Wisconsin Self-Employed Tailor Services Contract

Description

How to fill out Self-Employed Tailor Services Contract?

If you wish to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the most extensive collection of lawful forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Wisconsin Self-Employed Tailor Services Contract in just a few clicks.

Every legal document template you acquire is yours forever. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Wisconsin Self-Employed Tailor Services Contract with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to acquire the Wisconsin Self-Employed Tailor Services Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

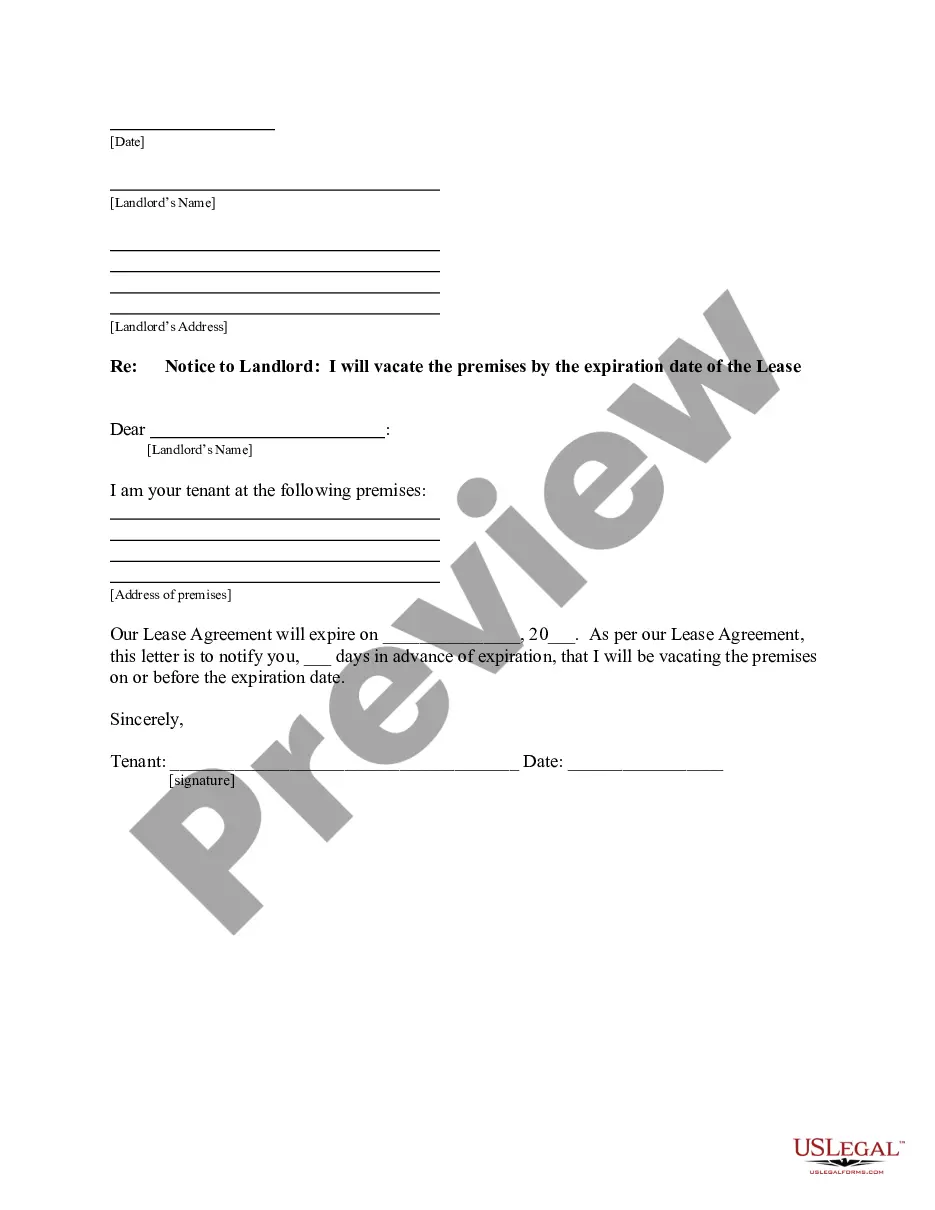

- Step 2. Use the Review option to examine the form’s details. Don’t forget to read the information.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Wisconsin Self-Employed Tailor Services Contract.

Form popularity

FAQ

To establish yourself as an independent contractor, start by defining your services and creating a business plan. Register your business and consider obtaining necessary licenses. Additionally, using a Wisconsin Self-Employed Tailor Services Contract will help you formalize your agreements, ensuring you and your clients understand the terms of your work.

Yes, it is legal to work without a signed contract, but it can lead to complications. Without a Wisconsin Self-Employed Tailor Services Contract, you may struggle to enforce payment or service expectations. It’s always best to have a written agreement to protect your rights.

While you can freelance without a contract, it is not advisable. A Wisconsin Self-Employed Tailor Services Contract provides clarity on the work being performed, payment structures, and deadlines. Without it, you risk miscommunication and potential legal issues with your clients.

Legal requirements for self-employed individuals vary by state, but typically include registering your business, obtaining necessary licenses, and paying taxes. In Wisconsin, you may also want a Wisconsin Self-Employed Tailor Services Contract to formalize agreements with clients. Understanding these requirements will help you operate legally and efficiently.

You do not need to form an LLC to work as a contractor, but it can offer legal protection and tax benefits. If you operate as a self-employed tailor, you can work as a sole proprietor without an LLC. However, consider a Wisconsin Self-Employed Tailor Services Contract to ensure your business operations are clearly defined.

Yes, having a contract is essential for self-employed individuals, including tailors. A Wisconsin Self-Employed Tailor Services Contract outlines the terms of your services, payment, and other important details. This document can prevent potential disputes and provide clarity for both you and your clients.

Working without a contract may lead to misunderstandings about job expectations, payment terms, and responsibilities. Without a formal agreement, you may find it challenging to resolve disputes or enforce your rights. Additionally, having a Wisconsin Self-Employed Tailor Services Contract helps clarify your professional relationship and protects your interests.

Yes, you can write your own legally binding contract as long as you adhere to the necessary legal requirements. Ensure that the contract includes all essential elements, such as offer, acceptance, and consideration. To make the process easier and ensure compliance, consider using a template from US Legal Forms for your Wisconsin Self-Employed Tailor Services Contract.

Independent contractors in Wisconsin are responsible for income tax and self-employment tax. The self-employment tax covers Social Security and Medicare contributions, while income tax rates vary based on your earnings. Understanding these tax obligations is crucial for managing your finances as a self-employed tailor. Platforms like US Legal Forms offer valuable resources to help you navigate these responsibilities.

To write a contract for a 1099 employee, outline the specific services they will provide, payment terms, and the independent nature of the work relationship. Be clear that the individual is responsible for their own taxes, as this is a key aspect of 1099 arrangements. Using a template from US Legal Forms can help you create a thorough Wisconsin Self-Employed Tailor Services Contract that meets legal standards.