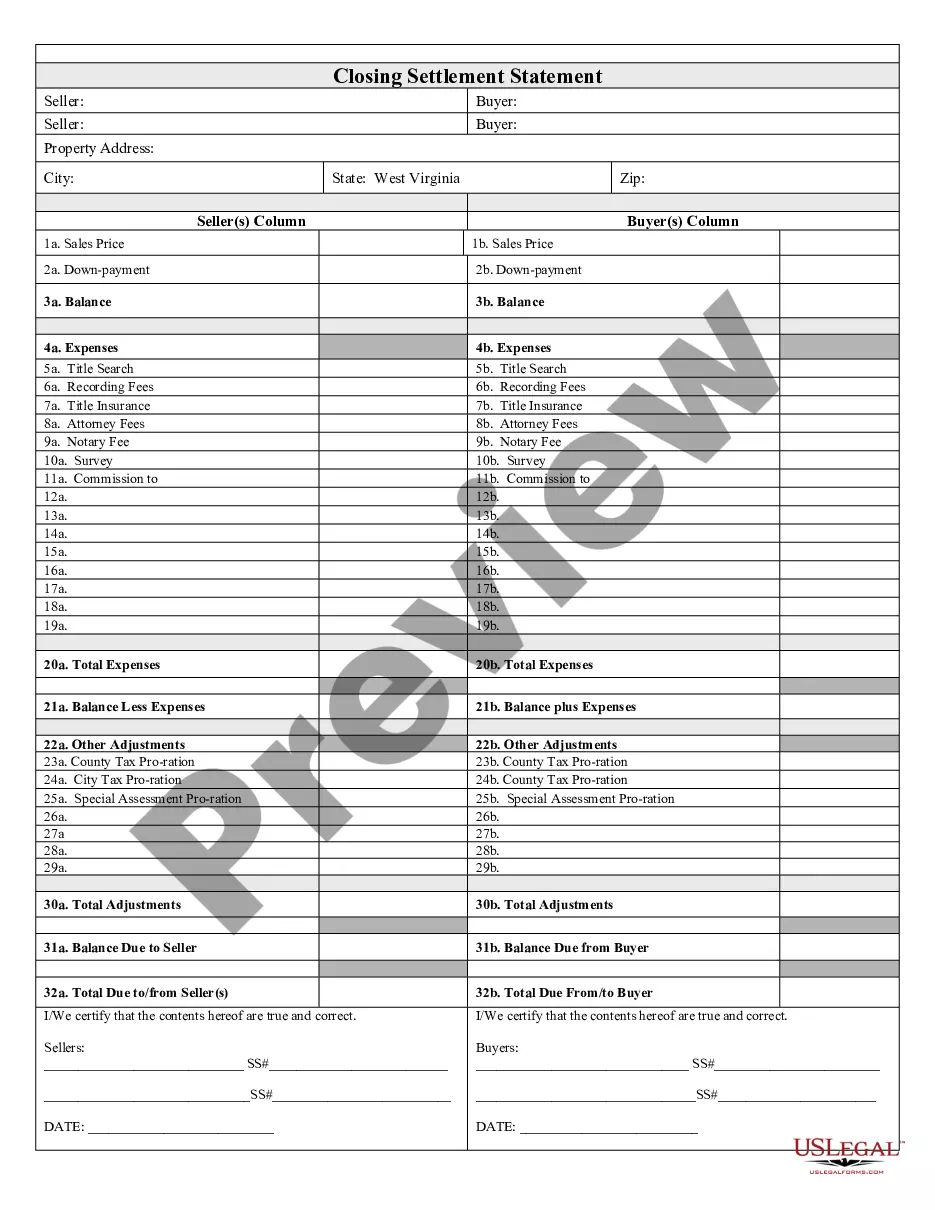

West Virginia Closing Statement

About this form

The Closing Statement is a crucial document used in real estate transactions where the sale is either a cash transaction or involves owner financing. This statement outlines the financial details of the transaction and is verified by both the buyer and the seller, distinguishing it from other forms like purchase agreements or lease agreements by providing a comprehensive settlement summary.

Main sections of this form

- Balance summaries to reflect the financial transactions between buyer and seller

- Expenses breakdown including title search, recording fees, and attorney fees

- Title insurance details to ensure property ownership is defensible

- Adjustments such as tax proration and special assessments

- Certification sections for both parties to confirm accuracy

Common use cases

This form should be utilized in real estate transactions at the closing stage. It is essential when finalizing the sale of real estate property, especially in cash sales or transactions involving owner financing. Use it to provide transparency regarding all financial aspects, such as expenses and any adjustments to the final sale price.

Who should use this form

- Homebuyers entering into cash purchases or owner-financed agreements

- Sellers of real estate properties involved in cash or financed transactions

- Real estate agents facilitating closings between buyers and sellers

- Attorneys overseeing the compliance of real estate transactions

Instructions for completing this form

- Identify the parties involved: list the buyer and seller's names.

- Specify the property details: include the address and legal description.

- Fill in all expense fields: record costs related to title searches, recording fees, and other relevant expenses.

- Calculate adjustments: include details such as tax prorations that affect the balance.

- Obtain signatures: both buyer and seller must verify the information by signing and dating the document.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to account for all expenses, leading to inaccuracies in the final balance

- Not obtaining signatures from both buyer and seller, which voids the document

- Omitting property details, creating confusion regarding the transaction

- Ignoring state-specific requirements that may affect the form's validity

Why complete this form online

- Convenient access to professionally drafted templates tailored to various jurisdictions

- Editability allows for customization based on specific transaction details

- Secure download ensures you have the most up-to-date forms available

- Ability to complete the form at your own pace, without time constraints

Looking for another form?

Form popularity

FAQ

Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

Owner's Title Insurance Premium: While some lenders may not require it, consider getting an owner's title insurance policy to protect yourself from any defects on the property title. This insurance coverage may cost more than $1,000 depending on your property value.

In West Virginia, the buyer traditionally pays for the items listed below, in addition to their lender's mortgage application costs, and other fees and closing costs. It is not unusual for buyer's closing costs to run between $3,000 and $6,000, PLUS their down payment.

One of the big differences is that, in West Virginia, buyers rarely purchase Buyer's Title Insurance (also known as Owner's Title Insurance, or an Owner's Title Policy) at closing. In Florida, virtually all buyers are provided with owner's title insurance, which is customarily paid for by the seller.

Who pays closing costs? Typically, both buyers and sellers pay closing costs, with buyers generally paying more than sellers. The buyer's closing costs typically run 5 to 6 percent of the sale price, according to Realtor.com.

According to data from ClosingCorp, the average closing cost in West Virginia is $3,384 after taxes, or approximately 1.69% to 3.38% of the final home sale price.

Generally, sellers can pay any of your settlement charges. This includes the amounts necessary to set up your escrow account. For sellers, offering, or at least being open to paying a buyer's closing costs, can increase the number of potential buyers.

How much are closing costs in West Virginia? While both you and the buyer will be shelling out for closing costs, typically the buyer takes the brunt of closing costs. For the buyer, they'll pay around 3% to 4% of the sales price. As the seller, you'll typically pay around 1% to 3% in closing costs.