This term sheet summarizes the principal terms with respect to a potential private placement of convertible preferred equity securities. It is not a legally binding document, but rather a basis for further discussions.

Wisconsin Convertible Preferred Equity Securities Term Sheet

Description

How to fill out Convertible Preferred Equity Securities Term Sheet?

Choosing the right authorized document format might be a struggle. Obviously, there are plenty of templates available on the Internet, but how would you obtain the authorized kind you require? Utilize the US Legal Forms website. The service offers thousands of templates, such as the Wisconsin Convertible Preferred Equity Securities Term Sheet, which can be used for business and personal demands. All of the kinds are checked by professionals and fulfill federal and state specifications.

If you are currently signed up, log in in your bank account and click on the Obtain button to find the Wisconsin Convertible Preferred Equity Securities Term Sheet. Use your bank account to appear throughout the authorized kinds you possess acquired earlier. Visit the My Forms tab of the bank account and have another version in the document you require.

If you are a new user of US Legal Forms, allow me to share basic instructions that you can stick to:

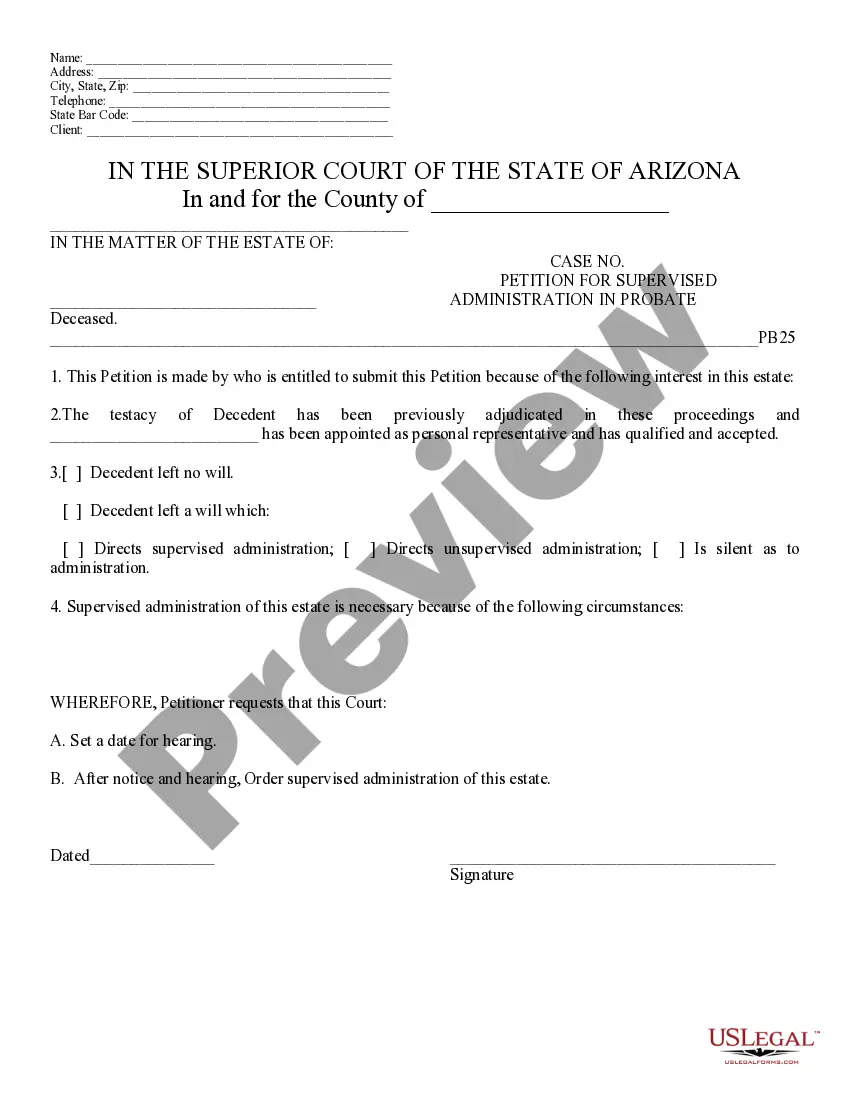

- Initially, make sure you have selected the proper kind for your town/county. You may check out the form using the Preview button and study the form outline to guarantee it will be the best for you.

- When the kind will not fulfill your preferences, take advantage of the Seach discipline to get the correct kind.

- When you are positive that the form is acceptable, click on the Acquire now button to find the kind.

- Choose the pricing strategy you desire and enter the necessary information and facts. Make your bank account and pay money for your order using your PayPal bank account or credit card.

- Pick the document formatting and download the authorized document format in your product.

- Complete, modify and print and indication the obtained Wisconsin Convertible Preferred Equity Securities Term Sheet.

US Legal Forms is the biggest catalogue of authorized kinds in which you will find a variety of document templates. Utilize the service to download expertly-made paperwork that stick to express specifications.

Form popularity

FAQ

What Are Convertible Preferred Shares? These shares are corporate fixed-income securities that the investor can choose to turn into a certain number of shares of the company's common stock after a predetermined time span or on a specific date.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

Typically in a Preferred Equity investment, all cash flow or profits are paid back to the preferred investors (after all debt has been repaid) until they receive the agreed upon ?preferred return,? for example, 12%. Remaining distributions of cash flow are returned to Common Equity holders.

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio. Conversion premium: The dollar amount by which the market price of the convertible preferred stock exceeds the current market value of the common shares into which it may be converted.

The preferred stock converts into a variable number of shares and the monetary value of the obligation is based solely on a fixed monetary amount (stated value) known at inception. ingly, it should be classified as a liability under the guidance in ASC 480-10-25-14a.

Redeemable convertible preference share It is liable to be redeemed by that body corporate. On redemption, the shareholder receives: an agreed cash amount; or. an agreed number of ordinary shares in the issuing body corporate.

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.