Wisconsin Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

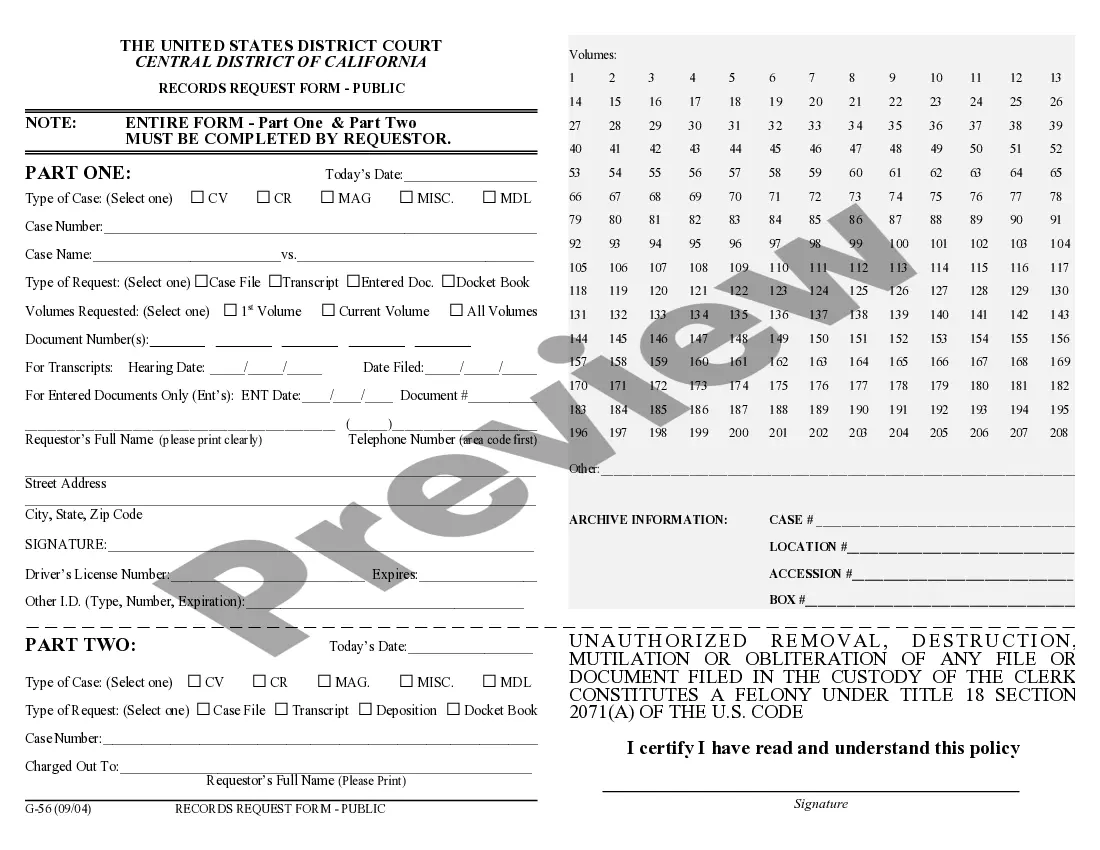

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

Finding the appropriate authorized document template can be a challenge.

Indeed, there are numerous templates accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Wisconsin Notice of Adverse Action - Non-Employment - Due to Credit Report, which can be utilized for both business and personal purposes.

If the form does not meet your needs, use the Search field to find the appropriate form. When you are certain that the form is right, choose the Get now option to acquire the form. Select the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your system. Complete, modify, and print, then sign the received Wisconsin Notice of Adverse Action - Non-Employment - Due to Credit Report. US Legal Forms is the largest library of legal forms where you can find a variety of document templates. Take advantage of this service to obtain professionally crafted documents that adhere to state regulations.

- All of the forms are reviewed by experts and comply with state and federal guidelines.

- If you are already registered, Log In to your account and click on the Download button to obtain the Wisconsin Notice of Adverse Action - Non-Employment - Due to Credit Report.

- Use your account to search through the legal forms you have purchased previously.

- Navigate to the My documents tab of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Preview option and review the form outline to ensure it is the right one for you.

Form popularity

FAQ

A denial or cancellation of, an increase in any charge for, or any adverse or unfavorable change in the terms of a government license or benefit; or. An action on an application or transaction initiated by a consumer, or in connection with account review that is adverse to the consumer's interests.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

Keep in mind that while employers can legally pull your credit report, it's one of many factors that go into getting hired for a new job. But there is a simple way to appear just as good on your credit report as you do in your job interview: Make sure you always pay your bills on time.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

There is no requirement that the lender have it signed. It is advantageous to have a point of contact listed, by name or department. But a signature is not required.

In particular: if you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.