Wisconsin Community Property Agreement

Description

How to fill out Community Property Agreement?

If you wish to completely acquire or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternative forms in the legal document format.

Step 4. Once you have found the form you require, click the Get Now button. Choose your preferred payment plan and provide your details to sign up for an account.

- Utilize US Legal Forms to find the Wisconsin Community Property Agreement with just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to retrieve the Wisconsin Community Property Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

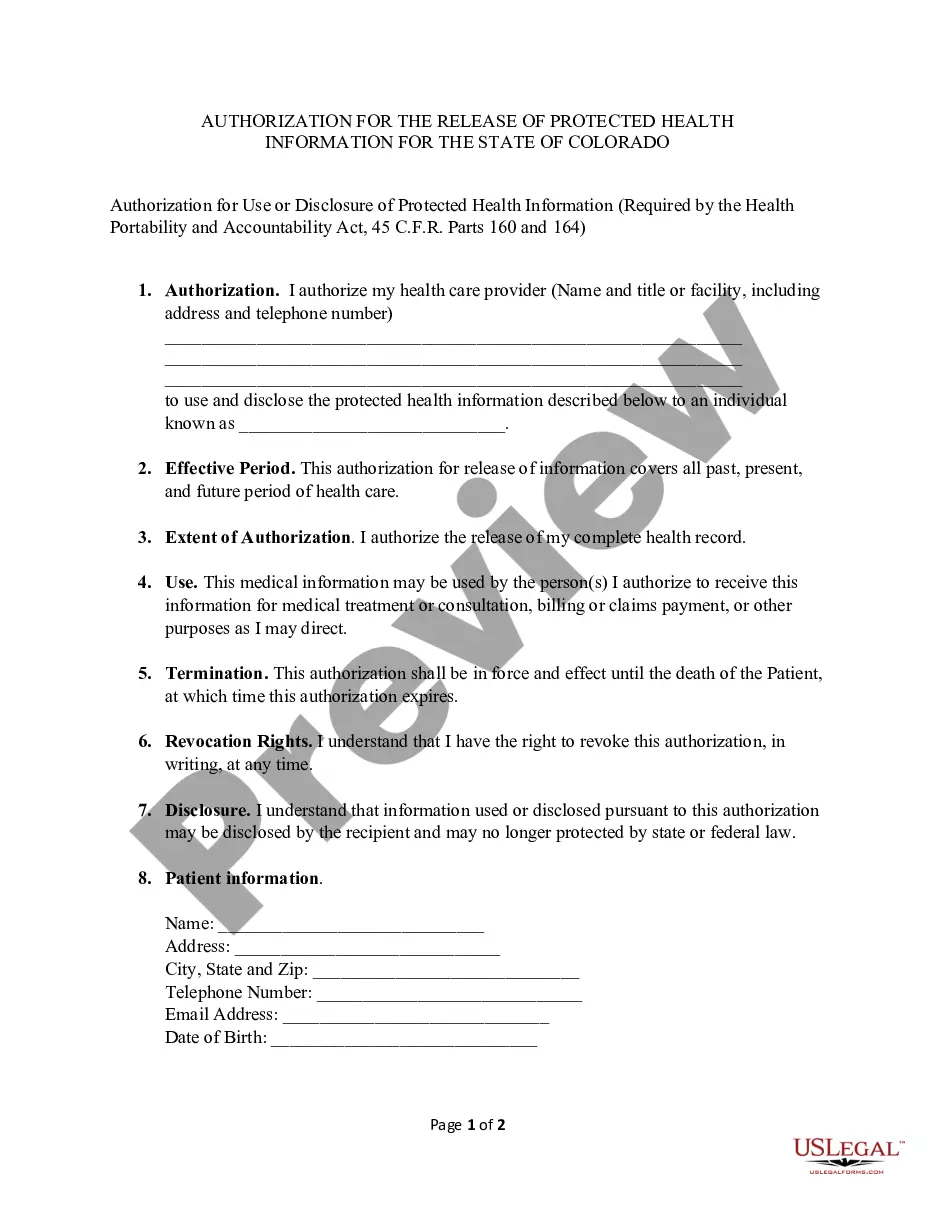

- Step 2. Use the Preview option to review the form’s content. Make sure to read the description.

Form popularity

FAQ

In Wisconsin, there is no specific duration of marriage required to claim half of the marital property. Each spouse is entitled to an equal share of the assets acquired during the marriage, regardless of the length of the union. However, establishing a Wisconsin Community Property Agreement can help both parties manage their finances more transparently. This proactive approach can guide couples in asset division, even in short marriages.

In Wisconsin, all property acquired during the marriage is generally classified as marital property. This includes income, real estate, and other assets, regardless of who's name is on the title. A Wisconsin Community Property Agreement allows couples to outline their division of assets, providing clarity and reducing potential disputes. It’s a beneficial tool for anyone looking to establish clear financial boundaries.

If you purchased your house before marriage in Wisconsin, it is typically considered non-marital property. However, if you have made significant improvements or invested marital funds into the home, that could complicate the situation. A Wisconsin Community Property Agreement can help clarify ownership and protect your interests. Consulting legal resources can further ensure your rights are maintained.

In Wisconsin, certain assets are not classified as marital property. For instance, property acquired by gift or inheritance remains separate, as does property owned before marriage. Additionally, pre-marital assets that have not been commingled may also remain separate. Understanding these distinctions is essential for those considering a Wisconsin Community Property Agreement.

Failing to fill out Form 8958 can lead to issues with your tax return, particularly in a community property state like Wisconsin. This form is essential for reporting income and adjustments for married couples filing separately. Not completing it may result in discrepancies in your finances and conflict with the principles of the Wisconsin Community Property Agreement.

When entering community property adjustments in TurboTax, you should input your total income along with the designated half for each spouse. Follow the prompts to indicate that you are in a community property state like Wisconsin. This ensures TurboTax accurately reflects your financial situation in light of the Wisconsin Community Property Agreement.

To fill out community property income adjustments, begin by identifying the total income earned during the marriage. Then, allocate half of that income to each spouse on your tax filings. Utilizing resources from platforms like US Legal Forms can simplify the completion of these adjustments, ensuring you comply with the guidelines of the Wisconsin Community Property Agreement.

In Wisconsin, you do not need to be married for a specific duration to claim half of the community property. As soon as you are legally married, any property acquired during the marriage generally qualifies as community property. This principle is a core aspect of the Wisconsin Community Property Agreement, ensuring fair division between spouses.

In Wisconsin, the ownership of property for married couples is primarily determined by the Wisconsin Community Property Agreement. Generally, property acquired during the marriage is deemed community property, while property acquired before marriage or through inheritance remains separate. It’s important to be clear about these distinctions to ensure a smooth resolution in property matters.

Community property income includes wages earned by either spouse during the marriage, business profits, and rental income generated from jointly owned properties. For instance, if one spouse receives a salary, half of that salary is considered community property in Wisconsin. Understanding these examples is crucial for managing your Wisconsin Community Property Agreement effectively.