Wisconsin Stock Option Agreement of Quantum Effect Devices, Inc.

Description

How to fill out Stock Option Agreement Of Quantum Effect Devices, Inc.?

US Legal Forms - one of several largest libraries of legitimate kinds in America - provides an array of legitimate papers templates you are able to download or printing. Utilizing the internet site, you will get 1000s of kinds for organization and specific purposes, sorted by types, suggests, or key phrases.You will discover the newest versions of kinds just like the Wisconsin Stock Option Agreement of Quantum Effect Devices, Inc. within minutes.

If you already possess a membership, log in and download Wisconsin Stock Option Agreement of Quantum Effect Devices, Inc. through the US Legal Forms catalogue. The Down load key can look on each kind you see. You get access to all earlier saved kinds within the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, here are basic directions to help you began:

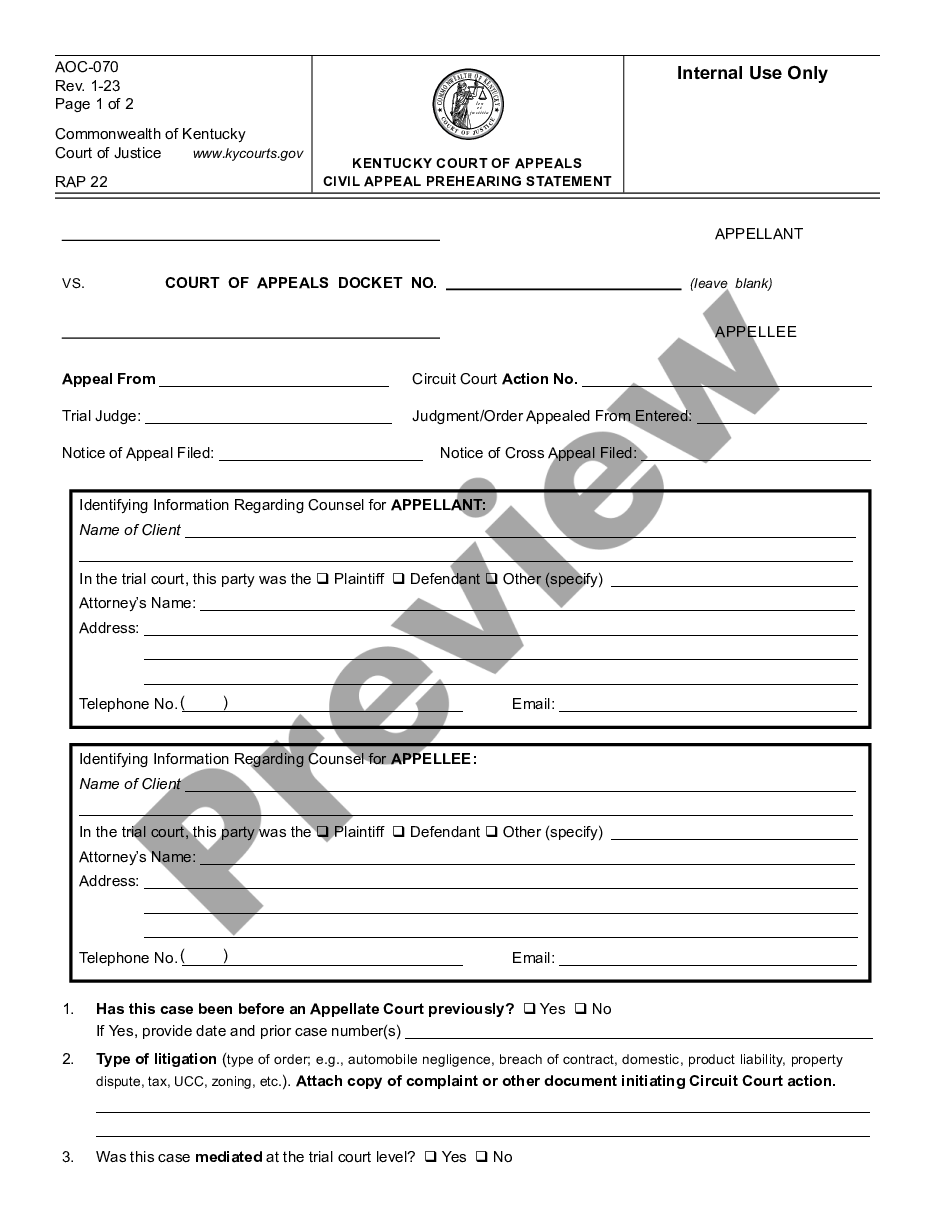

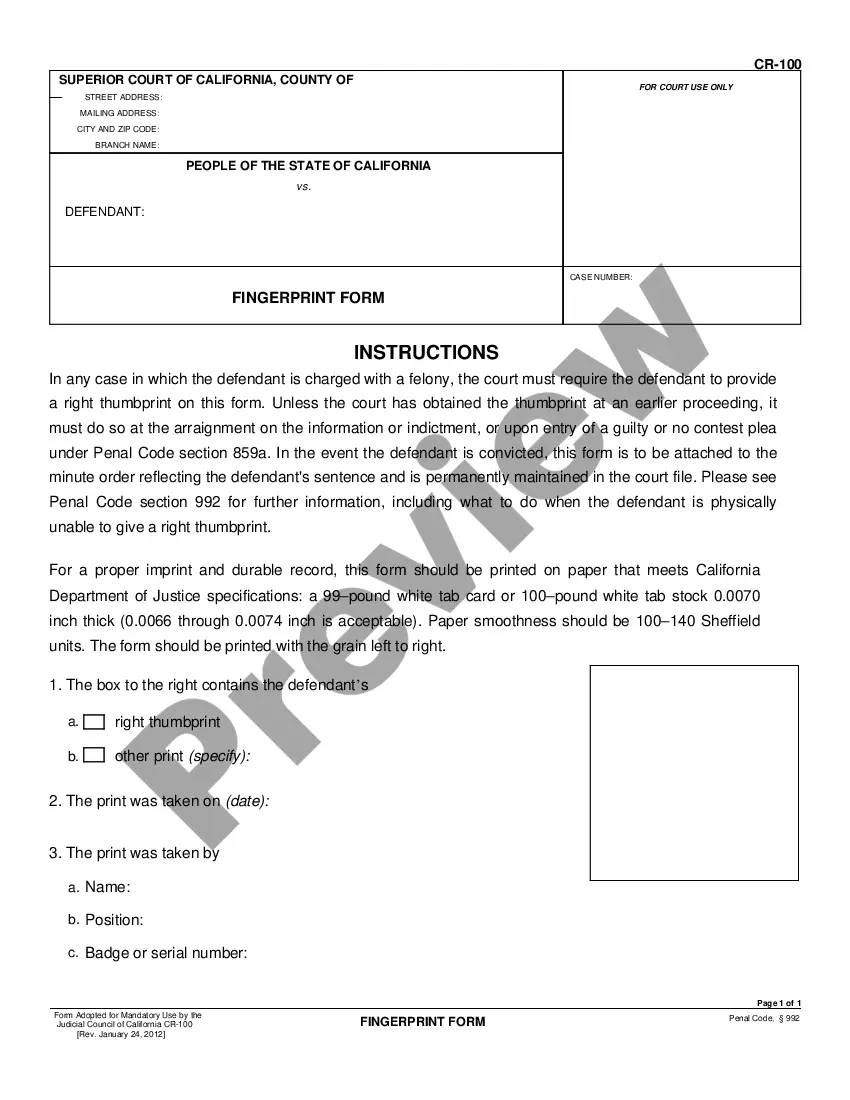

- Make sure you have chosen the best kind for your metropolis/state. Click on the Preview key to examine the form`s content. Read the kind explanation to actually have chosen the appropriate kind.

- When the kind doesn`t satisfy your needs, use the Lookup discipline on top of the monitor to discover the one that does.

- When you are content with the shape, verify your selection by visiting the Get now key. Then, select the rates plan you like and give your qualifications to sign up to have an profile.

- Method the financial transaction. Utilize your bank card or PayPal profile to finish the financial transaction.

- Select the formatting and download the shape on your own device.

- Make adjustments. Complete, change and printing and signal the saved Wisconsin Stock Option Agreement of Quantum Effect Devices, Inc..

Each and every format you put into your money does not have an expiration date which is the one you have permanently. So, if you would like download or printing an additional copy, just visit the My Forms area and click on around the kind you want.

Gain access to the Wisconsin Stock Option Agreement of Quantum Effect Devices, Inc. with US Legal Forms, by far the most extensive catalogue of legitimate papers templates. Use 1000s of professional and express-particular templates that satisfy your organization or specific needs and needs.

Form popularity

FAQ

When you buy an open-market option, you're not responsible for reporting any information on your tax return. However, when you sell an option?or the stock you acquired by exercising the option?you must report the profit or loss on Schedule D of your Form 1040.

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire. 10 Tips About Stock Option Agreements When Evaluating a Job ... melmedlaw.com ? how-to-evaluate-stock-op... melmedlaw.com ? how-to-evaluate-stock-op...

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions. Stock Grants: Why You Should Always Accept Them - Carta carta.com ? blog ? why-accept-your-stock-grant carta.com ? blog ? why-accept-your-stock-grant

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ... What are stock options & how do they work? - Empower empower.com ? the-currency ? money ? ho... empower.com ? the-currency ? money ? ho...

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them. What is a stock grant? | Global HR glossary | Oyster® Oyster HR ? glossary ? stock-grant Oyster HR ? glossary ? stock-grant

Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase. Your strike price.