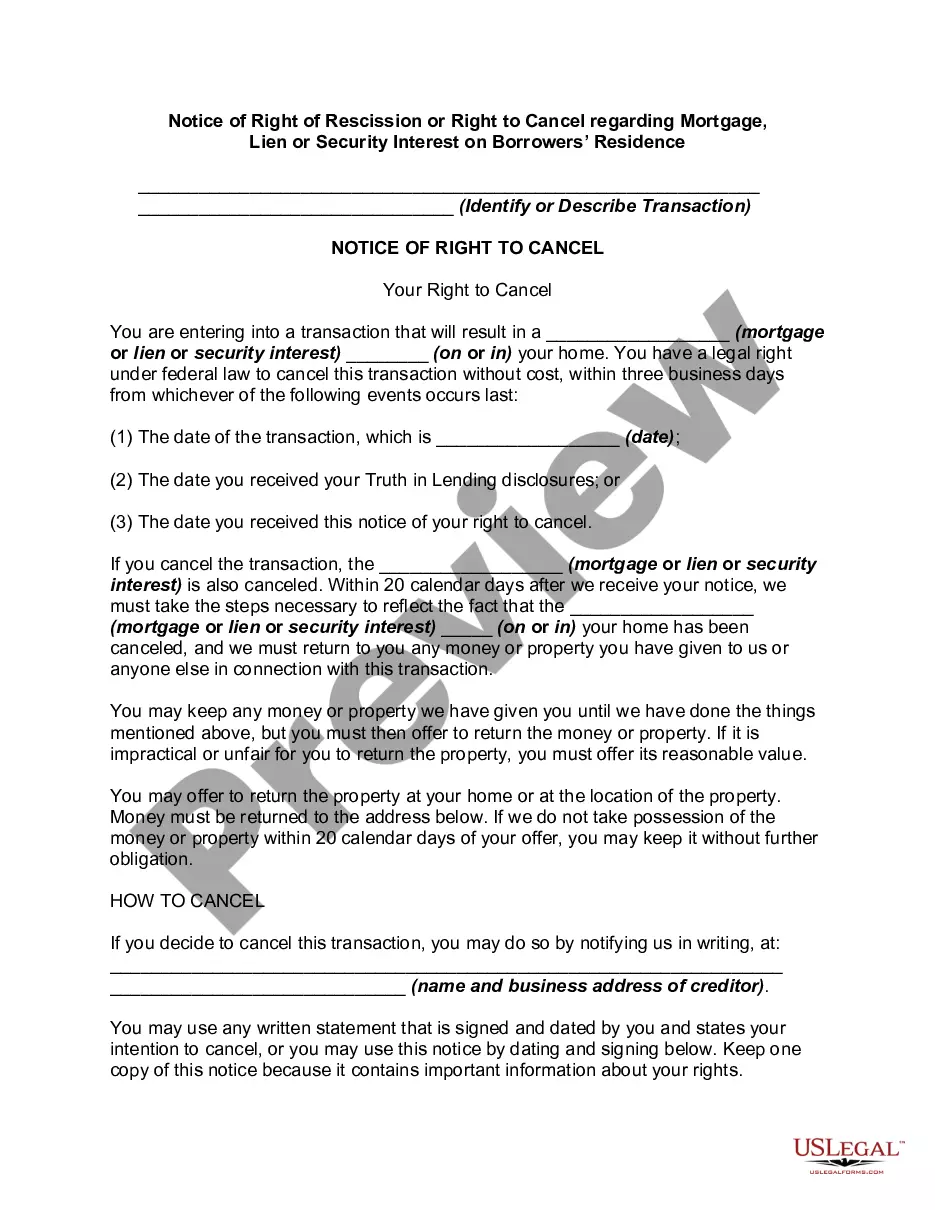

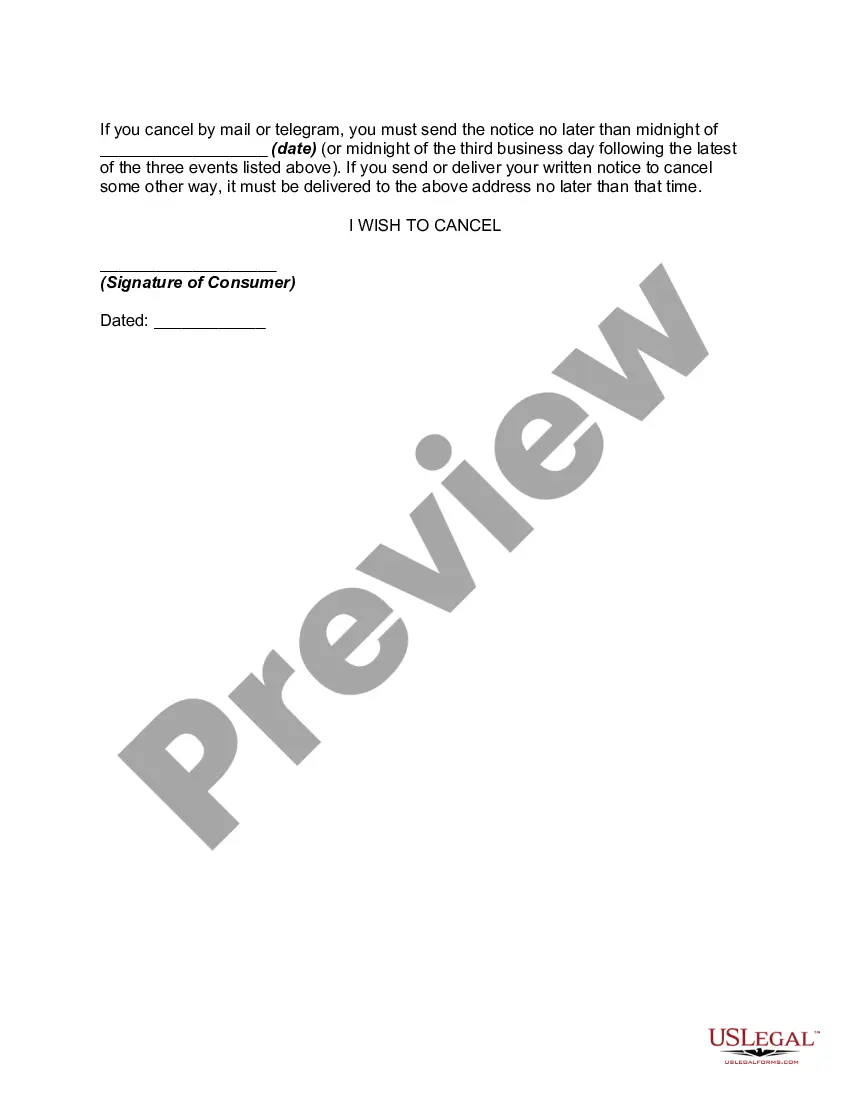

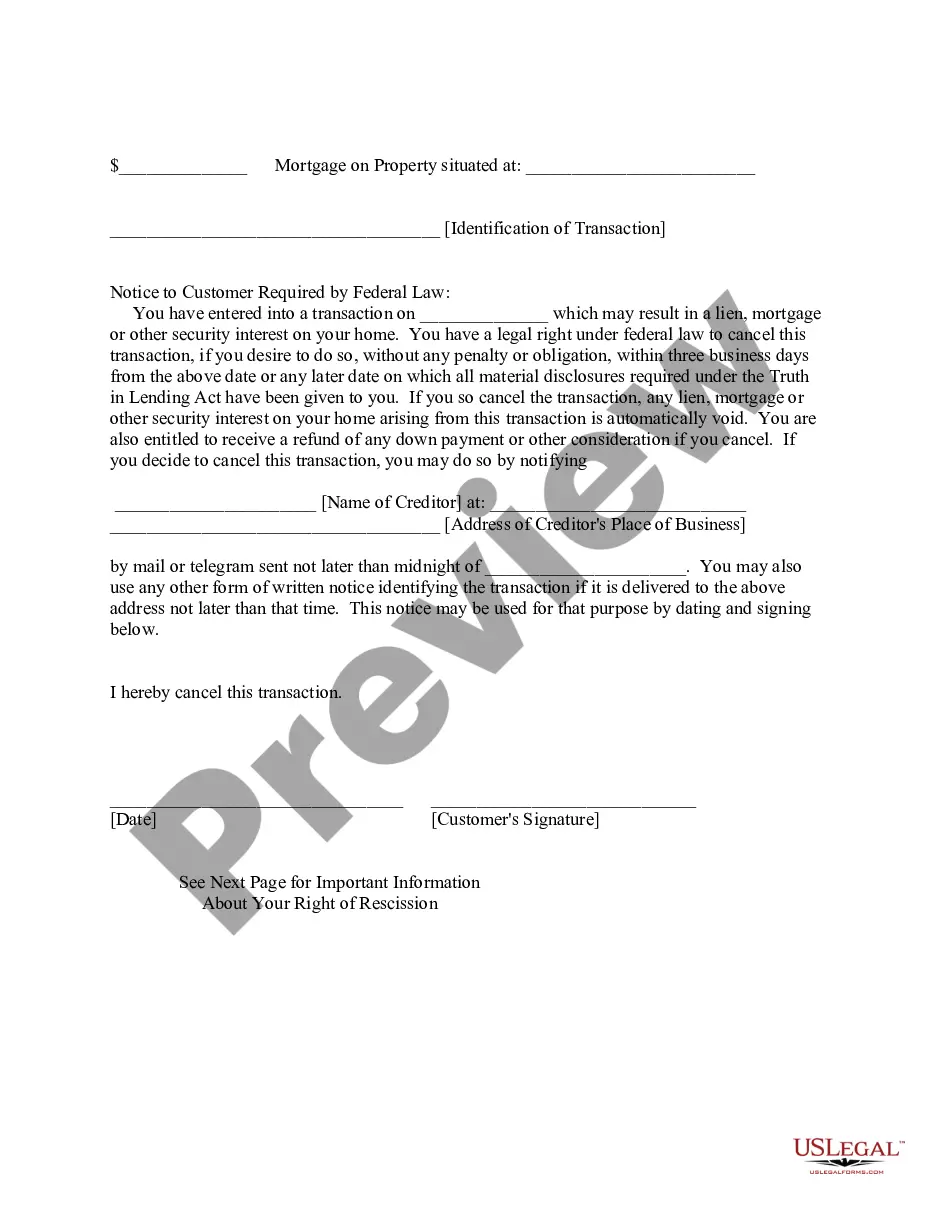

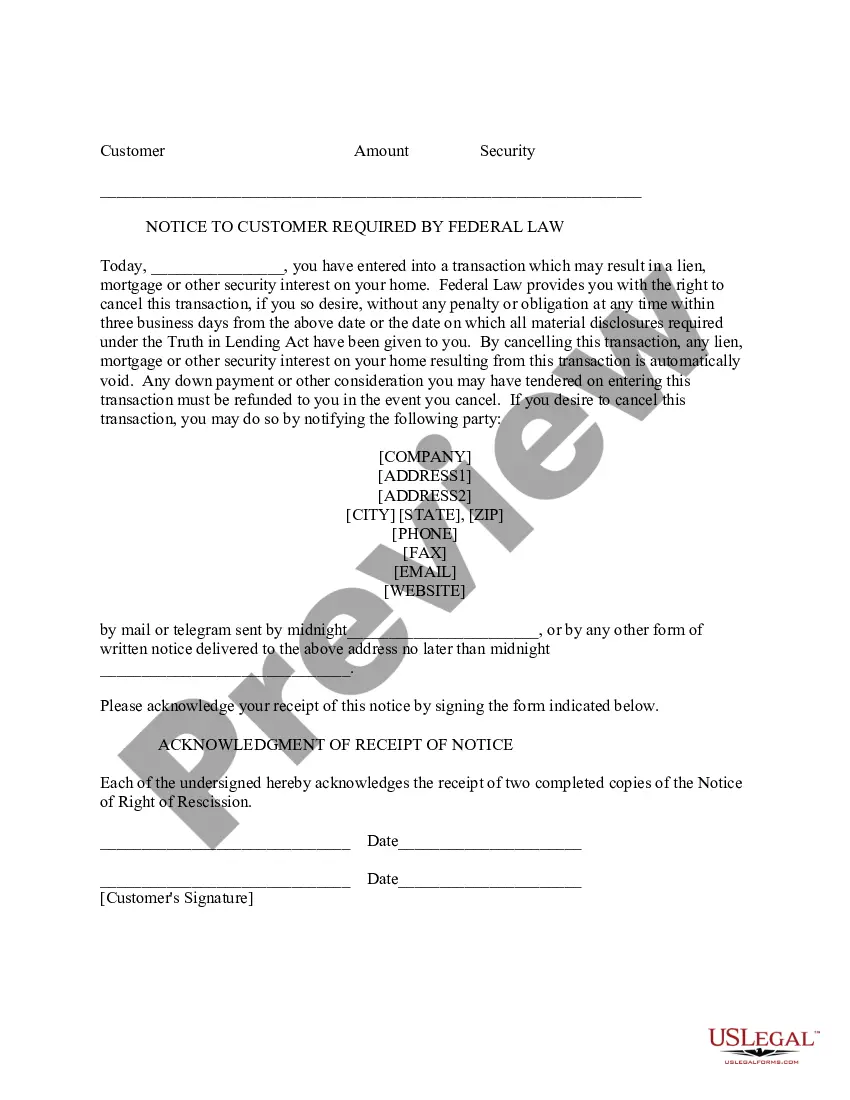

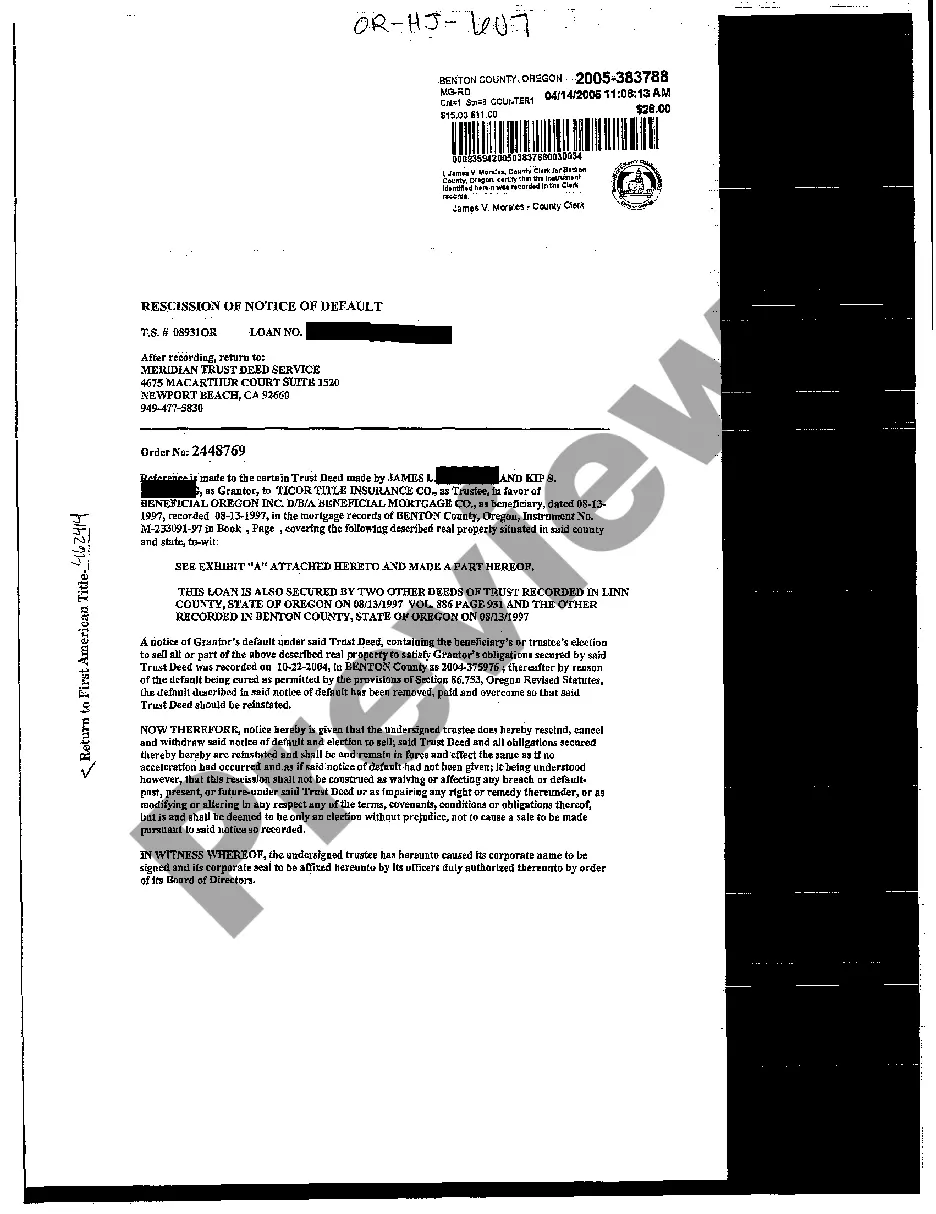

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice

required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

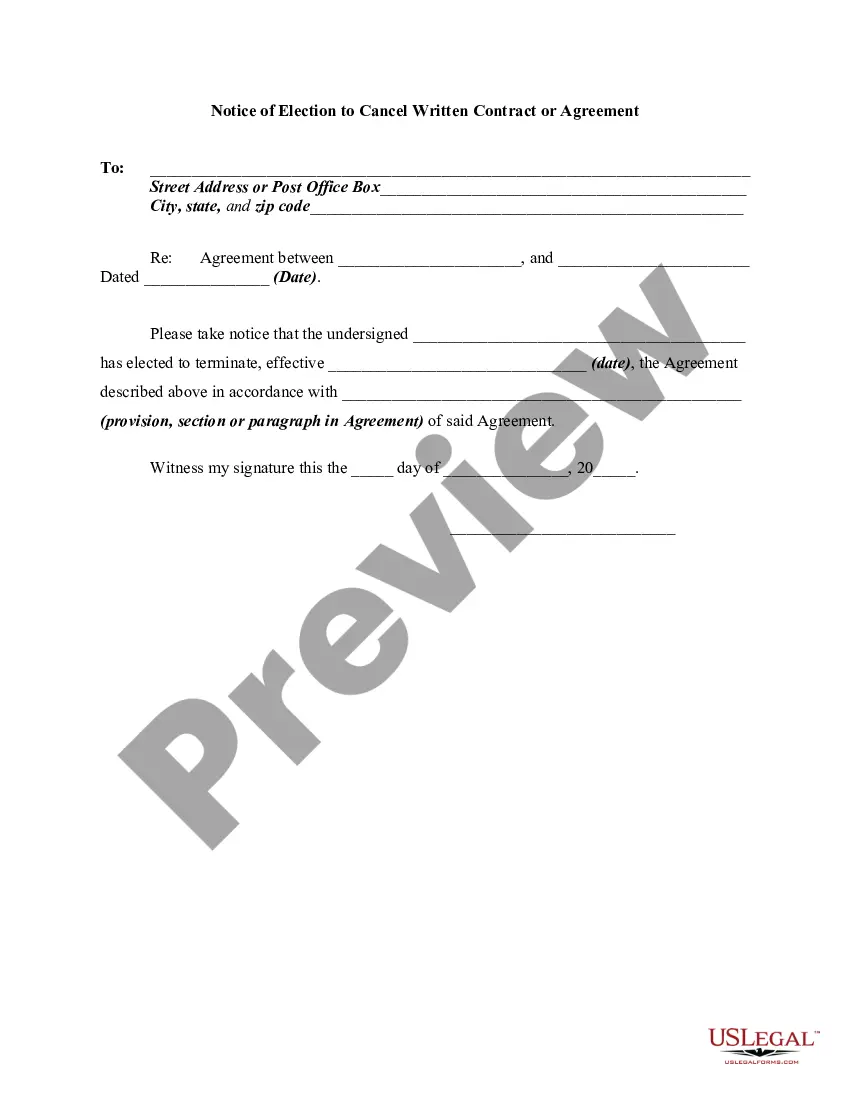

Wisconsin Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence

Description

How to fill out Notice Of Right Of Rescission Or Right To Cancel Regarding Mortgage, Lien Or Security Interest On Borrowers' Residence?

You can commit time online attempting to find the lawful papers web template which fits the federal and state specifications you will need. US Legal Forms provides a huge number of lawful forms that are examined by experts. It is simple to download or print out the Wisconsin Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence from our services.

If you have a US Legal Forms bank account, you can log in and then click the Download option. Following that, you can complete, change, print out, or signal the Wisconsin Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence. Every single lawful papers web template you purchase is your own permanently. To obtain one more backup for any obtained kind, proceed to the My Forms tab and then click the corresponding option.

If you use the US Legal Forms web site for the first time, keep to the simple recommendations under:

- Very first, make sure that you have selected the best papers web template for that area/area of your liking. Read the kind explanation to ensure you have selected the correct kind. If available, take advantage of the Review option to check through the papers web template as well.

- If you wish to find one more variation in the kind, take advantage of the Lookup field to find the web template that suits you and specifications.

- When you have identified the web template you desire, click on Acquire now to move forward.

- Find the costs plan you desire, type your credentials, and sign up for an account on US Legal Forms.

- Full the transaction. You can use your charge card or PayPal bank account to fund the lawful kind.

- Find the structure in the papers and download it for your device.

- Make changes for your papers if necessary. You can complete, change and signal and print out Wisconsin Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence.

Download and print out a huge number of papers web templates utilizing the US Legal Forms web site, which offers the biggest selection of lawful forms. Use skilled and condition-particular web templates to take on your company or specific requirements.

Form popularity

FAQ

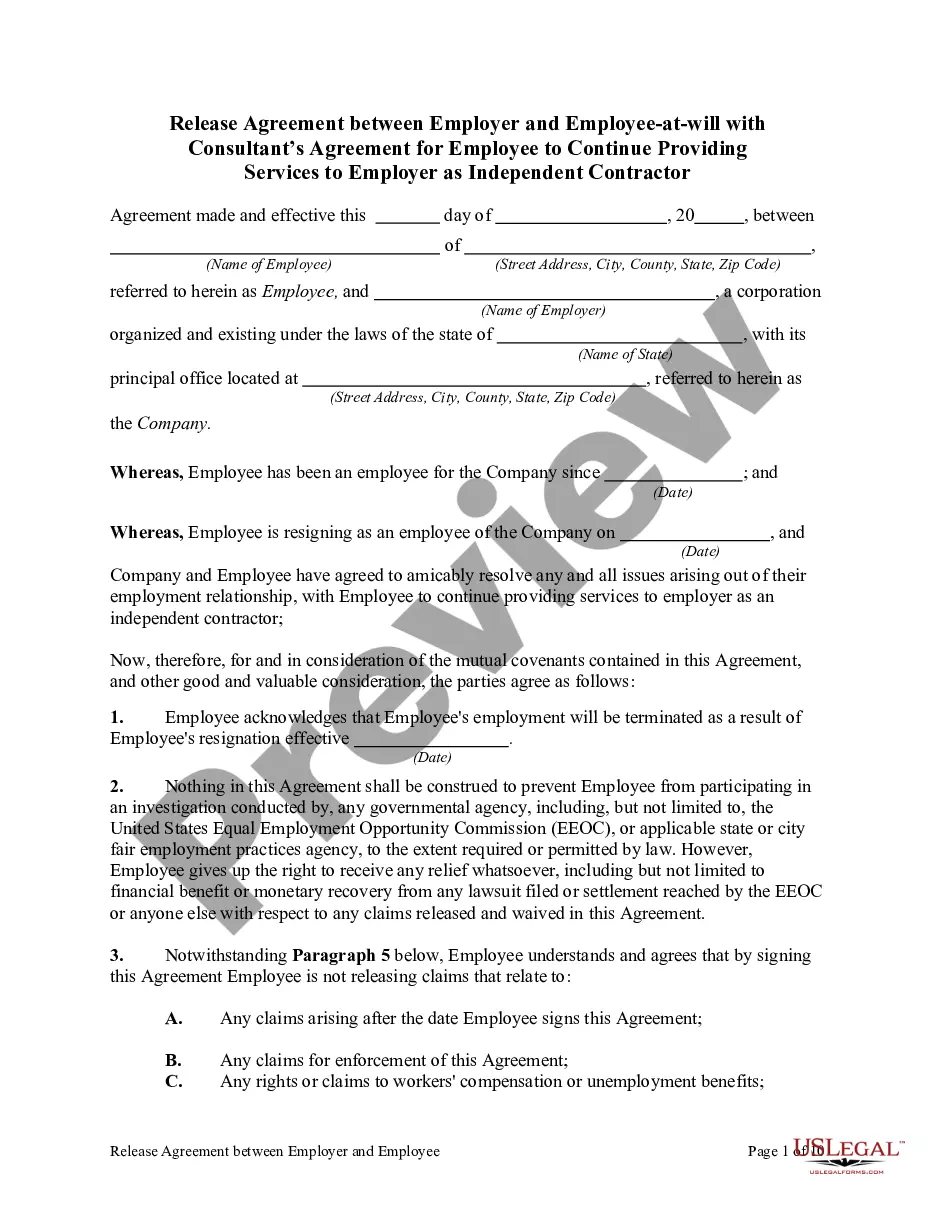

The right of rescission doesn't apply when you're buying a home, and it only applies to a loan against your primary residence. So, for instance, you won't be able to rescind your mortgage if you're buying or refinancing a second home, vacation home, or investment property.

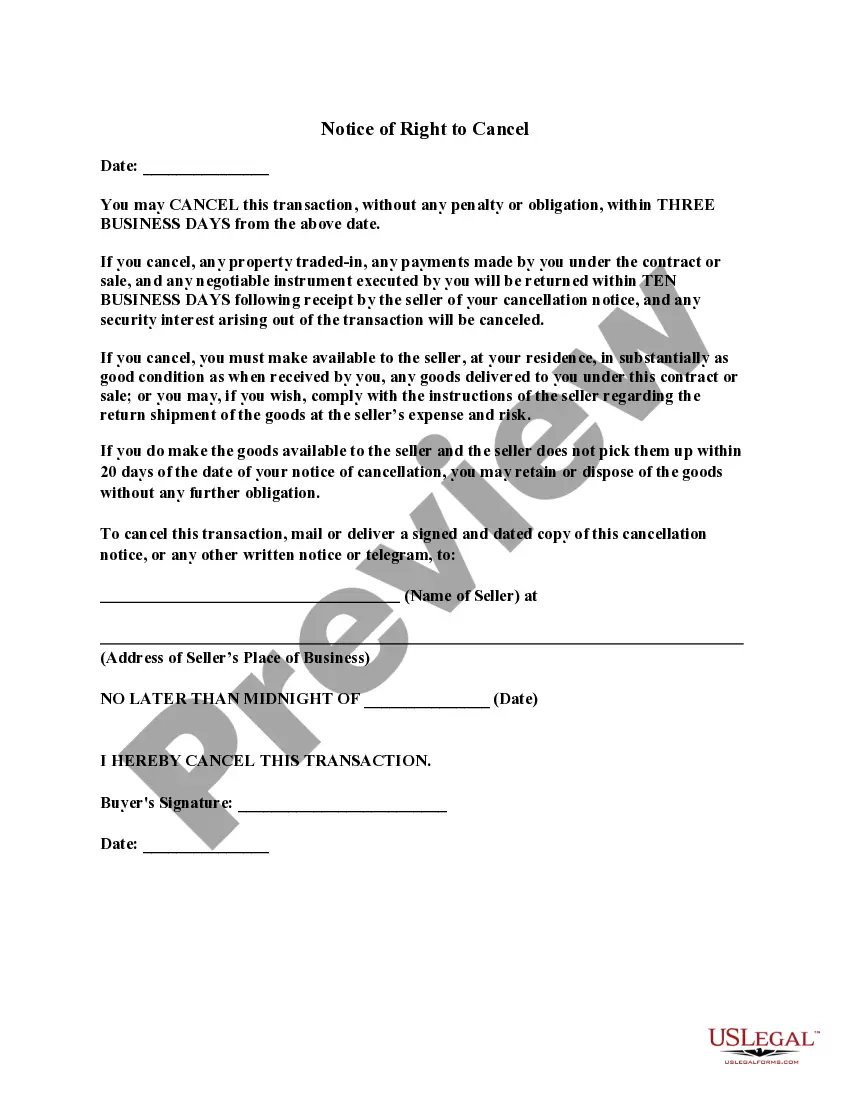

What is the purpose of a Notice of Right to Cancel form? Under federal law, some ? but not all ? mortgages include a right of rescission, which gives the borrower 3 business days following the signing of a loan document package to review the terms of the transaction and cancel the transaction.

If you are buying a home with a mortgage, you do not have a right to cancel the loan once the closing documents are signed. If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract.

If you're taking out a home equity loan, home equity line of credit (HELOC), or refinancing your home loan with a different lender, you have three days from when you sign the contract to rescind the deal. This is known as the right of rescission.

Each consumer entitled to rescind must be given two copies of the rescission notice and the material disclosures.

If you are buying a home with a mortgage, you do not have a right to cancel the loan once the closing documents are signed. If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract.

What Loans Have a Right of Rescission? The right of rescission applies only to certain types of home loans: home refinancing, home equity loans, home equity lines of credit (HELOCs) and some reverse mortgages. You can't, for instance, cancel a contract on a new home purchase.

In general, a lender cannot cancel a loan after closing unless there are specific circumstances outlined in the loan agreement or if fraud or misrepresentation is discovered. Once the loan has been closed and funded, the lender has typically committed the funds and established the mortgage lien on the property.