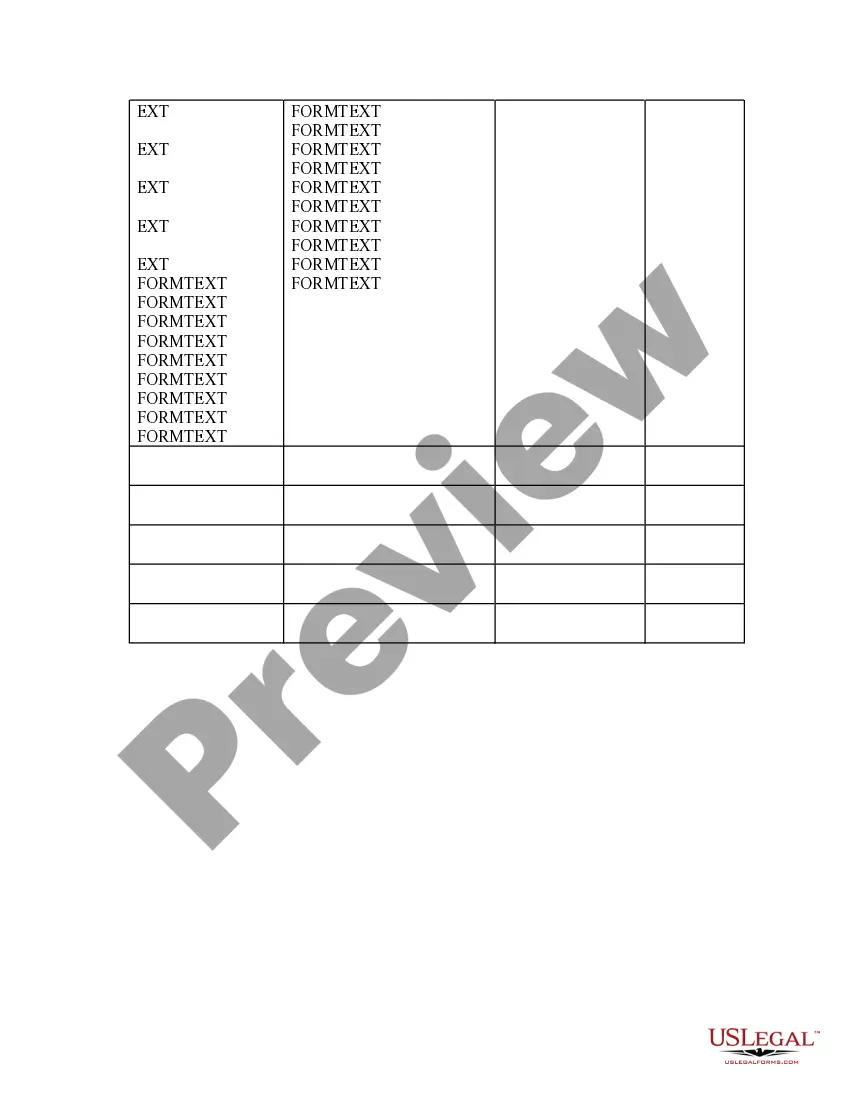

Wisconsin Employee Attendance Sheet

Description

How to fill out Employee Attendance Sheet?

Are you presently in a situation where you require documents for either business or specific purposes nearly every time.

There are many legitimate document templates available online, but finding forms you can rely on is challenging.

US Legal Forms provides thousands of form templates, including the Wisconsin Employee Attendance Sheet, which can be prepared to comply with federal and state regulations.

If you find the correct form, click Purchase now.

Select the pricing plan you want, fill in the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Employee Attendance Sheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/county.

- Utilize the Review option to inspect the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you seek, use the Lookup field to find the form that satisfies your needs.

Form popularity

FAQ

You should claim 0 allowances on your 2019 IRS W4 tax form if someone else claims you as a dependent on their tax return. (For example you're a college student and your parents claim you). This ensures the maximum amount of taxes are withheld from each paycheck.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

OVER WITHHOLDING: If you are using Form WT20114 to claim the maximum number of exemptions to which you are entitled and your withholding exceeds your expected income tax liability, you may use Form WT20114A to minimize the over withholding. WT-4 Instructions Provide your information in the employee section.

Form WT-4A is an agreement between the employee and employer that a lesser amount will be withheld from the employee's wages than is provided for in the Wisconsin income tax withholding tables.

Under Wisconsin law, unless an employee is specifically contracted to provide services for a company for an agreed-upon amount of time, an employer does not have to give any notice or reason to terminate an employee.

Form WT20114 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.