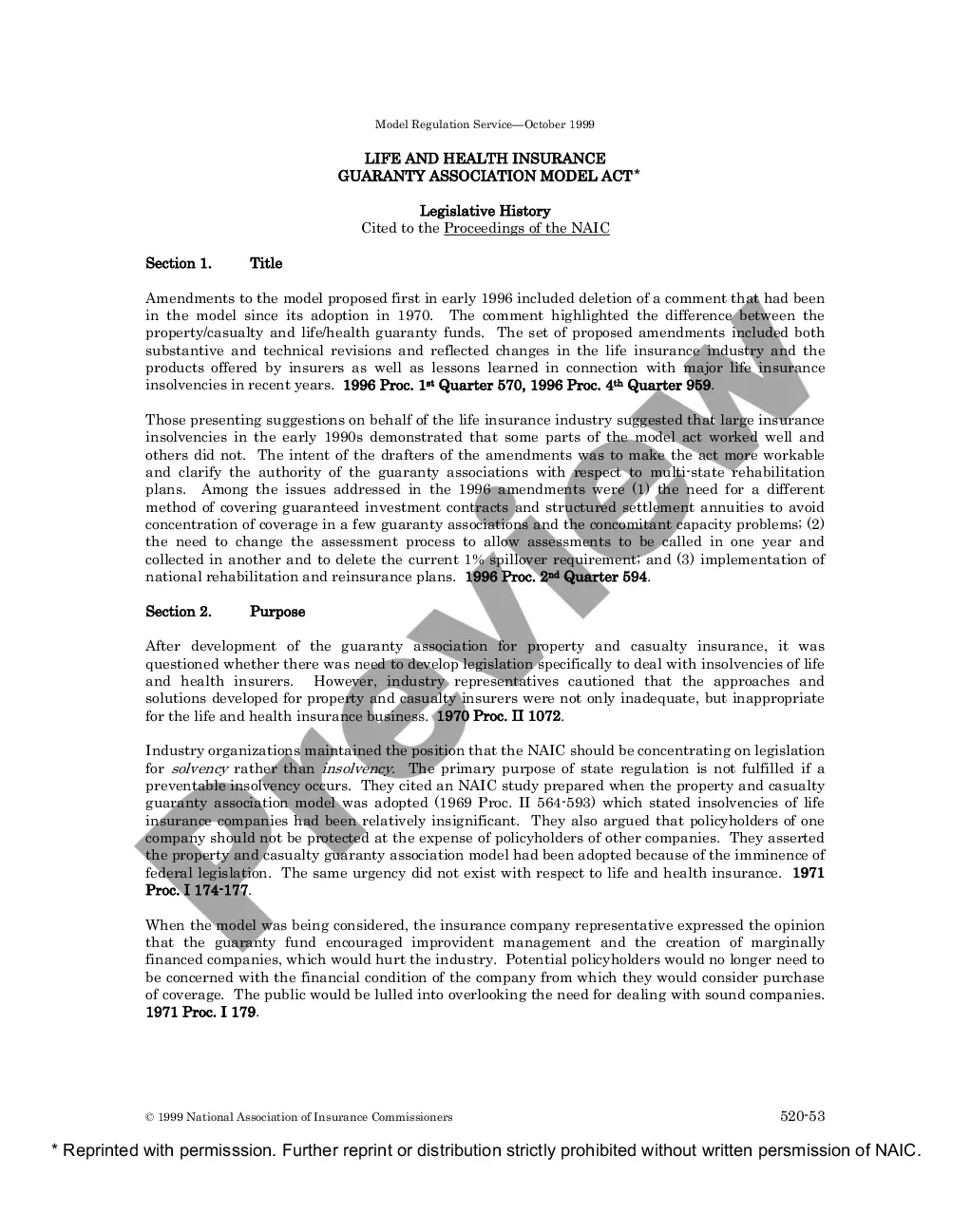

Full text and statutory guidelines for the Post Assessment Property and Liability Insurance Guaranty Association Model Act.

Wisconsin Post Assessment Property and Liability Insurance Guaranty Association Model Act

Description

How to fill out Post Assessment Property And Liability Insurance Guaranty Association Model Act?

It is possible to devote hrs on-line searching for the legitimate file format which fits the state and federal specifications you need. US Legal Forms offers a huge number of legitimate kinds that happen to be analyzed by pros. You can easily acquire or print out the Wisconsin Post Assessment Property and Liability Insurance Guaranty Association Model Act from the support.

If you already have a US Legal Forms account, you may log in and click the Download key. Following that, you may full, change, print out, or signal the Wisconsin Post Assessment Property and Liability Insurance Guaranty Association Model Act. Every legitimate file format you acquire is yours for a long time. To have an additional backup of the acquired kind, go to the My Forms tab and click the related key.

If you are using the US Legal Forms website the first time, follow the simple recommendations below:

- First, make sure that you have selected the best file format for the area/town of your liking. Look at the kind outline to ensure you have selected the proper kind. If readily available, make use of the Review key to search with the file format also.

- If you want to find an additional variation of your kind, make use of the Lookup field to discover the format that fits your needs and specifications.

- Upon having located the format you desire, click Get now to continue.

- Select the pricing prepare you desire, type in your credentials, and register for your account on US Legal Forms.

- Total the purchase. You can utilize your Visa or Mastercard or PayPal account to fund the legitimate kind.

- Select the file format of your file and acquire it to your gadget.

- Make changes to your file if needed. It is possible to full, change and signal and print out Wisconsin Post Assessment Property and Liability Insurance Guaranty Association Model Act.

Download and print out a huge number of file layouts while using US Legal Forms Internet site, which provides the largest variety of legitimate kinds. Use professional and state-distinct layouts to take on your company or specific requirements.

Form popularity

FAQ

$100,000 in net cash surrender or withdrawal values for life insurance. $300,000 in disability income (DI) insurance benefits. $300,000 in long-term care (LTC) insurance benefits.

The maximum amount of protection for each individual, regardless of the number of policies or contracts, is $300,000. Special rules may apply with regard to hospital, medical, and surgical insurance benefits.

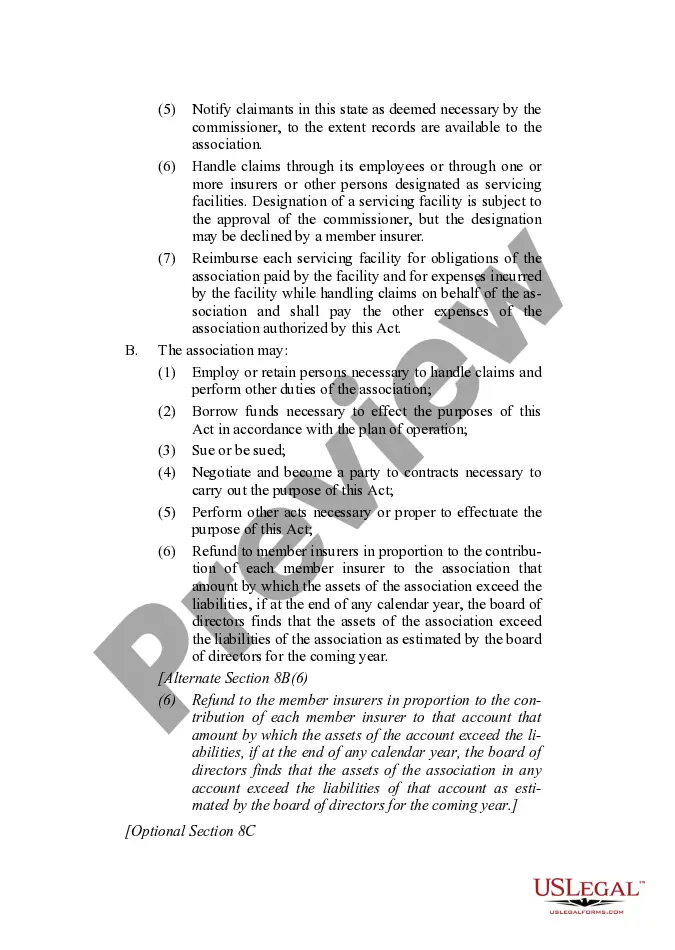

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.

The Oregon Life & Health Insurance Guaranty Association was created by the Oregon legislature in 1975 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits.

Once an insurer has been declared insolvent, the insurance department determines the value of the company's remaining assets. It then calculates the amount of money the guaranty association will need to pay claims. This amount is assessed by insurers.

Insurance guaranty associations provide protection to insurance policyholders and beneficiaries of policies issued by an insurance company that has become insolvent and is no longer able to meet its obligations. All states, the District of Columbia, and Puerto Rico have insurance guaranty associations.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.