This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

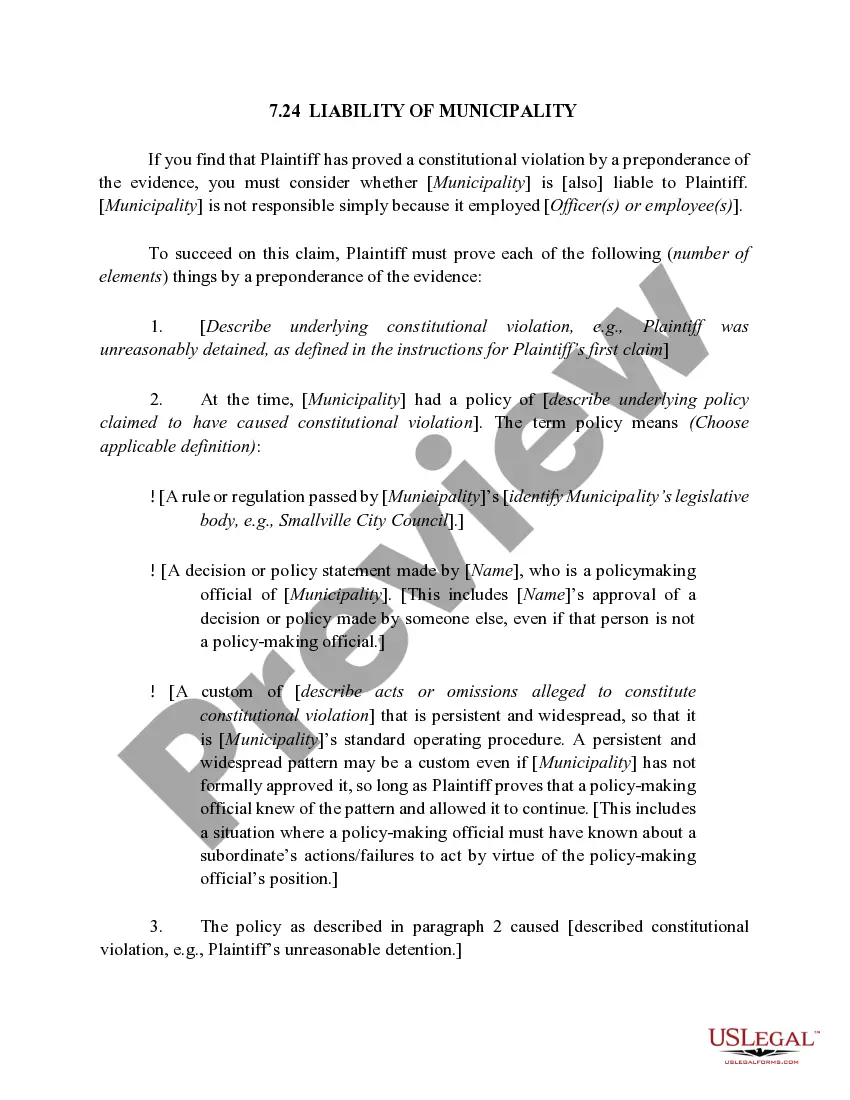

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

You can spend numerous hours online trying to locate the legal document format that meets the federal and state requirements you will require.

US Legal Forms offers a vast array of legal templates that are reviewed by experts.

You can download or print the Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities from our services.

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you may complete, modify, print, or sign the Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities.

- Every legal document template you receive is yours permanently.

- To obtain another copy of the purchased document, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your region/city of choice.

- Check the form summary to make sure you have chosen the right form.

Form popularity

FAQ

In general, one spouse is not automatically liable for the other spouse's debts. However, Wisconsin law allows for a spouse to declare a Notice of Non-Responsibility of Wife for Debts or Liabilities, which confirms that she is not responsible for her husband's debts incurred during the marriage. This important document protects your financial interests and clearly defines liability. To understand your rights fully and ensure proper legal protection, consider using US Legal Forms to guide you through this process.

In Wisconsin, separate bank accounts can be considered marital property under certain conditions. Generally, if one spouse acquires funds through efforts during the marriage, those funds may be classified as marital property, regardless of account separation. To protect against liabilities, such as debts incurred by one spouse, utilizing a Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities is beneficial. This notice can clarify the responsibility for any debts, demonstrating that your individual assets remain separate and safeguarded.

Malinda's law, enacted in Wisconsin, allows individuals to create a legal agreement that protects one spouse from the other's debts. This law is particularly significant for women who want to ensure they are not held responsible for their husband's financial obligations. Effectively using this law can be vital for maintaining financial independence and security. By filing a Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities, spouses can clearly delineate their financial responsibilities and protect their interests.

The dig law in Wisconsin, often referred to as the law concerning excavation, establishes the protocol for safely digging near underground utilities. This law aims to prevent accidents and property damage by requiring individuals and companies to notify utility providers before beginning any excavation work. Understanding these regulations is crucial for property owners and contractors alike. Ignoring this can lead to liabilities that may affect your standing under the Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities.

In Wisconsin, a husband or wife is not automatically responsible for the debts incurred by the other spouse before marriage. However, debts acquired during the marriage may be deemed community obligations. To delineate your personal liability, you can file the Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities. This measure safeguards your financial well-being.

The 'tattle tale law' in Wisconsin refers to how spouses must inform each other about certain debts and liabilities. While it does not impose financial responsibility on one spouse for the other's debts, this law emphasizes transparency in financial matters. Understanding this can help you effectively use the Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities to protect yourself from unwanted obligations.

No, you do not inherit your spouse's personal debts simply by marrying them in Wisconsin. The debts your spouse incurred before the marriage remain their responsibility. However, to ensure clarity around future obligations, you can utilize the Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities. This document allows you to maintain your financial separateness.

In Wisconsin, you generally are not responsible for your spouse's pre-existing debts. The state operates under a 'community property' system, meaning debts acquired during the marriage can affect both spouses. However, the Wisconsin Notice of Non-Responsibility of Wife for Debts or Liabilities can clearly indicate that you are not responsible for certain obligations. This notice helps protect your financial interests.