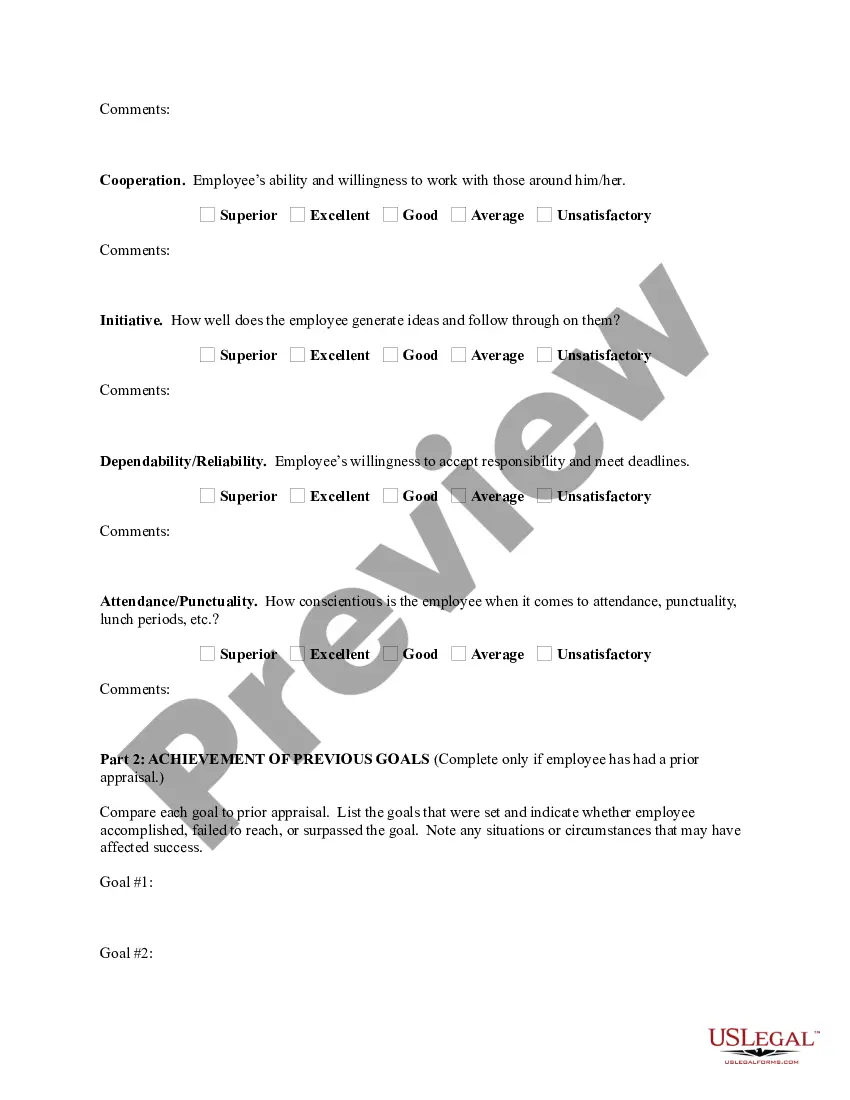

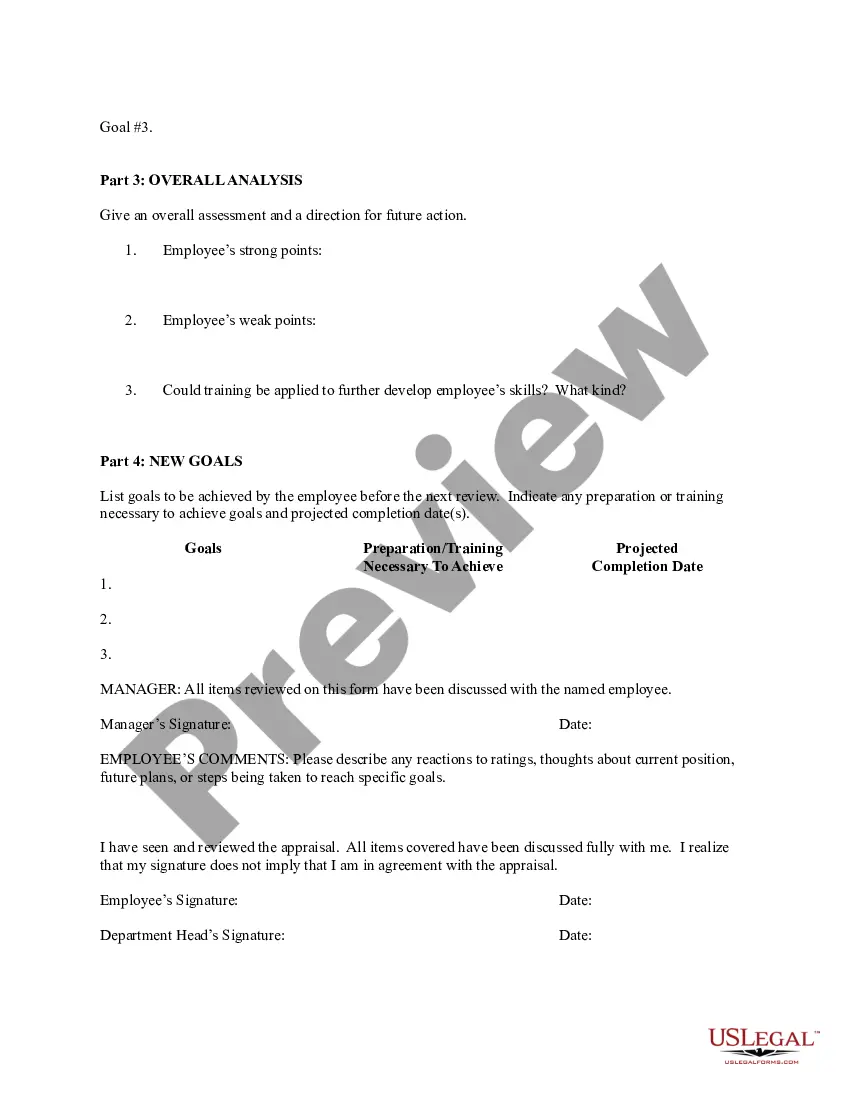

Wisconsin Employee Evaluation Form for Labourer

Description

How to fill out Employee Evaluation Form For Labourer?

If you aim to finish, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site’s straightforward and user-friendly search to find the documents you need.

Different templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Select your preferred pricing plan and enter your credentials to create an account.

Step 5. Process the payment. You may use your Visa, MasterCard, or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the Wisconsin Employee Assessment Form for Laborer with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and select the Download option to access the Wisconsin Employee Assessment Form for Laborer.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Don’t forget to check the information.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other templates from the legal form repository.

Form popularity

FAQ

What is employee classification? There are a number of classifications into which an employee might fall. These classifications include: Full-time, Part-time, Temporary, Intern and Seasonal. Employees are usually classified based on the hours worked, the expected duration of the job, and the job duties.

Seven common employee classification typesFull-time. Full-time employees work for a specified number of hours every week and are typically paid on a salary basis that does not change.Part-time.Contract.Independent contractor.Temporary.On-call.Volunteer.

WHO MUST COMPLETE: Effective on or after January 1, 2020, every newly2011hired employee is required to provide a completed Form WT20114 to each of their employers. Form WT20114 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

Analysis. From the above it is prima facie clear that the definition of employee is wider and seeks to cover a larger group of individuals than that of worker. Whereas the definition of worker is confined to those individuals working in factories and industries by and large.

The employer will control the place, hours, and method of work. The employee generally works exclusively for the employer. An independent contractor, on the other hand, is an individual hired as an outside professional to perform services to a business.

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.

Professor Margarita Mayo uses examples from the world of football to provide some useful do's and don'ts on managing the four types of workers; all stars, high performers, high potentials, and problem employees.

The factors are (1) the degree of control that the putative employer has over the manner in which the work is performed; (2) the worker's opportunities for profit or loss dependent on his managerial skill; (3) the worker's investment in equipment or material, or his employment of other workers; (4) the degree of skill

Wisconsin has among the highest workers' compensation medical reimbursement rates per procedure in the nation. With no published medical fee schedule and an employee's choice of medical provider, Payers' options for medical cost containment are limited in the State.

What is worker classification compliance? Worker classification compliance is determining whether the person you engaged to provide services is classified as an employee or independent contractor (IC). The tricky part is, a worker's classification status can change depending on how they're expected to perform the work.