Wisconsin How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

If you need to compile, obtain, or print legal document templates, use US Legal Forms, the largest selection of legal forms available online.

Utilize the site's straightforward and user-friendly search to find the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Buy Now button. Choose your preferred pricing plan and provide your credentials to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to find the Wisconsin How to Request a Home Affordable Modification Guide in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to access the Wisconsin How to Request a Home Affordable Modification Guide.

- You can also access forms you have previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/country.

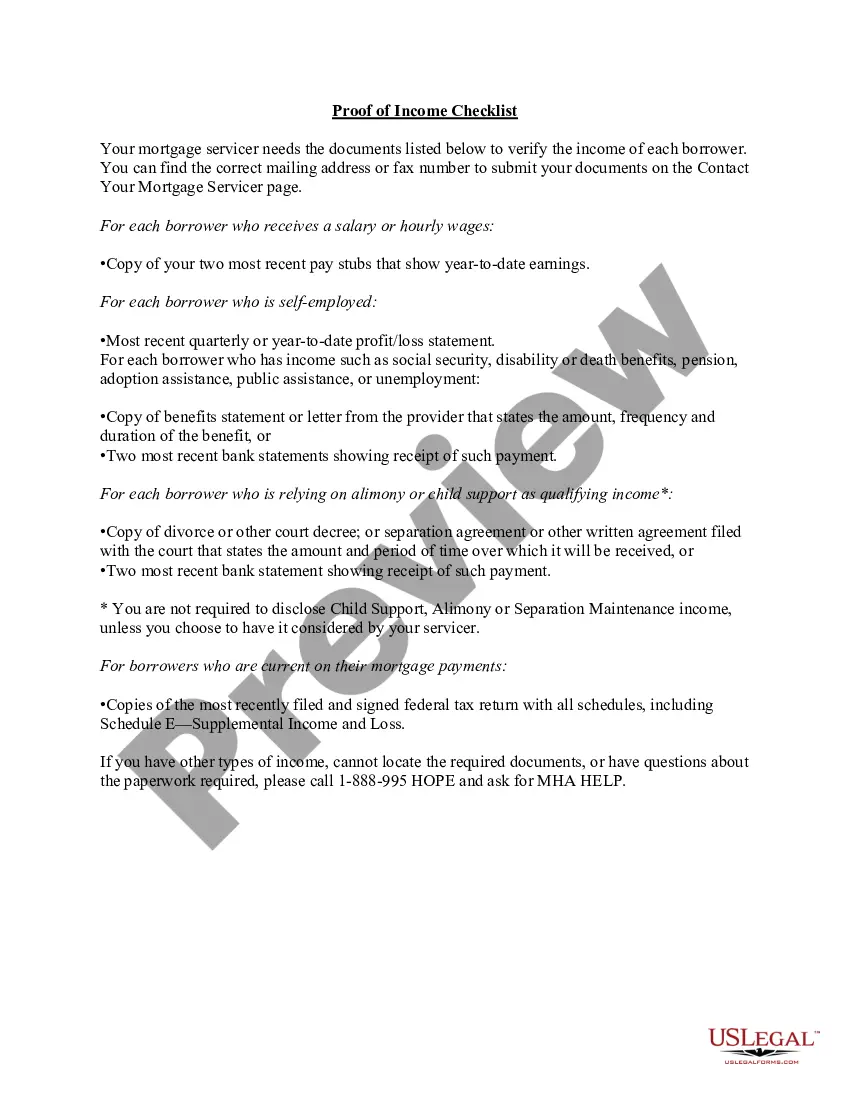

- Step 2. Use the Preview option to view the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Most home repair grants do not require repayment, making them an excellent option for homeowners needing assistance. However, specific terms and conditions may apply depending on the type of grant you receive. To understand the nuances of these grants, refer to our Wisconsin How to Request a Home Affordable Modification Guide. This guide will help you navigate the stipulations and ensure you comprehend your obligations, if any.

You can obtain a government grant for various purposes, including home repairs, renovations, and energy efficiency upgrades. These grants often aim to help homeowners improve the safety and value of their homes while reducing utility costs. Explore your options further in our Wisconsin How to Request a Home Affordable Modification Guide, which outlines different types of assistance available. Our platform also offers resources to help you apply for the grants you need.

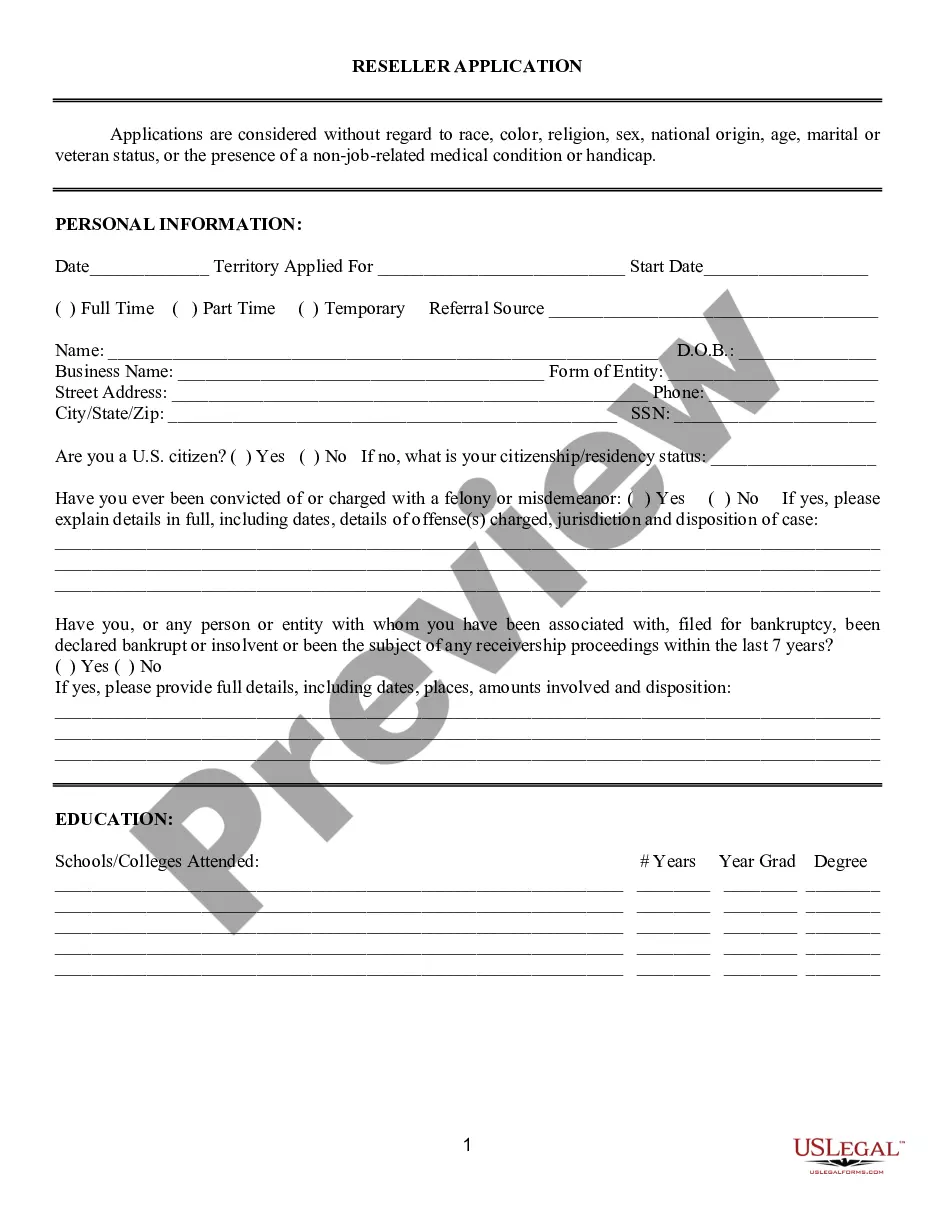

Eligibility for the Wisconsin grant typically includes low to moderate-income homeowners who need assistance with home repairs. Factors such as income level, family size, and the urgency of repairs may influence eligibility. Familiarizing yourself with the criteria in our Wisconsin How to Request a Home Affordable Modification Guide can provide clarity. This guide is designed to help you assess your eligibility and offer insights into the necessary documentation.

The Wisconsin Fund grant program assists homeowners in funding home repairs and improvements. This program specifically targets low-income residents and offers financial support to address critical needs. If you are looking for more information, our Wisconsin How to Request a Home Affordable Modification Guide can help clarify the available options. Utilizing this guide can help you understand how to navigate the application process effectively.

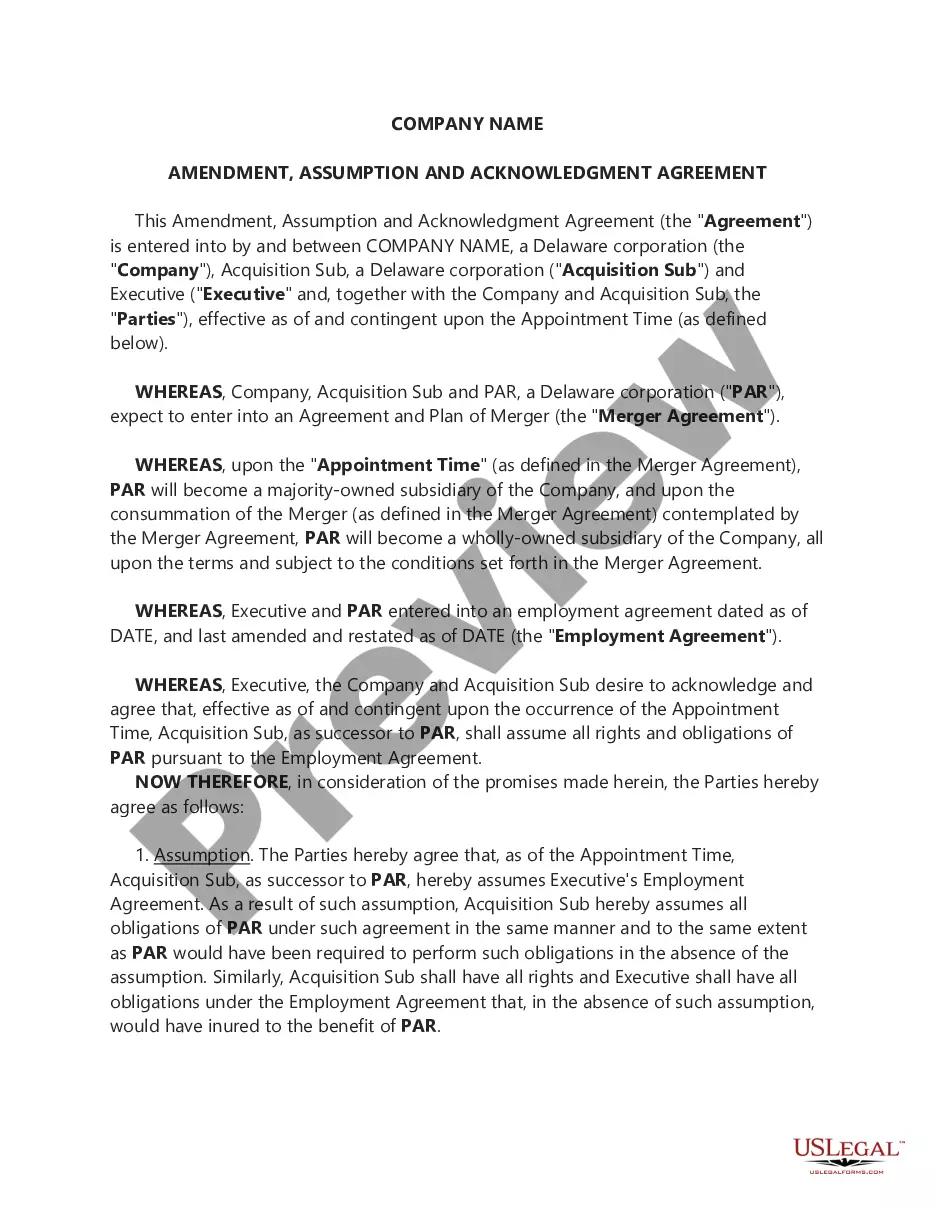

'HAMP' stands for Home Affordable Modification Program, a government initiative designed to assist homeowners at risk of foreclosure. This program offers financial relief through mortgage modifications, which can lower payments and make housing more affordable. By following our Wisconsin How to Request a Home Affordable Modification Guide, you can navigate the process with confidence and find the assistance you need.

In Wisconsin, eligibility for a government home improvement grant typically includes homeowners who meet specific income limits, as well as those facing financial hardship. Grants often focus on supporting low to moderate-income families and individuals with unique needs. If you are considering improvements to make your home more affordable, referencing the Wisconsin How to Request a Home Affordable Modification Guide can help you understand various assistance options, including grants. Additionally, you can explore resources through local housing authorities or organizations specializing in home modifications.

How does Flex Modification work?Reduce your monthly payment by as much as 20 percent.Add past-due amounts, including interest, to your principal balance, so it's not all due upfront.Extend your repayment term to up to 40 years.Lower your interest rate.More items...?

Tips for Getting a Mortgage Modification ApprovedApply as soon as you can.Pay attention to detail.Send in all items requested by your loan servicers.Hold on to all information provided by your servicer.Put together a new monthly budget.Write a hardship letter and put careful thought into it.More items...?

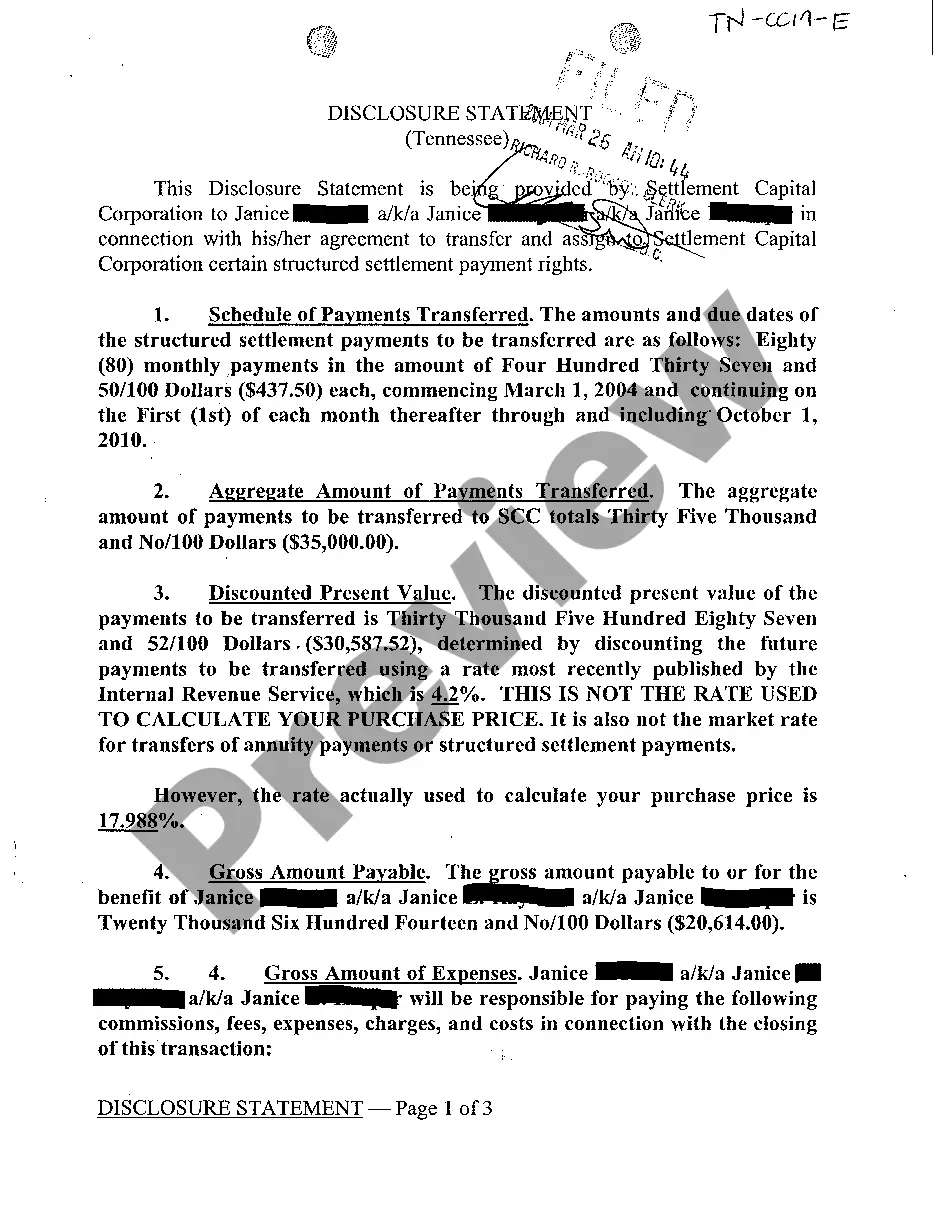

Generally, the simplest way to calculate a debt to income ratio for loan modification is simply to take total monthly debt obligations and divide it by total monthly gross household income. Anything over about 60-70% is pretty good for loan modification purposes.

Why are only 20% of homeowners who apply getting approval for loan modifications? It's a staggering statistic, so lets look at why banks are denying this process in today's market.