Wisconsin Purchase Invoice

Description

How to fill out Purchase Invoice?

Are you currently in a situation where you require paperwork for either business or personal reasons almost daily.

There are many legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template options, including the Wisconsin Purchase Invoice, designed to comply with state and federal regulations.

If you find the right form, just click Get now.

Choose the pricing plan you want, fill in the required information to set up your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wisconsin Purchase Invoice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Lookup field to find the form that suits your needs.

Form popularity

FAQ

The ST-12 form in Wisconsin is the Sales and Use Tax Exemption Certificate. This form allows certain purchasers to claim an exemption from sales tax on qualifying items. When filling out your Wisconsin Purchase Invoice, make sure to include your ST-12 form if applicable, so vendors can document your tax-exempt status. For clarity on what products and services this exemption covers, consult the Wisconsin Department of Revenue's guidelines.

Yes, you can e-file your Wisconsin taxes, which provides a convenient way to submit your returns. By using the e-filing system, you can also quickly receive confirmation of your submission. Ensure to include your Wisconsin Purchase Invoice details accurately to avoid any issues. Various tax preparation software options integrate with the Wisconsin e-filing system to simplify the process.

If you sell goods or services in Wisconsin, you will likely need to register for sales tax, especially if you plan to collect it from your customers. This registration allows you to issue a Wisconsin Purchase Invoice to customers, showing the included sales tax. You can complete your registration online through the Wisconsin Department of Revenue's website, making it a straightforward process. Additionally, being registered helps ensure compliance with state laws.

You can make a payment to the Wisconsin Department of Revenue electronically through their online portal, which allows for quick and secure transactions. When making a payment, it's important to have your Wisconsin Purchase Invoice handy, as this will help ensure your payment is processed correctly. You can also choose to send a check by mail, but electronic payments are often more efficient. Remember to check the specific payment methods available for your invoice type.

Creating a Wisconsin Purchase Invoice from a purchase order is straightforward. First, reference the purchase order to ensure accuracy in details such as items, quantities, and agreed prices. You can then generate the invoice using the purchase order as a basis, checking off items as they are fulfilled. Tools like US Legal Forms offer templates that streamline this process, making it easy to convert purchase orders into invoices.

To write a Wisconsin Purchase Invoice, start by including your company name and contact information at the top. Next, add the date, invoice number, and the recipient's details. Clearly list the items purchased with descriptions and prices, followed by the total amount due. Using a template from platforms like US Legal Forms can simplify this process, ensuring you cover all necessary details.

A correct Wisconsin Purchase Invoice typically includes essential elements like your business name, contact information, invoice number, and date. Additionally, it should list the buyer's details and the goods or services provided, along with their prices. It's important to also include payment terms and any applicable taxes. This structured approach ensures clarity and professionalism.

A sales invoice is issued by the seller to request payment, while a purchase invoice is received by the buyer as a summary of what has been purchased. The sales invoice focuses on the sale from the seller's perspective, whereas the purchase invoice emphasizes the buyer's responsibilities. Understanding this distinction helps streamline financial processes for businesses.

The primary difference lies in their usage and detail. A purchase bill usually serves as a straightforward request for payment, whereas a purchase invoice provides comprehensive details about the transaction, such as item descriptions and payment terms. Knowing this difference is essential for proper record-keeping and financial management in Wisconsin.

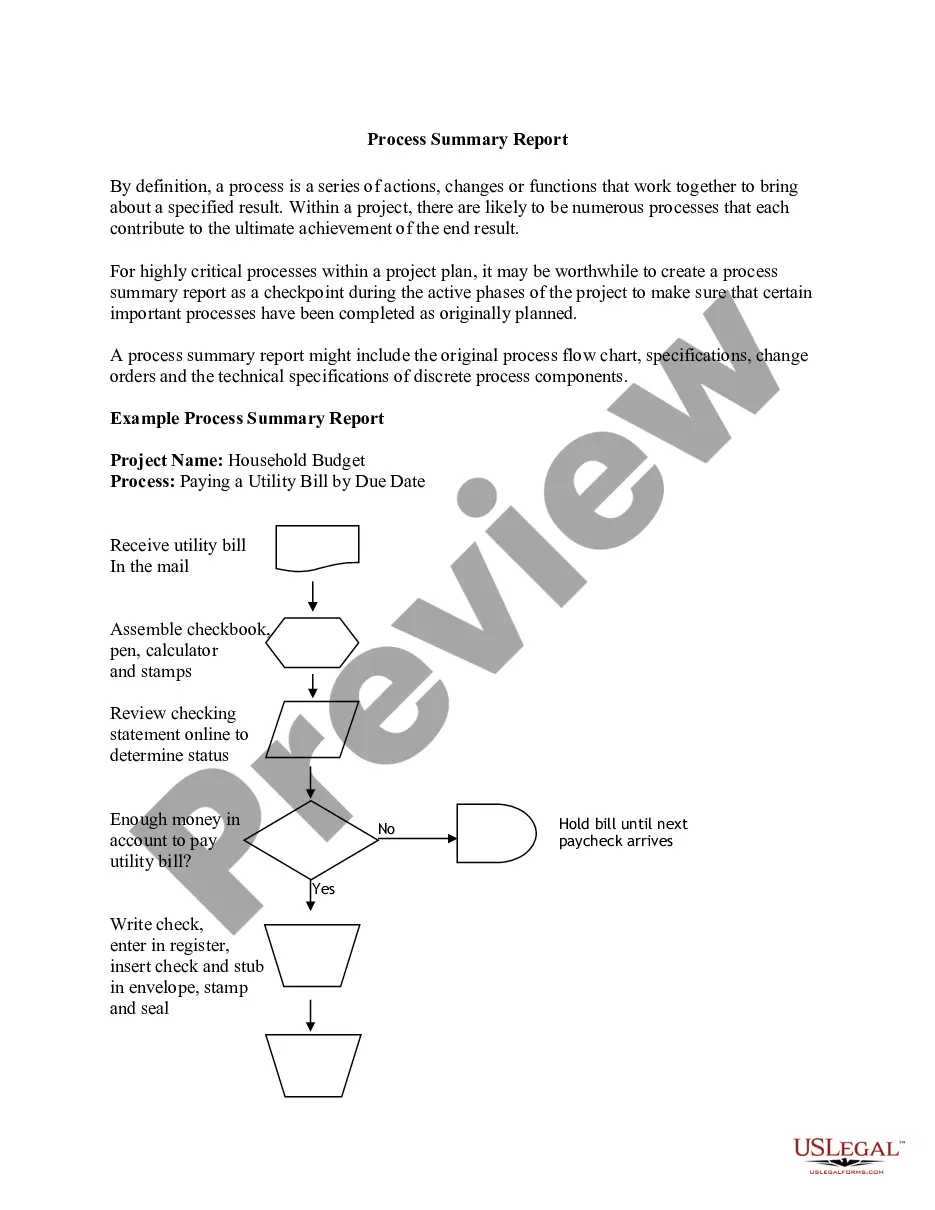

A purchase order (PO) typically comes first in the procurement process, as it authorizes the seller to provide goods or services. Once the transaction is completed, a purchase invoice is subsequently issued to request payment. This sequence fosters clear communication and accountability between the parties involved.