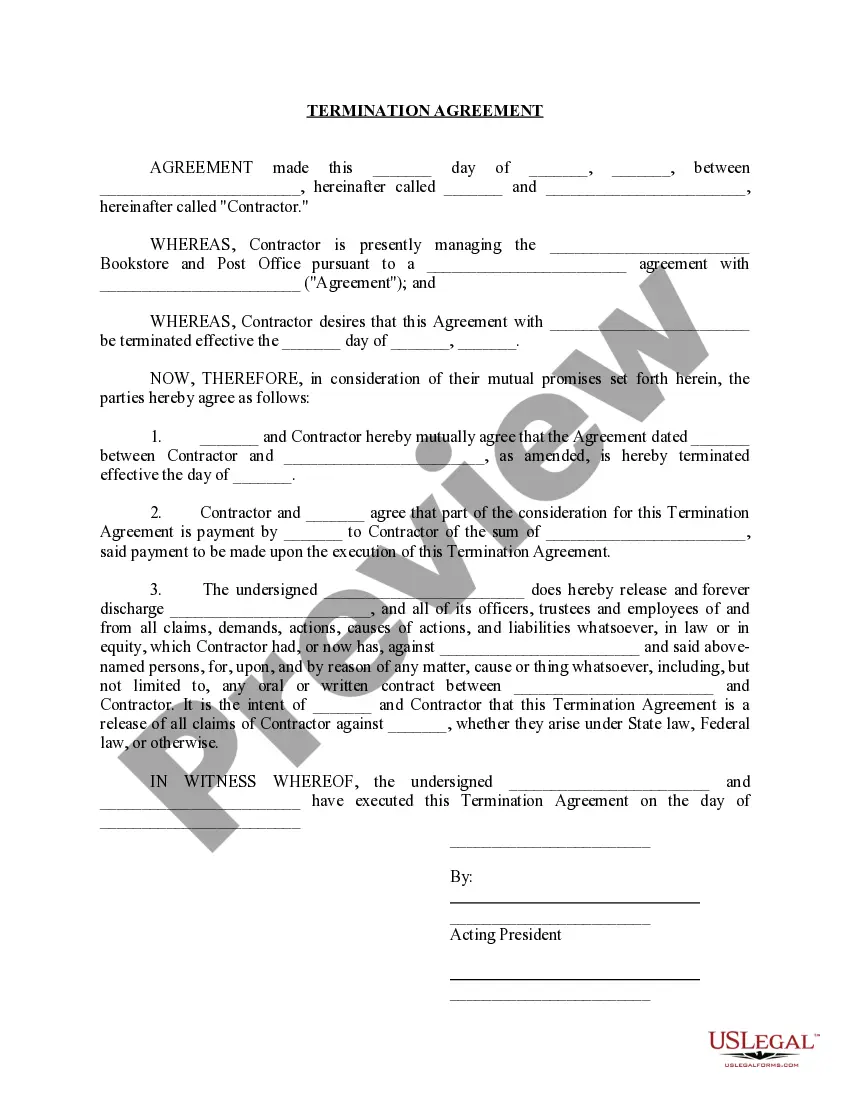

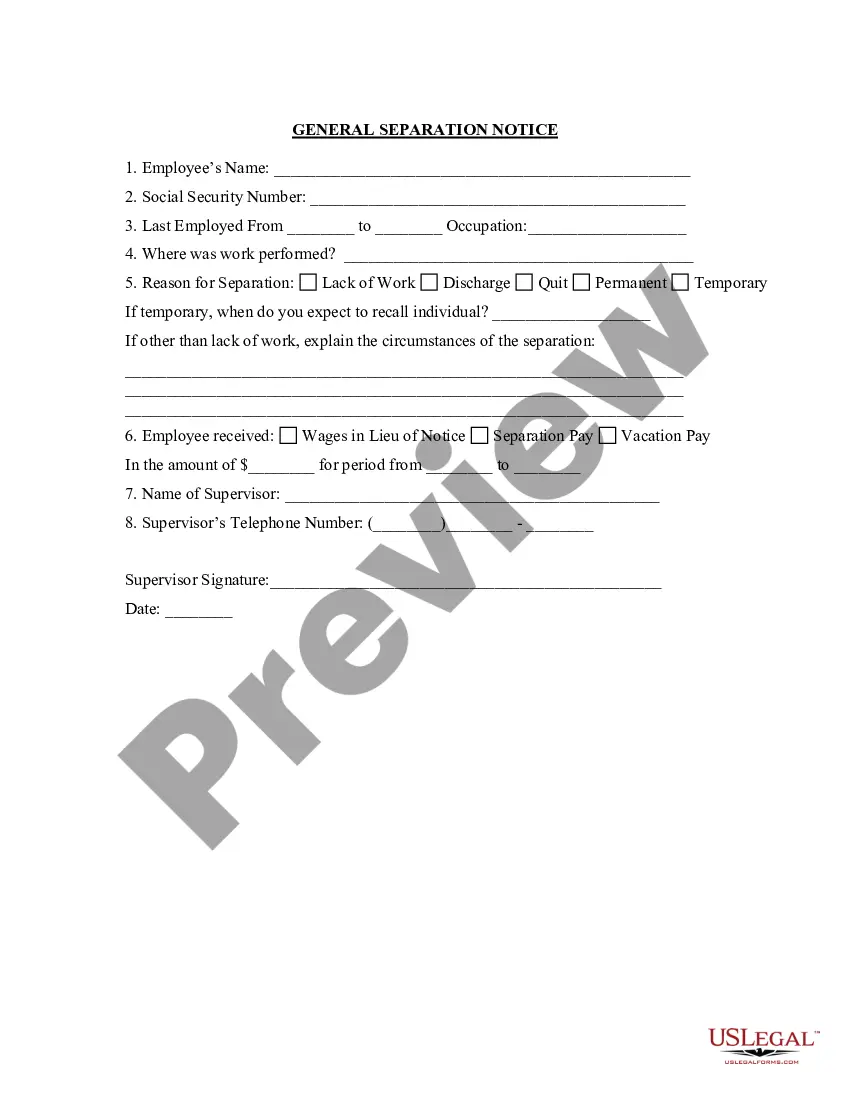

Wisconsin Separation Notice for Independent Contractor

Description

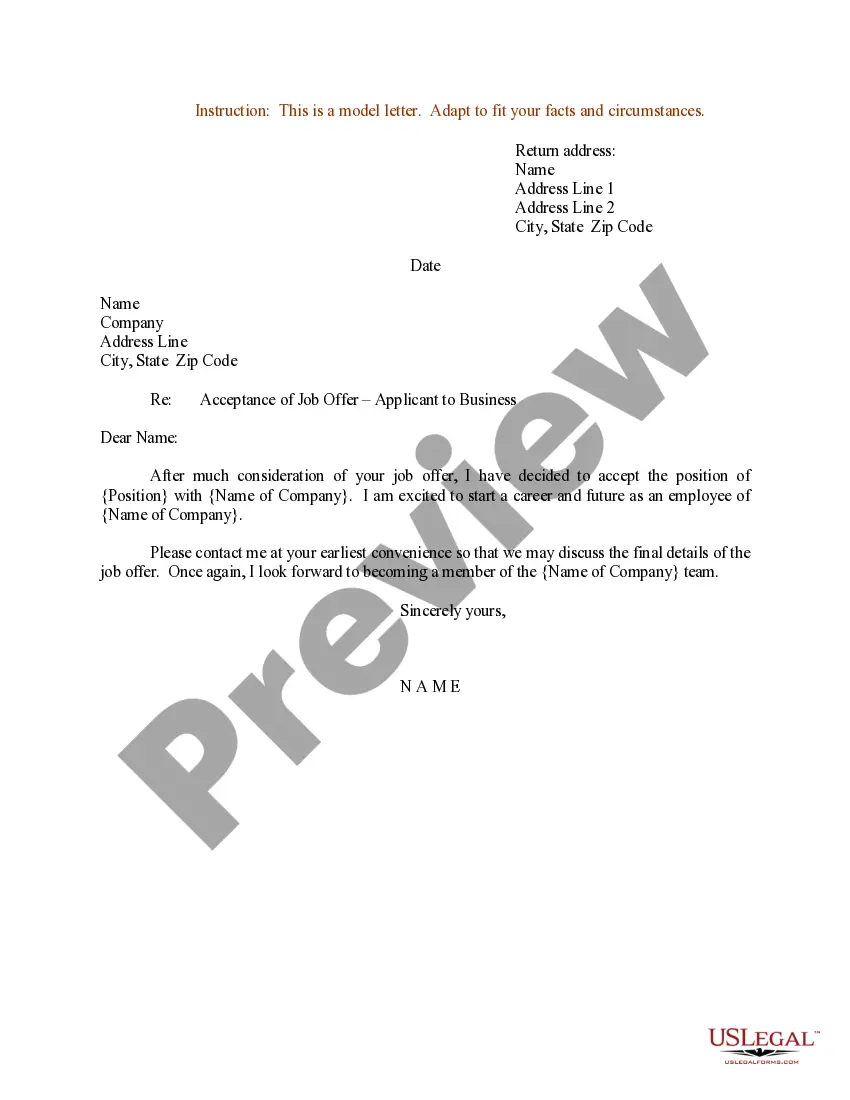

How to fill out Separation Notice For Independent Contractor?

Are you facing a circumstance in which you require documents for both organization or personal purposes almost all the time.

There are numerous legal document templates accessible online, yet finding versions you can rely on is challenging.

US Legal Forms provides a vast array of form templates, such as the Wisconsin Separation Notice for Independent Contractor, designed to comply with federal and state regulations.

Once you have the right form, click on Get now.

Choose a convenient document format and download your copy. You can view all the document templates you have purchased in the My documents section. You can acquire another copy of the Wisconsin Separation Notice for Independent Contractor at any time, if needed. Simply click on the desired form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service offers well-constructed legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Wisconsin Separation Notice for Independent Contractor template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific area/state.

- Utilize the Review feature to examine the document.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the document that suits your needs.

Form popularity

FAQ

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

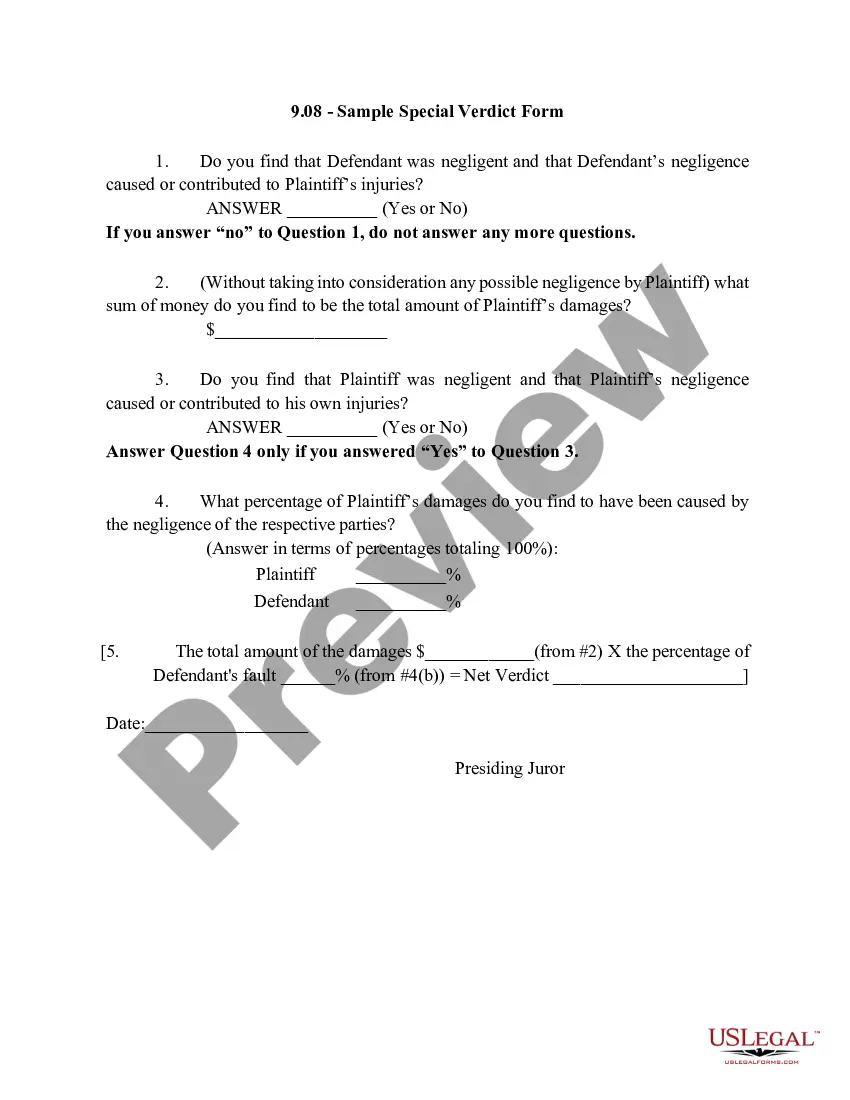

Even if you have been paid enough wages from covered employment to qualify for unemployment benefits, you will not receive benefits if you: quit a job without good cause. UI law suspends your benefits until you earn 6 times your WBR. are fired for misconduct.

The only problem is that it is often illegal. There is no such thing as a 1099 employee. The 1099 part of the name refers to the fact that independent contractors receive a form 1099 at the end of the year, which reports to the IRS how much money was paid to the contractor.

How To Resign From a Contract Position With GraceCommunicate with your recruiting partner. There are a lot of reasons why you might want to move on, most of which are perfectly understandable.Give proper notice.Keep the stakes in mind.Leave the job better than you found it.

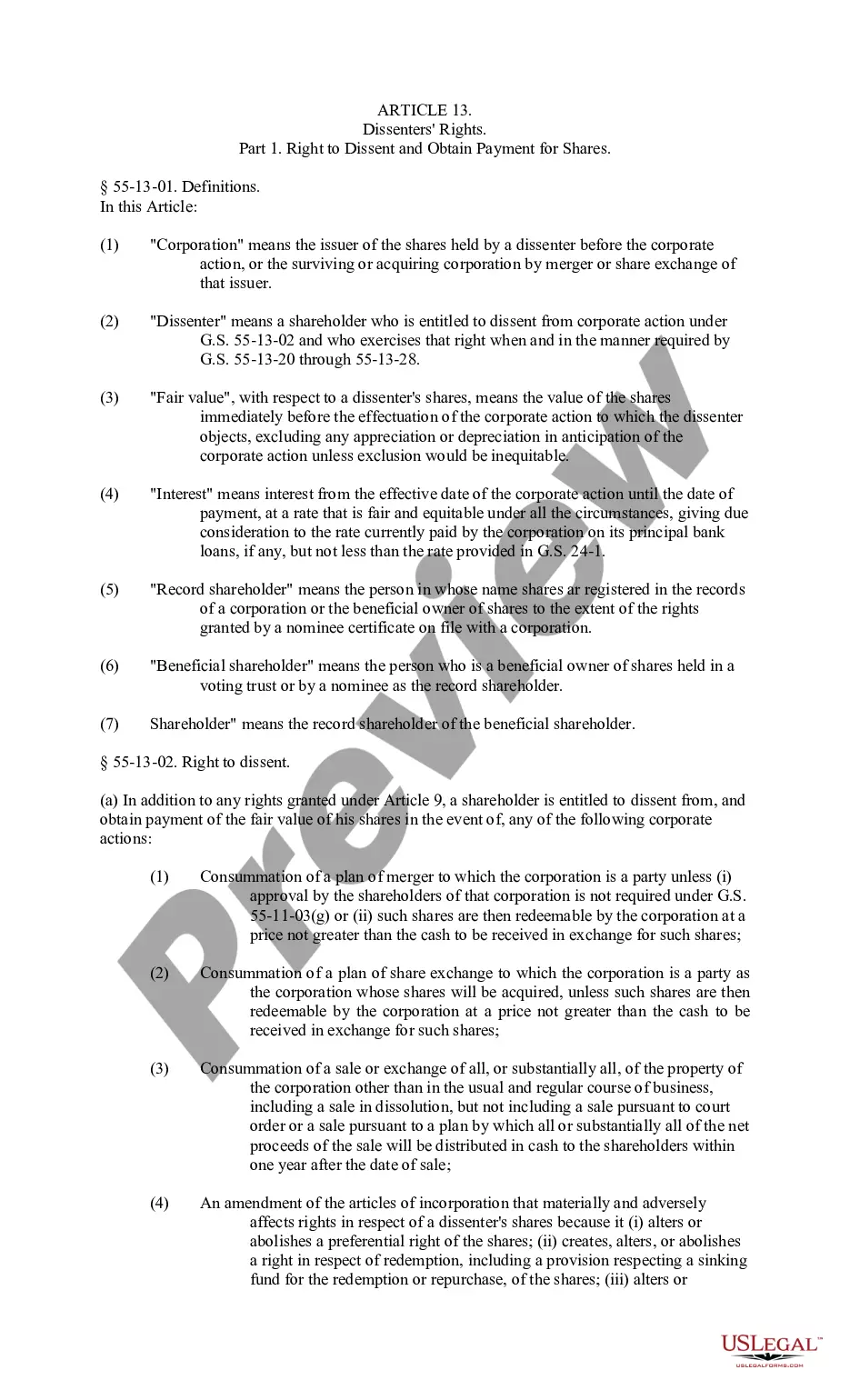

Employees are covered by the unemployment insurance law; independent contractors are not covered. If a worker is or has been "performing services for pay" for an employing unit, there is a presumption in the law that the worker is an "employee," not an independent contractor.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

It is not illegal for your employer to terminate your employment on the spot, without any notice. Under Wisconsin law, unless an employee is specifically contracted to provide services for a company for an agreed-upon amount of time, an employer does not have to give any notice or reason to terminate an employee.

The contract states further that "as an Independent contractor, you are not entitled to paid annual leave, or paid sick leave, paid responsibility leave, and you are not entitled to be paid for overtime worked and you're not entitled to be paid for public holidays or Sundays worked."

The maximum and minimum benefit rates are determined by UI law. The minimum WBR is $54, requiring high quarter earnings of $1,350; and the maximum WBR is $370, requiring high quarter earnings of $9,250.

A Wisconsin independent contractor agreement is a contract made between an employer conducting business in the state of Wisconsin and an independent worker who is not an employee of the company.