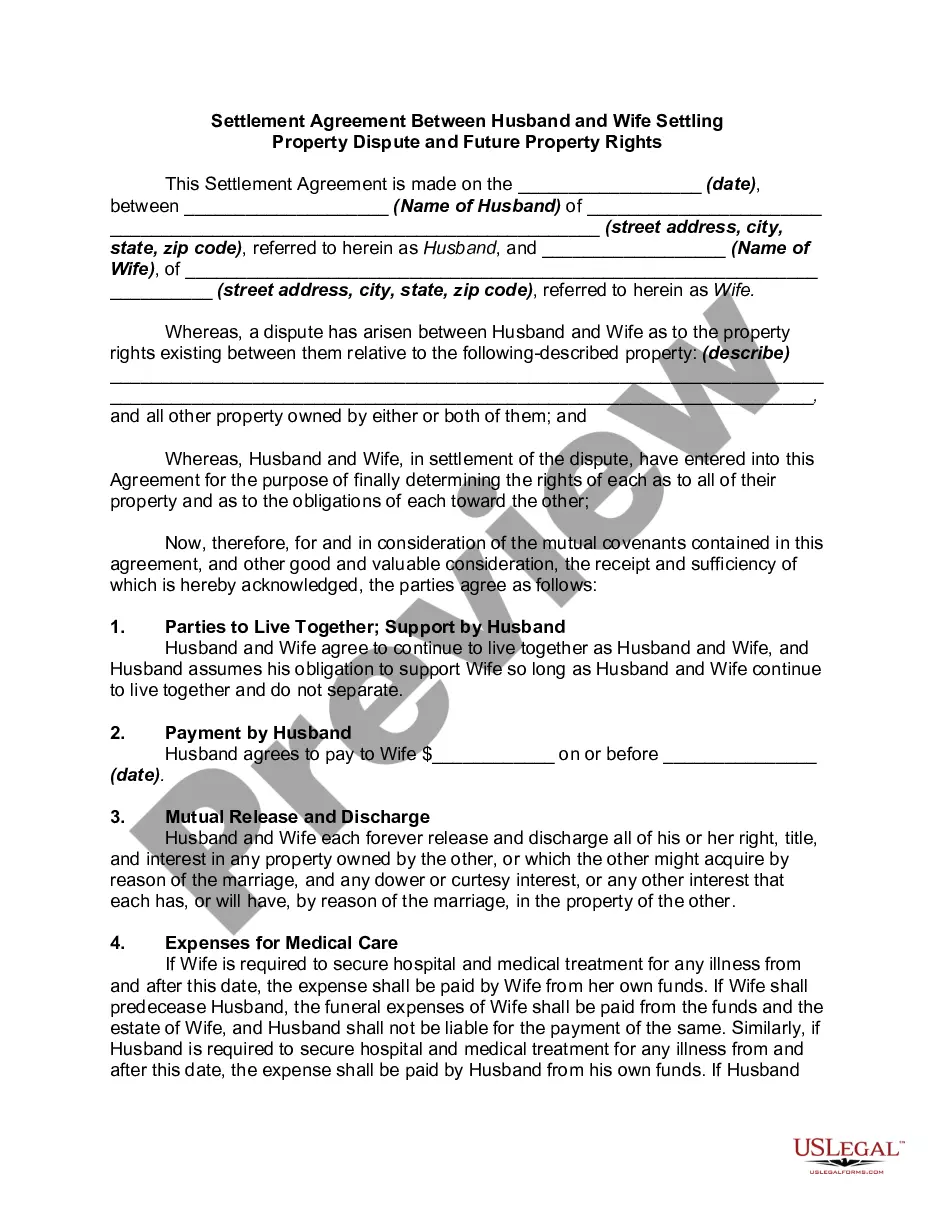

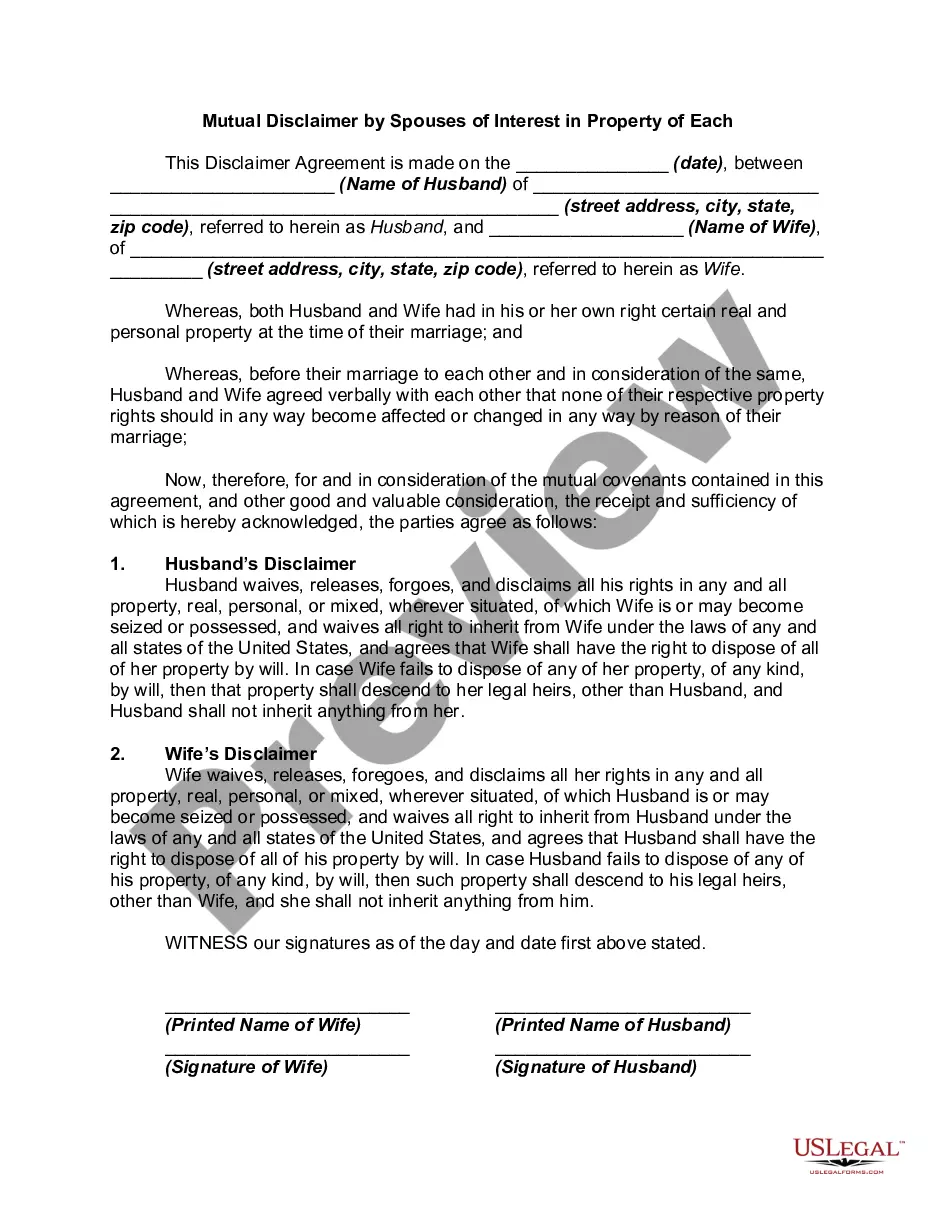

This form is a post-nuptial agreement between husband and wife. A post-nuptial agreement is a written contract executed after a couple gets married, to settle the couple's affairs and assets in the event of a separation or divorce. Like the contents of a prenuptial agreement, it can vary widely, but commonly includes provisions for division of property and spousal support in the event of divorce, death of one of the spouses, or breakup of marriage.

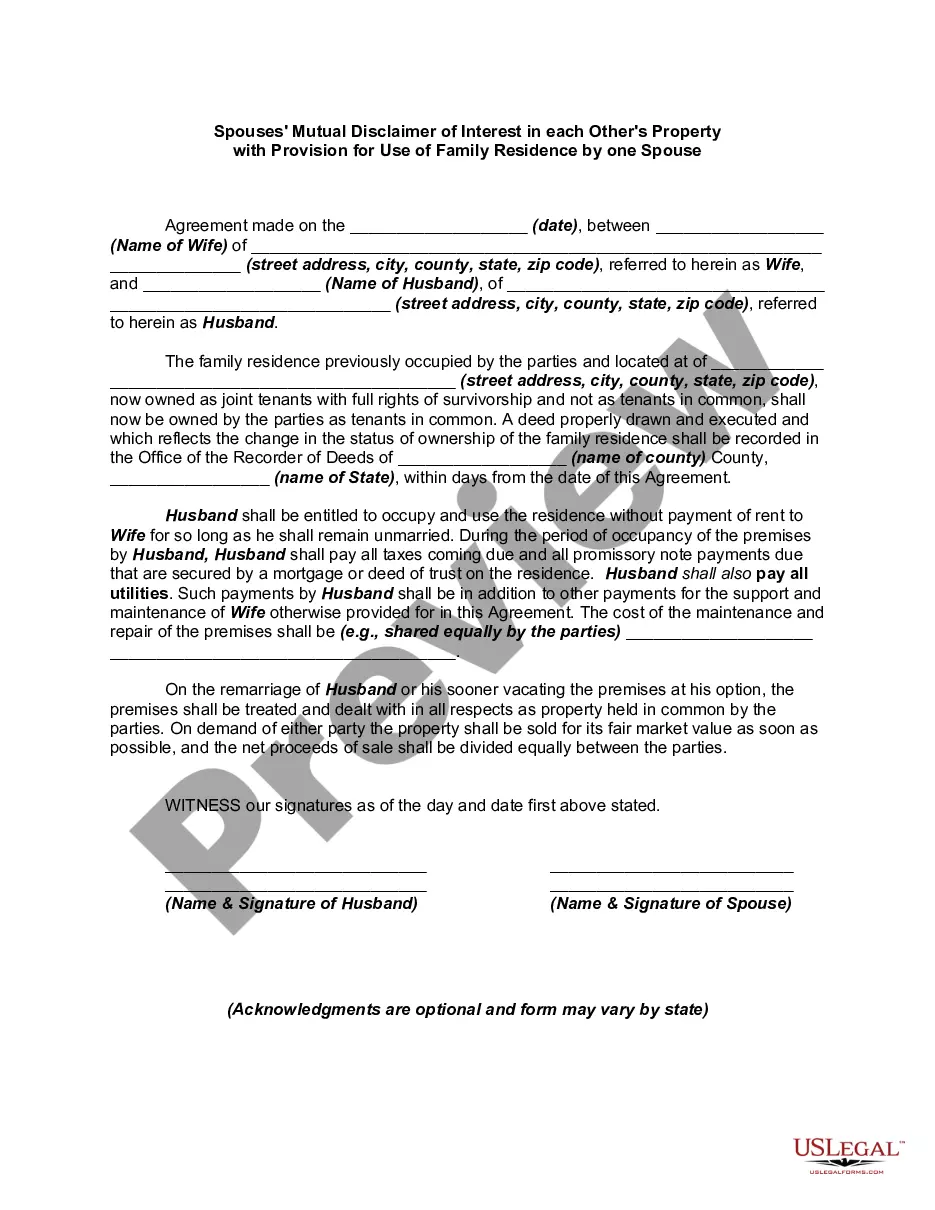

Wisconsin Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse

Description

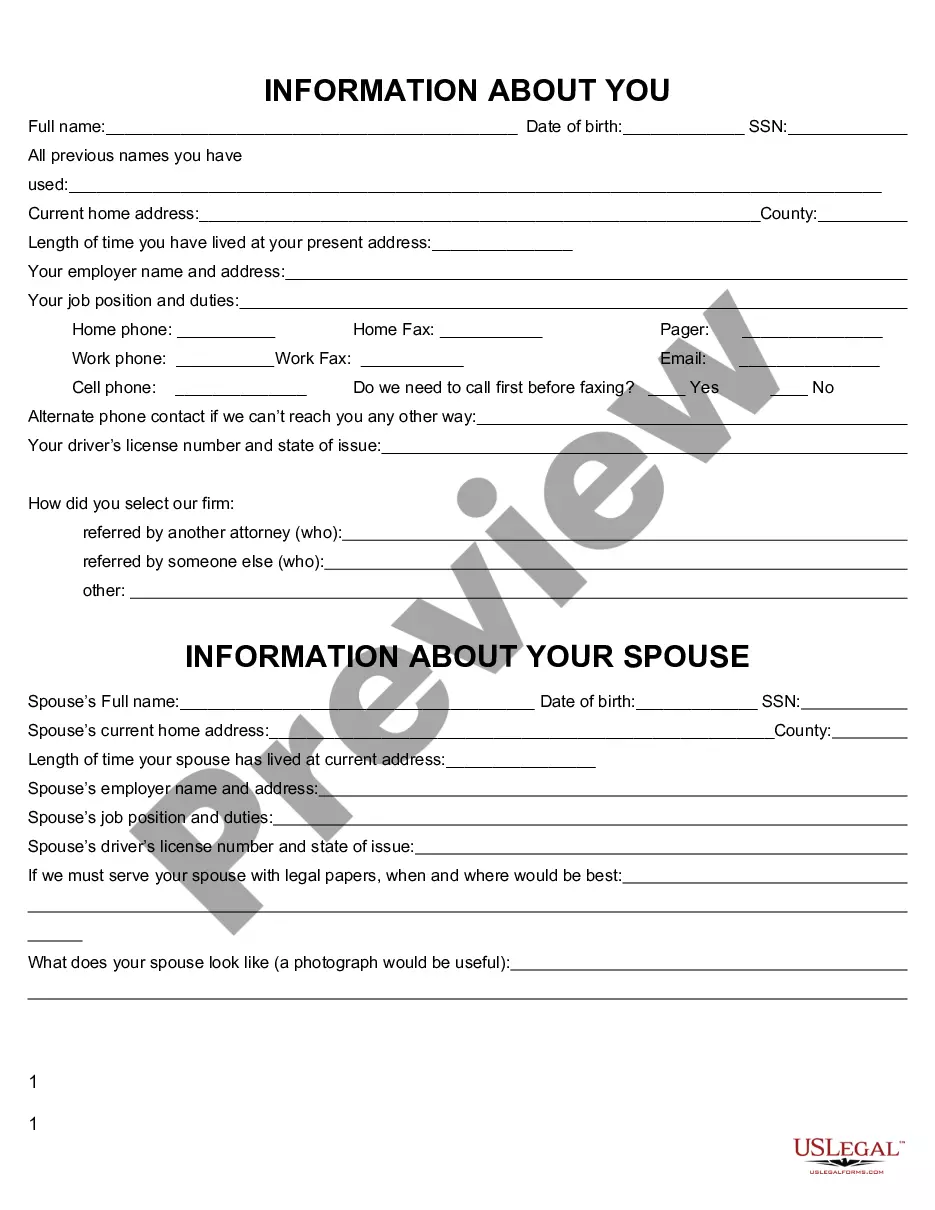

How to fill out Spouses' Mutual Disclaimer Of Interest In Each Other's Property With Provision For Use Of Family Residence By One Spouse?

Locating the appropriate authentic document template can be quite challenging.

Clearly, there is an abundance of templates accessible online, but how can you find the valid one that you need.

Utilize the US Legal Forms website. This service offers numerous templates, such as the Wisconsin Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by one Spouse, which can be utilized for both business and personal purposes.

If you are a new user of US Legal Forms, here are simple instructions to follow: First, verify that you have selected the correct form for your region/state. You can review the form using the Preview button and check the form outline to ensure it meets your needs.

- All forms are evaluated by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Wisconsin Spouses' Mutual Disclaimer of Interest in Each Other's Property with Provision for Use of Family Residence by one Spouse.

- Use your account to access the legal forms you have previously acquired.

- Visit the My documents tab of your account to retrieve another copy of the document you need.

Form popularity

FAQ

The common law Rule against Perpetuities is English in origin and was first promulgated centuries ago. The modern version of the Rule has been altered in California by statute. California has enacted the Uniform Statutory Rule Against Perpetuities, which supersedes the old common law rule.

And under Wisconsin marital property law, each spouse has a one-half interest in each marital asset, no matter whose name is on the title. Individual property (sometimes referred to as "separate" property) consists of assets a spouse owned before the marriage.

Marital property includes all income and possessions a couple acquires after their "determination date" (with certain exceptions). The determination date is the latest of: the couple's marriage day; the date when they both took up residence in Wisconsin; or Jan. 1, 1986.

These states are Alaska (repealed the rule for vesting of property interests), Delaware (repealed entirely for personal property interest held in trust; 110 year rule for real property held directly in trust), Idaho, Kentucky (repealing the rule interests in real or personal property), New Jersey, Pennsylvania, Rhode

Yes. If only one spouse is on title and the document to be signed is a purchase money mortgage even if the property is homestead, only the spouse on title is required to sign.

How Long Do You Have To Be Married In Wisconsin To Get Half Of Everything? There is no time requirement in Wisconsin for a marriage to qualify for community property division in the event of divorce. As such, any marriage can qualify for a 50/50 division of marital property in the event of divorce.

Wisconsin is one of the states labeled as a community property state. (The others are Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, and Washington.) In community property states, everything a married couple owns together is subject to a 50/50 split upon divorce.

Wisconsin also has a baseline requirement that marital property be divided equally between both spouses, meaning a 50/50 split, although this can sometimes be adjusted based on factors including the length of the marriage, each spouse's contributions to the marriage, and each spouse's earning capacity and financial

These trusts (sometimes called "Dynasty Trusts") will not be effective in states that still follow the old English law rule. Wisconsin is one of only a few states that does not recognize the rule against perpetuities in its common law form.

History: 1983 a. 186; 1985 a. 37. Chapter 766, the Marital Property Act, does not supplant divorce property division provisions.