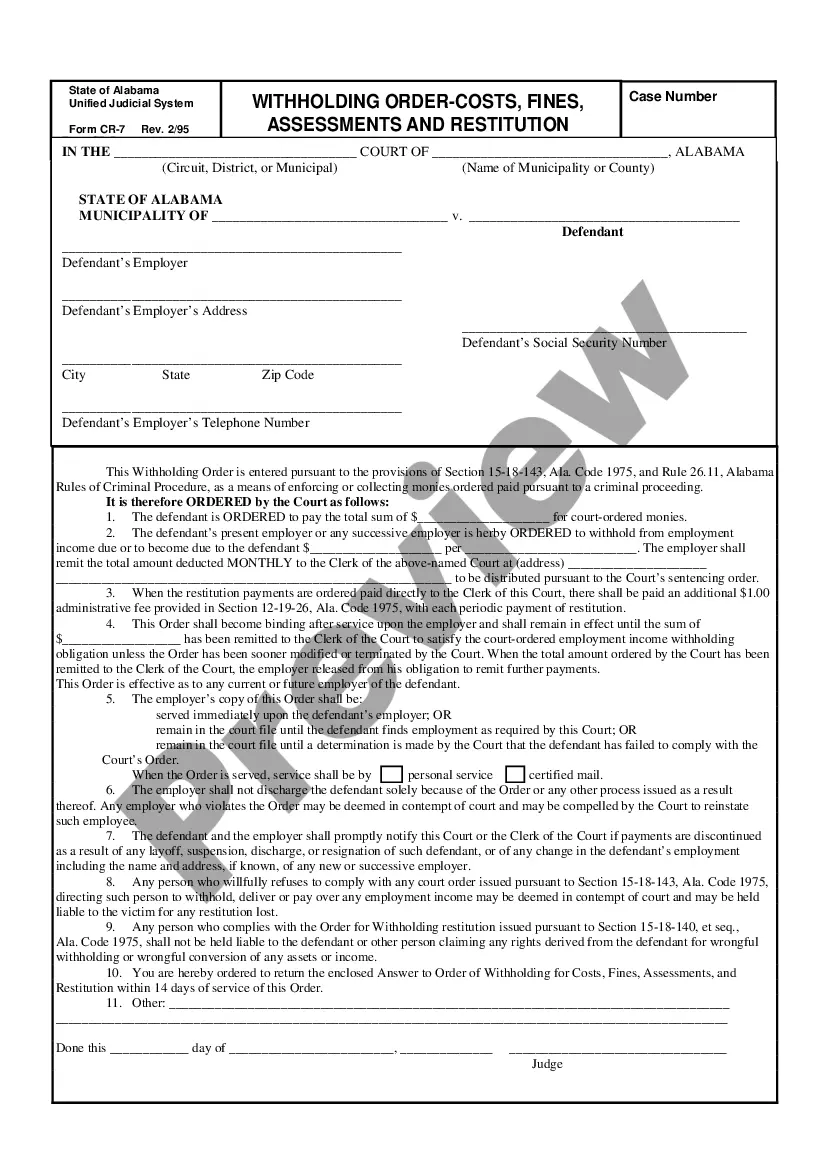

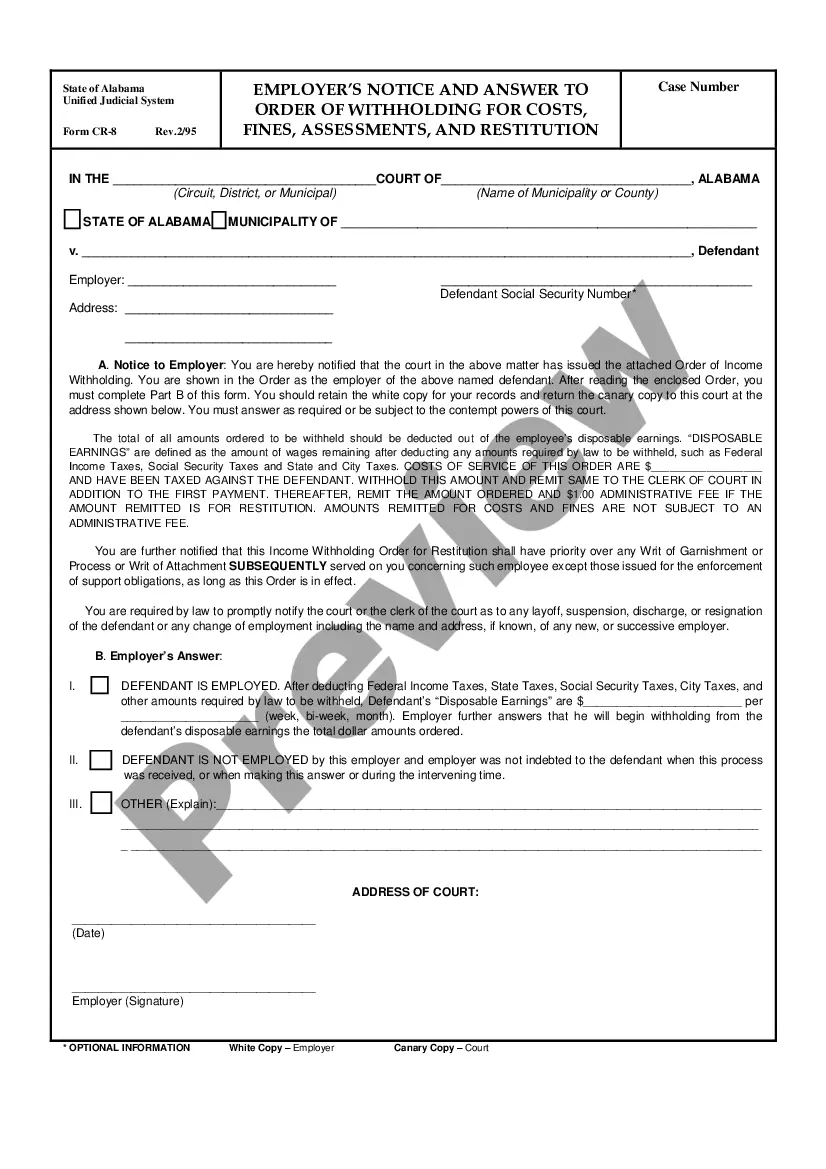

An Alabama Withholding Order-Costs, Fines, Assessments and Restitution is a court-ordered payment that is required to be deducted from an employee’s wages and sent to a designated agency or individual. This type of withholding order is used by the state of Alabama to collect money for unpaid fines, taxes, restitution, and other costs. Types of Alabama Withholding Order-Costs, Fines, Assessments and Restitution include: • Court-Ordered Fines: These are fines imposed by a court as a punishment for a criminal offense. • Tax Liability: These are taxes owed to the state of Alabama or the IRS. • Restitution: These are payments made to victims of a crime for damages or losses. • State or Local Fees/Fines: These are fees or fines imposed by a state or local agency. • Child Support Payments: These are payments made to an individual for the support of a minor child.

Alabama Withholding Order-Costs,Fines,Assessments and Restitution

Description

How to fill out Alabama Withholding Order-Costs,Fines,Assessments And Restitution?

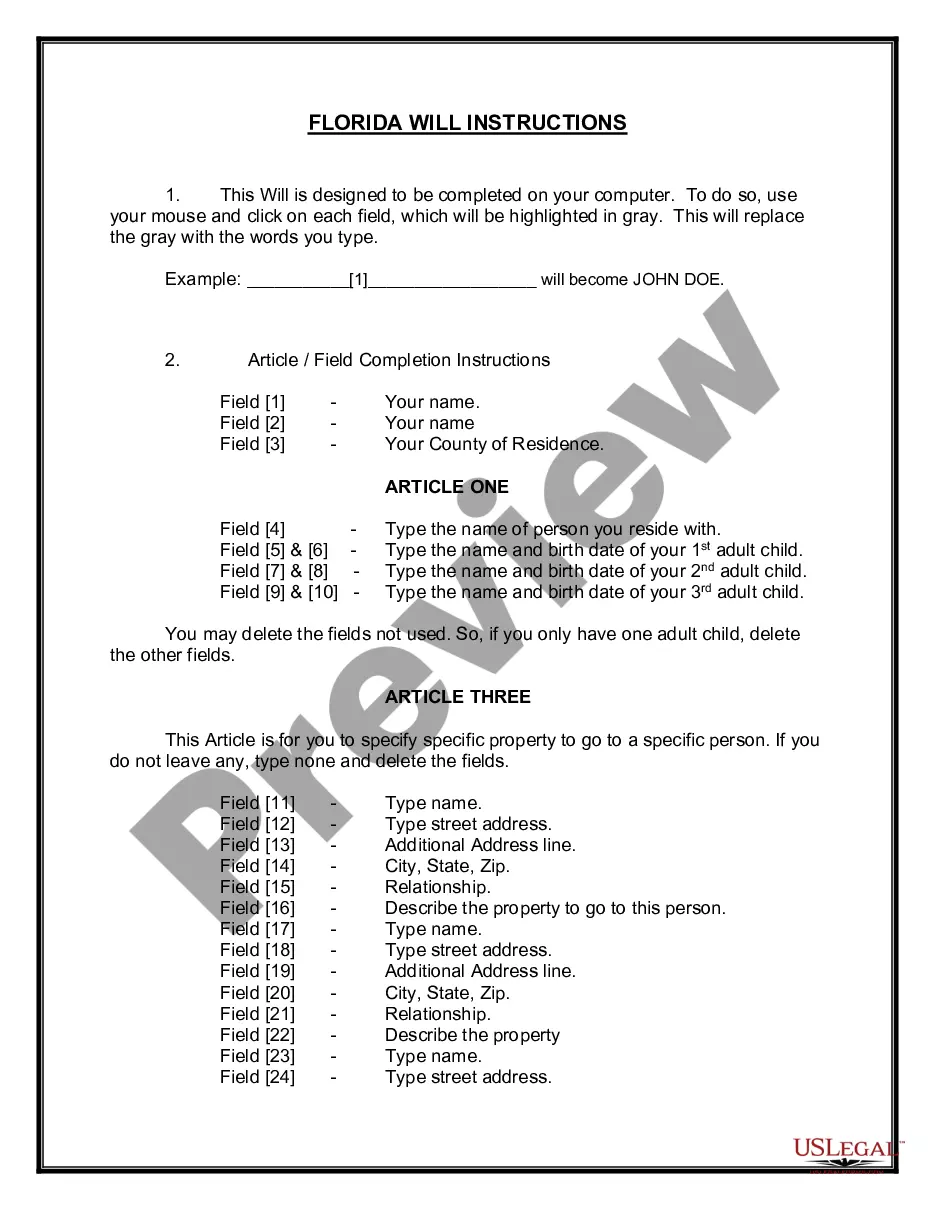

Managing official documentation necessitates focus, accuracy, and utilizing appropriately drafted forms. US Legal Forms has been assisting individuals nationwide in doing just that for 25 years, ensuring that when you select your Alabama Withholding Order-Costs,Fines,Assessments and Restitution template from our collection, it adheres to federal and state guidelines.

Engaging with our service is simple and swift. To acquire the required documentation, you only need an account with an active subscription. Here is a quick guide to obtain your Alabama Withholding Order-Costs,Fines,Assessments and Restitution in a matter of minutes.

All documents are designed for multiple uses, such as the Alabama Withholding Order-Costs,Fines,Assessments and Restitution presented on this page. If you require them in the future, you can complete them without additional payment - simply access the My documents section in your profile and finalize your document whenever needed. Try US Legal Forms and handle your business and personal paperwork quickly and in complete legal compliance!

- Make sure to thoroughly review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for another official form if the one you initially opened does not suit your circumstances or state laws (the link for that is located at the top page corner).

- Log In to your account and retrieve the Alabama Withholding Order-Costs,Fines,Assessments and Restitution in your preferred format. If this is your first visit to our site, click Buy now to proceed.

- Create an account, select your subscription option, and pay using your credit card or PayPal account.

- Choose the format in which you wish to save your form and click Download. Print the form or add it to a professional PDF editor for paperless submission.

Form popularity

FAQ

Registering for Alabama withholding tax requires completing an application through the Alabama Department of Revenue. You can access application resources online, ensuring you follow all necessary guidelines. Accurate registration will prevent unexpected costs, fines, assessments, and restitution later. For easier navigation, consider using USLegalForms to assist you with the registration process and related paperwork.

Setting up tax withholding involves determining the appropriate amount to deduct from each employee's paycheck. You’ll need to assess factors like employee wages and applicable exemptions. Make sure to stay informed about Alabama regulations to avoid potential costs, fines, assessments, and restitution. Utilizing resources like USLegalForms can simplify this process by providing clarity on forms and procedures.

To apply for withholding tax in Alabama, you need to fill out the appropriate forms provided by the Alabama Department of Revenue. Once completed, you can submit these forms online or via mail. Accurate information is crucial in this process; any errors might lead to costs, fines, assessments, and restitution. For your convenience, consider exploring USLegalForms, which offers templates and guidance for tax-related applications.

The Alabama employee withholding tax is a tax employers deduct from employees' wages. This amount is sent to the Alabama Department of Revenue and helps fund state services. Your business's compliance with this tax is essential to avoid costs, fines, assessments, and restitution associated with non-compliance. Ensure you understand the rates and regulations applicable to your business.

To register for withholding tax in Alabama, you need to complete the Application for Alabama Business Privilege Tax Form. You can submit this form online or mail it to the Alabama Department of Revenue. Make sure to provide accurate business information and your federal Employer Identification Number. This ensures you are compliant with Alabama's regulations regarding withholding tax costs, fines, assessments, and restitution.

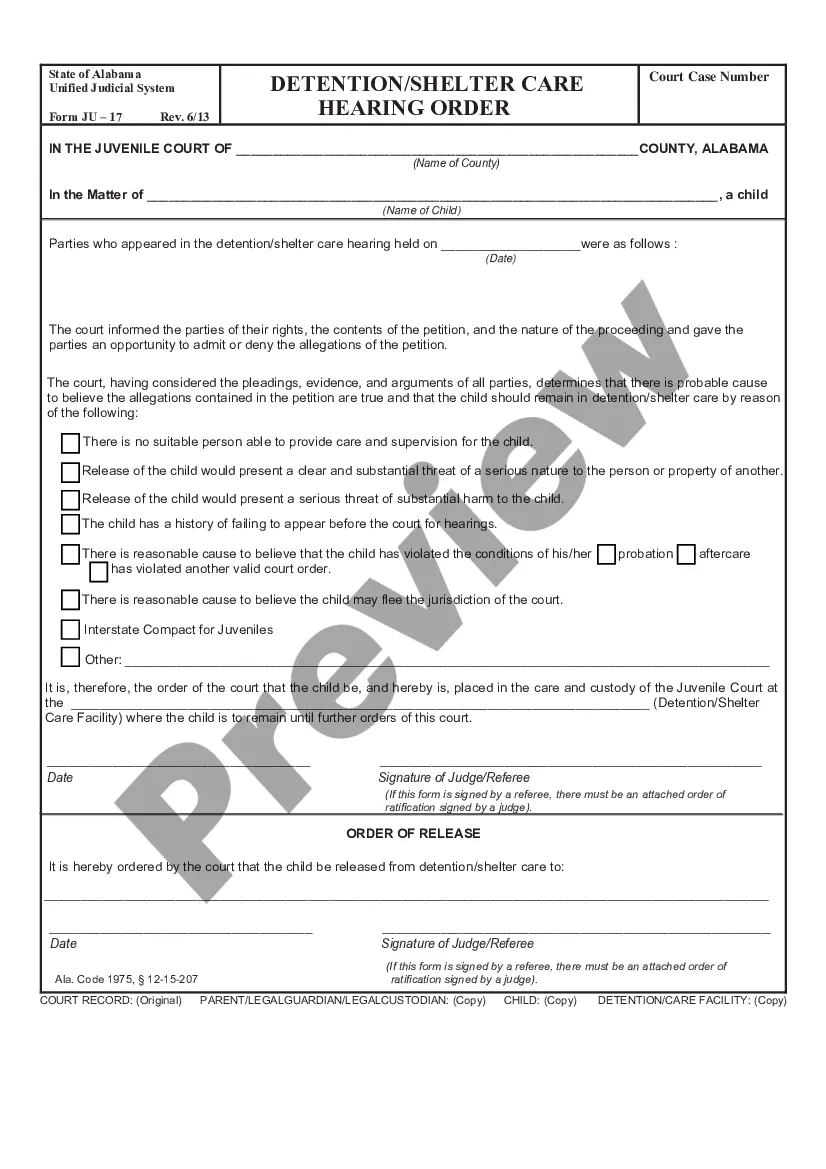

The restitution law in Alabama mandates that individuals convicted of certain crimes must make financial reparations to their victims. This law aims to restore victims to their financial position prior to the crime. Knowledge of Alabama Withholding Order-Costs, Fines, Assessments and Restitution is essential for both victims seeking justice and offenders navigating their responsibilities.

In Alabama, restitution works by requiring offenders to compensate their victims for losses incurred from their actions. The court determines the amount based on various factors, including the extent of loss and the financial capability of the offender. Being aware of Alabama Withholding Order-Costs, Fines, Assessments and Restitution helps victims and offenders understand their rights and obligations during this process.

Statute 36 21 14 in Alabama pertains to the procedures involving the withholding of funds for certain obligations, including fines and restitution. This law clarifies how the state manages the collection of dues owed by individuals following legal judgments. Understanding Alabama Withholding Order-Costs, Fines, Assessments and Restitution is key to ensuring compliance with these legal frameworks.

The rule of restitution requires that a person who suffers loss due to another's actions should be compensated for that loss. In legal cases, this often involves repayment of stolen funds or damages awarded by the court. Familiarity with Alabama Withholding Order-Costs, Fines, Assessments and Restitution helps individuals navigate the responsibilities that arise during restitution claims.

Withdrawal of a withholding order indicates that the court has decided to lift the hold on funds, usually due to the satisfaction of debts or obligations. This action releases the funds back to the individual or organization that had them withheld. It's important to grasp the implications of Alabama Withholding Order-Costs, Fines, Assessments and Restitution during this process to ensure compliance with any remaining legal requirements.