Wisconsin Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

Are you in a situation where you frequently need to have documents for both business or specific objectives? There are numerous official document templates accessible online, but locating trustworthy ones is not easy.

US Legal Forms offers a vast array of form templates, including the Wisconsin Lab Worker Employment Contract - Self-Employed, which are designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Wisconsin Lab Worker Employment Contract - Self-Employed template.

Choose a suitable file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can download another copy of the Wisconsin Lab Worker Employment Contract - Self-Employed anytime, if needed. Just select the required form to download or print the document template. Use US Legal Forms, the most extensive collection of official forms, to save time and avoid mistakes. The service provides well-crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

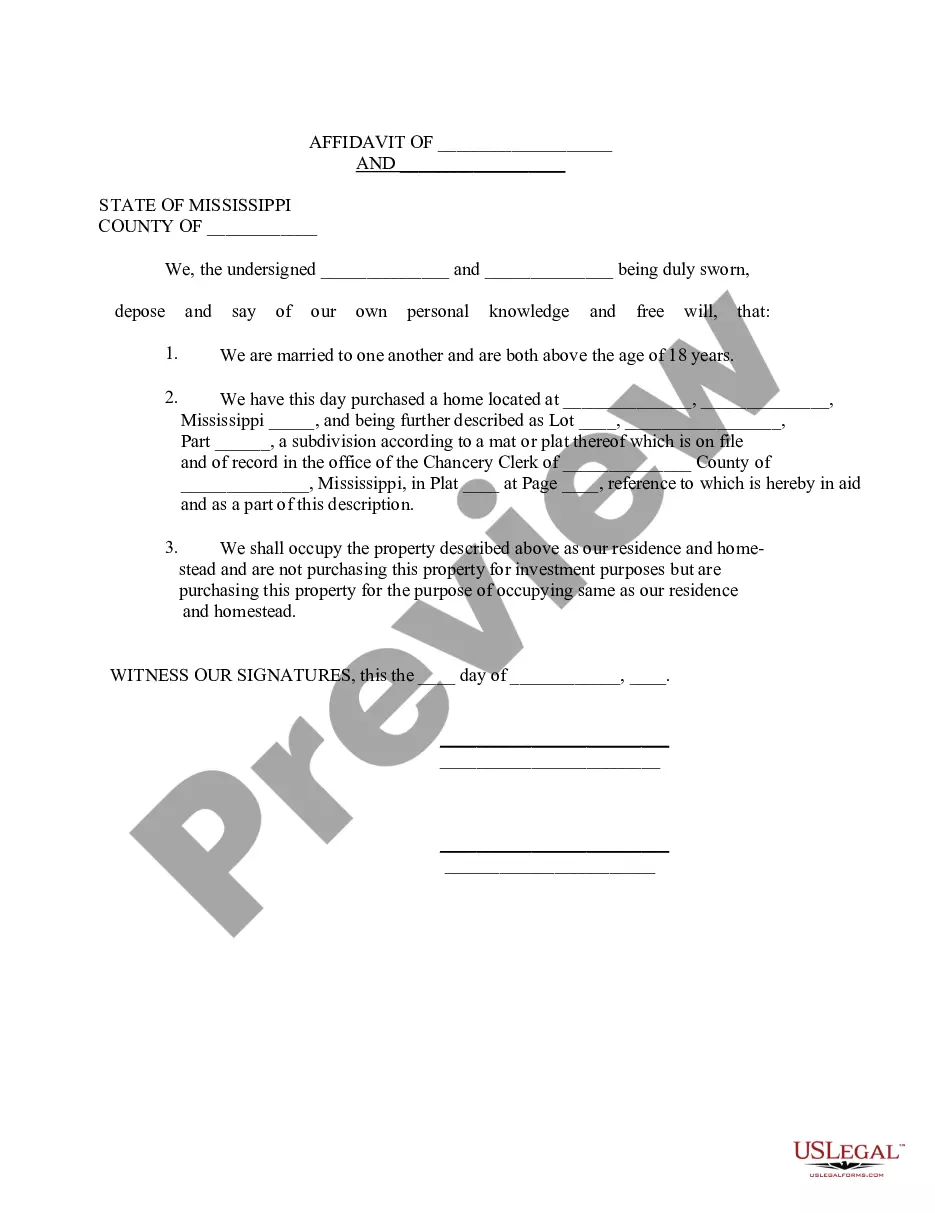

- Utilize the Review button to examine the form.

- Read the details to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs and requirements.

- Once you find the correct form, click on Acquire now.

- Select the pricing plan you prefer, fill in the necessary information to set up your account, and place an order using your PayPal or credit card.

Form popularity

FAQ

Certainly, having a contract is essential when you are self-employed. A Wisconsin Lab Worker Employment Contract - Self-Employed formalizes your working relationship and sets clear expectations. This contract can help mitigate disputes and clarify terms like payment and project scope, making it a vital tool for your business.

Recent changes in laws affect various aspects of self-employment, including tax regulations and eligibility for certain benefits. It's crucial to stay updated on these changes to ensure compliance. When drafting a Wisconsin Lab Worker Employment Contract - Self-Employed, consider how these new rules might influence your agreement and financial obligations.

The terms self-employed and independent contractor can often be used interchangeably, but they have subtle differences. Being self-employed captures a broader range of entrepreneurial activities, while independent contractor often refers specifically to individuals working under contracts. In a Wisconsin Lab Worker Employment Contract - Self-Employed, choose the term that best reflects your situation and the nature of your work.

Yes, being self-employed often involves having contracts in place. A Wisconsin Lab Worker Employment Contract - Self-Employed is designed to clarify the terms of your work and protect your rights. This contract can outline your role and responsibilities while providing a formal agreement that supports your professional status.

Creating a private contract with yourself can be complex but possible. You can outline your duties and expectations as a self-employed individual within a Wisconsin Lab Worker Employment Contract - Self-Employed. However, it's essential to maintain clarity and legality, so consider using templates from reliable platforms like uslegalforms for guidance.

Filling out an independent contractor agreement starts with identifying the parties involved. Clearly state the scope of work, payment terms, and duration of the contract. For a Wisconsin Lab Worker Employment Contract - Self-Employed, include any specific requirements or certifications needed for the lab work. This ensures both parties understand their obligations and protects your interests.

An independent contractor agreement in Wisconsin outlines the relationship between a service provider and a client. It specifies the terms of work, including obligations, duties, and payment structures. This is crucial for those looking to work on their own as it protects both parties and clarifies expectations. Utilizing a Wisconsin Lab Worker Employment Contract - Self-Employed can help ensure all legal requirements are met and provide peace of mind.

Yes, a 1099 employee is generally classified as self-employed. These workers receive compensation without tax withholdings and are responsible for their tax obligations. Understanding this classification is essential when entering agreements like a Wisconsin Lab Worker Employment Contract - Self-Employed, as it affects your financial planning and responsibilities.

Contract work is not synonymous with self-employment, though it often overlaps. When you have a contract, you commit to a specific role or task, whereas self-employment refers to the broader concept of running your own business. A Wisconsin Lab Worker Employment Contract - Self-Employed can fall under either category, depending on how you structure your work.

Yes, a 1099 employee can have a contract outlining the terms of their work. In such cases, a Wisconsin Lab Worker Employment Contract - Self-Employed may be part of their arrangement, ensuring clear communication of responsibilities and expectations. This contract safeguards both the worker and the employer.