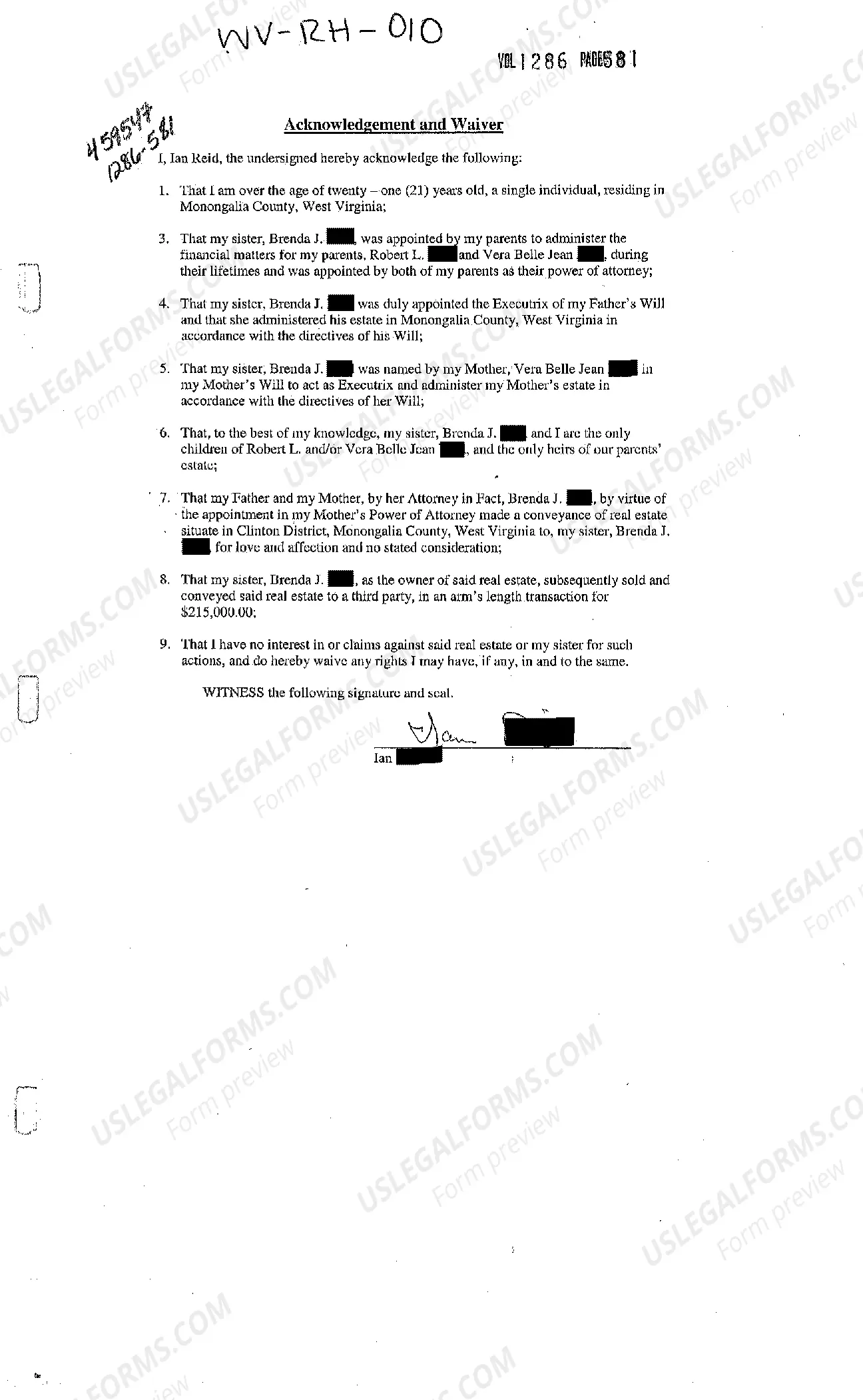

West Virginia Acknowledgment and Waiver of Claims Against Sibling for Proceeds from Sale of Deceased Parent's Property

Description

How to fill out West Virginia Acknowledgment And Waiver Of Claims Against Sibling For Proceeds From Sale Of Deceased Parent's Property?

Among countless free and paid samples that you find on the web, you can't be certain about their accuracy and reliability. For example, who made them or if they are qualified enough to take care of the thing you need these people to. Always keep relaxed and utilize US Legal Forms! Get West Virginia Acknowledgment and Waiver of Claims Against Sibling for Proceeds from Sale of Deceased Parent's Property templates developed by professional legal representatives and prevent the expensive and time-consuming process of looking for an attorney and after that paying them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you’re trying to find. You'll also be able to access all of your earlier acquired documents in the My Forms menu.

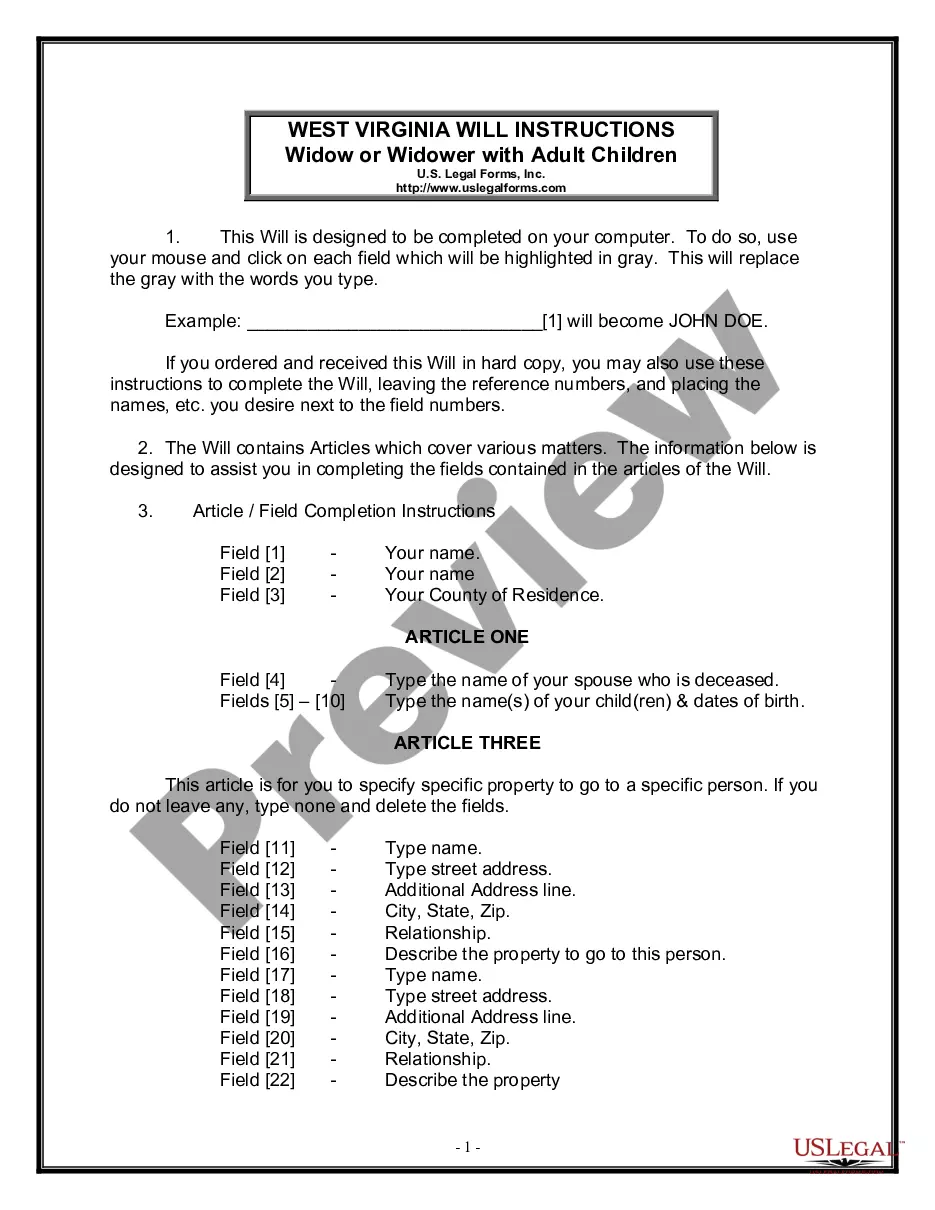

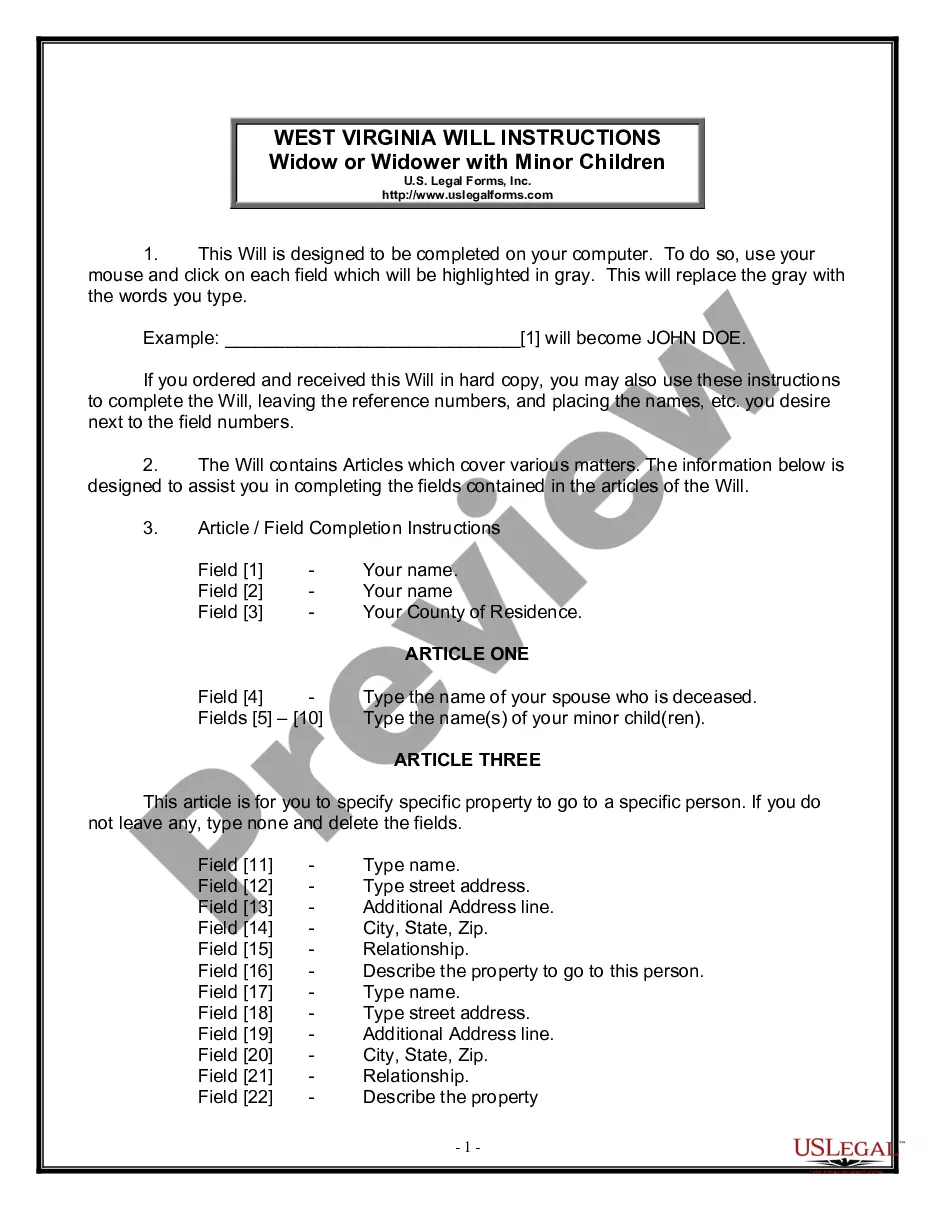

If you’re making use of our platform the very first time, follow the guidelines listed below to get your West Virginia Acknowledgment and Waiver of Claims Against Sibling for Proceeds from Sale of Deceased Parent's Property with ease:

- Ensure that the file you see is valid where you live.

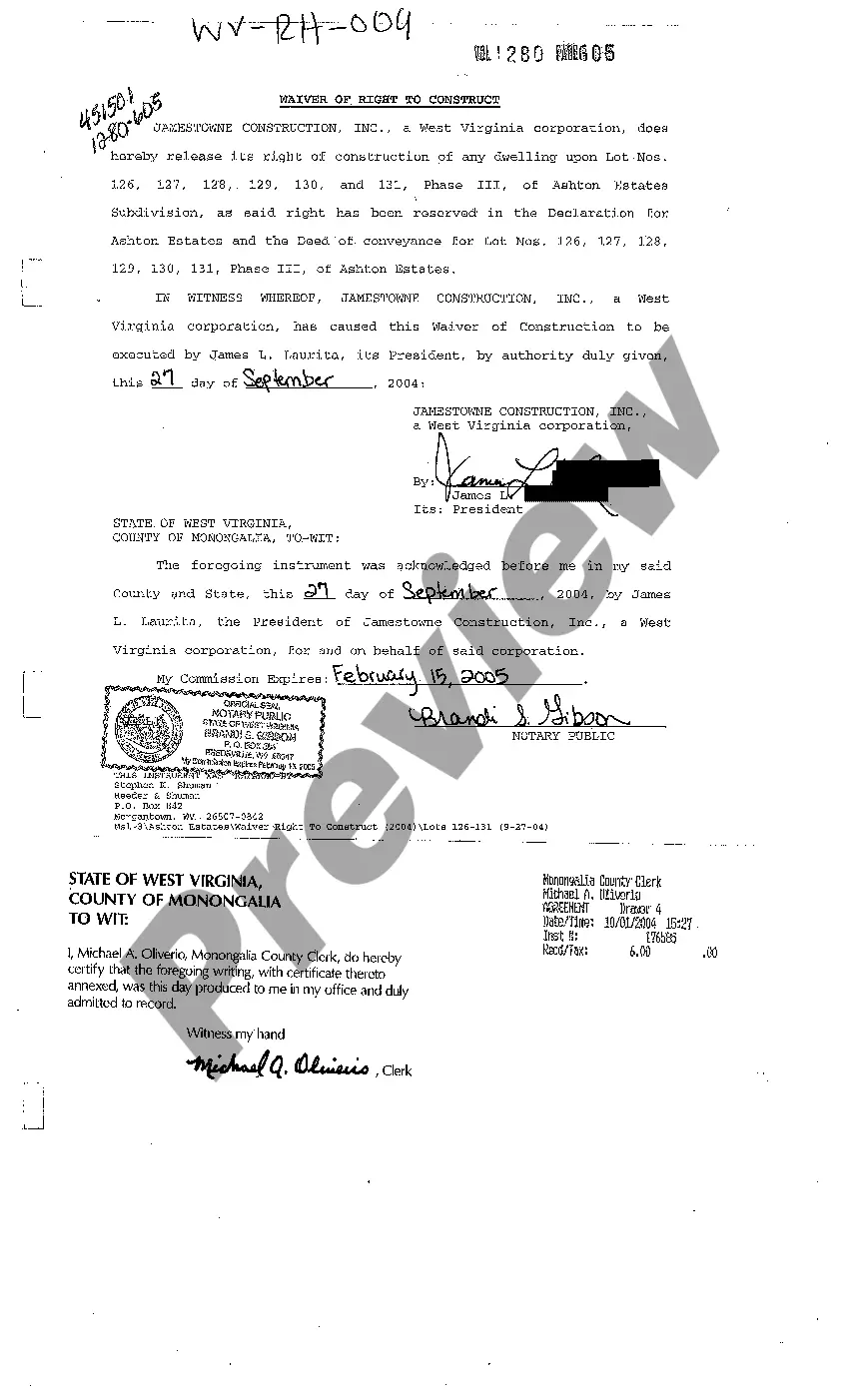

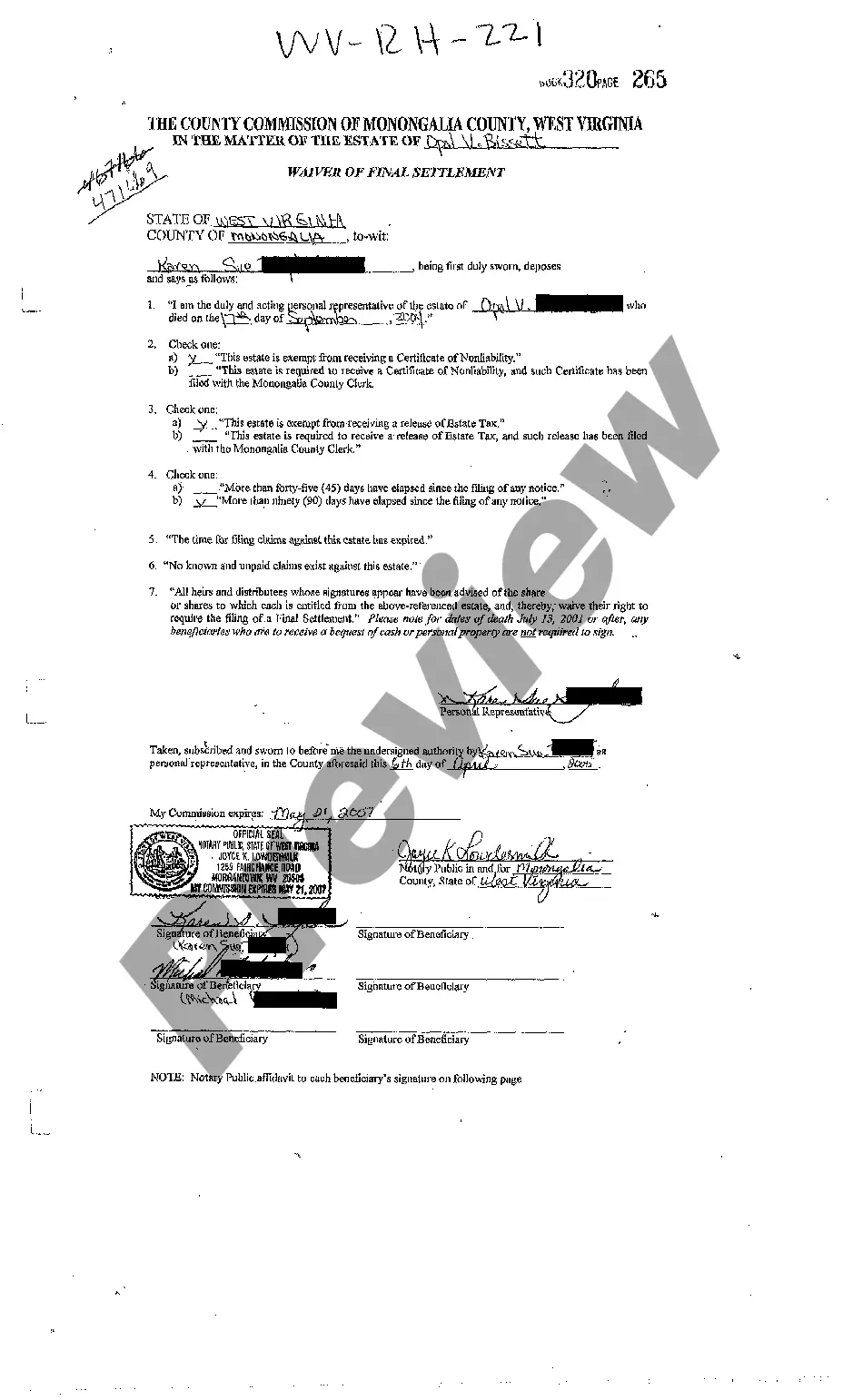

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another sample using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and bought your subscription, you may use your West Virginia Acknowledgment and Waiver of Claims Against Sibling for Proceeds from Sale of Deceased Parent's Property as often as you need or for as long as it continues to be active where you live. Revise it with your preferred editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Executor compensation for VA estates is primarily calculated as a percentage of the qualified estate gross value (see limitations below): 5.0% on the first $400K. 4.0% on the next $300K. 3.0% on the next $300K.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

You need to file the paperwork with the court and provide notice to the sibling. The court can proceed even if the sibling does not sign, both now and in the future.

Length and Commitment of Process. A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

In Virginia, a nonresident executor must appoint someone who lives in the state to act as an agent. Your executor's in-state agent will accept legal papers on behalf of your estatate. A bond may be required unless your executor serves with a resident coexecutor.

Unfortunately, there is not much you can do if the person will not agree to settle or sell the home. There may be other legal tactics you can do, but generally, if the property must get sold (or you want to sell the home) and the other heirs do not, then a partition action may be your only option.

The deadline can be anywhere from three to nine months, depending on state law, but it can run simultaneously with the inventory period in some states. The executor is then granted another period of time to decide whether claims are valid and whether they should or should not be paid.

The probate of the will can usually wait until a week or so after the funeral. It is recommended that the initial steps in the estate process start within 30 days after death. If any questions exist, call your attorney or your local Circuit Court Clerk's Office.

The disadvantage of having an estate disposed of by descent and distribution is that failing to draft a residuary clause in a will cause the remainder of the property, usually the bulk of the testator's estate, topass by intestate succession.