Wisconsin Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

Description

How to fill out Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

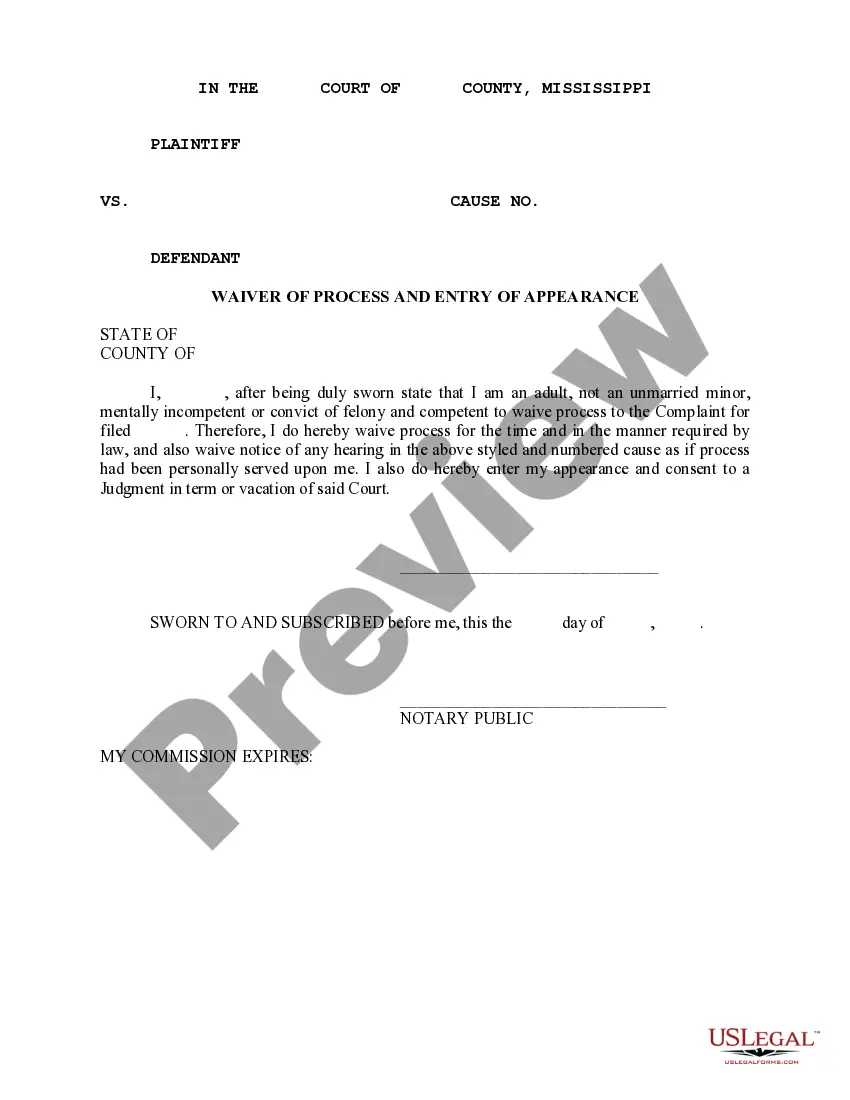

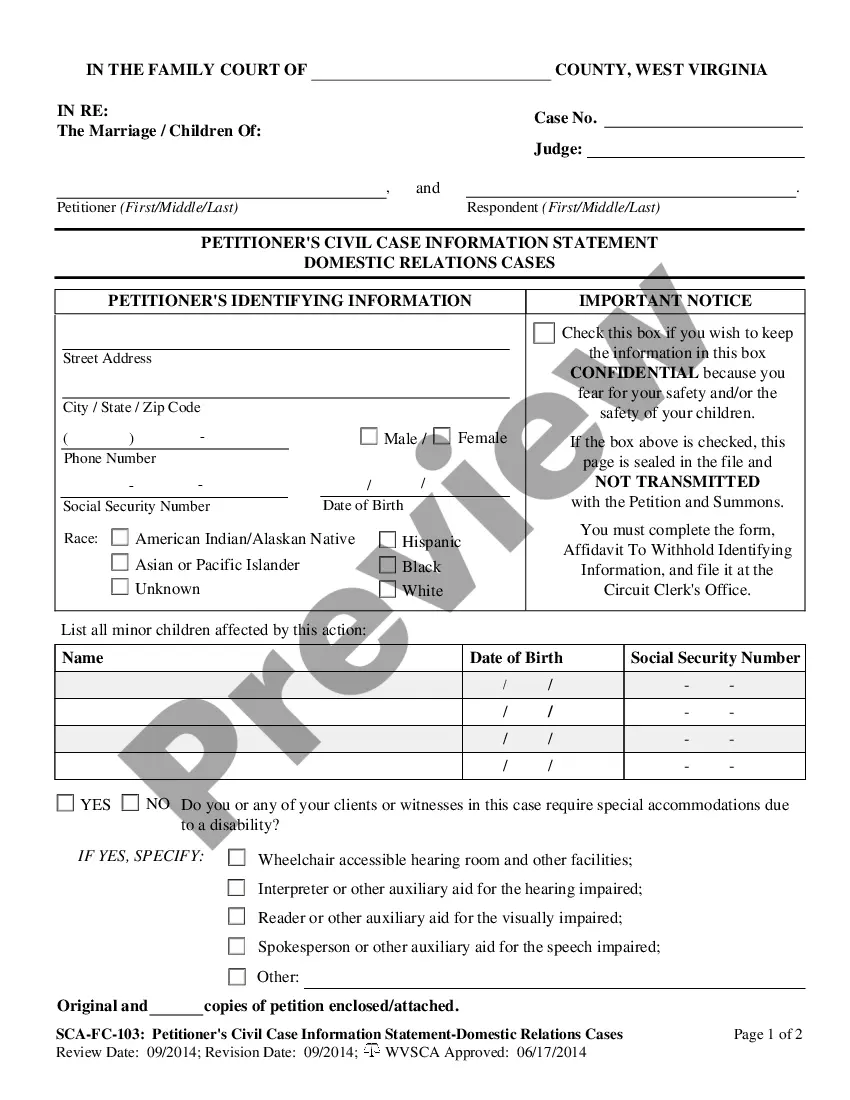

If you have to complete, down load, or print legitimate papers web templates, use US Legal Forms, the greatest selection of legitimate types, that can be found on-line. Utilize the site`s simple and easy practical lookup to obtain the papers you require. Numerous web templates for organization and individual uses are categorized by groups and says, or key phrases. Use US Legal Forms to obtain the Wisconsin Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files with a few mouse clicks.

When you are already a US Legal Forms customer, log in for your accounts and click the Download switch to have the Wisconsin Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files. You can even access types you in the past downloaded inside the My Forms tab of the accounts.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape to the proper town/region.

- Step 2. Utilize the Review method to examine the form`s information. Don`t overlook to learn the description.

- Step 3. When you are unhappy together with the develop, take advantage of the Search area on top of the display screen to locate other models from the legitimate develop web template.

- Step 4. When you have discovered the shape you require, go through the Get now switch. Choose the rates prepare you favor and include your references to sign up on an accounts.

- Step 5. Process the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the financial transaction.

- Step 6. Find the file format from the legitimate develop and down load it in your gadget.

- Step 7. Full, modify and print or signal the Wisconsin Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files.

Each and every legitimate papers web template you buy is yours for a long time. You might have acces to every single develop you downloaded inside your acccount. Go through the My Forms section and pick a develop to print or down load once more.

Compete and down load, and print the Wisconsin Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files with US Legal Forms. There are millions of expert and state-certain types you may use to your organization or individual requirements.

Form popularity

FAQ

?UCC? stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

How long is my filing active? A financing statement is active for five years, statutory agricultural lien for five years, Public Finance Lien is thirty years and Manufactured Home Lien is thirty years. A continuation will extend the filing for another 5-year term if filed within 6 months of expiration.

If the borrower defaults on the loan, the lender has a legally recognized priority claim to the collateral over other creditors. Once the loan is paid off, the lender should file a UCC-3 termination statement. This removes the UCC lien and indicates that the lender no longer has an interest in the collateral.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

In general, a UCC filing is not bad for your business ? it simply serves as an official notice to other creditors that your lender has a security interest in one or all of your assets. However, UCC filings can impact your business credit, risk your company's assets and/or hinder your ability to get future financing.

A creditor with a UCC lien against your assets could immediately come after things like: Cash from your bank account. Your vehicle or other personal property. Any other assets mentioned in the UCC-1.

Most Uniform Commercial Code (UCC) filings can be filed online by using our online lien system. Simply create an account and begin filing the same day. Please note that UCC-1 Transmitting Utilities can only be filed by paper.

If you need to remove a UCC filing form your credit report, ask the lender to file for its removal. In order to do this, they need to file a UCC-3 Financing Statement Amendment. You can also just wait it out. Depending on how long you have been with the lender, the filing may be removed within a few months.

A UCC filing is the official notice lenders use to indicate that they have a security interest in a borrower's assets or property. The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default.