West Virginia Non-Foreign Affidavit Under IRC 1445

About this form

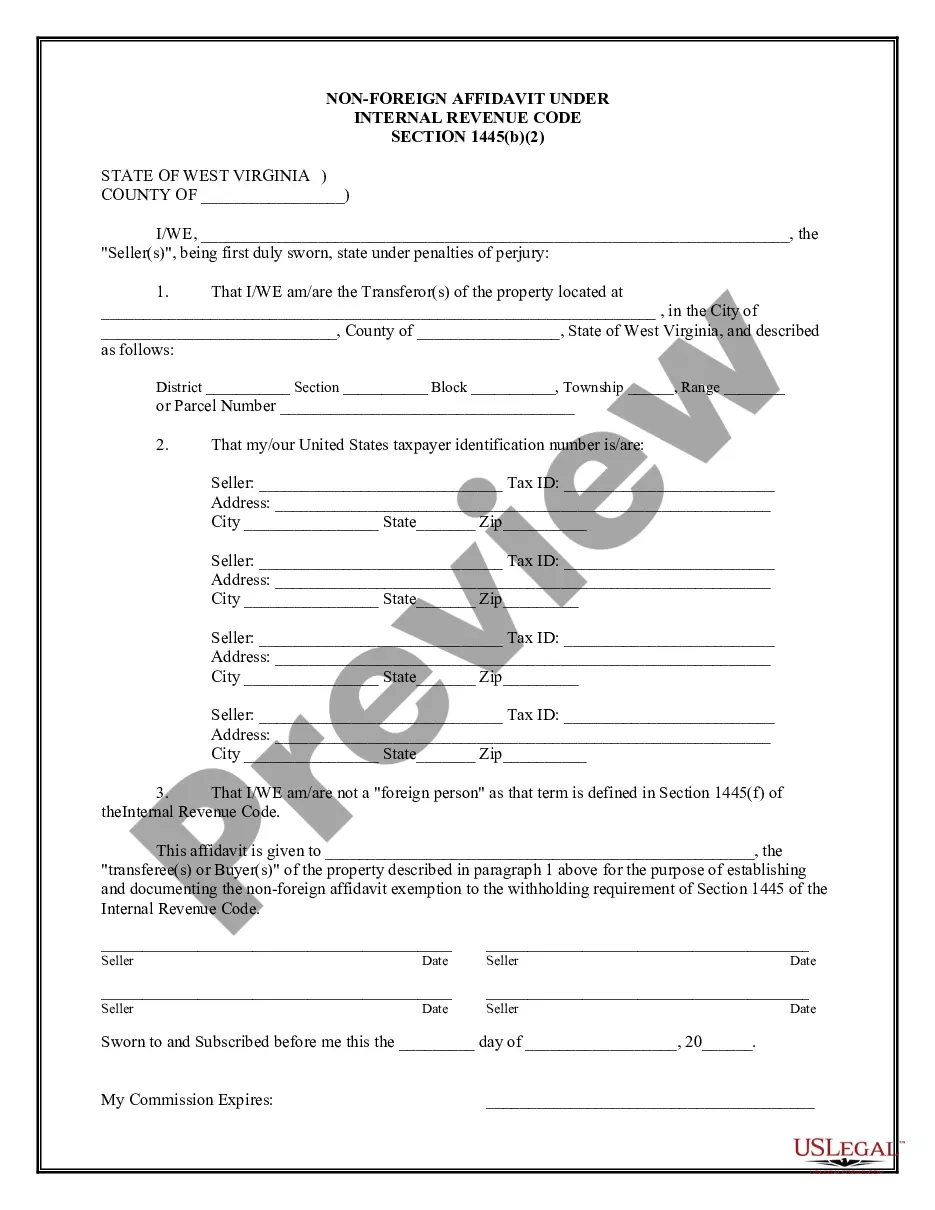

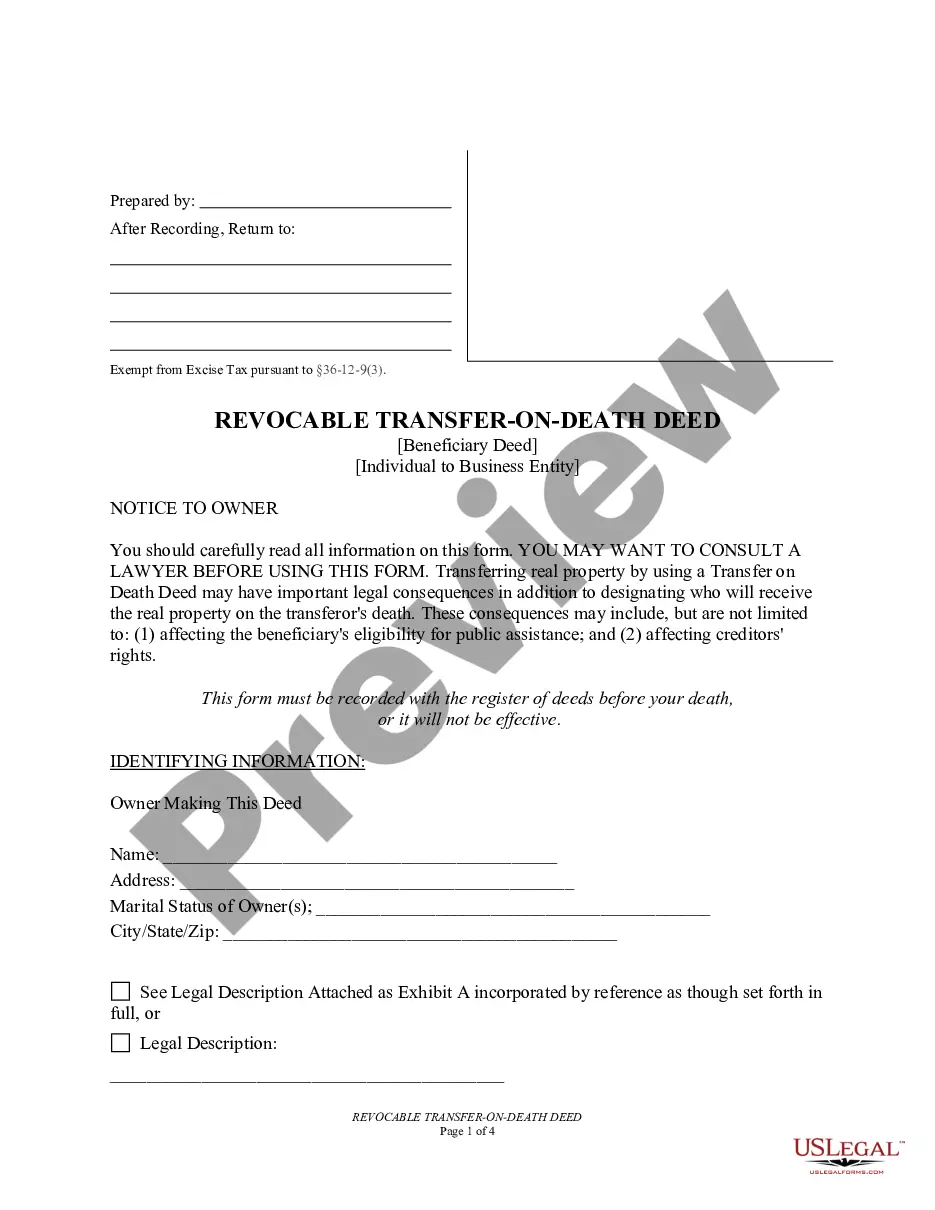

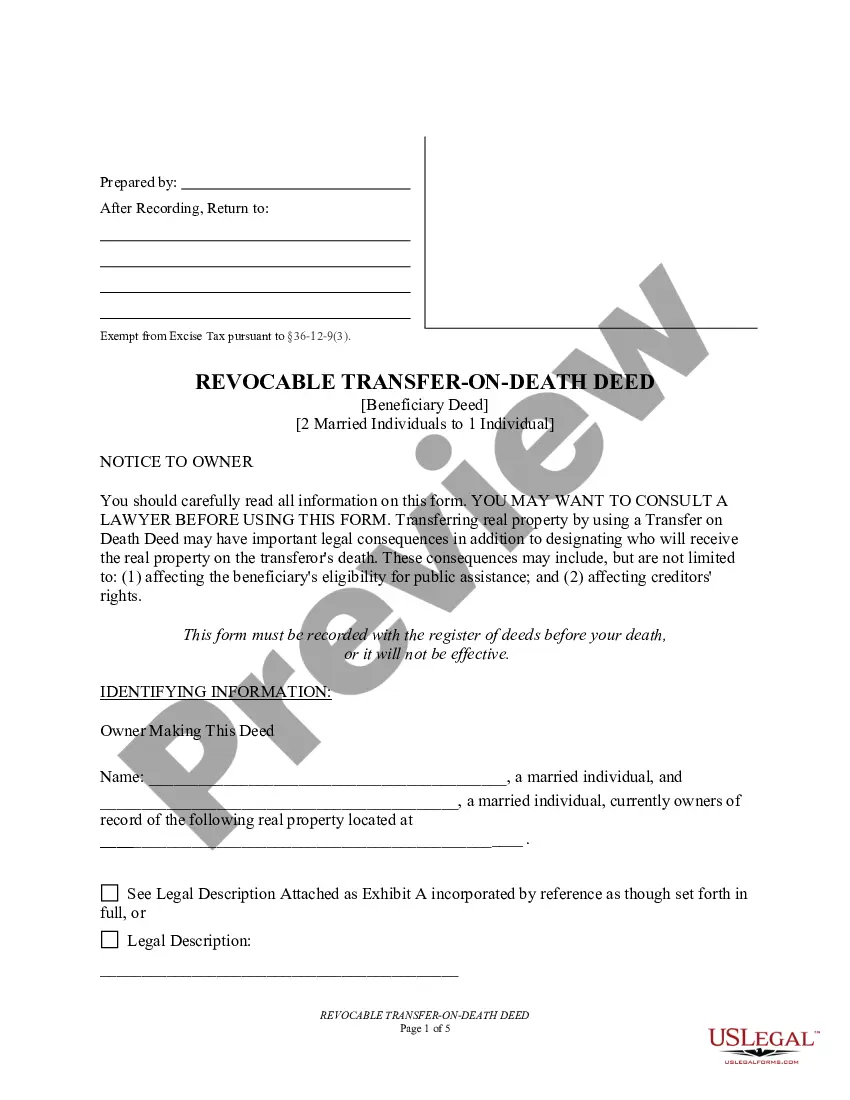

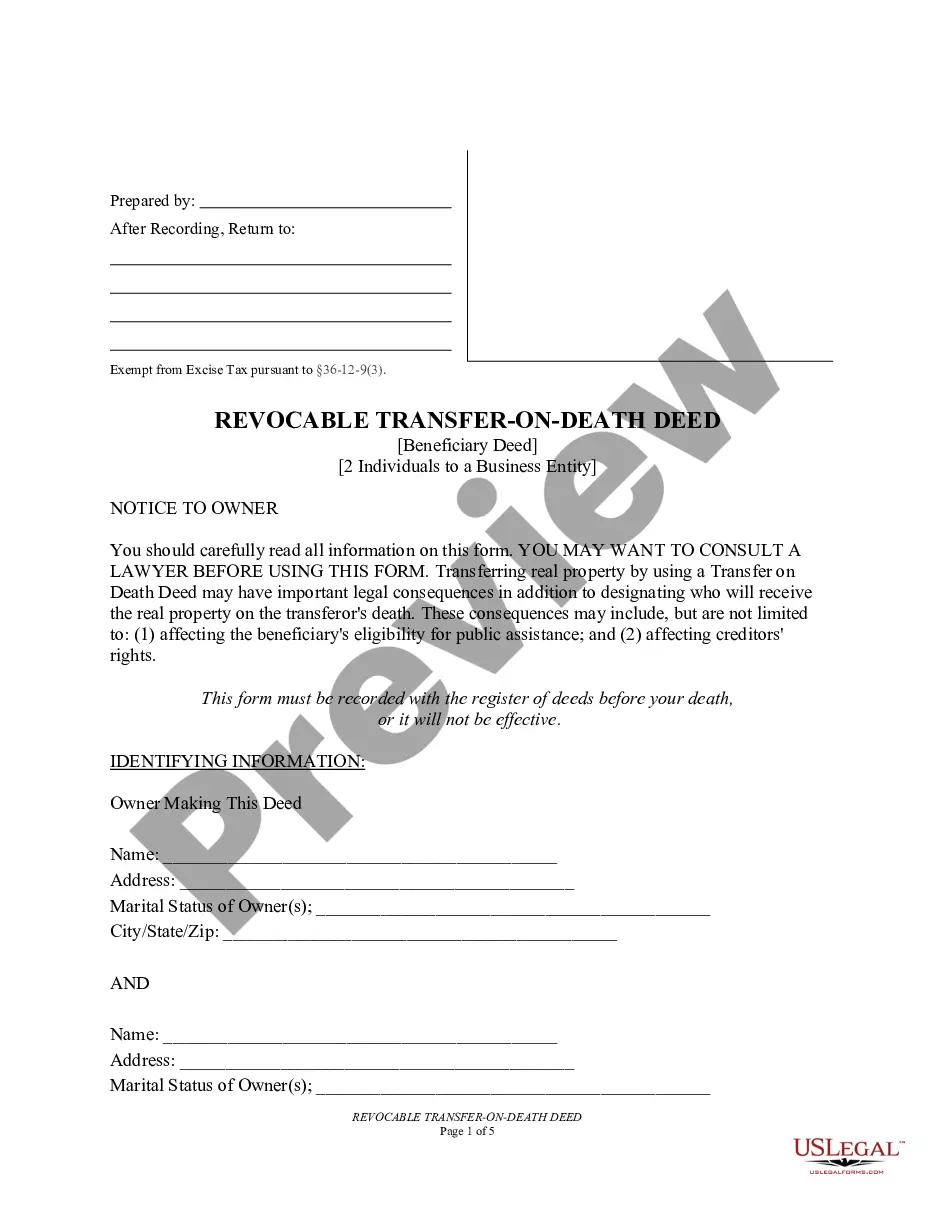

The Non-Foreign Affidavit Under IRC 1445 is a legal document used by sellers of real estate to confirm that they are not foreign individuals as defined by the Internal Revenue Code Section 26 USC 1445. This affidavit serves to prevent withholding taxes that would apply if the seller were identified as a foreign entity. Proper completion of this form is essential to ensure compliance with tax laws during real estate transactions.

Main sections of this form

- Identification of the seller(s) and their affiliation with the property.

- Confirmation that the seller(s) is/are not foreign persons according to Section 1445(f).

- Specification of the property, including legal description and tax identification numbers.

- Notary section for the affidavit to be sworn before a notary public.

- Signature lines for all sellers involved in the transaction.

When to use this document

This form should be used during the sale of real property when the seller is a U.S. citizen or a domestic entity. It is particularly crucial when the buyer needs to establish that no withholding taxes are required under IRC 1445 due to the seller's non-foreign status. Failing to submit this affidavit may result in unnecessary withholding during the property transaction.

Who should use this form

This form is intended for:

- Individuals or entities selling real estate in the U.S.

- U.S. citizens or domestic corporations who need to prove they are not foreign persons.

- Real estate agents assisting sellers in completing legal documentation.

Completing this form step by step

- Identify the seller(s) by entering their names and taxpayer identification numbers.

- Specify the property location, including the legal description and parcel number.

- Confirm that the seller(s) are not foreign persons by checking the relevant clause.

- Enter the date and provide signatures for all sellers.

- Complete the notary section to ensure the affidavit is valid and enforceable.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately identify the property description, which can lead to complications.

- Omitting signatures or not dating the document, rendering it incomplete.

- Incorrectly stating foreign status, which could trigger withholding requirements.

Quick recap

- The Non-Foreign Affidavit is essential for U.S. sellers of real estate.

- It prevents unnecessary tax withholding by establishing non-foreign status.

- Completing this form correctly is crucial for compliance with federal tax laws.

Looking for another form?

Form popularity

FAQ

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

FIRPTA Certificate: Certification of Non-Foreign Status - FIRPTA is the Foreign Investment in Real Property Act and Form 8288. It was developed to ensure that foreign sellers of U.S. property be subject to U.S. tax on the sale.

Foreign affidavit is an affidavit involving a matter of concern in one state but taken in another state or country before an officer of that state or country.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.