Have you been in a position in which you require papers for either business or personal uses just about every working day? There are tons of legitimate record web templates available on the net, but getting versions you can depend on is not easy. US Legal Forms provides 1000s of develop web templates, much like the Wisconsin Guide to Complying with the Red Flags Rule under FCRA and FACTA, which are created to meet state and federal specifications.

When you are previously informed about US Legal Forms website and have an account, merely log in. Next, you may down load the Wisconsin Guide to Complying with the Red Flags Rule under FCRA and FACTA format.

Unless you come with an account and need to begin using US Legal Forms, abide by these steps:

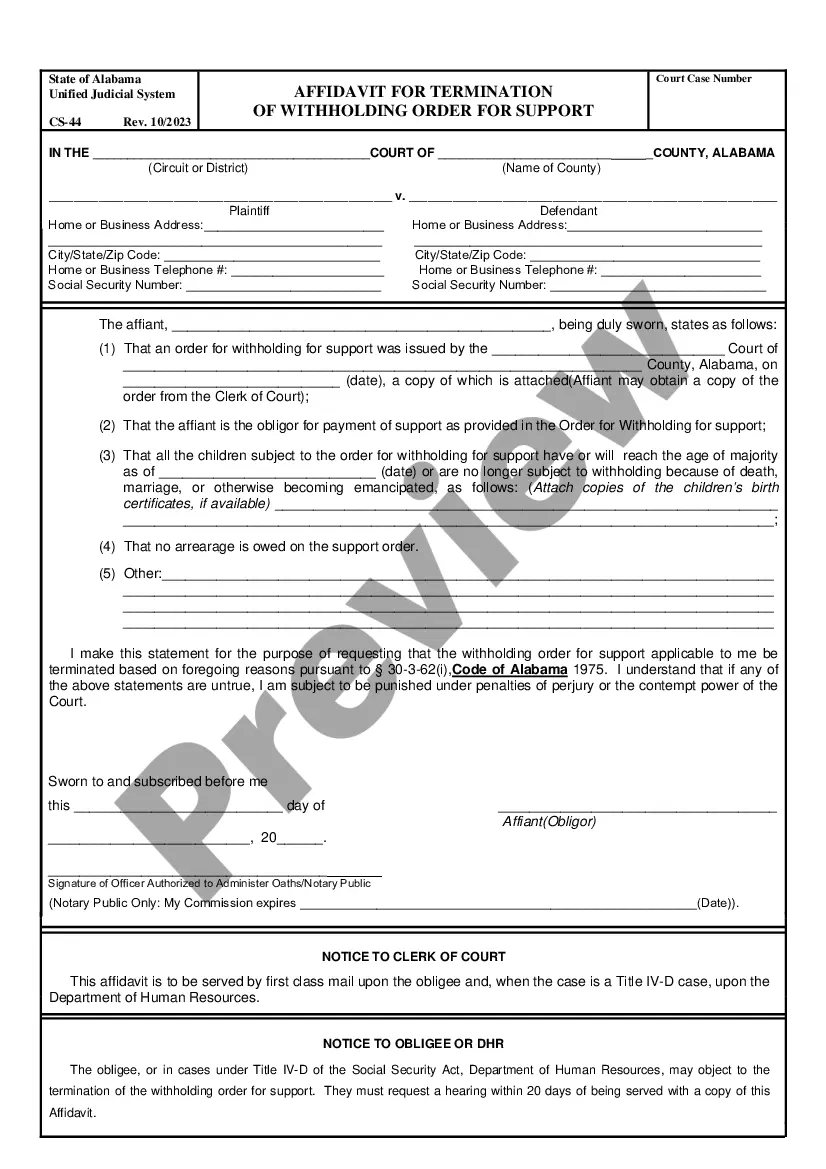

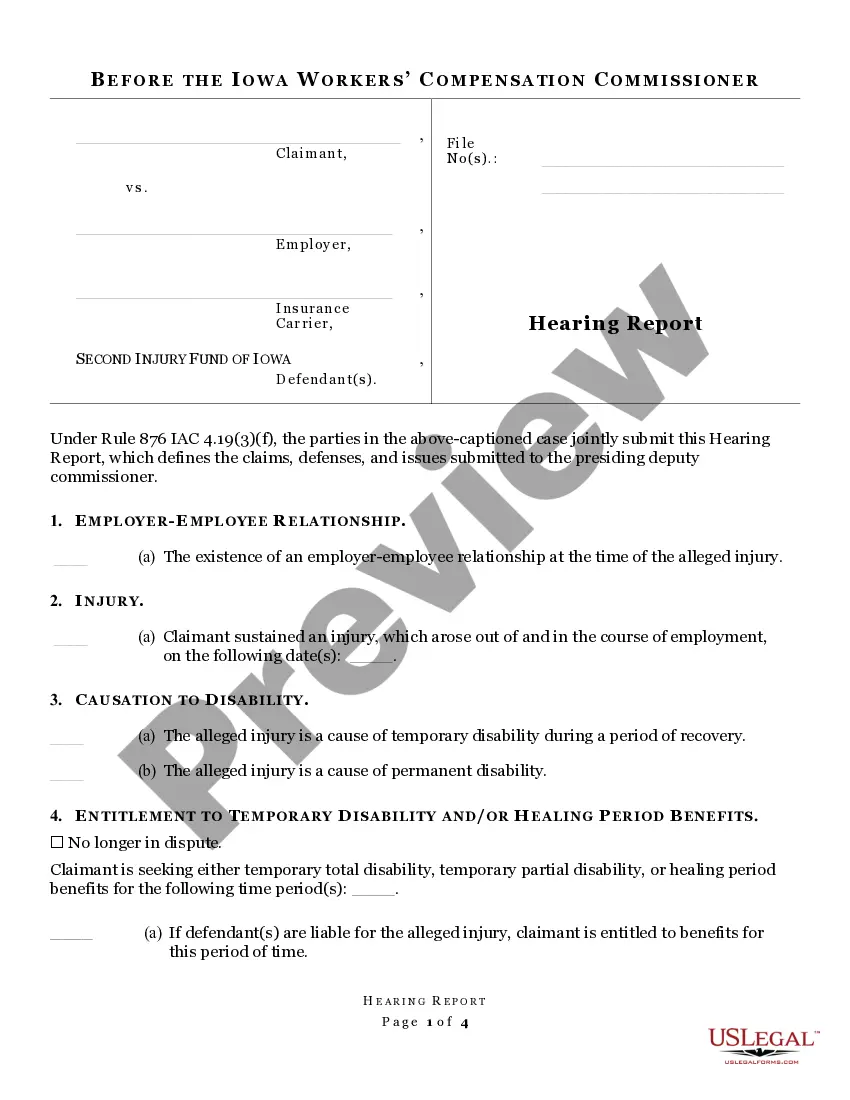

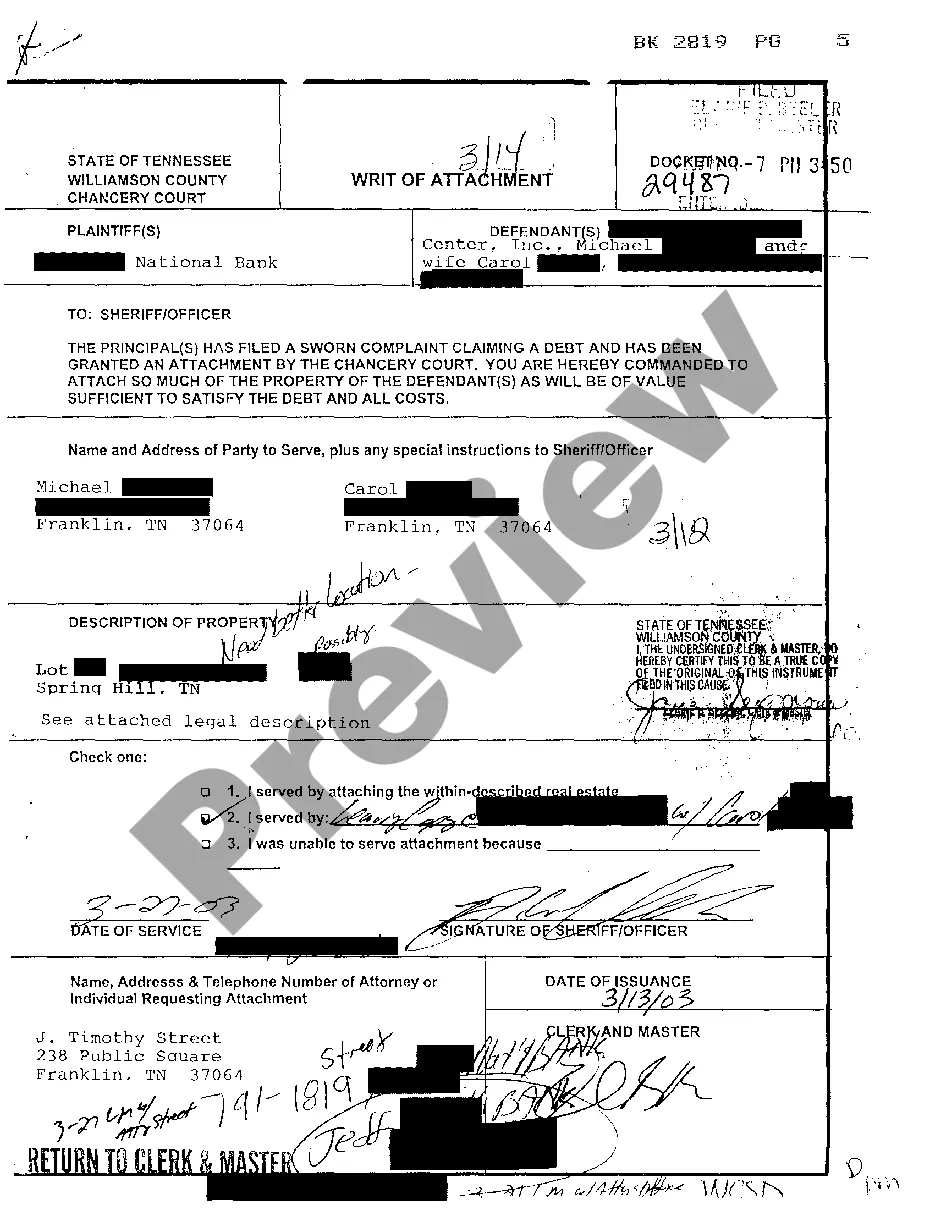

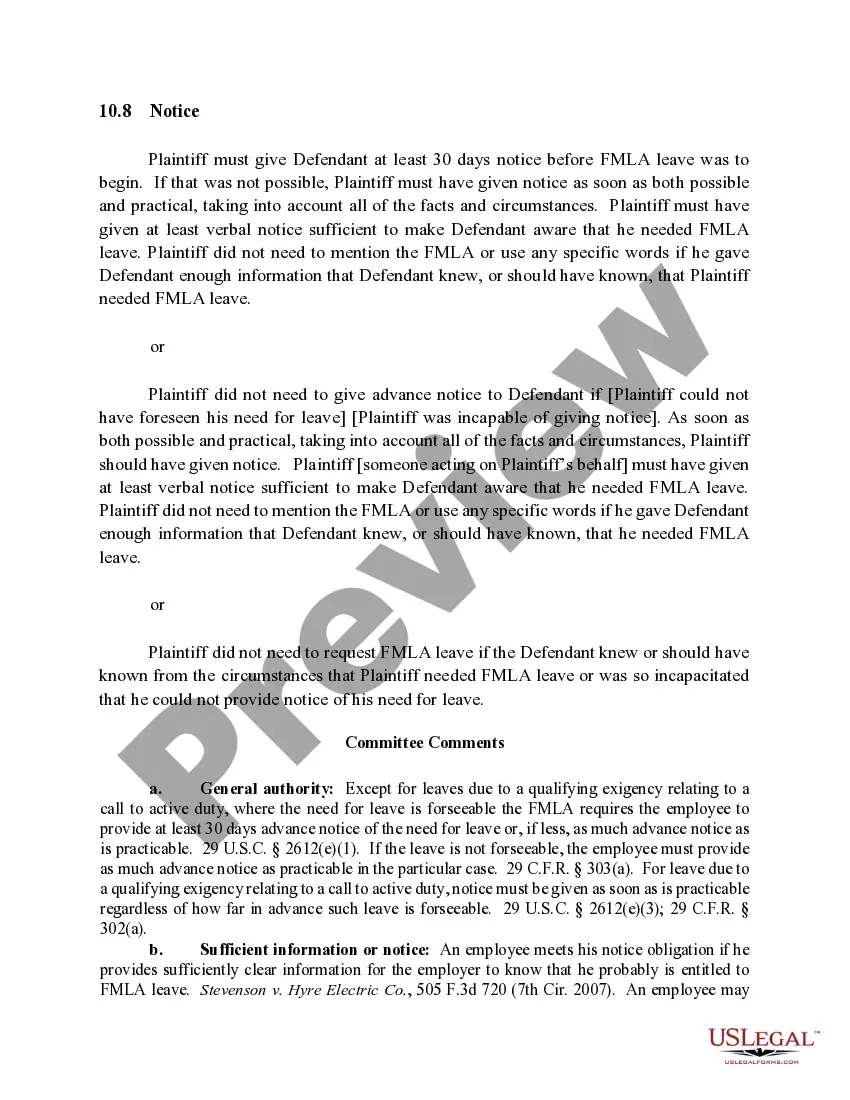

- Get the develop you need and ensure it is for your right town/region.

- Make use of the Preview button to analyze the form.

- Look at the description to ensure that you have chosen the correct develop.

- In case the develop is not what you are searching for, use the Lookup area to find the develop that fits your needs and specifications.

- When you get the right develop, click on Get now.

- Choose the rates strategy you need, complete the desired details to make your account, and buy the order with your PayPal or bank card.

- Choose a handy data file file format and down load your version.

Get every one of the record web templates you possess bought in the My Forms food list. You may get a extra version of Wisconsin Guide to Complying with the Red Flags Rule under FCRA and FACTA any time, if required. Just click on the needed develop to down load or printing the record format.

Use US Legal Forms, probably the most extensive assortment of legitimate varieties, to conserve some time and steer clear of faults. The support provides appropriately created legitimate record web templates which you can use for a selection of uses. Produce an account on US Legal Forms and start producing your way of life a little easier.