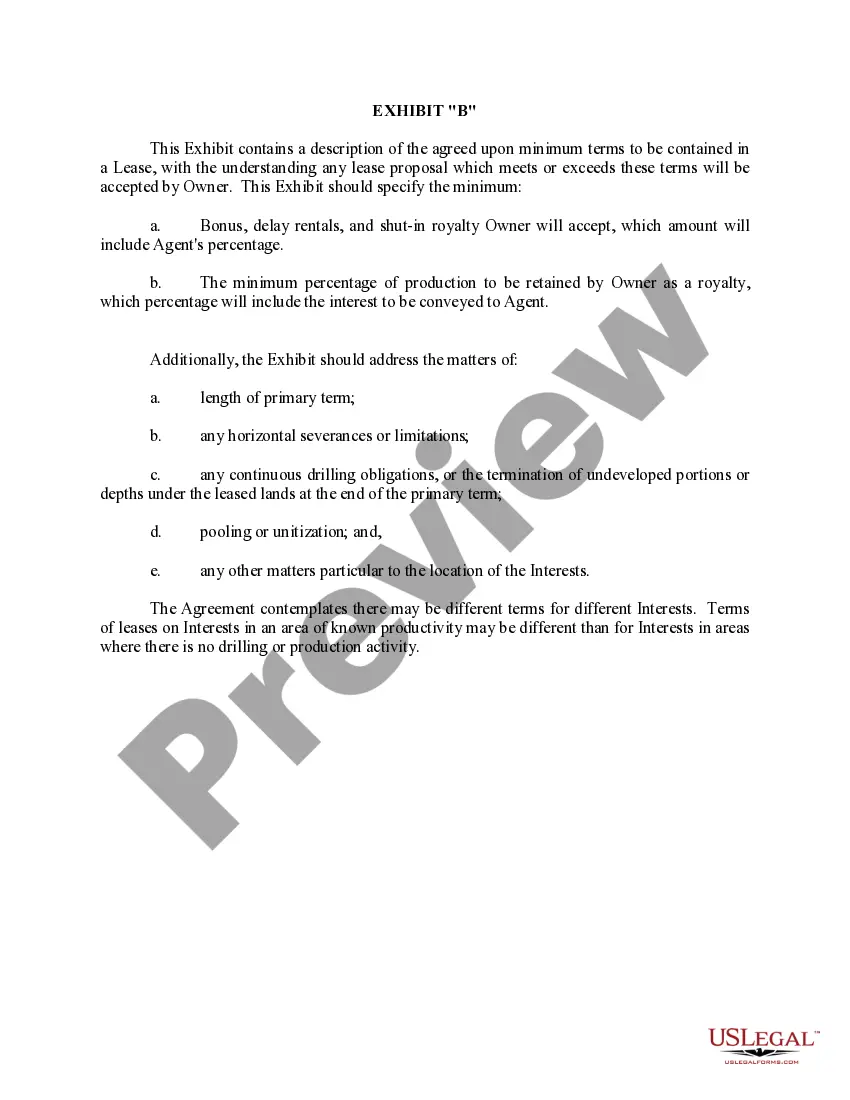

Wisconsin Agreement Designating Agent to Lease Mineral Interests

Description

How to fill out Agreement Designating Agent To Lease Mineral Interests?

Choosing the best legitimate file web template might be a have a problem. Obviously, there are a lot of themes available online, but how do you discover the legitimate form you require? Take advantage of the US Legal Forms website. The service gives thousands of themes, like the Wisconsin Agreement Designating Agent to Lease Mineral Interests, that you can use for company and private demands. Each of the forms are checked by experts and meet federal and state needs.

In case you are previously listed, log in to your bank account and click the Down load button to have the Wisconsin Agreement Designating Agent to Lease Mineral Interests. Use your bank account to check throughout the legitimate forms you might have bought earlier. Check out the My Forms tab of your own bank account and obtain yet another version from the file you require.

In case you are a brand new customer of US Legal Forms, listed below are straightforward recommendations that you should adhere to:

- First, be sure you have selected the proper form for the metropolis/county. It is possible to check out the form using the Preview button and study the form information to make sure this is the right one for you.

- When the form fails to meet your expectations, use the Seach field to get the appropriate form.

- When you are certain that the form is proper, click on the Acquire now button to have the form.

- Pick the prices prepare you want and enter in the required information and facts. Design your bank account and pay for the transaction using your PayPal bank account or credit card.

- Choose the document structure and download the legitimate file web template to your product.

- Total, revise and printing and sign the received Wisconsin Agreement Designating Agent to Lease Mineral Interests.

US Legal Forms will be the largest collection of legitimate forms where you will find numerous file themes. Take advantage of the service to download skillfully-manufactured documents that adhere to state needs.

Form popularity

FAQ

The Book of Jargon® ? Oil & Gas is one in a series of practice area and industry-specific glossaries published by Latham & Watkins. The definitions provide an introduction to each term and may raise complex legal issues on which specific legal advice is required.

Total operated basis: The total reserves or production associated with the wells operated by an individual operator. This is also commonly known as the "gross operated" or "8/8ths" basis.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

The cost basis for inherited mineral rights is ?fair value.? It's simply the book value of what you receive on the day you acquire it. If you sell your rights afterward, you'll have to pay capital gains tax on the difference between your cost basis and the sale price.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Sometimes called at payout, the point after all the costs of exploring, drilling, producing, equipping, completing, and operating have been recouped from the sale of production from an oil or gas well.

8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.

. ©Equinor. Aker Solutions has secured a contract extension with Equinor in Norway to continue providing maintenance and modification services (M&M) on the Johan Sverdrup field in the North Sea.