Wisconsin Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

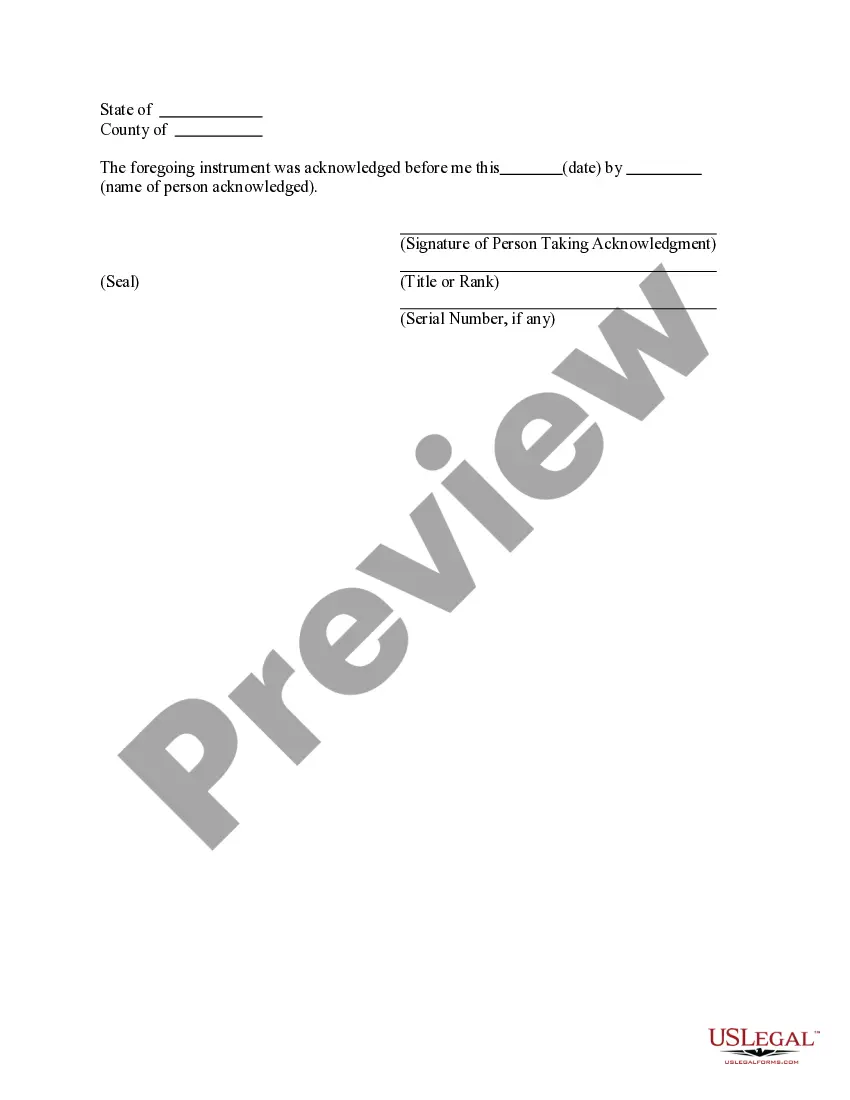

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

It is possible to commit hrs on-line trying to find the authorized document template that meets the federal and state needs you want. US Legal Forms offers a large number of authorized types which can be reviewed by professionals. It is simple to down load or produce the Wisconsin Assignment of Note and Deed of Trust as Security for Debt of Third Party from our service.

If you currently have a US Legal Forms account, you may log in and then click the Down load key. Following that, you may full, modify, produce, or signal the Wisconsin Assignment of Note and Deed of Trust as Security for Debt of Third Party. Every authorized document template you purchase is yours eternally. To acquire one more backup for any bought develop, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms site for the first time, adhere to the simple instructions below:

- Initial, ensure that you have selected the best document template for the state/metropolis of your liking. Read the develop description to make sure you have picked out the right develop. If offered, use the Review key to search from the document template as well.

- In order to find one more version of your develop, use the Lookup area to obtain the template that suits you and needs.

- After you have found the template you desire, simply click Buy now to move forward.

- Choose the rates program you desire, type your credentials, and register for your account on US Legal Forms.

- Full the deal. You can utilize your credit card or PayPal account to cover the authorized develop.

- Choose the structure of your document and down load it to the product.

- Make adjustments to the document if required. It is possible to full, modify and signal and produce Wisconsin Assignment of Note and Deed of Trust as Security for Debt of Third Party.

Down load and produce a large number of document web templates utilizing the US Legal Forms site, which provides the biggest collection of authorized types. Use expert and status-certain web templates to handle your small business or individual demands.

Form popularity

FAQ

Since a "Deed of Trust" replaces or serves as a mortgage where legal title to real property is placed with a Trustee (and is considered a conveyance), it needs a transfer return. If there is a default, the trustee would convey the property to the lender or successful bidder.

The biggest difference between a title versus a deed is the physical component. A deed is an official written document declaring a person's legal ownership of a property, while a title refers to the concept of ownership rights.

The Wisconsin real estate transfer fee (RETF) is imposed upon the grantor (seller) of real estate at a rate of $3.00 per $1,000 of value.

Leases less than 99 years are not conveyances of real property per state law (sec. 77.21(1), Wis. Stats.). If an original lease of 50 years expires and is then renewed for another 50 years, it is considered to be less than 99 years and is exempt from transfer return and the transfer fee.