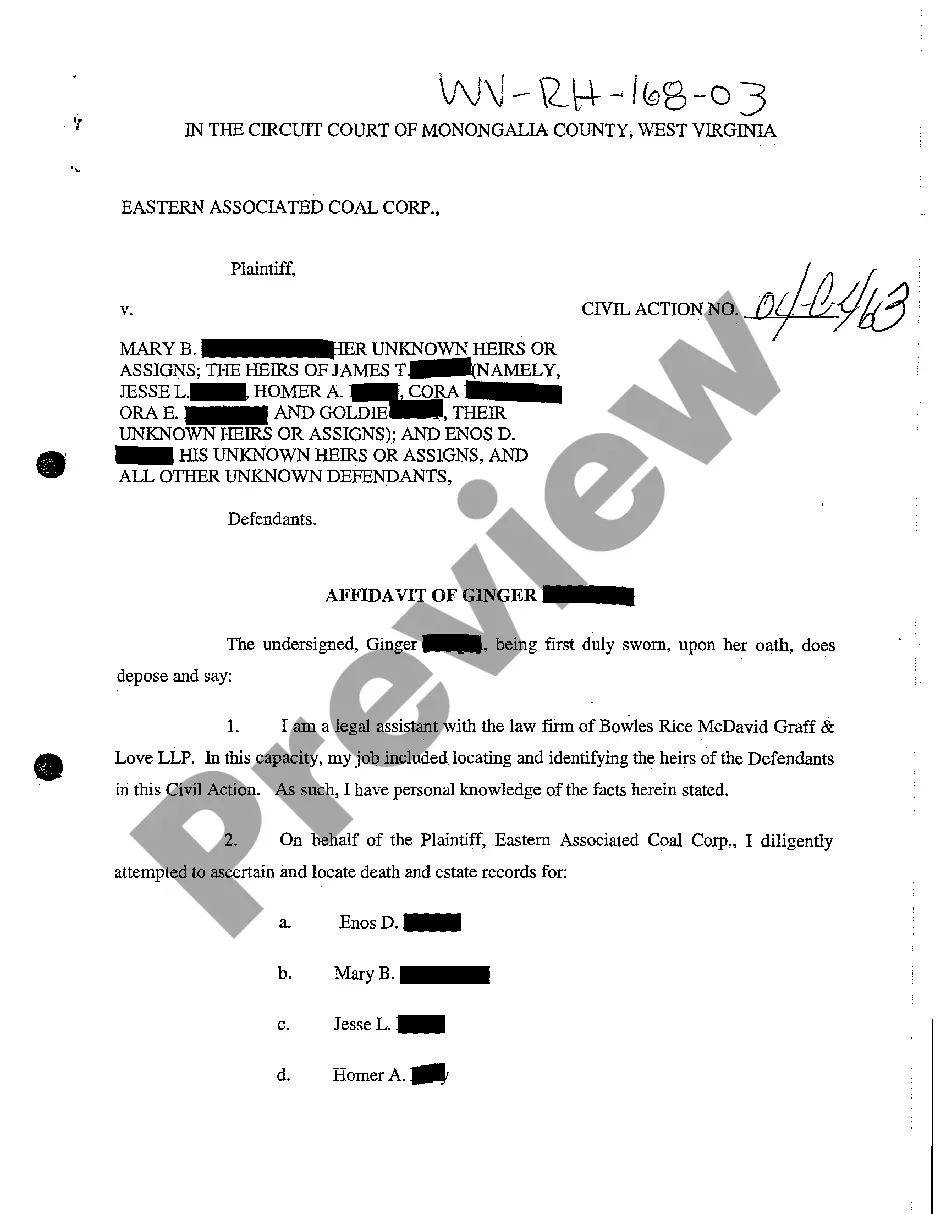

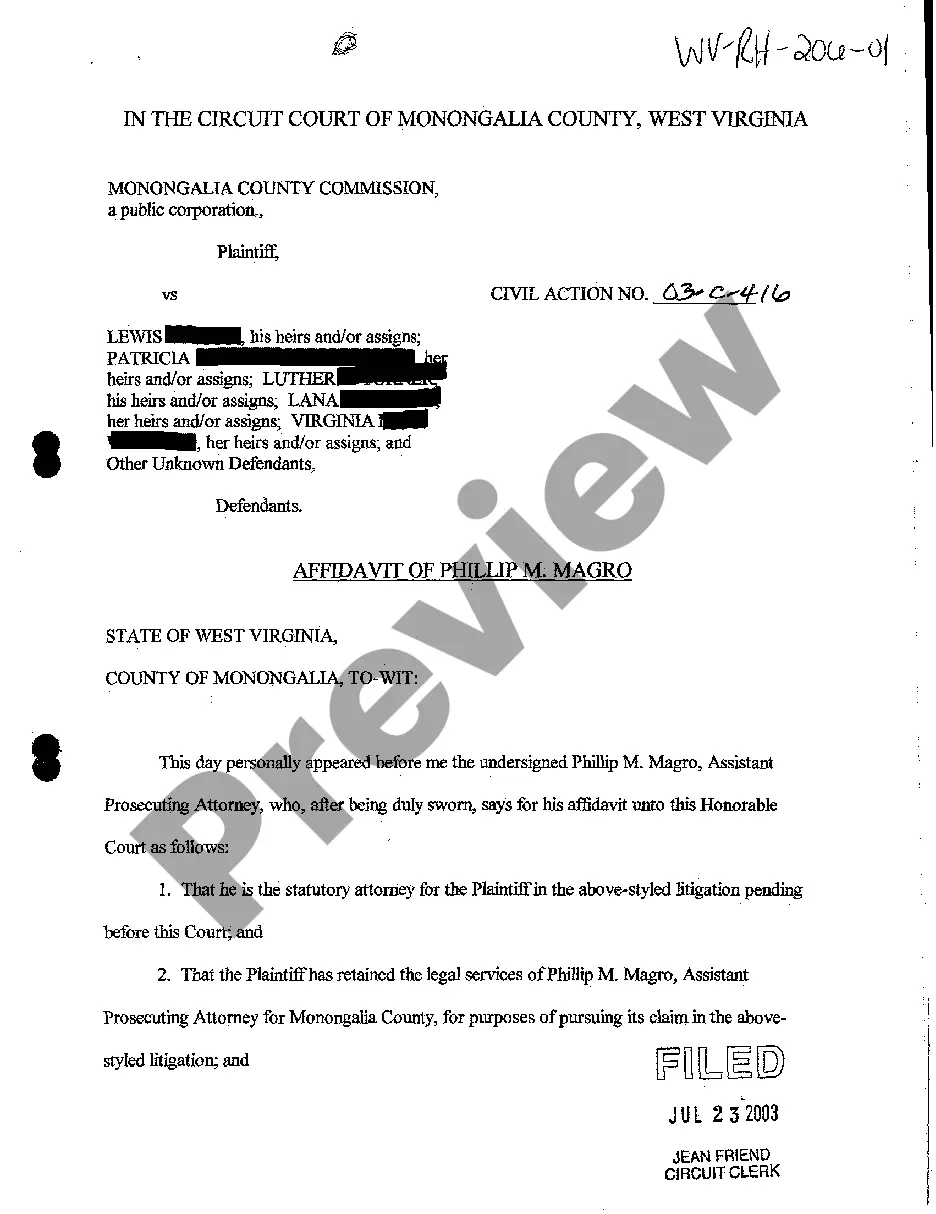

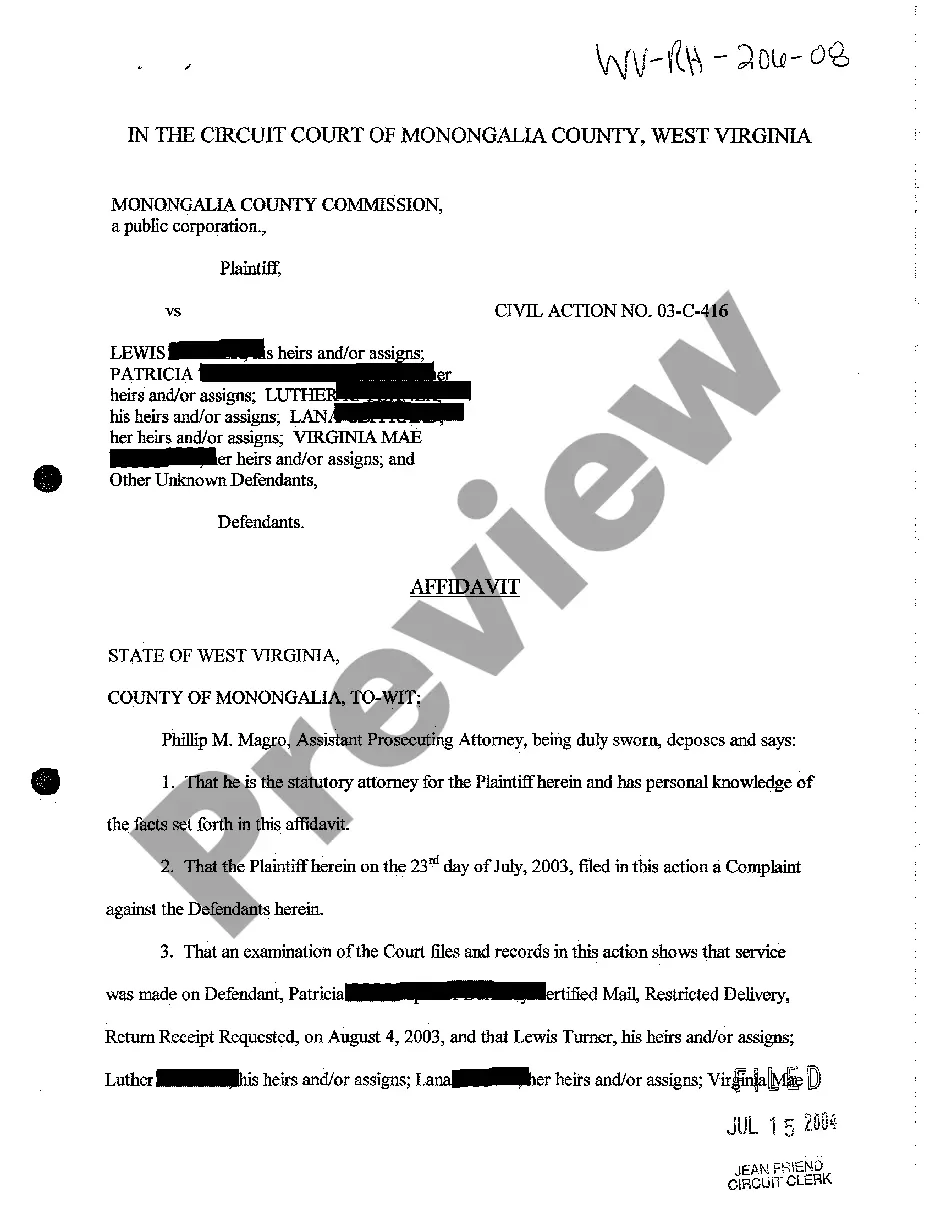

West Virginia Affidavit of Legal Assistant Charged with Locating the Heirs with Interest in Subject Property

Description

How to fill out West Virginia Affidavit Of Legal Assistant Charged With Locating The Heirs With Interest In Subject Property?

- If you are a returning user, log in to your account. Verify your subscription status and download the required form template by clicking the Download button.

- For new users, begin by browsing the Preview mode and reading the form description to confirm that it meets your specifications and complies with local jurisdiction requirements.

- If needed, utilize the Search tab to find the correct template. Ensure it matches your criteria before proceeding.

- Next, purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You’ll be prompted to create an account for access to the extensive library.

- Complete your transaction by providing your credit card information or using your PayPal account to finalize your subscription.

- Finally, download the form to your device and access it any time from the My documents section of your profile.

In conclusion, US Legal Forms provides a robust platform that empowers users with a vast collection of legal forms, making the entire process efficient and reliable.

Start your seamless experience today by visiting US Legal Forms to access a wealth of legal resources.

Form popularity

FAQ

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

For a beneficiary to effectively monitor the administration of estate property it goes without saying the beneficiary needs information regarding the performance of the executor's duties and powers. To this end the law has imposed on executors and trustees a duty to account beneficiaries.

As an executor, you have a fiduciary duty to the beneficiaries of the estate. That means you must manage the estate as if it were your own, taking care with the assets. So you cannot do anything that intentionally harms the interests of the beneficiaries.

If there is anyone to whom the deceased person owed money, they have only 60 days to file a claim against the estate to get paid.

Beneficiaries who receive a share of the balance of the estate (known as the residue) are entitled to a full accounting of the estate including details of all funds received and expended by the estate. A beneficiary can bring court proceedings against an executor who fails to provide adequate information.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

The executor can sell property without getting all of the beneficiaries to approve.The administrator will come in with a buyer and a contract and if someone else in court wants to pay more for the property than that contract price then the judge will allow that.

The creditors then have 3 months to make a claim. An inventory (called an Appraisement) of the estate's assets must be filed with the court listing the estate's assets within 90 days of the appointment of the executor.