Wisconsin Employee Shareholder Escrow Agreement

Description

How to fill out Employee Shareholder Escrow Agreement?

Are you currently within a place the place you need to have documents for either company or individual uses just about every working day? There are a lot of legal document layouts accessible on the Internet, but getting kinds you can depend on isn`t effortless. US Legal Forms delivers a large number of develop layouts, like the Wisconsin Employee Shareholder Escrow Agreement, which are written in order to meet federal and state demands.

In case you are already informed about US Legal Forms website and possess a free account, merely log in. Following that, you are able to obtain the Wisconsin Employee Shareholder Escrow Agreement format.

If you do not offer an account and wish to begin using US Legal Forms, adopt these measures:

- Discover the develop you require and make sure it is for your right city/region.

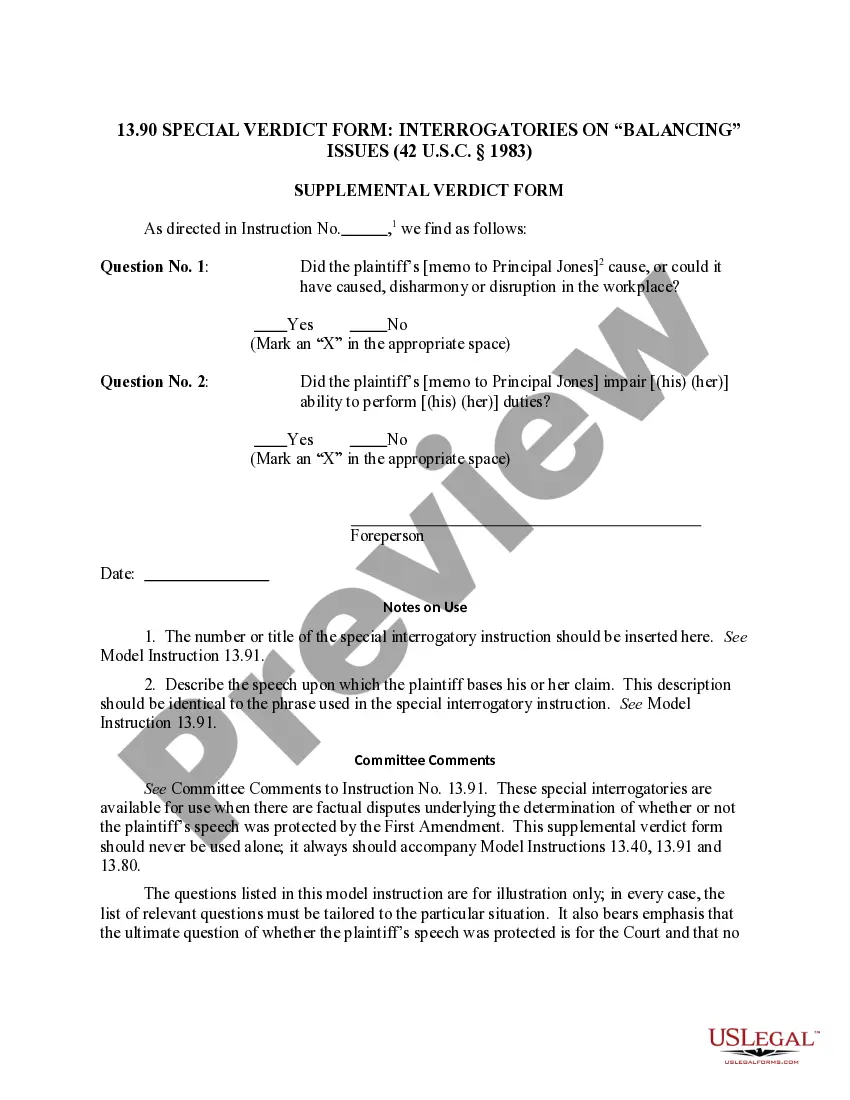

- Utilize the Review option to examine the form.

- Read the information to ensure that you have chosen the correct develop.

- If the develop isn`t what you are searching for, utilize the Look for discipline to find the develop that meets your requirements and demands.

- Once you discover the right develop, simply click Get now.

- Pick the costs strategy you want, fill in the required information to make your bank account, and pay money for an order using your PayPal or charge card.

- Choose a practical data file formatting and obtain your duplicate.

Find each of the document layouts you may have bought in the My Forms food list. You can aquire a more duplicate of Wisconsin Employee Shareholder Escrow Agreement anytime, if necessary. Just click the essential develop to obtain or print the document format.

Use US Legal Forms, the most comprehensive selection of legal types, to save time as well as steer clear of errors. The services delivers professionally made legal document layouts which can be used for an array of uses. Generate a free account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

How do I apply for a Wisconsin withholding tax number? You can register online at My Tax Account or complete an Application for Business Registration. The initial application fee is $20. The registration is valid for two years.

You may obtain most Wisconsin tax forms and publications in one of the following ways: Download forms and publications in Adobe PDF format by visiting the Forms page or the Publications page. Between January and April, many libraries will have a supply of Wisconsin individual income tax forms on hand.

For Wisconsin State tax, a Form WT-4A must be completed, if you are withholding only a fixed dollar amount. Additional tax withholding amounts are taken from every check. If you wish to discontinue previously requested additional or fixed tax withholding, you must submit a new W4 and/or WT-4A.

Wisconsin requires employers to withhold state personal income tax (PIT) from their employees' wages and remit the amounts withheld to the Department of Revenue. Wisconsin has reciprocal withholding agreements with Illinois, Indiana, Kentucky, and Michigan.

Form WT-4A is an agreement between the employee and employer that a lesser amount will be withheld from the employee's wages than is provided for in the Wisconsin income tax withholding tables. Worksheet For Employee Withholding Agreement Form WT-4A Wisconsin Department of Revenue (.gov) ? ... Wisconsin Department of Revenue (.gov) ? ... PDF

In general, 90% of the net tax shown on your income tax return should be withheld. OVER WITHHOLDING: If you are using Form WT?4 to claim the maximum number of exemptions to which you are entitled and your withholding exceeds your expected income tax liability, you may use Form WT?4A to minimize the over withholding. August 2023 W-204 WT-4 Employee's Wisconsin Withholding Exemption ... wi.gov ? ... wi.gov ? ...

For Wisconsin State tax, a Form WT-4A must be completed, if you are withholding only a fixed dollar amount. Additional tax withholding amounts are taken from every check. If you wish to discontinue previously requested additional or fixed tax withholding, you must submit a new W4 and/or WT-4A. Form W-4 | Employee's Withholding Allowance Certificate wisc.edu ? docs ? pay-w4-employee-withholding wisc.edu ? docs ? pay-w4-employee-withholding

We've got the steps here; plus, important considerations for each step. Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form. How to Fill Out a W-4 Form 2023 | H&R Block hrblock.com ? tax-center ? irs ? forms ? ho... hrblock.com ? tax-center ? irs ? forms ? ho...