A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Disclaimer by Beneficiary of all Rights in Trust

Description

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

You can spend hours online attempting to locate the approved document template that meets the state and federal regulations you need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can actually obtain or print the Wisconsin Disclaimer by Beneficiary of all Rights in Trust through my services.

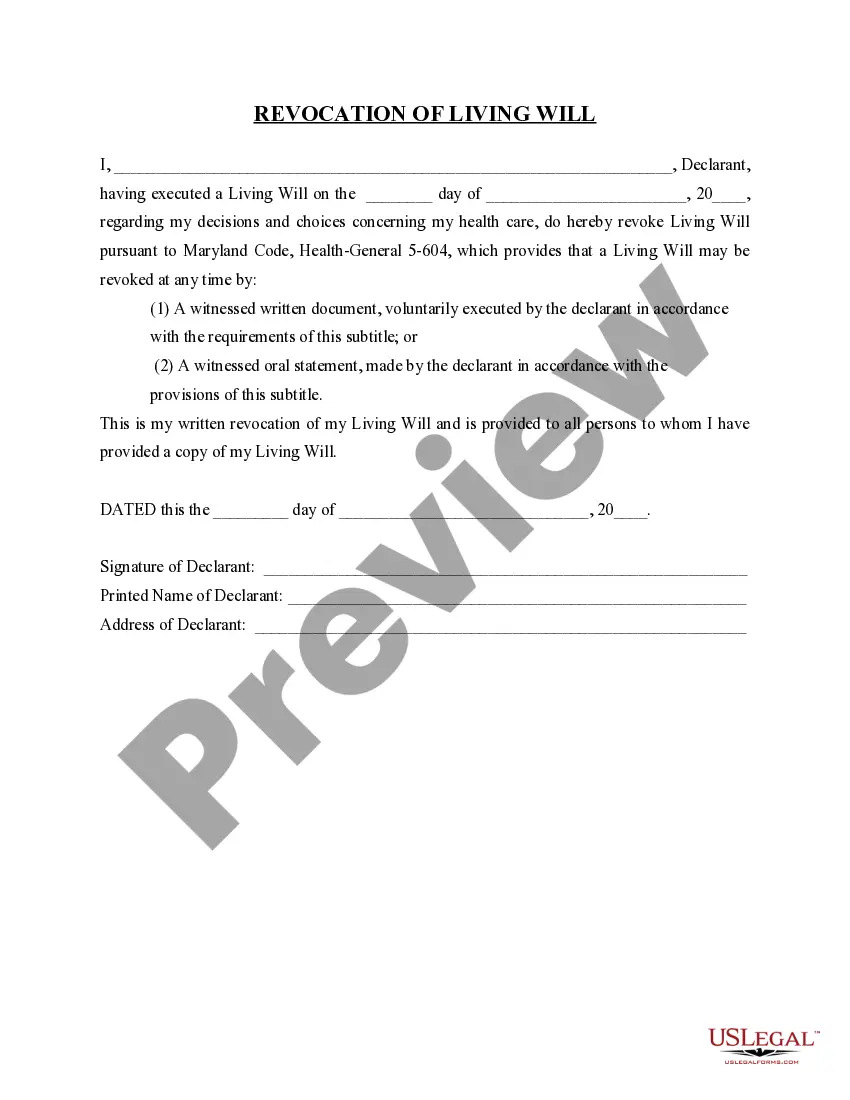

If available, use the Preview button to preview the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, modify, print, or sign the Wisconsin Disclaimer by Beneficiary of all Rights in Trust.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/region of your choice.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

In most cases, Wisconsin law stipulates that a beneficiary must disclaim an inheritance within nine months of the person's death or the trust's funding. This period is important to ensure the disclaimer is valid and that proper legal procedures are followed. Acting promptly and using tools like the Wisconsin Disclaimer by Beneficiary of all Rights in Trust can help streamline the process without delays.

A beneficiary statement is written by explicitly stating that you are a beneficiary and detailing the assets or benefits you may receive. It should include your personal information, the trust's details, and your declaration to either accept or decline those benefits. The Wisconsin Disclaimer by Beneficiary of all Rights in Trust can help refine this statement, making sure it meets legal requirements.

Writing a disclaimer example involves clearly stating your intent to refuse the inheritance or benefit, identifying the assets being disclaimed, and including necessary legal language. It is important to provide specific details about the trust in question and to comply with Wisconsin laws. Utilizing the Wisconsin Disclaimer by Beneficiary of all Rights in Trust template offered by U.S. Legal Forms can guide you through this process effectively.

A disclaimer trust is created when a beneficiary declines their portion of an estate, which then passes to a trust for the benefit of themselves or their heirs. For instance, if a parent leaves an inheritance, the child may refuse it and allow the assets to pass into a trust. The Wisconsin Disclaimer by Beneficiary of all Rights in Trust can facilitate this process, ensuring that the trust operates as intended while benefiting from the original assets.

A beneficiary disclaimer is a legal document that allows a person to refuse or give up their right to receive benefits from a trust, estate, or inheritance. In Wisconsin, this process can be crucial in managing trust assets and can impact tax liabilities. By using the Wisconsin Disclaimer by Beneficiary of all Rights in Trust, individuals can strategically decline their interest for various personal or financial reasons.

The power dynamics between a trustee and a beneficiary can vary depending on the specific trust terms and situation. Typically, the trustee holds significant authority in managing the trust, while beneficiaries are entitled to enforce their interests. However, leveraging a Wisconsin Disclaimer by Beneficiary of all Rights in Trust can empower beneficiaries to assert their rights more effectively.

Yes, in Wisconsin, beneficiaries generally have the right to request and receive a copy of the trust document. This access allows beneficiaries to understand their rights and interests more clearly. By utilizing a Wisconsin Disclaimer by Beneficiary of all Rights in Trust, beneficiaries can further delineate their roles and responsibilities within the trust.

A disclaimer by a beneficiary of a trust is a formal refusal to accept their interest in the trust assets. This legal action can have significant tax and estate implications, potentially redirecting the assets to other beneficiaries. If you're contemplating this step, a Wisconsin Disclaimer by Beneficiary of all Rights in Trust may be the strategic move to ensure your wishes are honored.

Section 701.1001 in Wisconsin outlines the rules regarding disclaimers by beneficiaries of trusts. This law allows beneficiaries to refuse their interest in trust assets, effectively passing on the interest to other successors. Understanding this section can empower beneficiaries when considering a Wisconsin Disclaimer by Beneficiary of all Rights in Trust to clarify their intentions.

In cases of breach of trust, a beneficiary has the right to seek remedies that may include compensation for damages and a change of trustee. They can also request a full accounting of trust transactions. Utilizing a Wisconsin Disclaimer by Beneficiary of all Rights in Trust gives beneficiaries more control over the trust's direction and protects their legal rights.