With this General Partnership Forms Package, you will find the general forms that will assist you with the formation, management and dissolution of a partnership. You may modify these forms to suit your particular needs or situation.

Included in your package are the following forms:

1. A Simple Partnership Agreement;

2. A Sample Complex Partnership Agreement

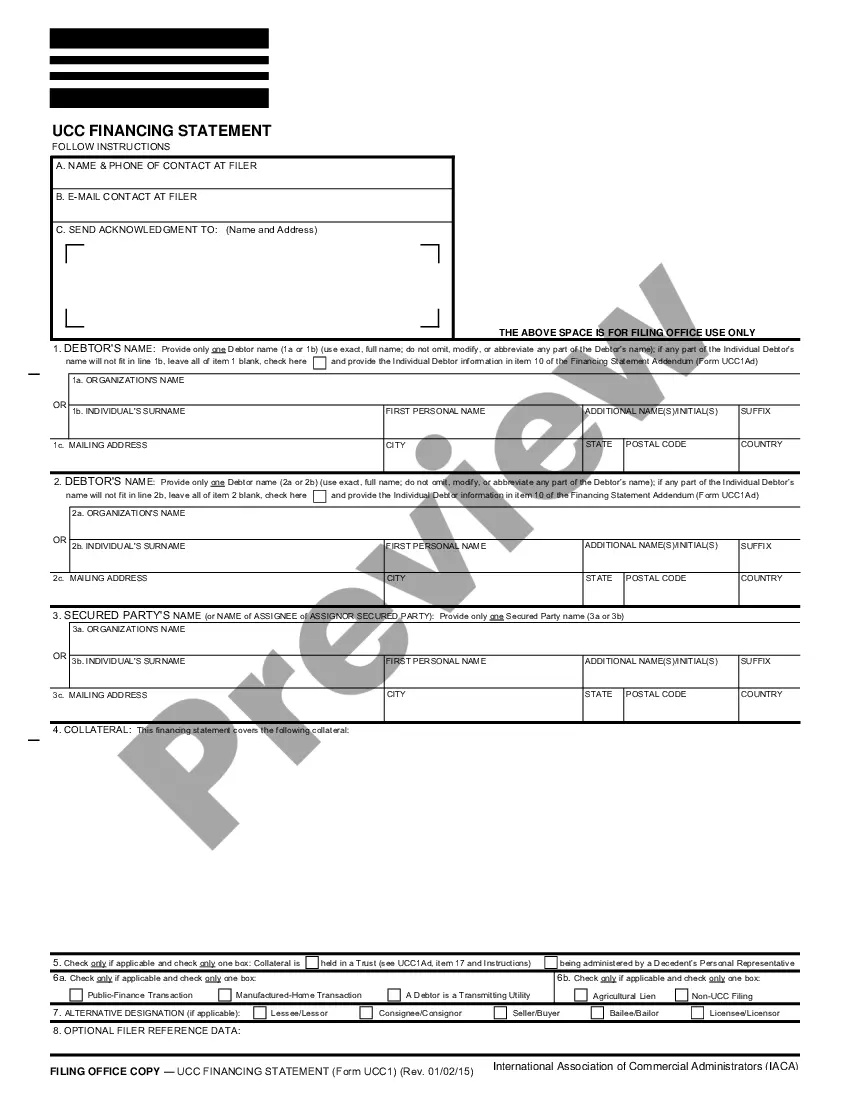

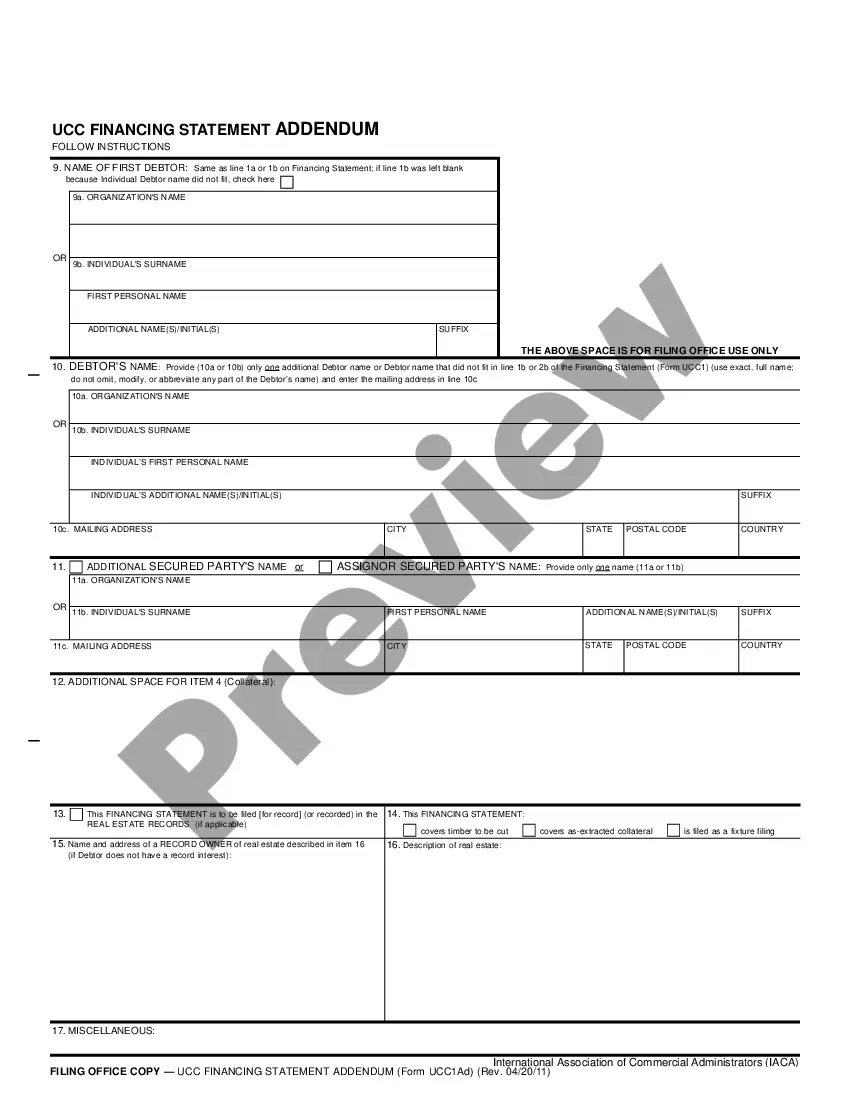

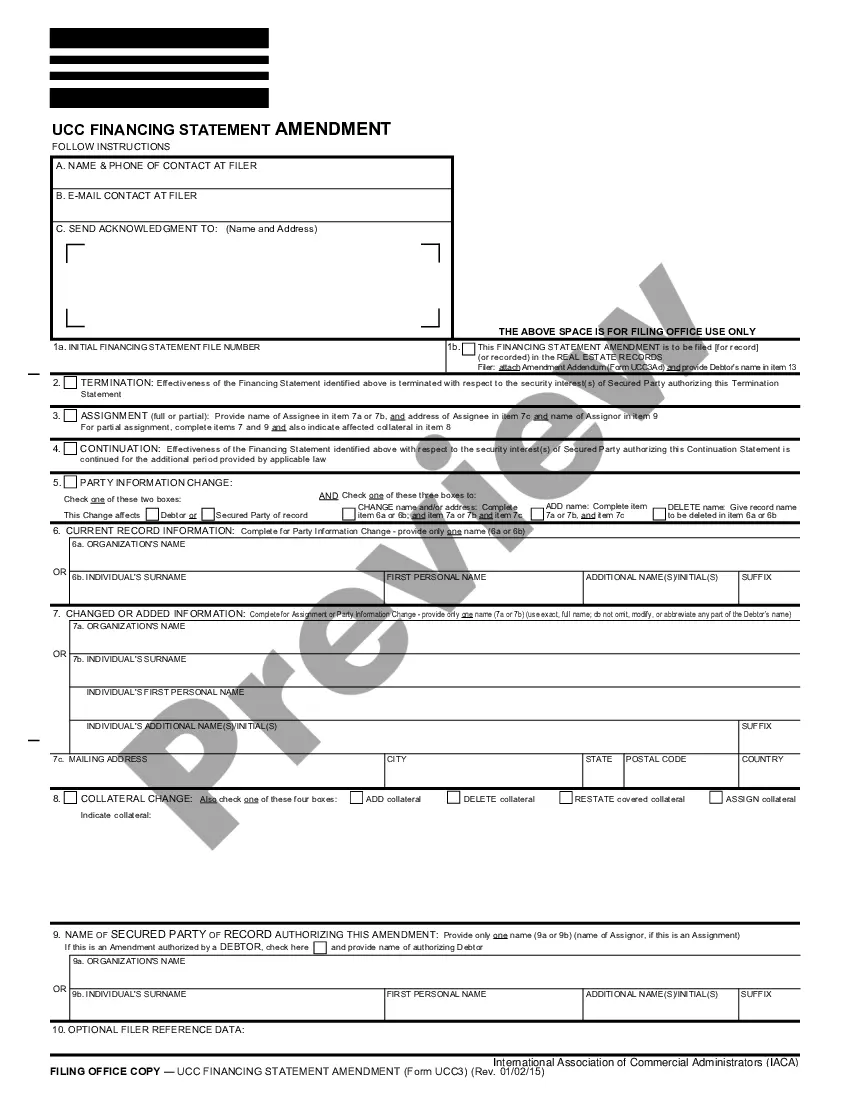

3. A Buy Sell Agreement between Partners in a Partnership;

4. A Profit – Loss Statement; and

5. An Agreement for the Dissolution of a Partnership.

Purchase this package and save up to 40% over purchasing the forms separately!