Wisconsin Charitable Contribution Payroll Deduction Form

Description

How to fill out Charitable Contribution Payroll Deduction Form?

Have you ever been in a location where you need documents for potential commercial or personal purposes almost every day.

There are numerous legal document templates available on the web, but locating reliable ones can be challenging.

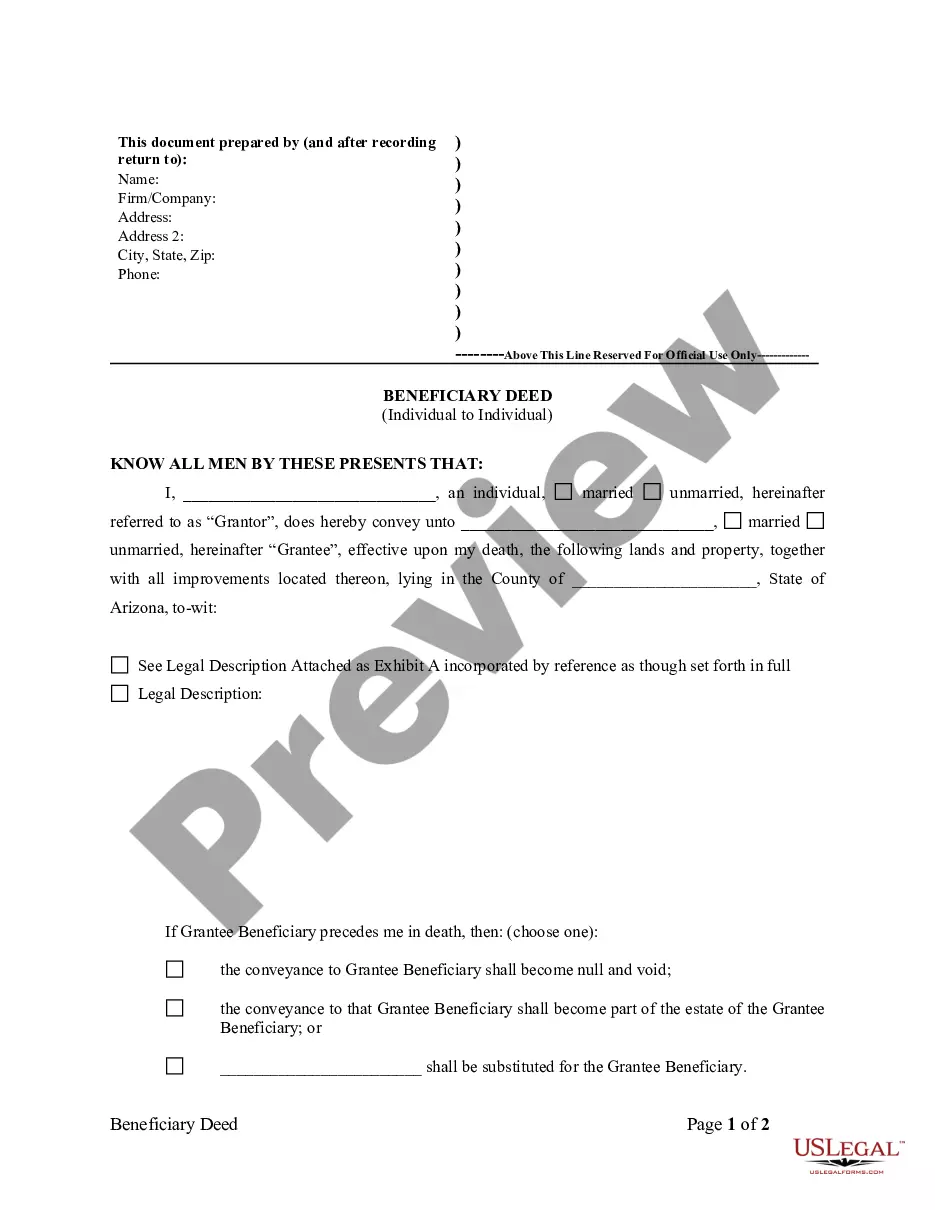

US Legal Forms offers a wide range of form templates, including the Wisconsin Charitable Contribution Payroll Deduction Form, which can be tailored to fulfill state and federal requirements.

Once you find the appropriate form, click Acquire now.

Choose the pricing plan you want, enter the required information to create your account, and pay for the transaction using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Wisconsin Charitable Contribution Payroll Deduction Form template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review button to assess the form.

- Check the description to confirm that you have selected the correct document.

- If the form is not what you're looking for, use the Search field to find the form that best suits your needs.

Form popularity

FAQ

Wisconsin adopted sec. 2204 of the Cares Act relating to the federal $300 above-the-line charitable contribution deduction in 2019 Wisconsin Act 185. Therefore, it applies for Wisconsin purposes as well for tax year 2020.

On February 18, 2021, Wisconsin Governor Tony Evers signed Acts 1 (AB 2) and 2 (AB 3), which update the Internal Revenue Code (IRC) conformity for the state's income tax law along with other tax changes, some of which provide tax relief to Wisconsin taxpayers.

This schedule determines the federal adjusted gross income using the Internal Revenue Code adopted for Wisconsin. Note: As a result of this addition to federal adjusted gross income for Wisconsin purposes, other Wisconsin computations may be affected.

No, if you take the standard deduction you do not need to itemize your donation deduction. However, if you want your deductible charitable contributions you must itemize your donation deduction on Form 1040, Schedule A: Itemized Deductions.

How to score a tax write-off for 2021 donations to charity if you don't itemize deductions. Single taxpayers can claim a tax write-off for cash charitable gifts up to $300 and married couples filing together may get up to $600 for 2021.

Under this new change, individual taxpayers can claim an "above-the-line" deduction of up to $300 for cash donations made to charity during 2020.

Wisconsin still allows a 100% deduction for certain meals provided by employers. These meals are for de minimis fringe benefits, which include eating facilities located on or near the business premises of the employer and meals furnished on the business premises of the employer for the convenience of the employer.

Wisconsin adopted sec. 2204 of the Cares Act relating to the federal $300 above-the-line charitable contribution deduction in 2019 Wisconsin Act 185. Therefore, it applies for Wisconsin purposes as well for tax year 2020.

If you have an approved electronic filing waiver, send your amended Form 3 to the Wisconsin Department of Reve- nue, PO Box 8908, Madison, WI 53708-8908.

What is Wisconsin Form 1? Wisconsin Form 1 is used by full-year residents to file their state income tax return. Nonresident and part-year resident filers will complete Wisconsin Form 1NPR instead.