Wisconsin Security And Alarm Services Contract - Self-Employed

Description

How to fill out Security And Alarm Services Contract - Self-Employed?

Are you presently in a position where you require documents for either business or personal purposes almost every working day.

There are numerous legal document templates available online, but locating reliable versions is not easy.

US Legal Forms offers thousands of form templates, such as the Wisconsin Security And Alarm Services Contract - Self-Employed, that are designed to meet state and federal requirements.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes.

The service provides properly crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Wisconsin Security And Alarm Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

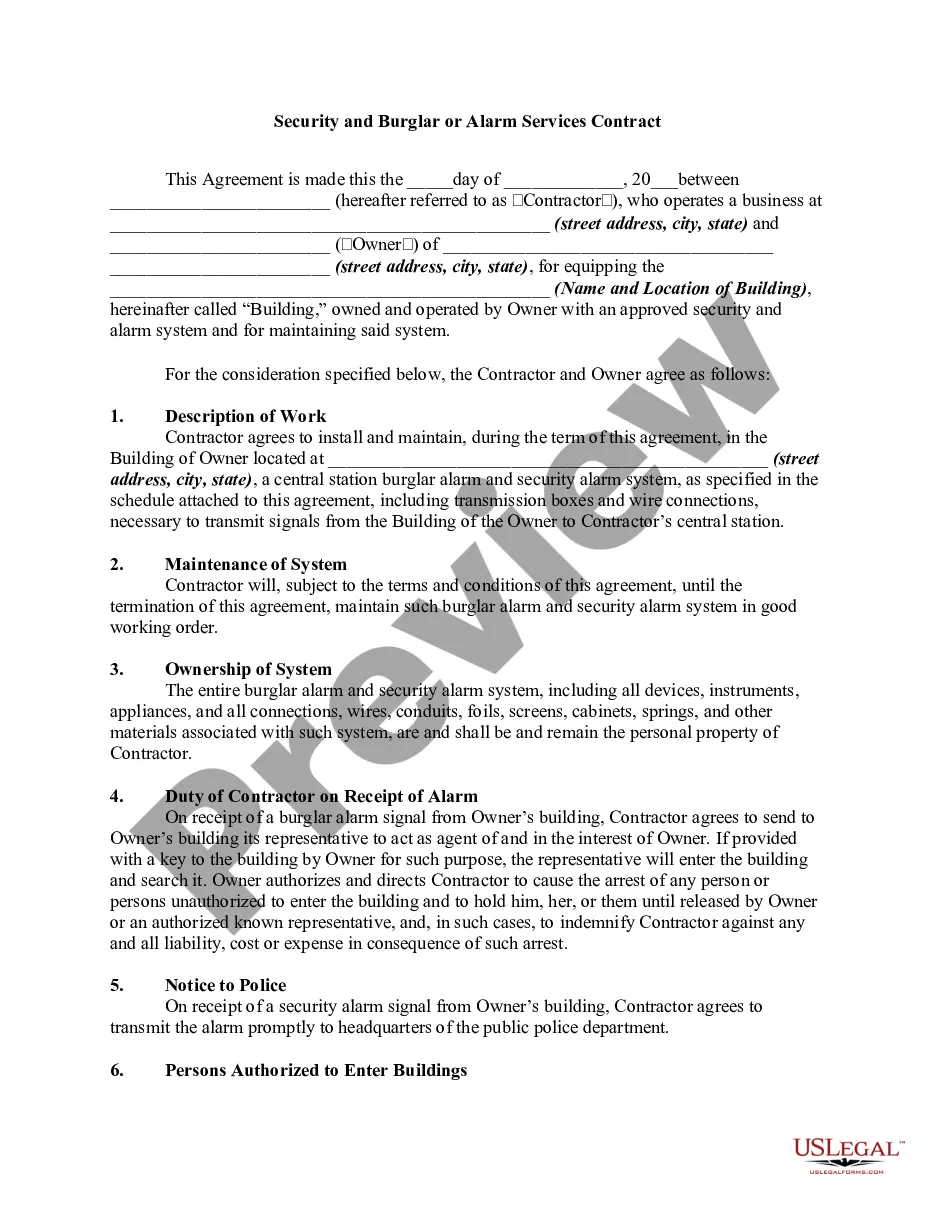

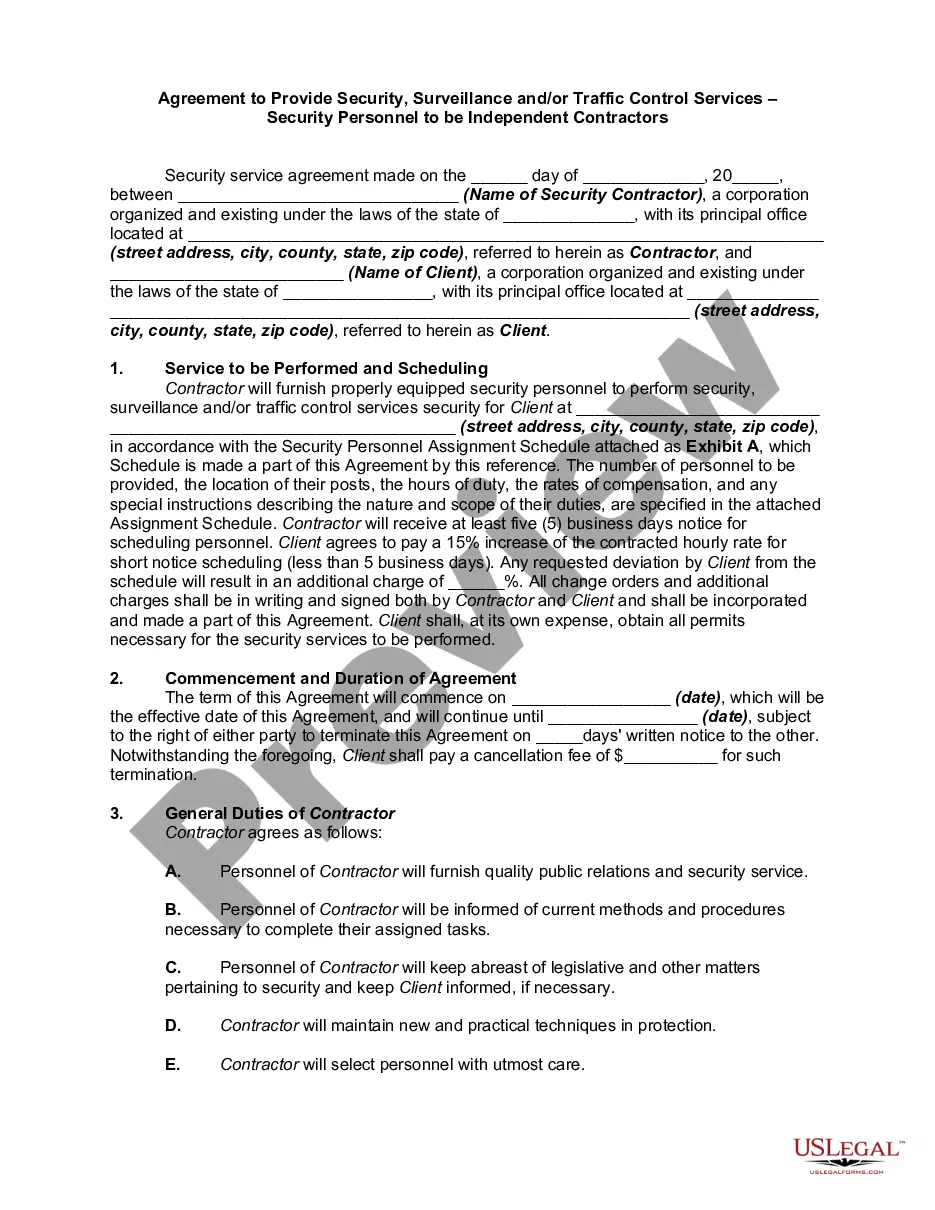

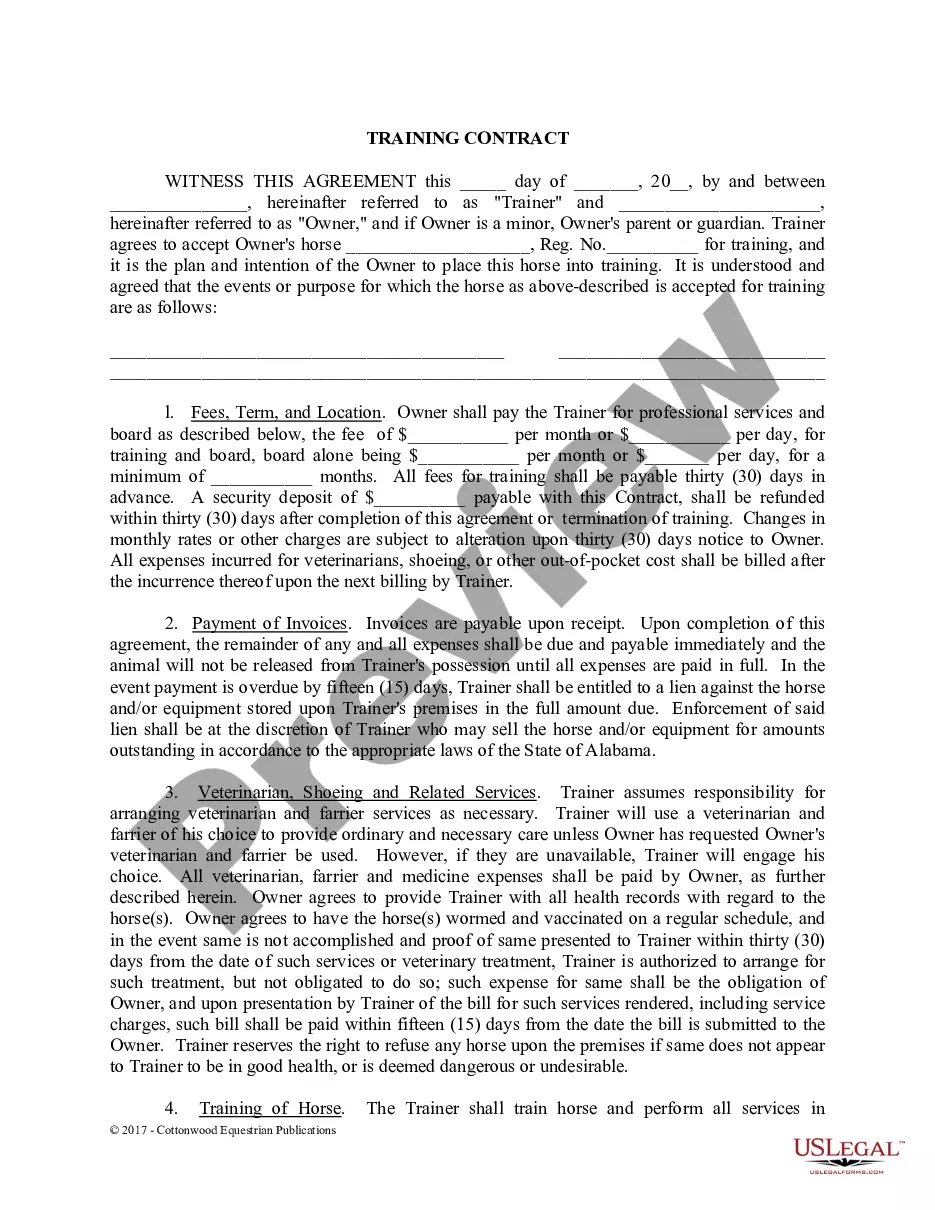

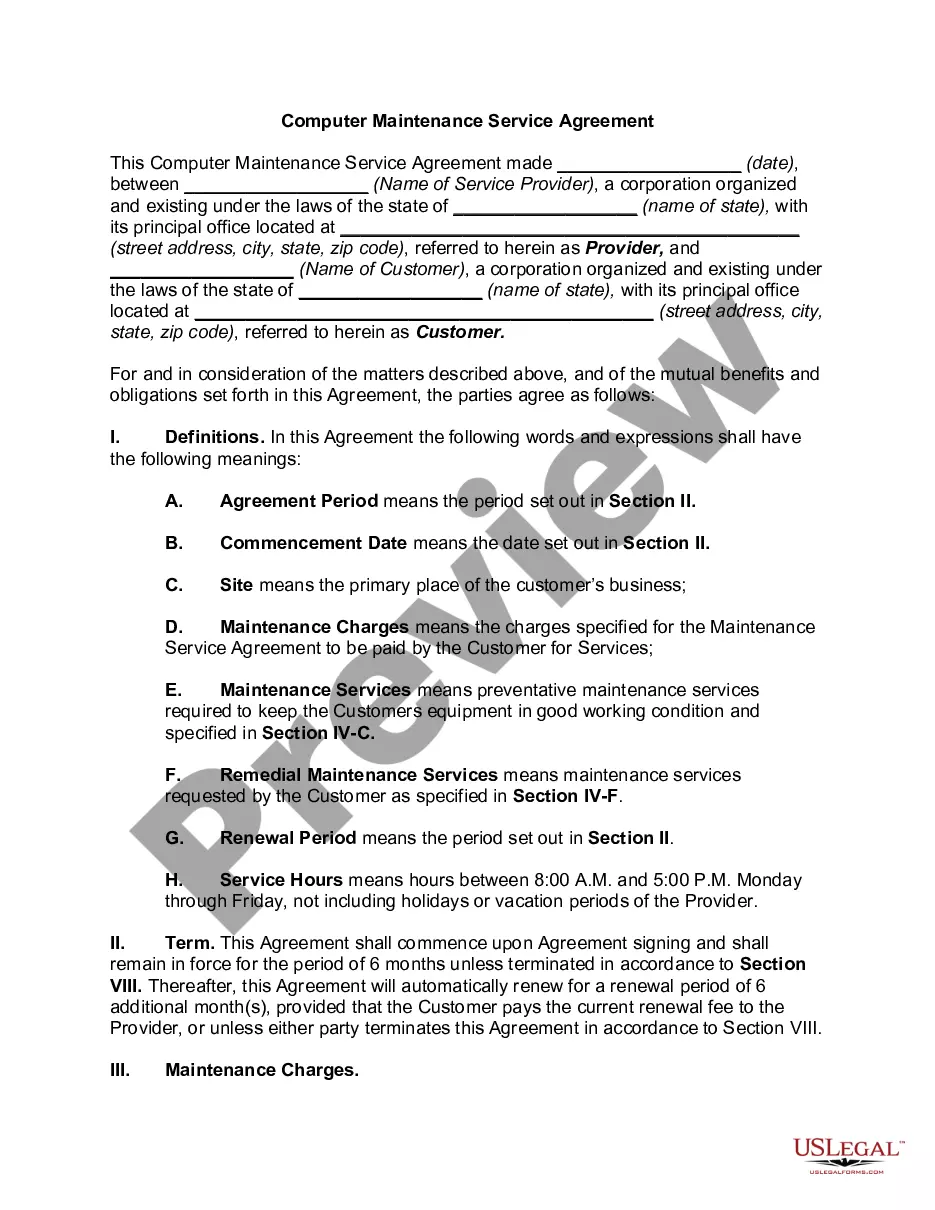

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Find all of the document templates you have purchased in the My documents menu. You can obtain another copy of the Wisconsin Security And Alarm Services Contract - Self-Employed at any time, if needed. Just select the desired form to download or print the document template.

Form popularity

FAQ

Legal requirements for independent contractors vary by state, but generally include tax obligations, licensing, and insurance needs. In Wisconsin, ensuring compliance with local laws is vital when drafting your Wisconsin Security And Alarm Services Contract - Self-Employed. By understanding these requirements, you can protect yourself and your clients, paving the way for a successful contracting relationship. Using USLegalForms can help streamline this process and ensure you stay compliant with all regulations.

A basic independent contractor agreement includes essential elements, such as the project's description, payment rates, and deadlines. It serves as a legal framework for the working relationship, ensuring both parties are on the same page. For those seeking a Wisconsin Security And Alarm Services Contract - Self-Employed, this agreement is crucial for clarifying expectations and establishing trust between the contractor and the client.

An independent contractor agreement in Wisconsin outlines the terms of the relationship between a business and a self-employed individual. This contract typically details the scope of work, payment terms, and responsibilities. When engaging with Wisconsin Security And Alarm Services Contract - Self-Employed, you should ensure that this agreement clearly defines both parties' roles, helping to avoid misunderstandings and disputes.

To start a security business in Wisconsin, you should first research local laws and obtain necessary licenses. Creating a business plan that outlines your services and marketing strategies is essential for success. Additionally, using solutions like USLegalForms can assist in securing the appropriate Wisconsin Security And Alarm Services Contract - Self-Employed to ensure you meet compliance needs and build trust with clients.

Several factors may disqualify a person from becoming a security guard in Wisconsin. These can include a criminal record, certain felony convictions, and failure to meet training requirements. It’s crucial to review the specific disqualifications laid out in Wisconsin’s regulations regarding the Wisconsin Security And Alarm Services Contract - Self-Employed to ensure eligibility.

While it’s not strictly required to form an LLC for a security company, doing so offers significant advantages. An LLC can protect your personal assets and provide flexibility in management, which is beneficial for operating a Wisconsin Security And Alarm Services Contract - Self-Employed. Consulting with a legal professional about the best option for your business structure can ensure you make an informed decision.

Earnings for private security owners depend on various factors, such as location, clientele, and service offerings. In general, those who manage a successful security business in Wisconsin can earn a substantial income, especially when operating under a solid Wisconsin Security And Alarm Services Contract - Self-Employed. Industry averages suggest that income can range significantly, but successful companies often yield strong returns.

Starting a security company involves specific steps and careful planning. You will need to understand local regulations, licensing, and insurance requirements related to the Wisconsin Security And Alarm Services Contract - Self-Employed. Many entrepreneurs find this process manageable with the right resources and guidance. Utilizing platforms like USLegalForms can simplify form requirements and compliance.

In Colorado, you are required to hold a license for installation and servicing of security systems. This requirement ensures that you meet safety and regulatory standards in the industry. If you are considering offering services under a Wisconsin Security And Alarm Services Contract - Self-Employed, be aware of similar licensing requirements in your operating state. Always verify local regulations to remain compliant.

As an independent contractor in Wisconsin, your total tax burden will depend on your income. Generally, federal income tax, state income tax, and self-employment tax will apply to your earnings. When you structure your Wisconsin Security And Alarm Services Contract - Self-Employed, be sure to factor in these potential taxes to better anticipate your net income. Planning for taxes can help you retain more income from your contracts.