Wisconsin Closing Agreement

Description

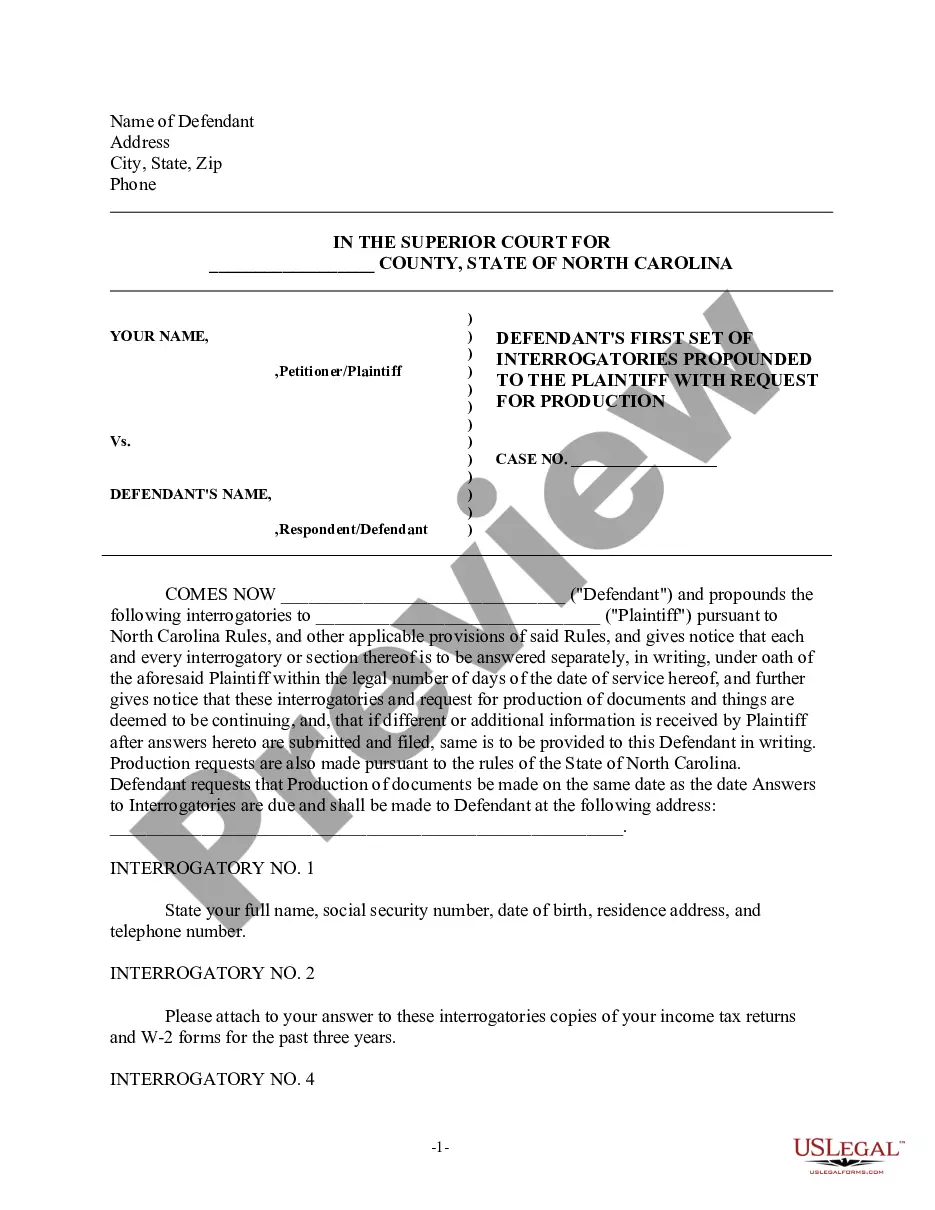

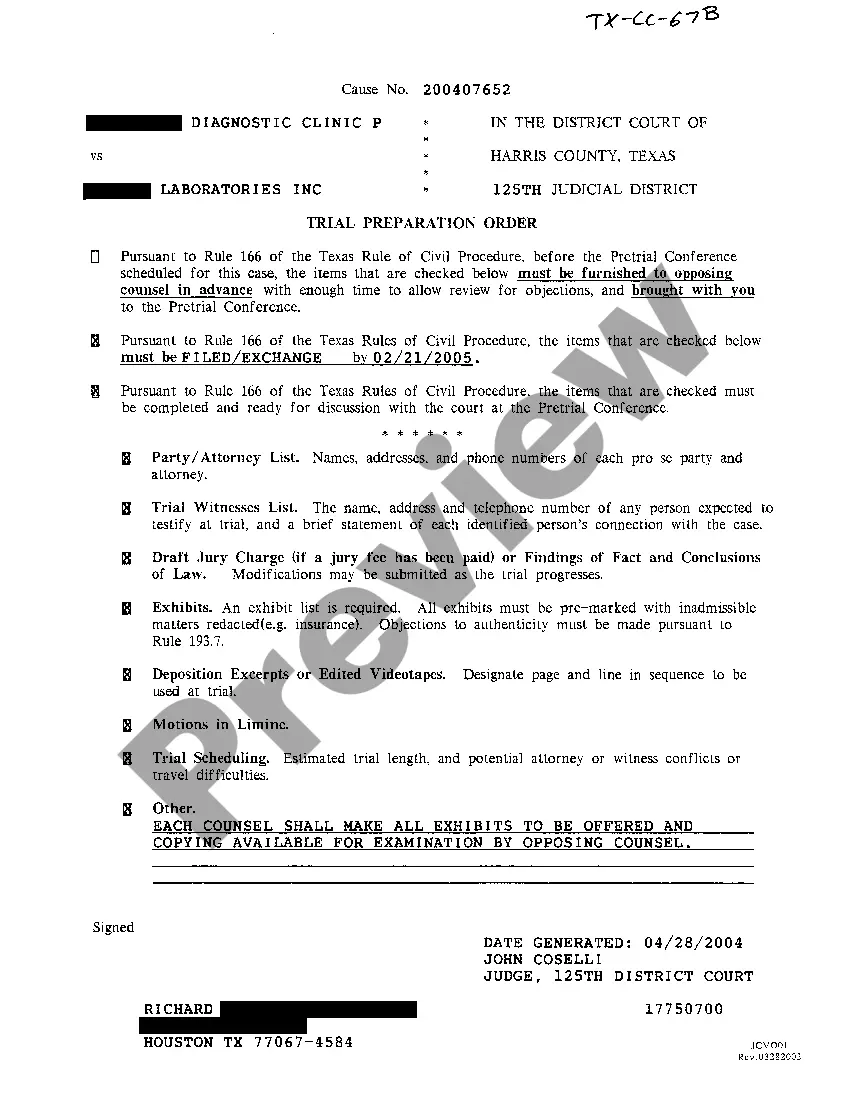

How to fill out Closing Agreement?

Are you inside a position that you will need files for both business or specific reasons just about every working day? There are plenty of authorized document web templates available on the net, but locating versions you can trust isn`t easy. US Legal Forms offers a huge number of kind web templates, like the Wisconsin Closing Agreement, that happen to be written in order to meet state and federal needs.

Should you be previously acquainted with US Legal Forms website and possess an account, just log in. Following that, you may obtain the Wisconsin Closing Agreement design.

If you do not provide an accounts and want to begin to use US Legal Forms, adopt these measures:

- Find the kind you need and ensure it is for the proper area/region.

- Utilize the Preview switch to examine the shape.

- See the explanation to ensure that you have selected the proper kind.

- In the event the kind isn`t what you are searching for, utilize the Research discipline to obtain the kind that meets your needs and needs.

- Once you obtain the proper kind, click Acquire now.

- Pick the costs prepare you would like, submit the desired information to make your bank account, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Choose a handy file formatting and obtain your backup.

Get all the document web templates you possess purchased in the My Forms food list. You can get a further backup of Wisconsin Closing Agreement whenever, if required. Just click the necessary kind to obtain or print the document design.

Use US Legal Forms, the most substantial collection of authorized forms, to conserve time as well as steer clear of mistakes. The services offers appropriately manufactured authorized document web templates that you can use for a range of reasons. Make an account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

This exemption is the value of assets you can give away, throughout your life and after your death, without being subject to the federal estate taxes described previously. For 2023, this exemption is $12.92 million/per person. Because the exemption is per person, married couples can give away double that amount.

Close your business tax account: Complete the Request to Close Account in My Tax Account for each business tax account, or. Email DORBusinessTax@wisconsin.gov, or. Call (608) 266?2776.

No, Wisconsin does not impose an inheritance tax on properties. However, you need to pay taxes while selling the property.

Do I have to report my inheritance on my tax return? In general, any inheritance you receive does not need to be reported to the IRS. You typically don't need to report inheritance money to the IRS because inheritances aren't considered taxable income by the federal government.

What is the Inheritance Tax in Wisconsin? Since Wisconsin is not a state that imposes an inheritance tax, the inheritance tax in 2023 is 0% (zero). As a result, you won't owe Wisconsin inheritance taxes.

All states impose certain exemptions that prevent smaller estates from being subject to these taxes. Oregon has the lowest exemption at $1 million, and Connecticut has the highest exemption at $12.92 million. Of the six states with inheritance taxes, Kentucky and New Jersey have the highest top rate of 16 percent.

What is the Inheritance Tax in Wisconsin? Since Wisconsin is not a state that imposes an inheritance tax, the inheritance tax in 2023 is 0% (zero). As a result, you won't owe Wisconsin inheritance taxes.