Wisconsin Simple Promissory Note for Vehicle Purchase

Description

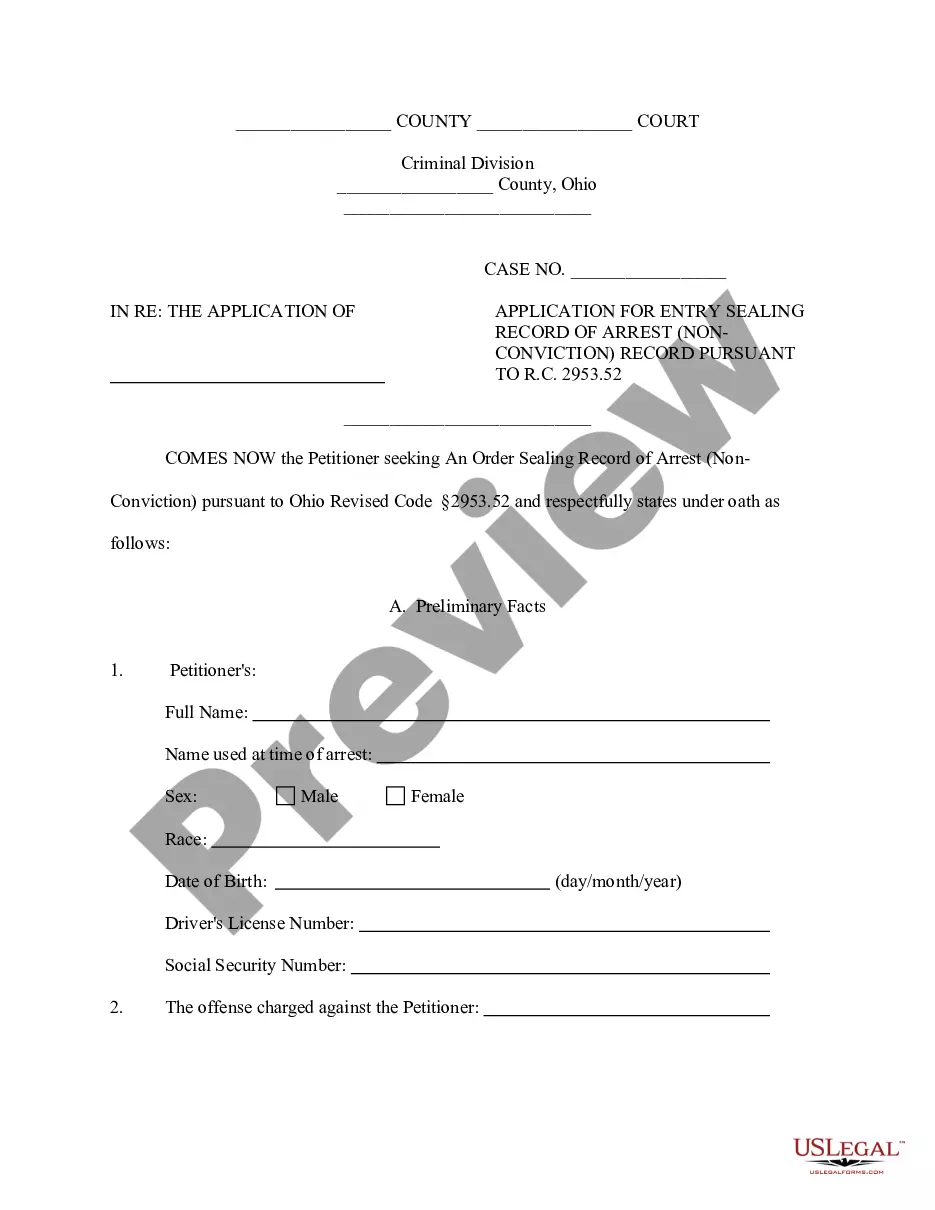

How to fill out Simple Promissory Note For Vehicle Purchase?

If you want to be thorough, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal templates available online.

Take advantage of the site's simple and efficient search to locate the documents you require.

Various templates for business and personal use are categorized by type and jurisdiction, or by keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose your pricing plan and provide your details to create an account.

Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the process.

- Use US Legal Forms to access the Wisconsin Simple Promissory Note for Vehicle Purchase with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to obtain the Wisconsin Simple Promissory Note for Vehicle Purchase.

- You can also retrieve forms you previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have selected the form for your correct area.

- Step 2. Utilize the Preview option to browse the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal template.

Form popularity

FAQ

Filling out a promissory note requires attention to detail to ensure accuracy. Start by writing the names of the parties and the date, followed by the principal amount borrowed. Clearly outline the repayment terms, including installments and due dates. If you use a template, like those found on US Legal Forms, the process becomes much simpler.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

You can create a Promissory Note as a lender or borrower by following these steps:Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

A promissory note can be used for different types of loans such as a mortgage, student loan, car loan, business loan or personal loan.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.