Wisconsin Use of Company Equipment

Description

How to fill out Use Of Company Equipment?

If you need to finalize, acquire, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s simple and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have located the document you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the Wisconsin Use of Company Equipment in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Wisconsin Use of Company Equipment.

- You can also find templates you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

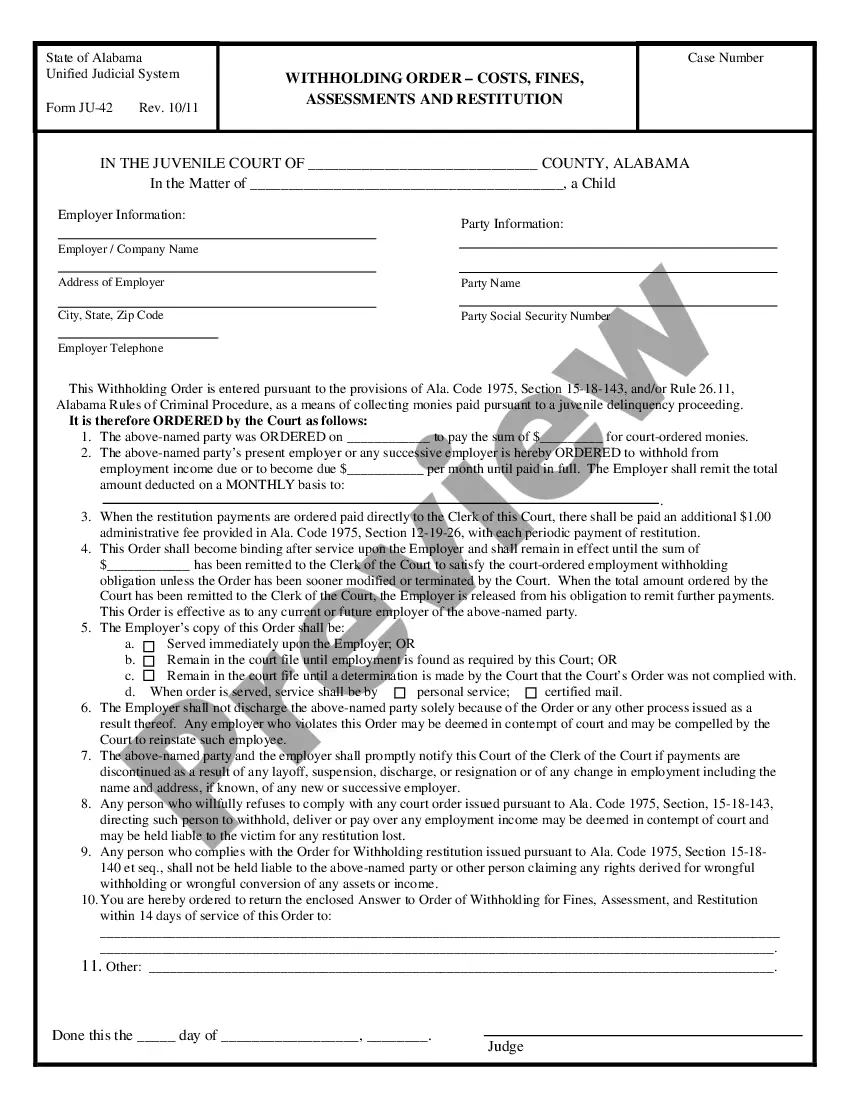

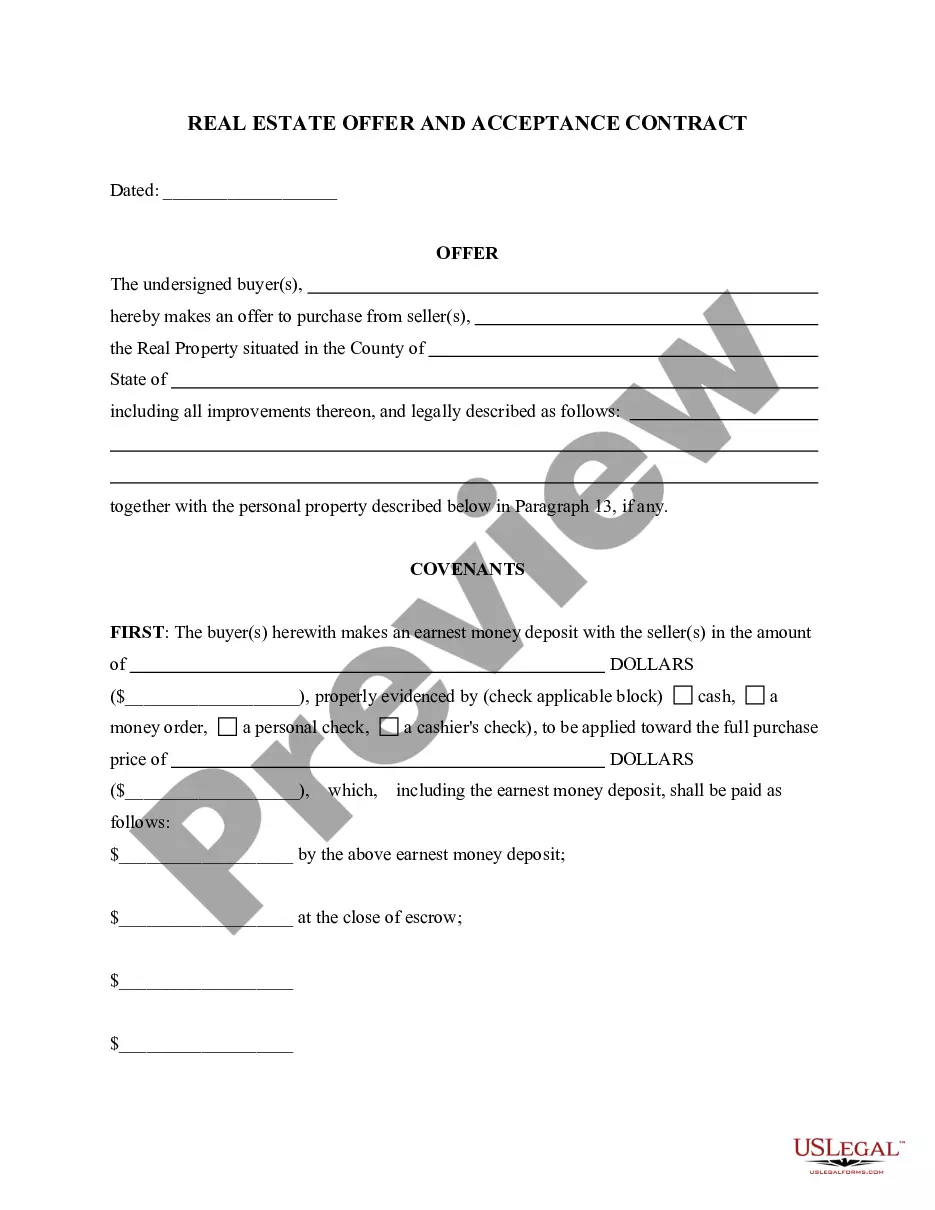

- Step 1. Confirm that you have selected the form for the correct region/state.

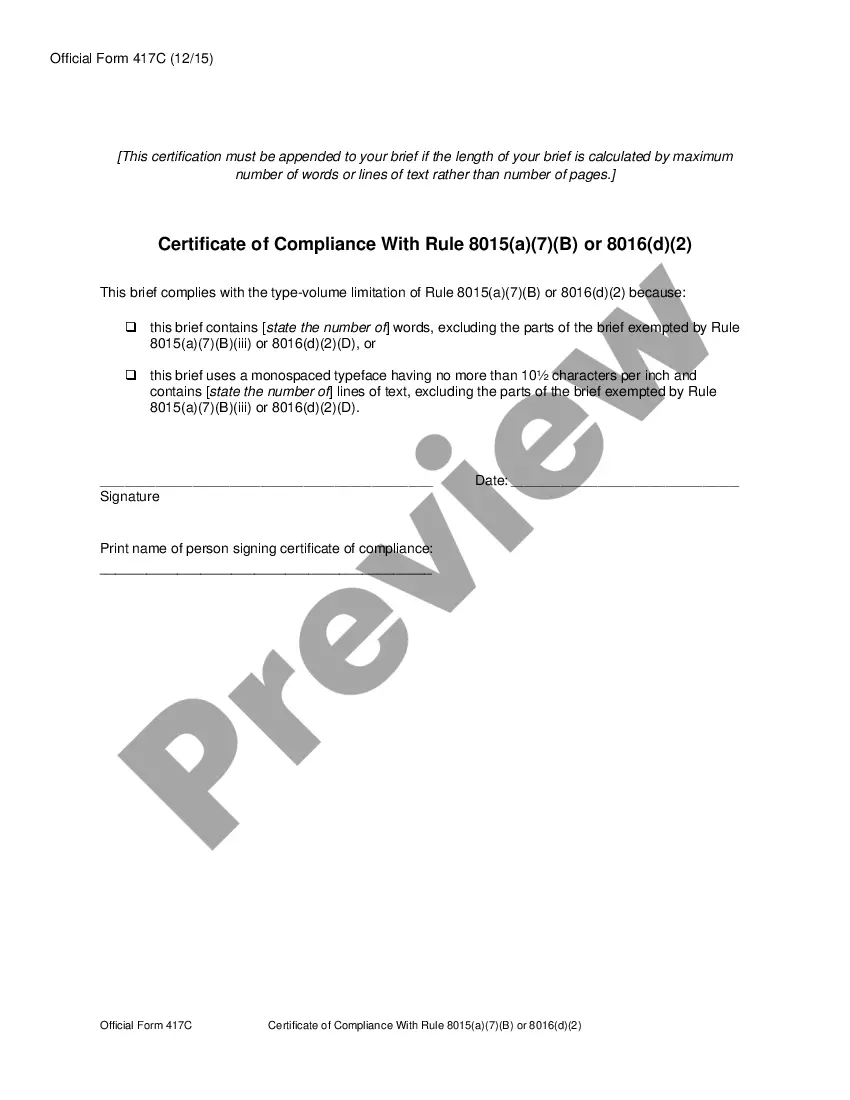

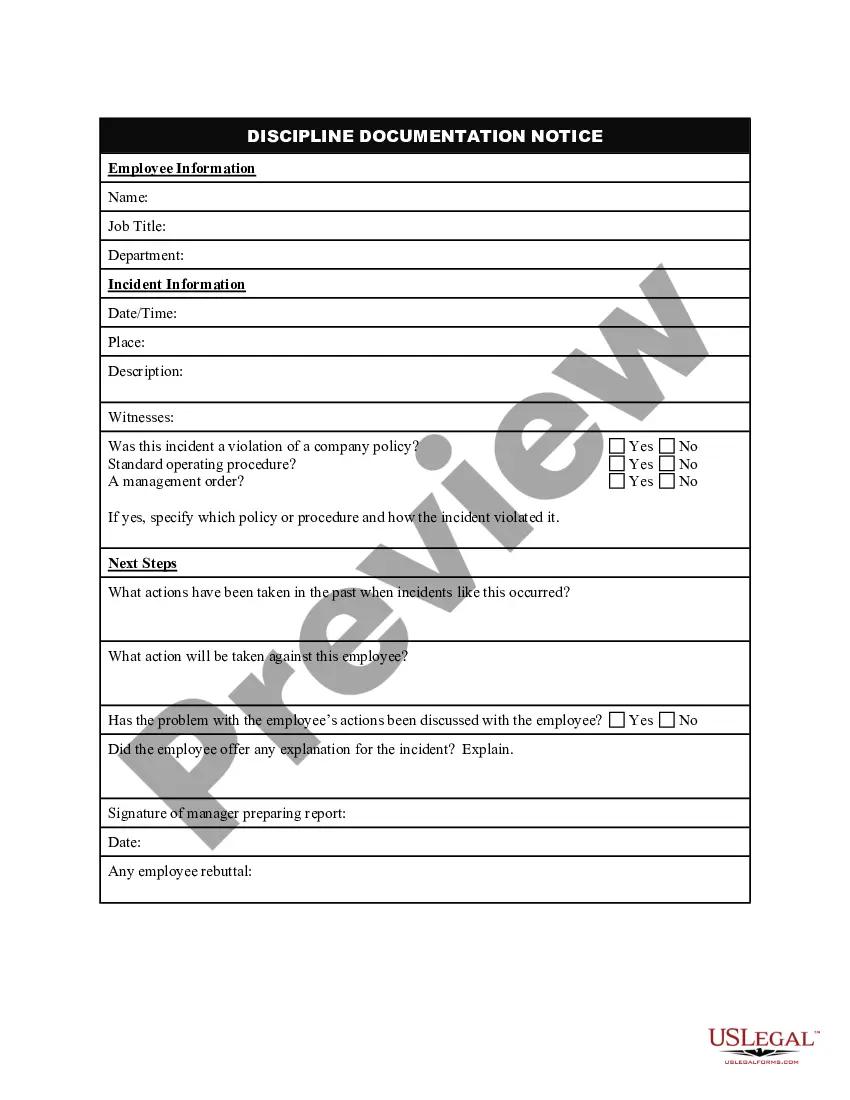

- Step 2. Utilize the Preview feature to review the form's content. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions in the legal form template.

Form popularity

FAQ

Computers or computer accessories: If you've been waiting to buy a laptop or desktop computer, you'll be in luck on tax-free weekend. No sales tax will be charged on your new MacBook, Dell Inspiron or other brands. However, computer parts are not tax free.

Leases and Rentals of Equipment: Leases and rentals of equipment with an operator that only maintains, inspects, or sets up the equipment are subject to sales or use tax.

"A tax is imposed on all retailers at the rate of 5% of the sales price from the sale, lease, license, or rental of specified digital goods and additional digital goods at retail for the right to use the specified digital goods or additional digital goods on a permanent or less than permanent basis and regardless of

Like hotel and B&B stays, short-term rentals in Wisconsin are subject to tax. Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities. Failure to comply with tax laws can result in fines and interest penalties.

Sales Tax Exemptions in Wisconsin There are many exemptions to state sales tax. This includes, burial caskets, certain agricultural items, certain grocery items, prescription medicine and medical devices, modular or manufactured homes, and certain pieces of manufacturing equipment.

Traditional Goods or Services Goods that are subject to sales tax in Wisconsin include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Wisconsin are subject to sales tax.

Property rental is optional.The charge for the rental of the tangible personal property is subject to sales tax, unless an exemption applies (e.g., the customer holds a CES number).

That brings us to the generous Wisconsin use tax benefit This means that all the manufacturing machines and specific processing equipment purchased for storage, use or consumption in the state is exempt from sales & use tax.

Introduction. The sale and use of certain computer system hardware is exempt from sales tax. Computer system hardware that qualifies for the exemption may be purchased, rented, or leased using Form ST-121.3, Exemption Certificate For Computer System Hardware.

Therefore the sale, lease, or license of computer hardware and computer software, except custom computer software, is subject to Wisconsin sales or use tax.