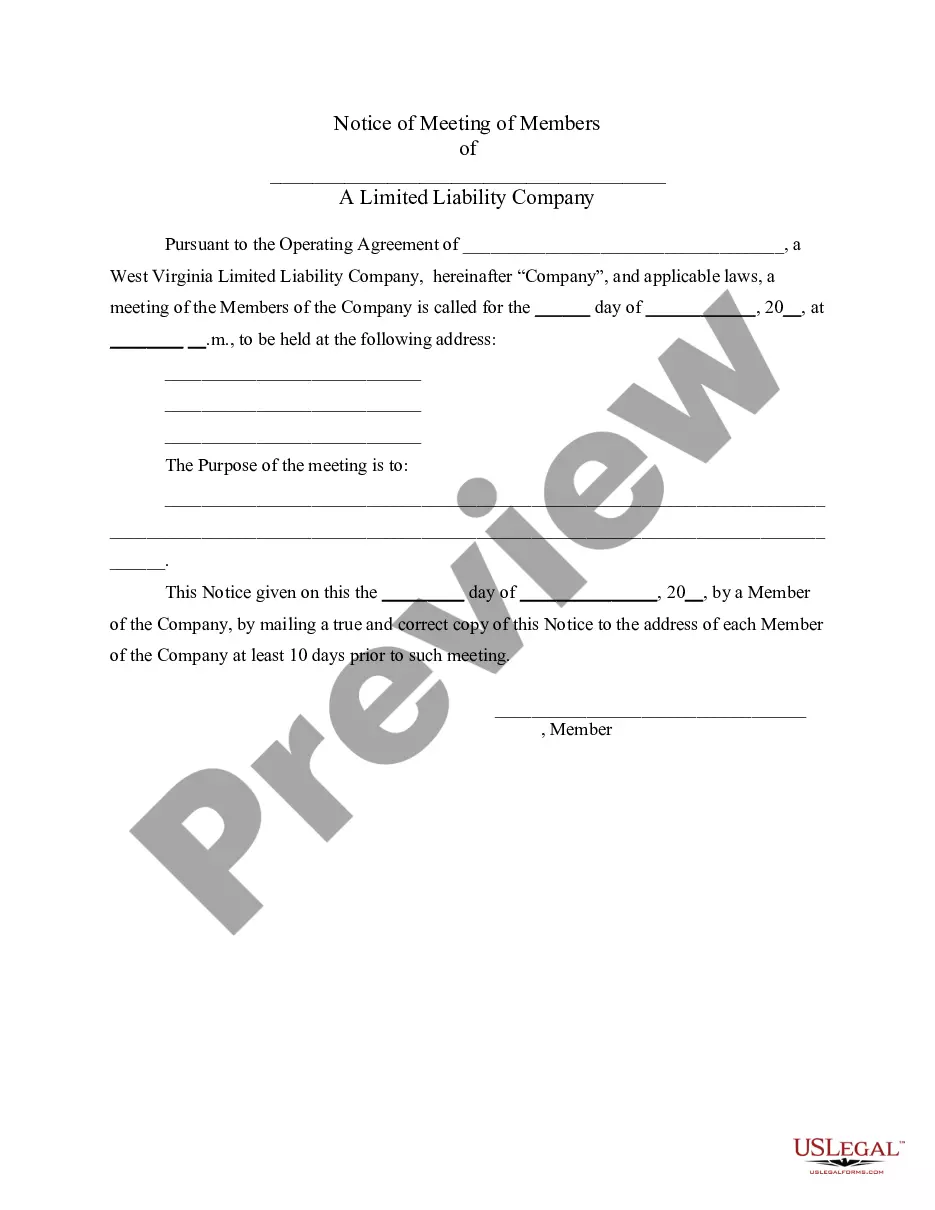

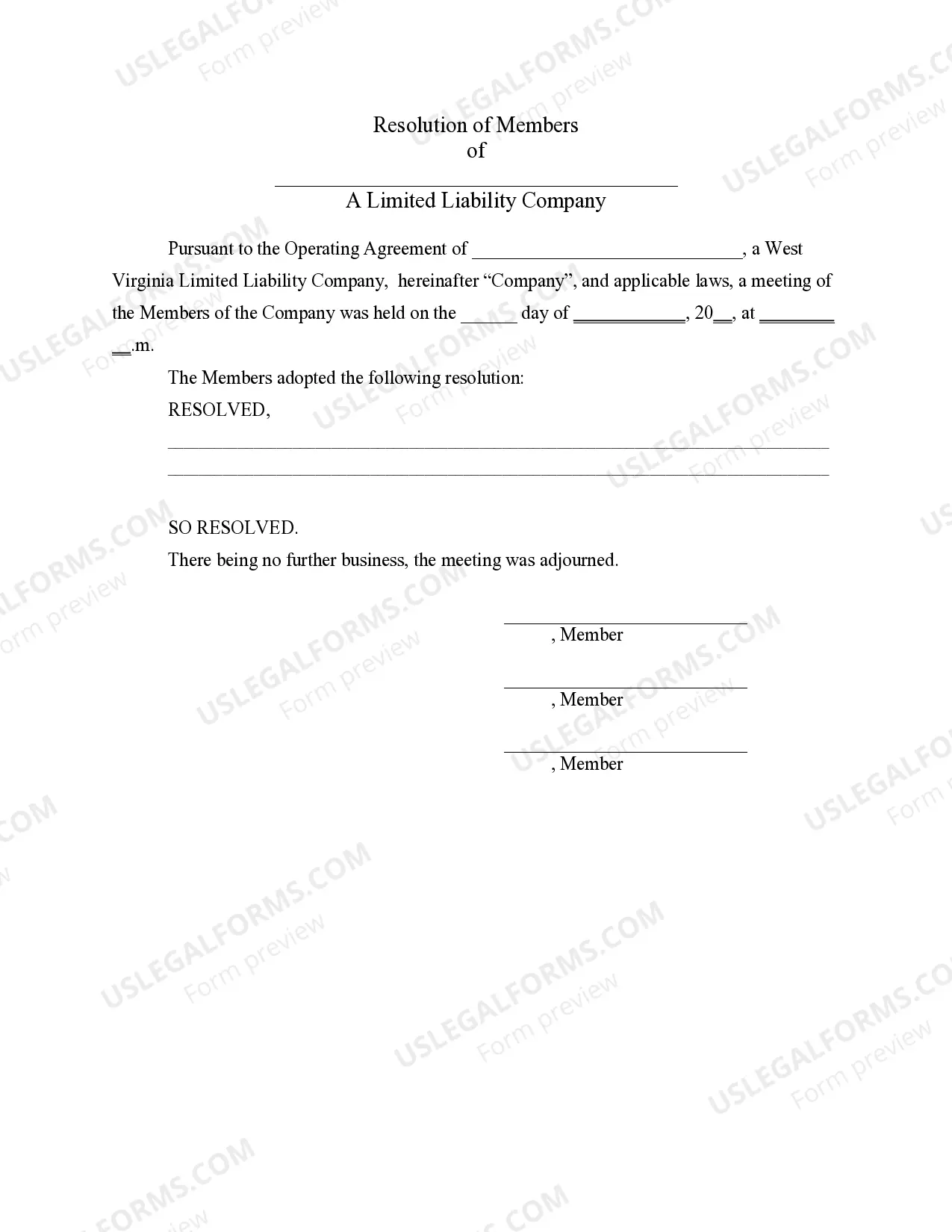

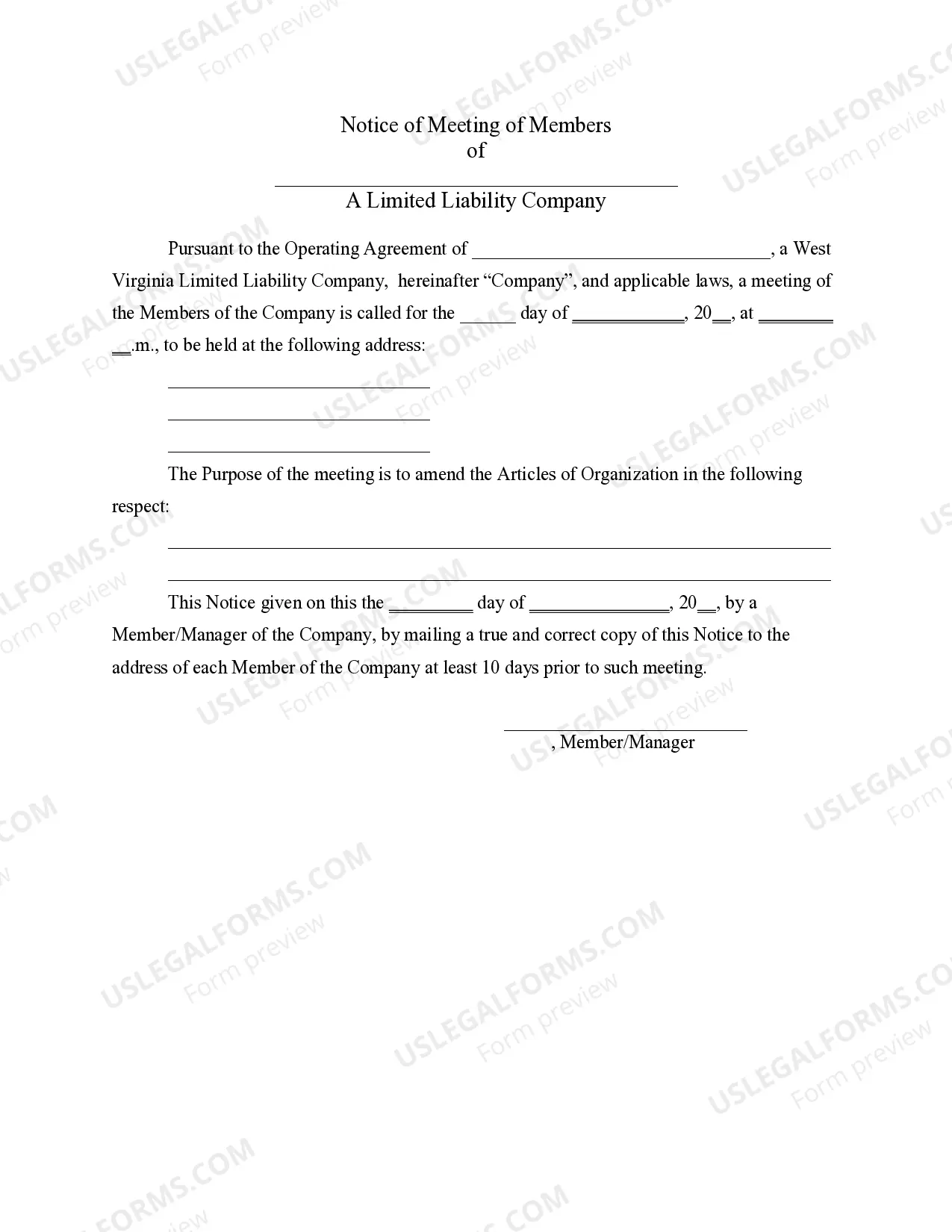

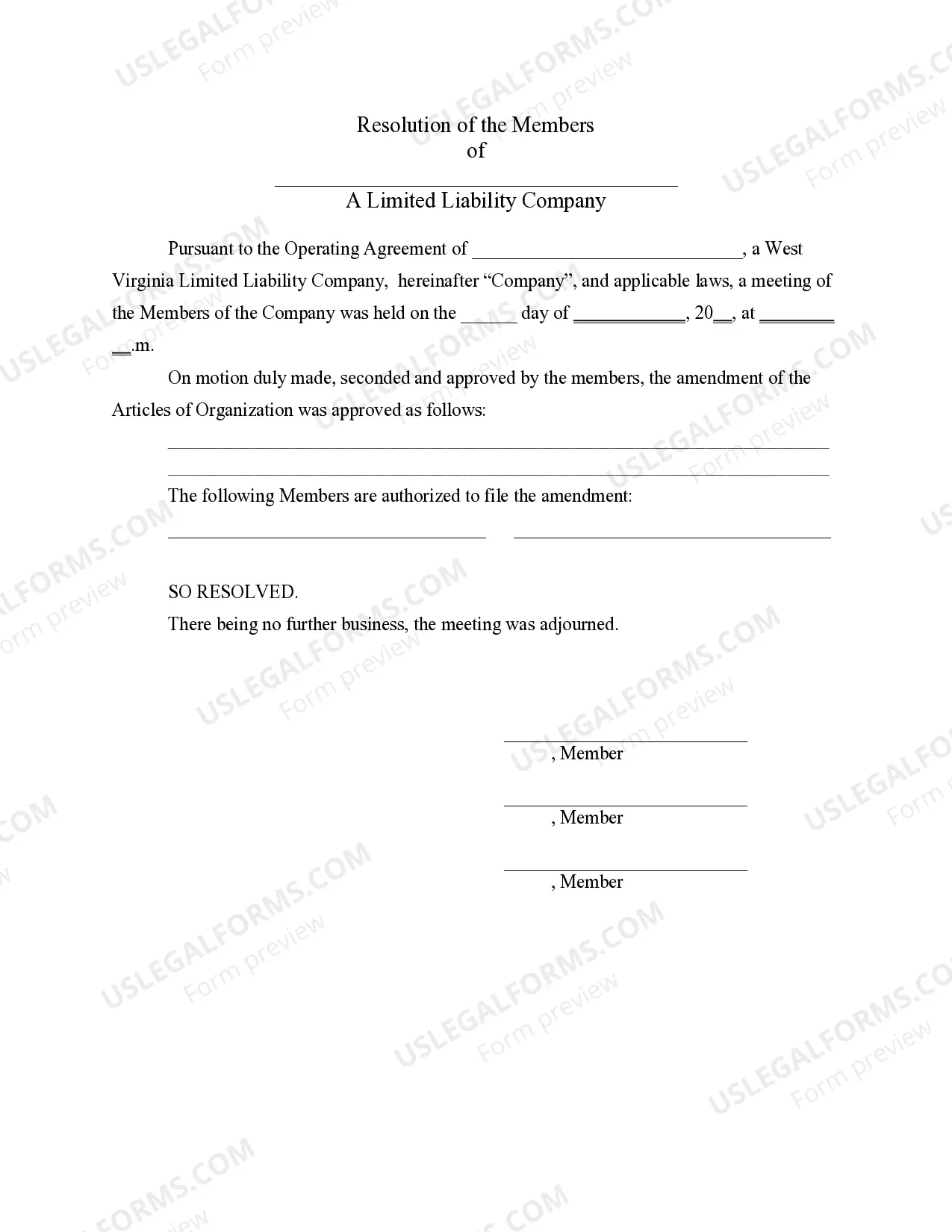

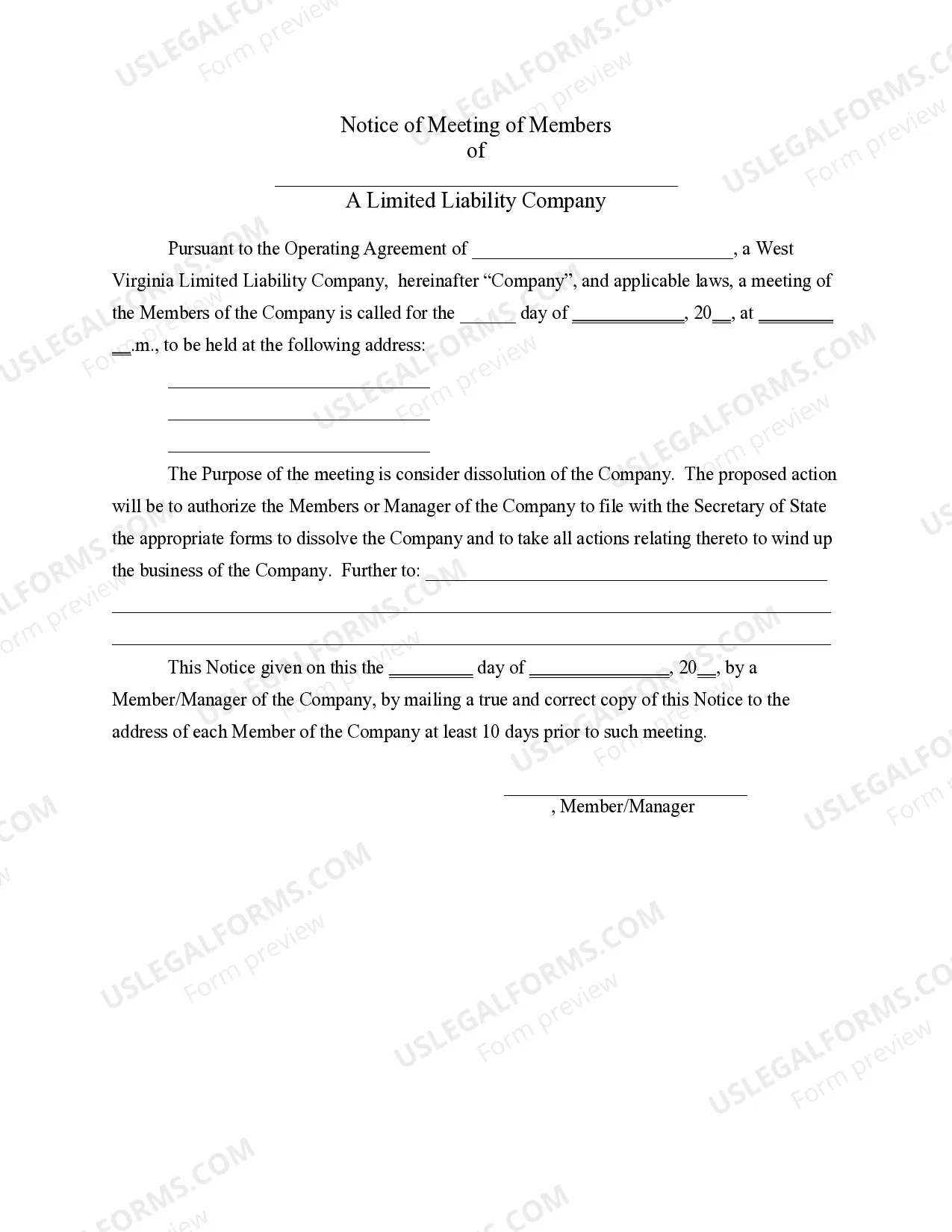

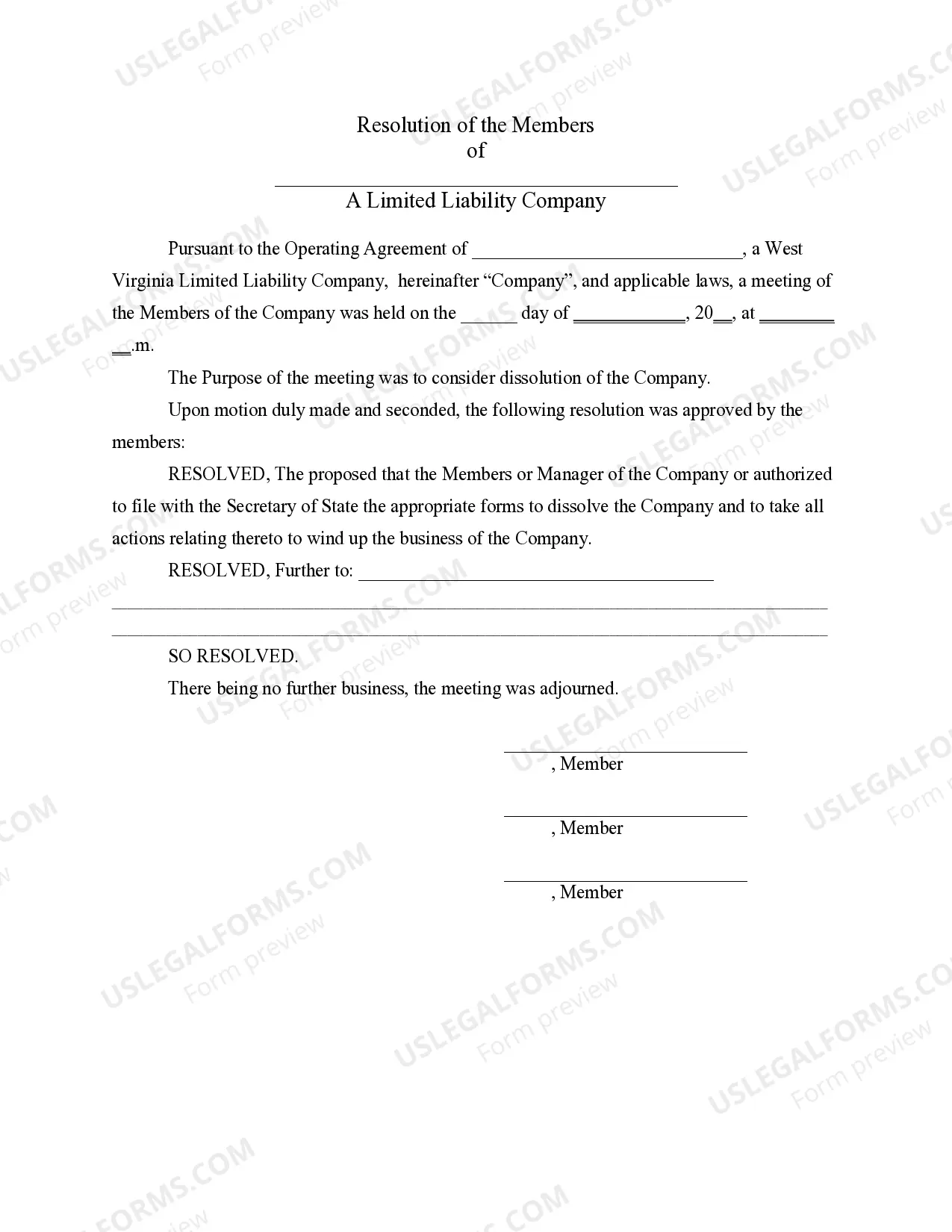

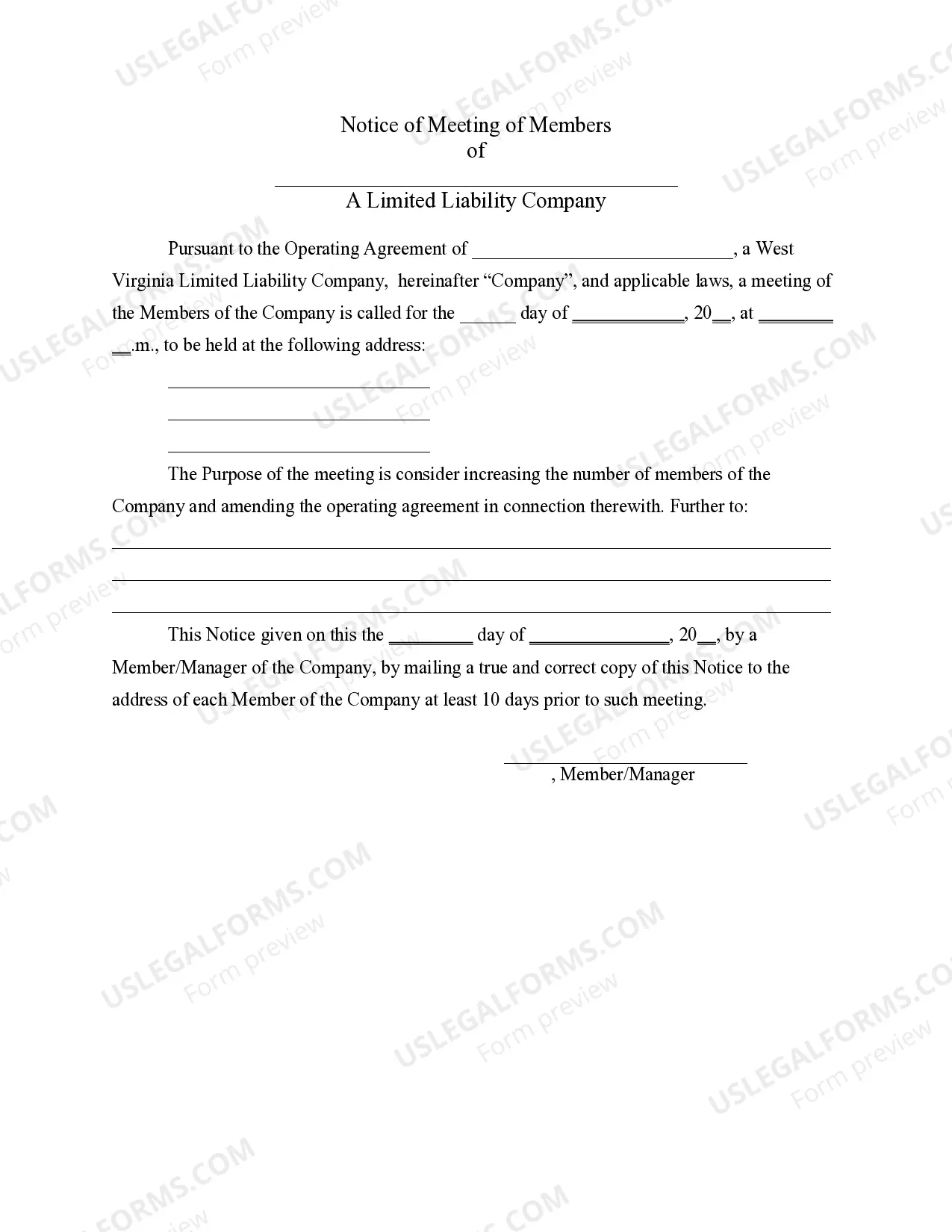

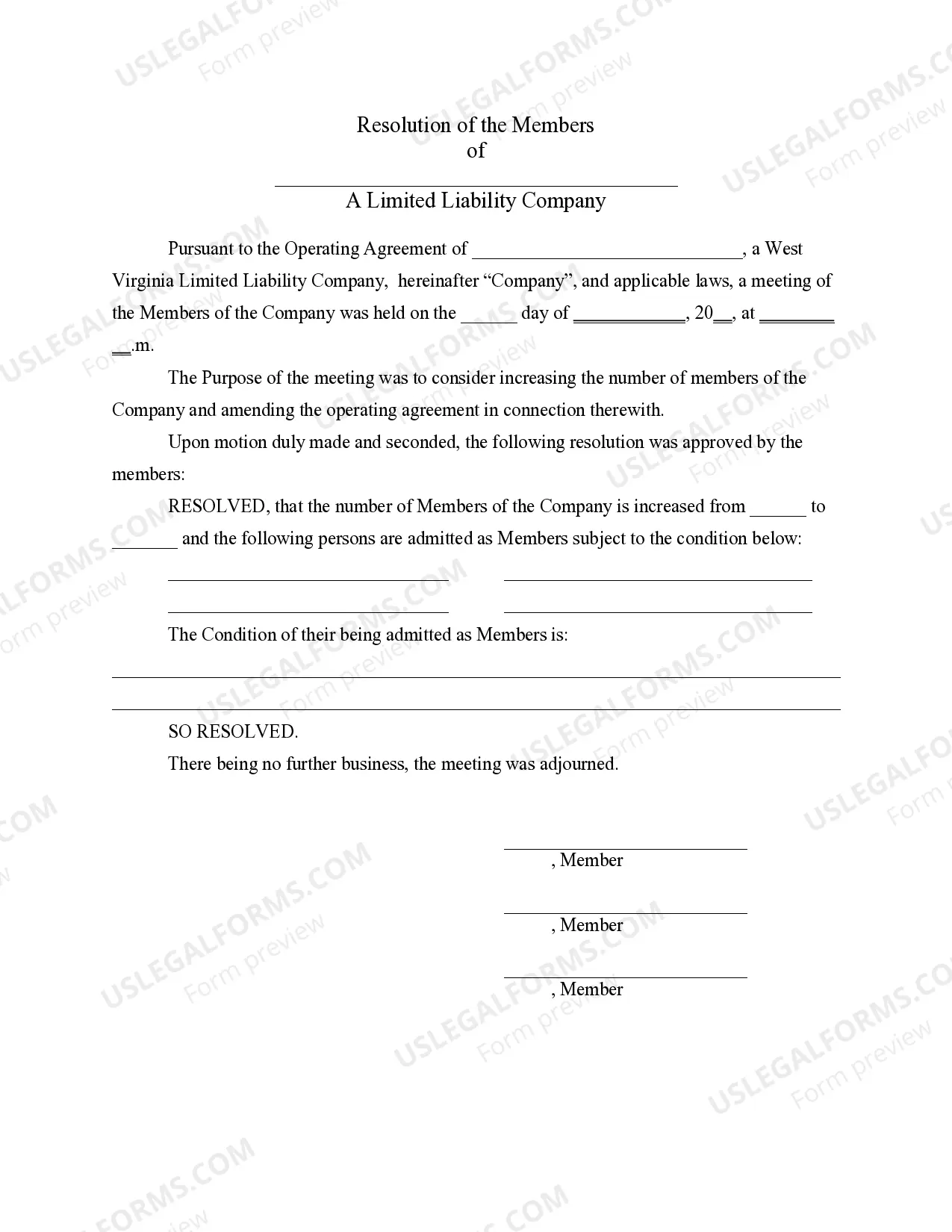

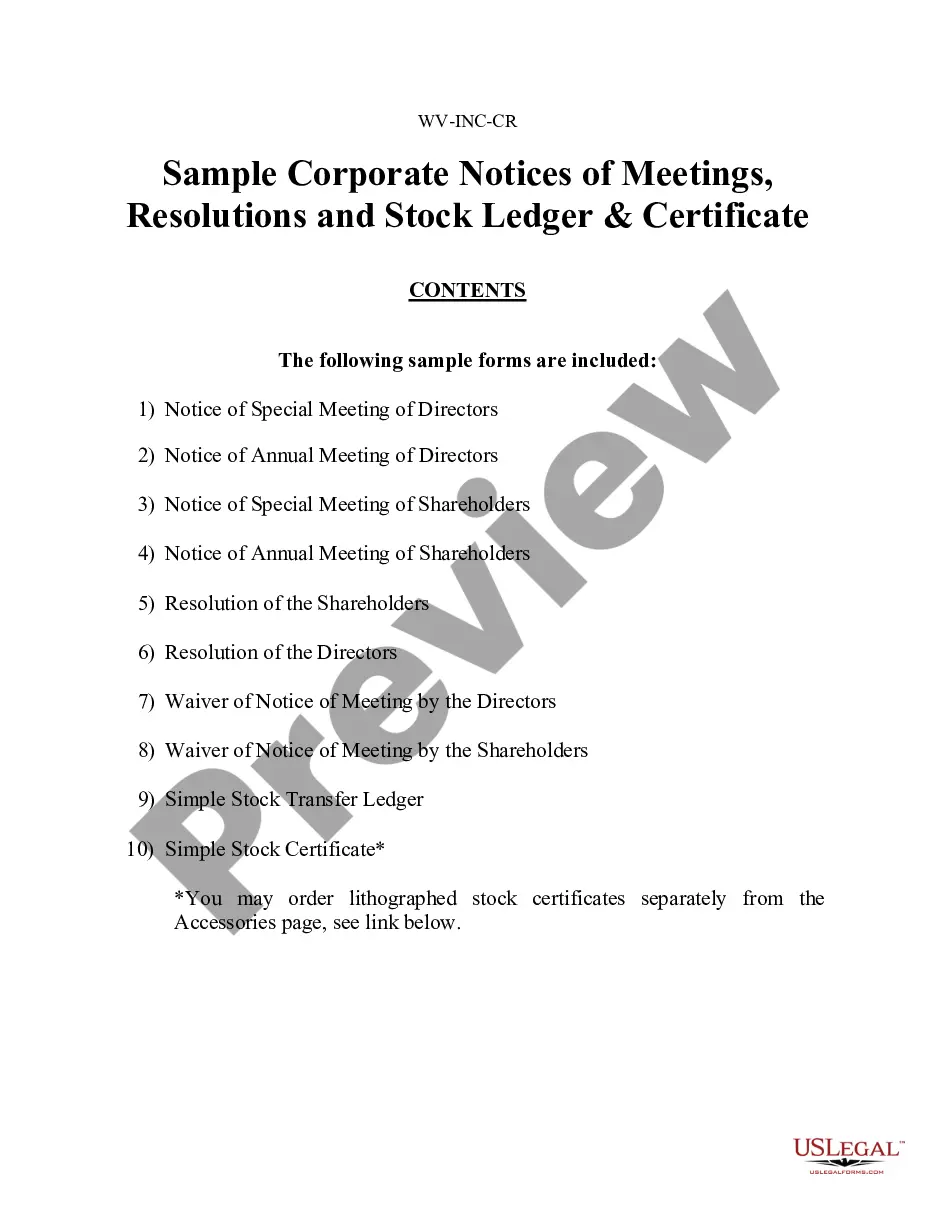

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

West Virginia LLC Notices, Resolutions and other Operations Forms Package

Description

How to fill out West Virginia LLC Notices, Resolutions And Other Operations Forms Package?

Out of the multitude of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms before purchasing them. Its comprehensive library of 85,000 templates is grouped by state and use for efficiency. All the documents available on the platform have been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, search for the form, press Download and obtain access to your Form name from the My Forms; the My Forms tab keeps all your downloaded documents.

Follow the guidelines listed below to get the form:

- Once you find a Form name, make certain it is the one for the state you really need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Search for a new sample via the Search field if the one you have already found isn’t appropriate.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the document.

Once you’ve downloaded your Form name, you may edit it, fill it out and sign it in an online editor that you pick. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains the most updated version in your state. Our platform offers fast and easy access to samples that suit both attorneys and their customers.

Form popularity

FAQ

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

The cost of the business license is based upon your estimate of total gross receipts from the day the business opens to December 31 of the same year. If the estimate is less than $100,000, the license will cost $50.00 which is the minimum tax.

LLC Taxes in CaliforniaCalifornia LLCs must pay an annual $800 LLC tax. California LLC taxes are due by April 15th, just like federal taxes, and should be paid to the California Franchise Tax Board. You must pay this tax even if your LLC doesn't earn any income.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. Pay Annual Registration Fees.

The filing fee to form an LLC in Virginia is $100. Filings can take 3 to 12 days to process. Expedited service is available for an additional fee. incorporate.com will handle all filing requirements and provide you with the total cost to get your business up and running in Virginia.

Step 1: Choose a Business Idea. Step 2: Write a Business Plan. Step 3: Select a Business Entity. Step 4: Register a Business Name. Step 5: Get an EIN. Step 6: Open a Business Bank Account. Step 7: Apply for Business Licenses & Permits. Step 8: Find Financing.

The filing fee is $50.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

Cost to Form a West Virginia LLC The LLC filing fee is $100; however, the fee is waived for veteran-owned businesses. Standard approval for the LLC is 5-10 days. Expedited service is available.