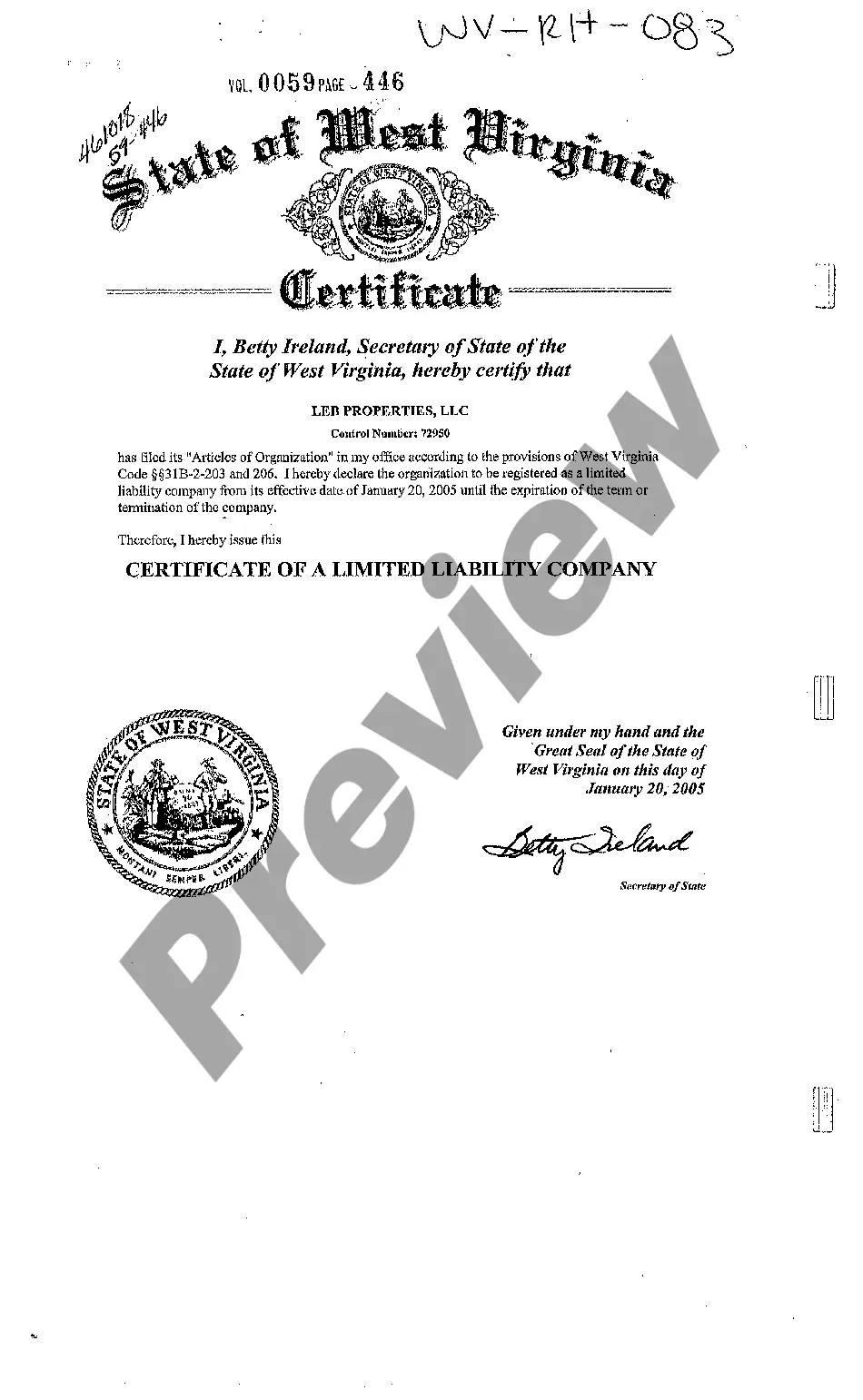

West Virginia Certificate of a Limited Liability Company LLC Formation

Description

How to fill out West Virginia Certificate Of A Limited Liability Company LLC Formation?

Among countless free and paid templates that you get on the web, you can't be certain about their accuracy. For example, who made them or if they’re qualified enough to take care of what you need them to. Keep calm and utilize US Legal Forms! Locate West Virginia Certificate of a Limited Liability Company LLC Formation samples developed by professional lawyers and avoid the expensive and time-consuming process of looking for an lawyer and then having to pay them to write a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you’re searching for. You'll also be able to access your previously acquired files in the My Forms menu.

If you’re using our platform the first time, follow the instructions below to get your West Virginia Certificate of a Limited Liability Company LLC Formation with ease:

- Ensure that the document you find is valid where you live.

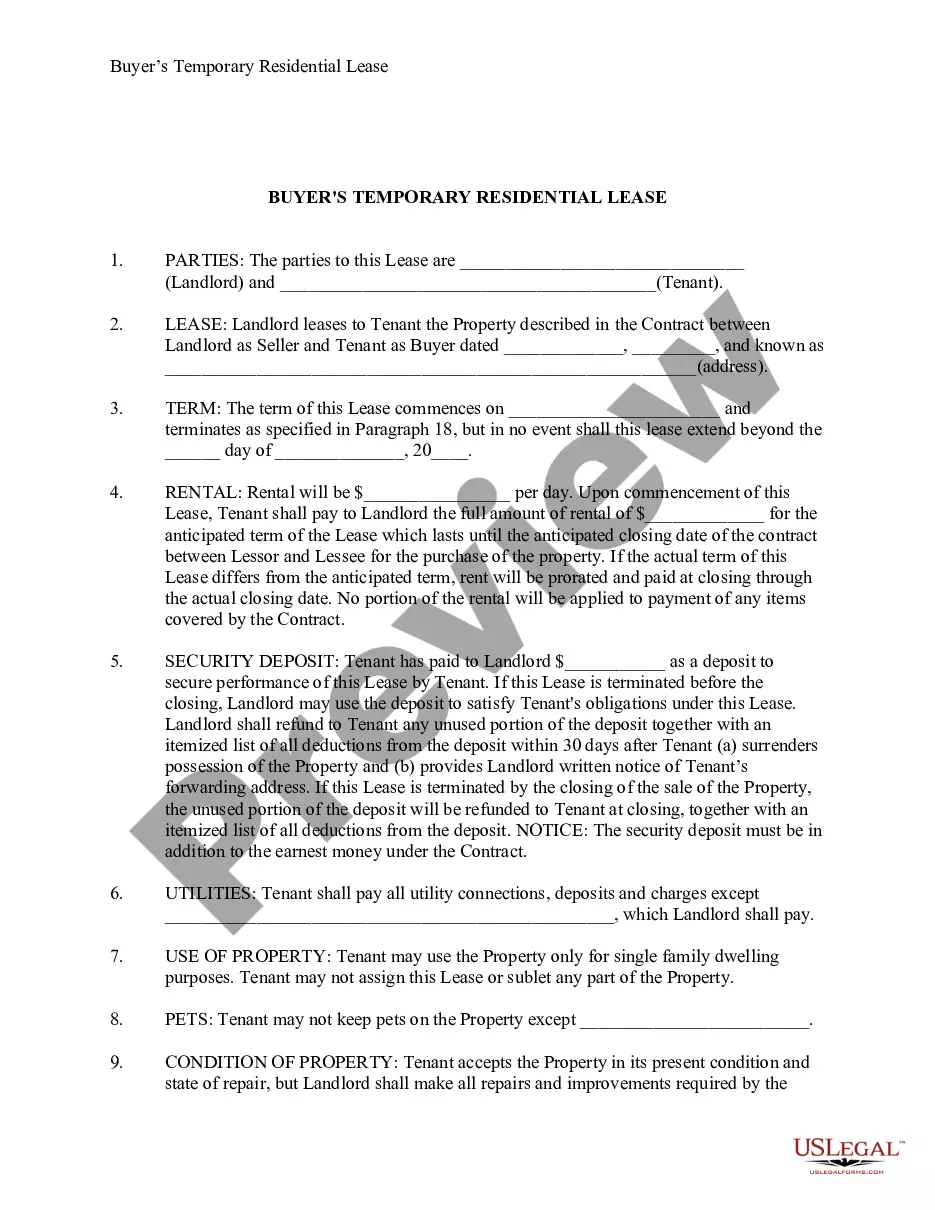

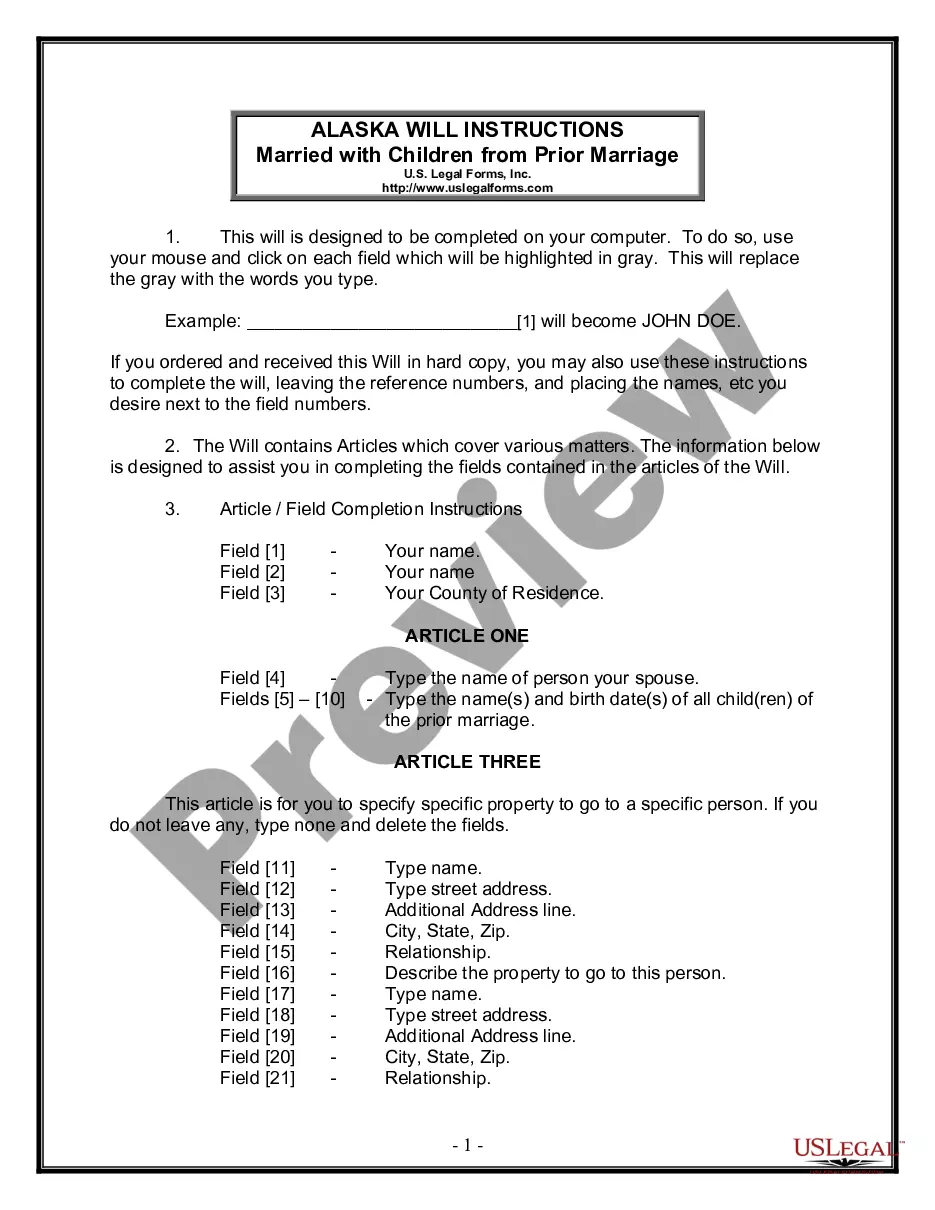

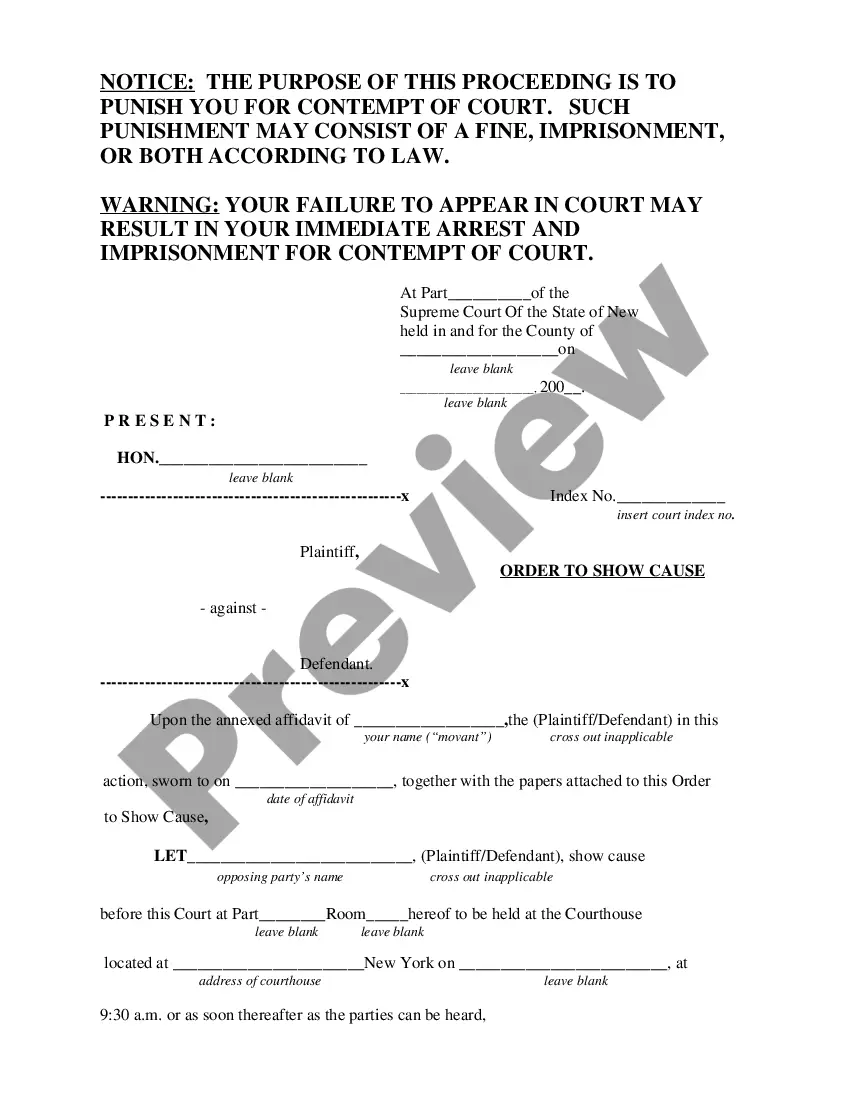

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or look for another sample utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you’ve signed up and bought your subscription, you can utilize your West Virginia Certificate of a Limited Liability Company LLC Formation as often as you need or for as long as it stays active where you live. Edit it with your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

To form a Limited Liability Company in West Virginia, file the Articles of Organization with the West Virginia Secretary of State. The LLC filing fee is $100; however, the fee is waived for veteran-owned businesses. Standard approval for the LLC is 5-10 days. Expedited service is available.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

Organizational documents for LLC primarily include an articles of organization that creates your LLC. An LLC is a legal entity created within the state you reside in and mixes aspects of a partnership and corporation.

Unlike a corporation, an LLC is not considered separate from its owners for tax purposes. Instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship.While an LLC itself doesn't pay taxes, co-owned LLCs must file Form 1065, an informational return, with the IRS each year.

2022 Form LLC-1A may be used for the following conversions: Any California stock corporation, limited partnership or general. partnership, and any foreign limited liability company or foreign other business entity converting into a California limited liability company.

To form a limited liability company (LLC), you must file Articles of Organization (Form LLC-1) with the California Secretary of State.Operating Agreements are to be maintained by the LLC and are not filed with the California Secretary of State.

Who Should Form an LLC? Any person starting a business, or currently running a business as a sole proprietor, should consider forming an LLC. This is especially true if you're concerned with limiting your personal legal liability as much as possible. LLCs can be used to own and run almost any type of business.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

The filing document for an LLC is called the Articles of Organization.