Wisconsin Assignment and Bill of Sale to Corporation

Description

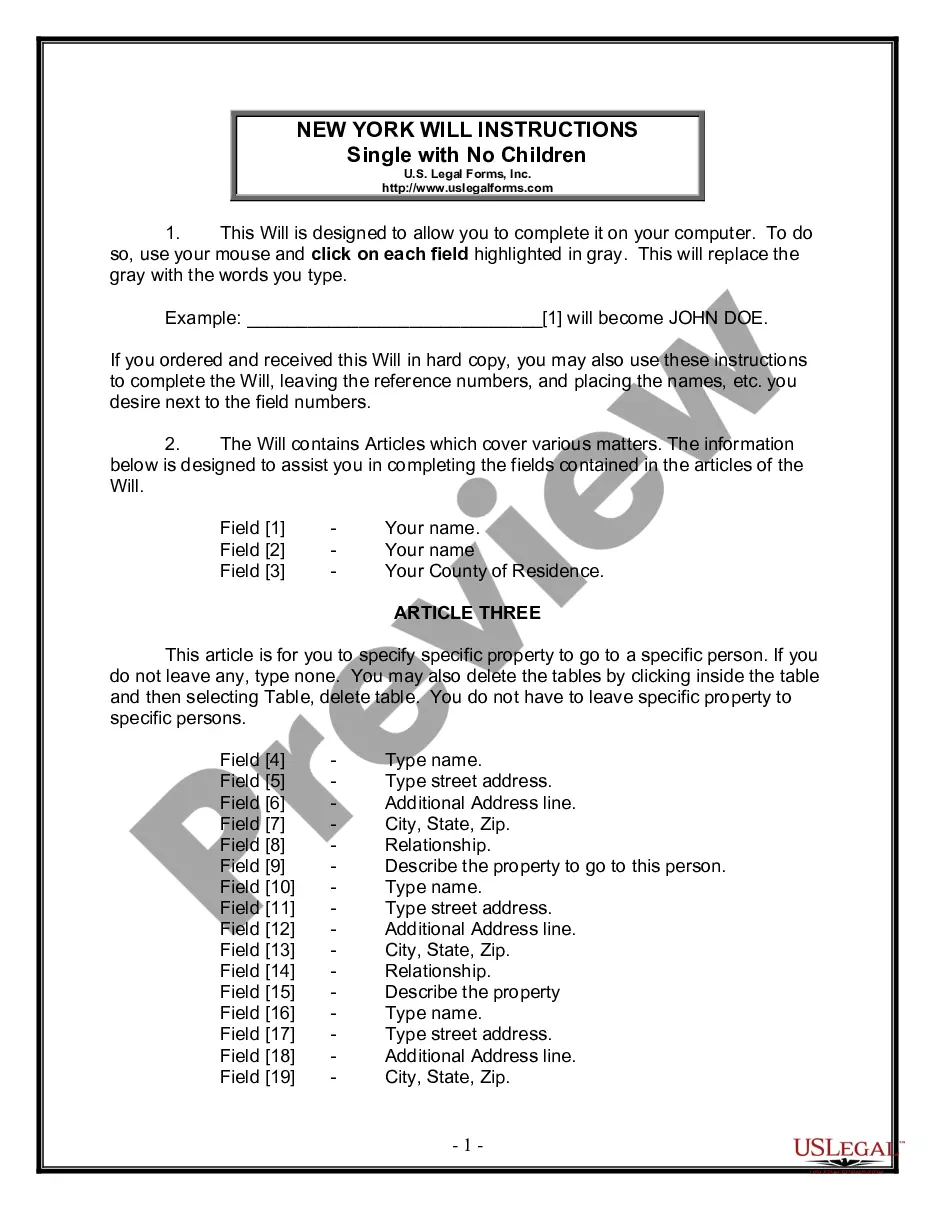

How to fill out Assignment And Bill Of Sale To Corporation?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a selection of legal documents that you can acquire or print.

By utilizing the website, you can discover numerous templates for business and personal needs, categorized by types, states, or keywords.

You can quickly find the latest versions of documents such as the Wisconsin Assignment and Bill of Sale to Corporation.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the document, confirm your selection by clicking the Buy Now button. Then select your preferred pricing plan and provide your details to register for an account.

- If you already have a monthly subscription, Log In and obtain the Wisconsin Assignment and Bill of Sale to Corporation from the US Legal Forms collection.

- The Download button will appear on each template you view.

- You will have access to all previously acquired templates in the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple steps to get you started.

- Ensure you've selected the correct form for your city/state.

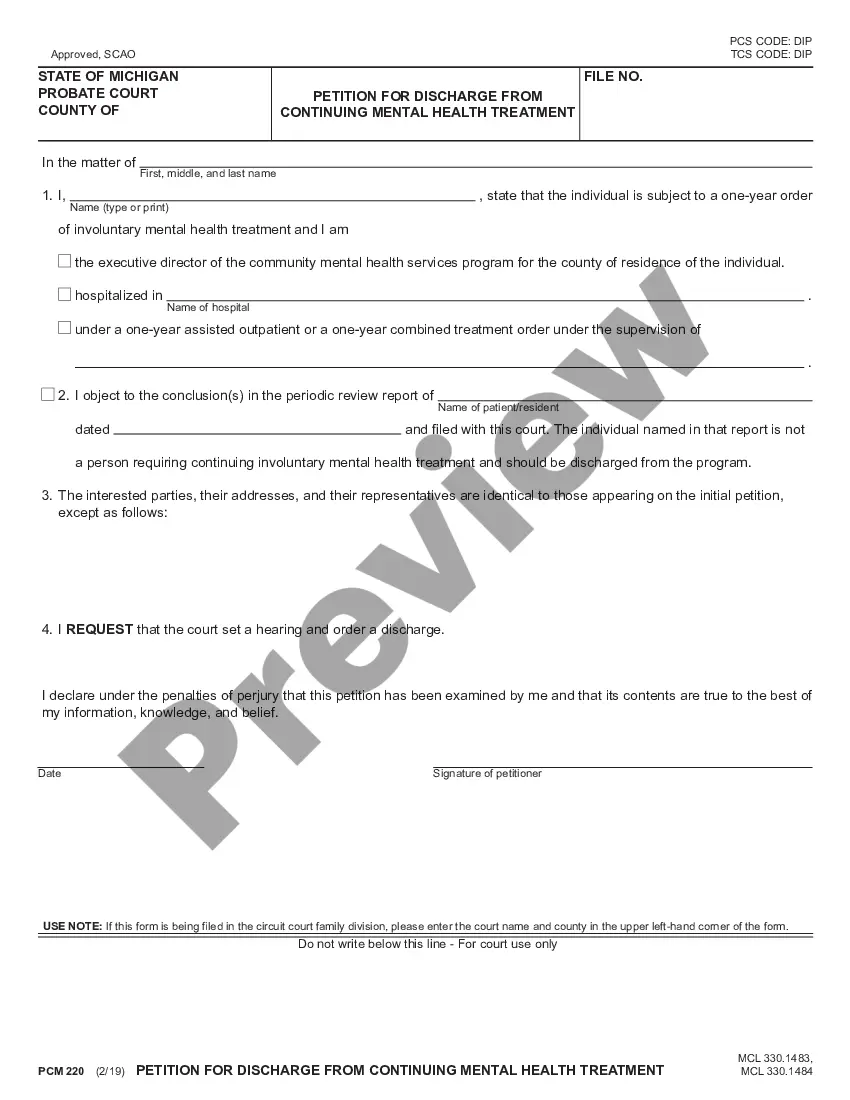

- Click the Preview button to review the content of the form.

Form popularity

FAQ

A Schedule SB is essentially a detailed report that corporations use to disclose taxable income and other relevant financial information. It's crucial for businesses to accurately complete this form as part of their compliance with state tax laws. If you engage in the Wisconsin Assignment and Bill of Sale to Corporation, being knowledgeable about Schedule SB supports better financial management.

Wisconsin Form 3 is used to report corporate income and is specifically designed for C corporations. This form plays a critical role in calculating corporate tax obligations effectively. If you're involved in transactions like a Wisconsin Assignment and Bill of Sale to Corporation, understanding Form 3 can aid in financial transparency.

Exemptions from Wisconsin withholding typically apply to certain types of income or entity classifications. For instance, non-resident members of pass-through entities may qualify for exemptions. In the context of a Wisconsin Assignment and Bill of Sale to Corporation, clarity on withholding requirements is essential for smooth transactions.

Wisconsin Form 5S is primarily used for the taxation of corporate income, particularly S corporations. It allows these entities to report their income efficiently. If your corporation deals with assets listed in a Wisconsin Assignment and Bill of Sale to Corporation, understanding Form 5S is key for accurate tax compliance.

Schedule SB in Wisconsin serves as an important reporting tool for corporations. It includes details about income earned within the state and applicable deductions. If you’re managing corporate assets through a Wisconsin Assignment and Bill of Sale to Corporation, having proper records on Schedule SB is crucial for your tax filings.

Yes, Wisconsin imposes a corporate franchise tax on businesses operating within the state. This tax applies to corporations, including those that might engage in transactions involving the Wisconsin Assignment and Bill of Sale to Corporation. Being aware of this tax ensures your business remains compliant and can help in effective planning for financial obligations.

Schedule SB in Wisconsin refers to a specific form related to corporate income tax. It is essential for businesses to report certain types of income and deductions. If you're dealing with corporate matters, the Wisconsin Assignment and Bill of Sale to Corporation may provide context for transferring ownership effectively. Understanding Schedule SB can help streamline your business reporting.

To fill out a bill of sale consideration, you need to specify the exact amount exchanged or define the consideration, which can include trade or services. Clearly state this section in the document to avoid any confusion. Including your consideration terms is essential, as it strengthens the validity of your Wisconsin Assignment and Bill of Sale to Corporation.

When filling out a bill of sale for a trade, list both items being exchanged with accurate descriptions. Include the names and addresses of the parties involved, along with the date of the transaction for record-keeping. It’s vital to also add the terms of the trade, as this helps formalize the agreement and can be tied back to the Wisconsin Assignment and Bill of Sale to Corporation.

The main difference between assignment and bill of sale lies in the nature of what is being transferred. An assignment typically focuses on transferring specific rights or interests, while a bill of sale involves the transfer of ownership of tangible assets. When dealing with a Wisconsin Assignment and Bill of Sale to Corporation, it is critical to know when to use each document for clarity and legal compliance.