This is an agreement between the firm and a new partner, for compensation based on generating new business. It lists the base draw and the percentage of fees earned by generating new business. It also covers such areas as secretarial help, office space, medical insurance, and malpractice insurance.

Wisconsin Agreement with New Partner for Compensation Based on Generating New Business

Description

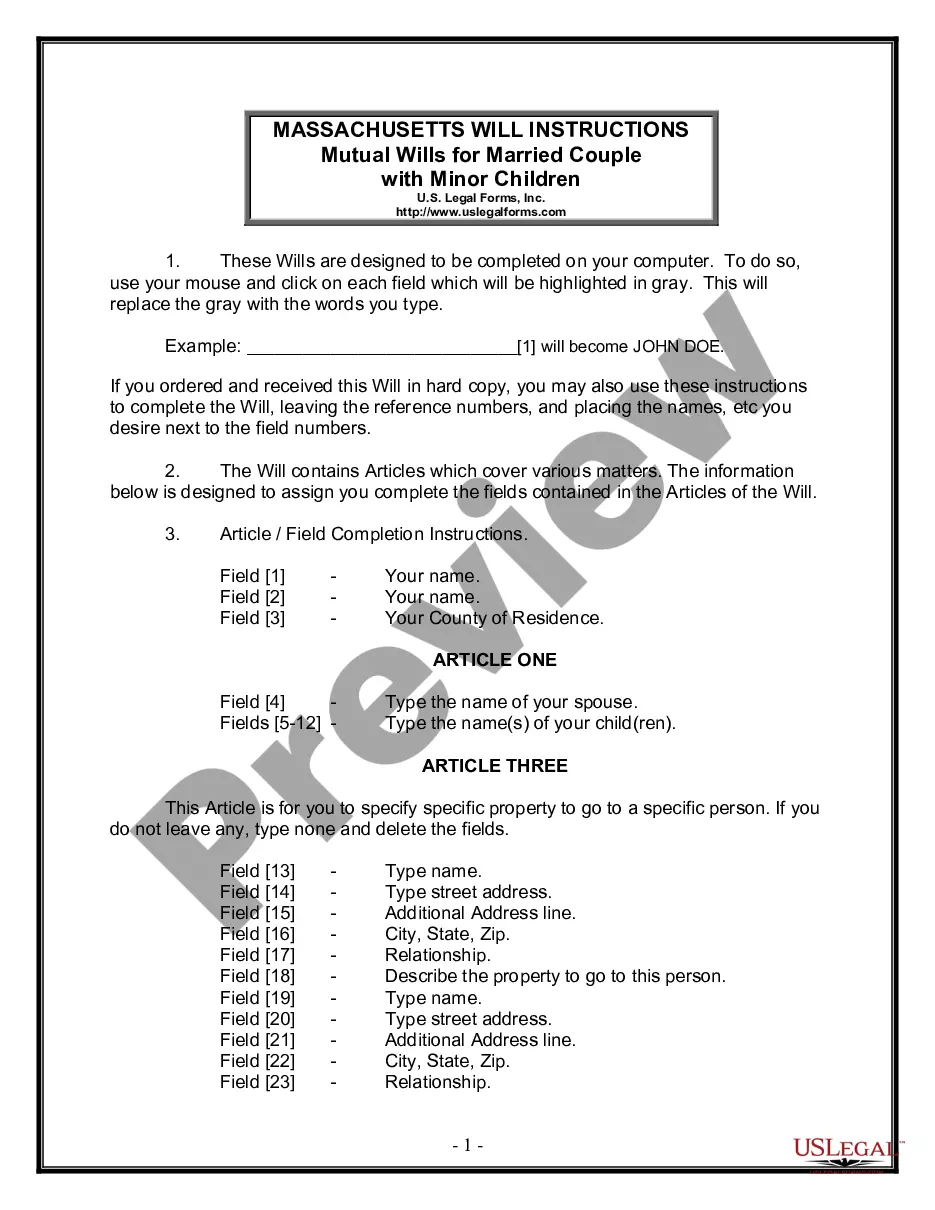

How to fill out Agreement With New Partner For Compensation Based On Generating New Business?

You are able to devote hrs on the Internet attempting to find the legitimate file format which fits the state and federal specifications you need. US Legal Forms provides thousands of legitimate kinds which can be evaluated by professionals. You can actually down load or produce the Wisconsin Agreement with New Partner for Compensation Based on Generating New Business from our service.

If you currently have a US Legal Forms profile, it is possible to log in and click the Download option. Following that, it is possible to complete, modify, produce, or sign the Wisconsin Agreement with New Partner for Compensation Based on Generating New Business. Each legitimate file format you acquire is yours eternally. To acquire another backup of the obtained develop, proceed to the My Forms tab and click the corresponding option.

If you use the US Legal Forms site the very first time, keep to the simple directions beneath:

- Initially, make certain you have selected the proper file format for your area/area of your choosing. Look at the develop information to make sure you have selected the correct develop. If available, utilize the Preview option to look through the file format also.

- In order to discover another model from the develop, utilize the Research field to get the format that fits your needs and specifications.

- After you have found the format you would like, just click Purchase now to move forward.

- Select the rates program you would like, key in your references, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You should use your credit card or PayPal profile to fund the legitimate develop.

- Select the format from the file and down load it to your product.

- Make changes to your file if necessary. You are able to complete, modify and sign and produce Wisconsin Agreement with New Partner for Compensation Based on Generating New Business.

Download and produce thousands of file layouts utilizing the US Legal Forms site, which offers the greatest assortment of legitimate kinds. Use expert and status-particular layouts to deal with your small business or individual demands.

Form popularity

FAQ

No formal or written agreement among the partners is needed to create a partnership, even though under current law, ?A partnership is an entity distinct from its partners?. Corp. Code § 16201; 9 Witkin, Summary of California Law (10th Ed., 2008), Partnership, § 23.

Here are the five steps you'll need to follow to file business taxes for your partnership. Prepare Form 1065, U.S. Return of Partnership Income. ... Prepare Schedule K-1. ... File Form 1065 and copies of the K-1 Forms. ... File state tax returns. ... File personal tax returns. 5 steps to filing partnership taxes | .com ? articles ? 5-steps-to-filing-... .com ? articles ? 5-steps-to-filing-...

Create a General Partnership in Wisconsin Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Wisconsin state tax identification numbers. How to Register as a General Partnership in Wisconsin ZenBusiness ? ... ? General Partnership ZenBusiness ? ... ? General Partnership

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

A Partnership Agreement is a contract between two or more business partners. The partners use the agreement to outline their rights, responsibilities, and profit and loss distribution. The agreement also sets general partnership rules, like withdrawals, capital contributions, and financial reporting.

How to form a Wisconsin General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565. 2021 Partnership Tax Booklet | California Forms & Instructions 565 ca.gov ? forms ? 2021-565-booklet ca.gov ? forms ? 2021-565-booklet

How to form a partnership: 10 steps to success Choose your partners. ... Determine your type of partnership. ... Come up with a name for your partnership. ... Register the partnership. ... Determine tax obligations. ... Apply for an EIN and tax ID numbers. ... Establish a partnership agreement. ... Obtain licenses and permits, if applicable. Ready, Set, Go! Learn How to Form a Partnership Using These 10 Steps patriotsoftware.com ? blog ? accounting ? h... patriotsoftware.com ? blog ? accounting ? h...