This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

Are you currently inside a place in which you need to have paperwork for possibly company or specific purposes almost every working day? There are plenty of legitimate file templates available on the Internet, but locating versions you can trust is not effortless. US Legal Forms delivers 1000s of form templates, such as the Wisconsin Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage, which can be published to meet federal and state demands.

If you are currently familiar with US Legal Forms site and also have an account, simply log in. Next, you may download the Wisconsin Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage design.

If you do not come with an bank account and wish to start using US Legal Forms, abide by these steps:

- Get the form you require and ensure it is for the proper metropolis/area.

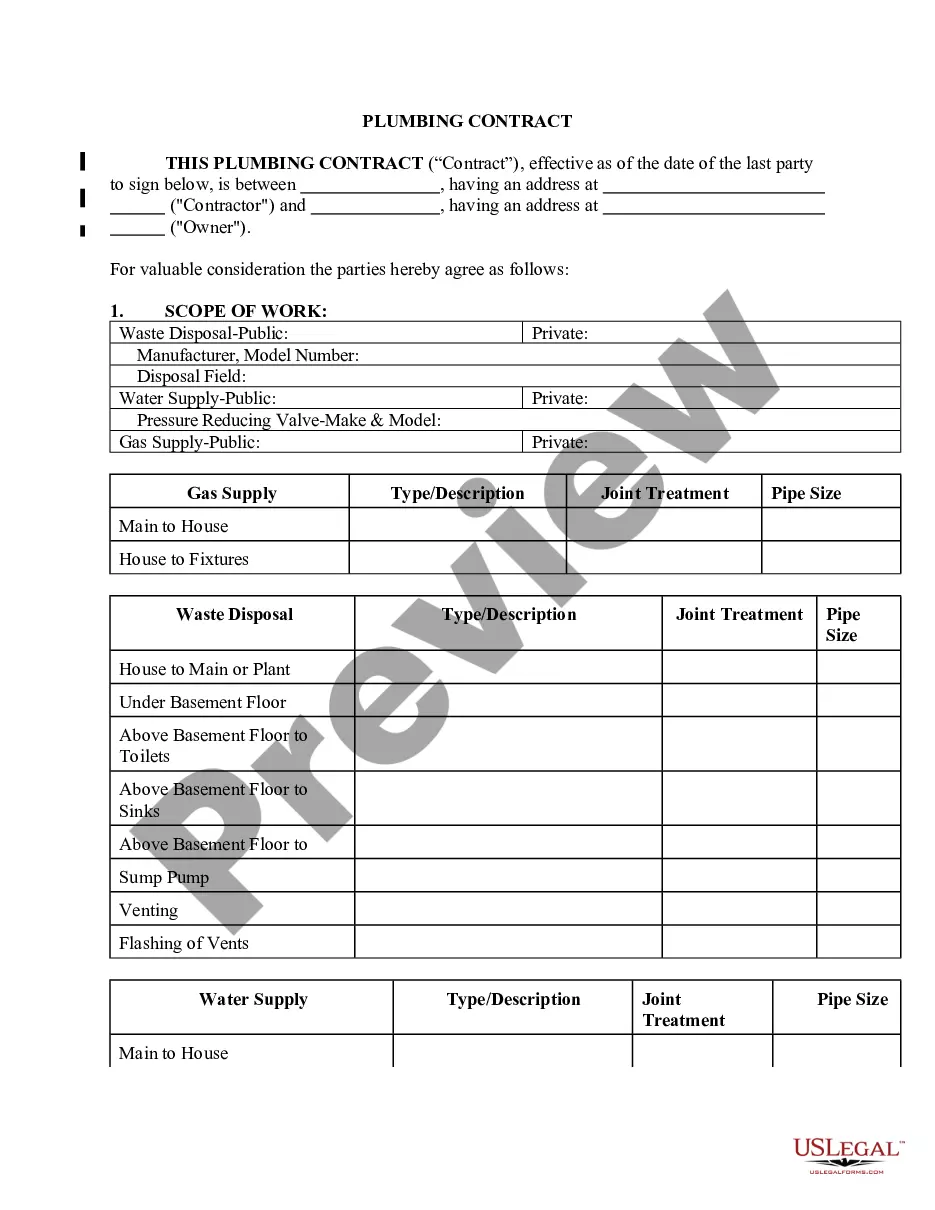

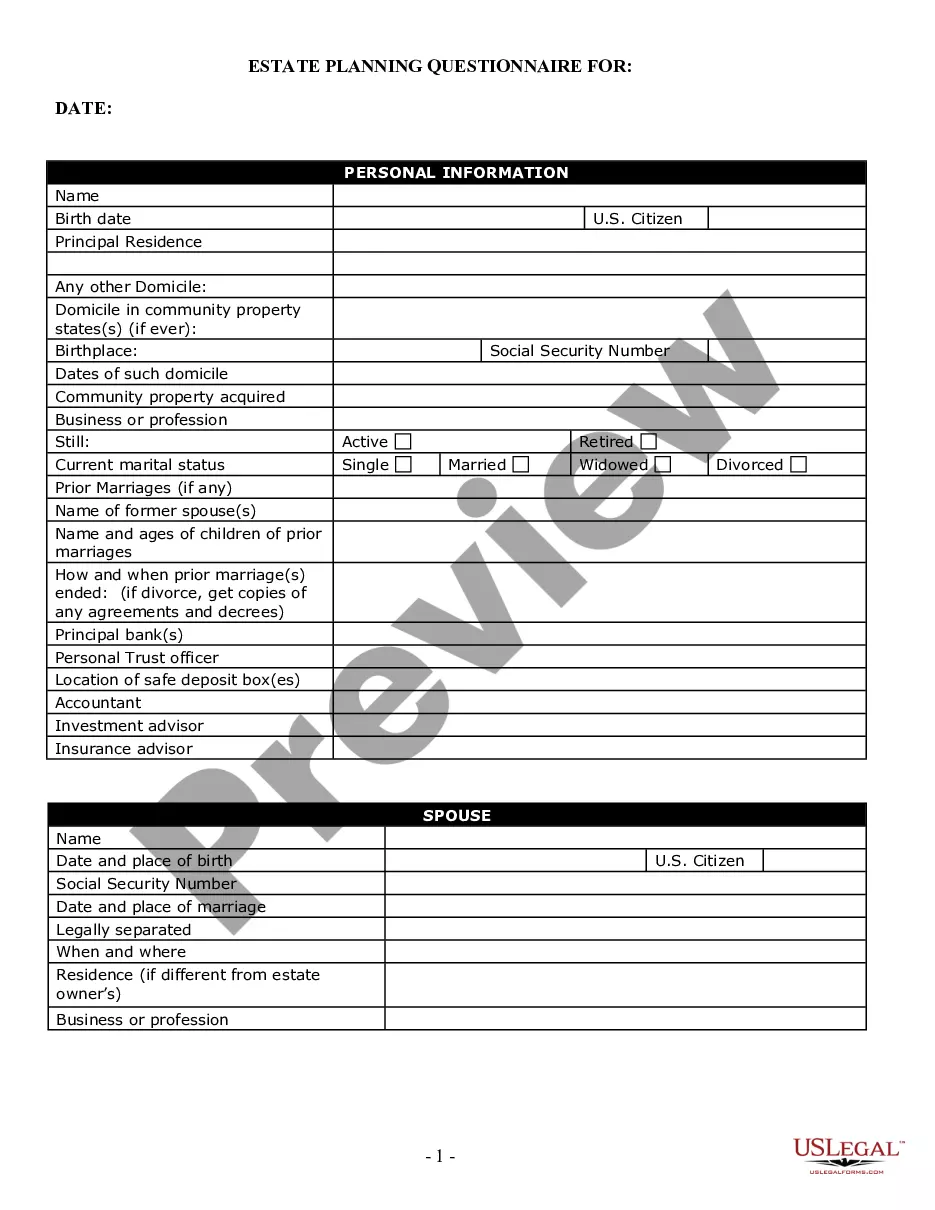

- Make use of the Review option to check the shape.

- Browse the information to actually have selected the correct form.

- In case the form is not what you`re trying to find, make use of the Look for industry to find the form that fits your needs and demands.

- If you obtain the proper form, just click Purchase now.

- Select the costs strategy you want, fill out the specified info to produce your bank account, and buy an order utilizing your PayPal or bank card.

- Select a handy data file structure and download your copy.

Get every one of the file templates you may have purchased in the My Forms food list. You can aquire a additional copy of Wisconsin Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage at any time, if possible. Just click the required form to download or print the file design.

Use US Legal Forms, one of the most considerable selection of legitimate kinds, to save lots of time and avoid errors. The service delivers skillfully created legitimate file templates which you can use for a variety of purposes. Create an account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

Ingly, a lender involved in a typical loan situation needs to understand that their mortgage lien will only remain effective in Wisconsin for 30 years unless an additional notice of such a mortgage lien is placed of record prior to the expiration of the initial 30-year effectiveness period.

Statute of limitations in Wisconsin The statute of limitations for open accounts like credit cards and written and oral contracts in Wisconsin is six years under Chapter 893.43. The 10-year statute of limitations applies to promissory notes.

The lender will specify in the complaint which redemption period will apply to your situation. The period is usually 6 months if the lender agrees to waive its right to a deficiency judgment, which is the right to sue you for the difference between the sale price of the house and the amount you owe on the loan.

PROPERTY DAMAGE OR DEATH Under Wisconsin law, the statute of limitations in an action to recover for property damage is generally six years after the cause of action accrues.

In Wisconsin, the 6-year SOL on contracts (and thereby, notes) accrues on the date of breach ? here, the date of the missed payment. The more important SOL for note investors is this one ? Wisconsin's 30-year limitation on mortgage foreclosures.