Wisconsin Assignment or Sale of Interest in Limited Liability Company (LLC)

Description

How to fill out Assignment Or Sale Of Interest In Limited Liability Company (LLC)?

Have you been in the placement where you need to have papers for sometimes organization or personal uses just about every day time? There are a lot of legitimate file layouts available online, but getting versions you can rely on is not simple. US Legal Forms delivers a huge number of develop layouts, like the Wisconsin Assignment or Sale of Interest in Limited Liability Company (LLC), which can be created to fulfill federal and state specifications.

In case you are currently informed about US Legal Forms site and also have a free account, simply log in. Afterward, you are able to acquire the Wisconsin Assignment or Sale of Interest in Limited Liability Company (LLC) web template.

Unless you have an account and want to begin to use US Legal Forms, abide by these steps:

- Get the develop you require and ensure it is for that appropriate metropolis/county.

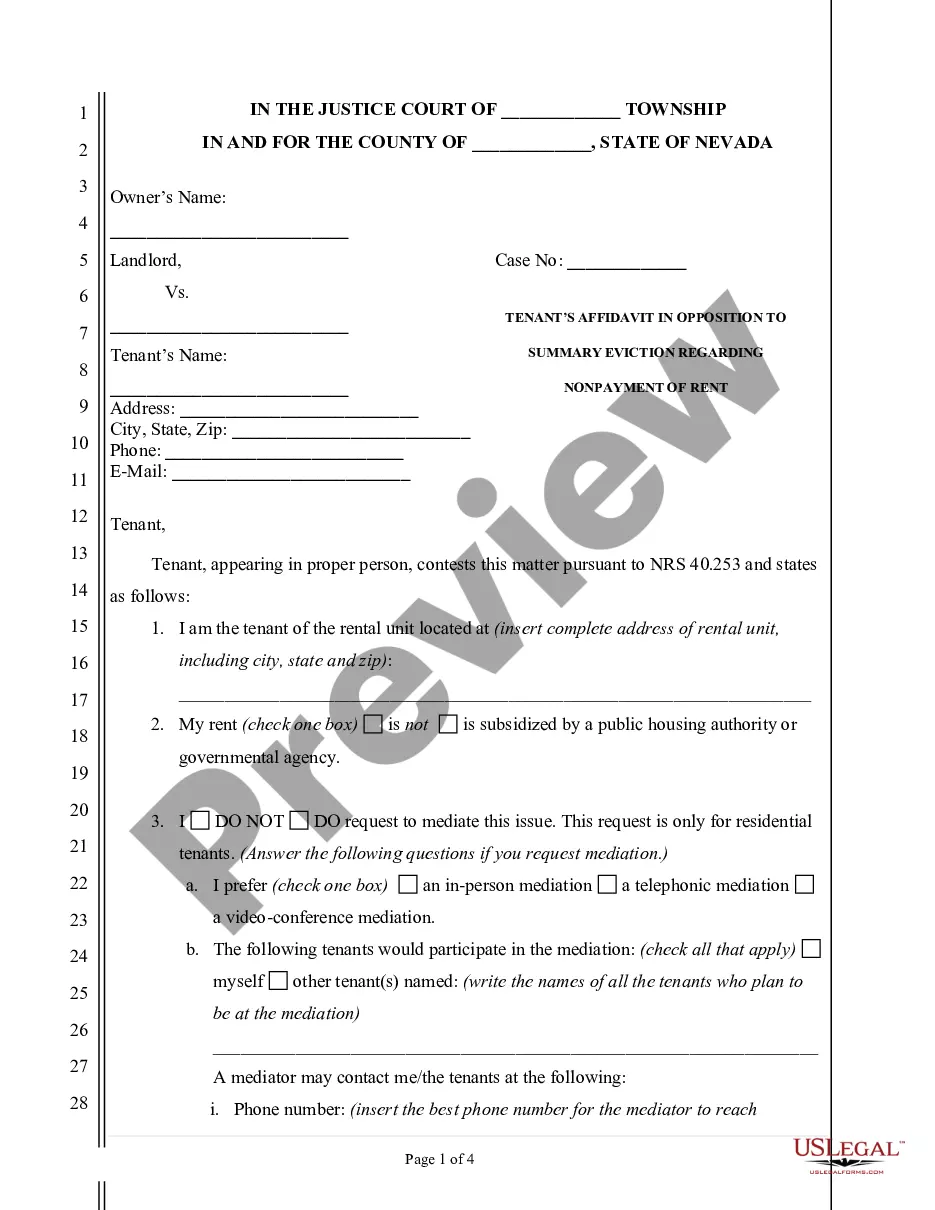

- Take advantage of the Review switch to analyze the form.

- Read the outline to actually have selected the right develop.

- In the event the develop is not what you`re looking for, use the Look for area to find the develop that meets your needs and specifications.

- Once you obtain the appropriate develop, just click Purchase now.

- Opt for the costs program you want, fill in the specified details to create your account, and purchase the transaction utilizing your PayPal or charge card.

- Decide on a convenient data file formatting and acquire your version.

Get all the file layouts you may have purchased in the My Forms food list. You can aquire a additional version of Wisconsin Assignment or Sale of Interest in Limited Liability Company (LLC) anytime, if possible. Just click the essential develop to acquire or printing the file web template.

Use US Legal Forms, the most substantial collection of legitimate types, to conserve efforts and steer clear of errors. The service delivers appropriately created legitimate file layouts which can be used for a range of uses. Generate a free account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

Unlike a corporation in which the directors are tasked with making the decisions, in an LLC, the members (or managers) are the decision-makers. There are two common management structures for LLCs: (1) manager-managed and (2) member-managed.

In a member-managed LLC, members (owners) are responsible for the LLC's day-to-day operations. In a manager-managed LLC, members appoint or hire a manager or managers to run the business. Whoever manages your LLC will be able to open and close bank accounts, hire and fire employees, enter contracts, and take out loans.

Each member has an equal right to manage the LLC's business, unless otherwise stated in the operating agreement. If a dispute arises, the vote of a majority generally rules. Although certain actions can require unanimous consent.

To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail. The member in question of removal may need to get compensated for his share of membership interests.

LLC ownership percentage is usually determined by how much equity each owner has contributed. The ownership interest given to each owner can depend on the need of the limited liability company and the rules of the state where the LLC has been formed.

The term member refers to the individual(s) or entity(ies) holding a membership interest in a limited liability company. The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property. They may or may not manage the business and its affairs.

How to Transfer Wisconsin LLC Ownership Step 1: Review Your Wisconsin LLC Operating Agreement. Many states do not need to file the operating agreement. ... Step 2: Amend the Wisconsin Articles of Organization. ... Step 3: Spread the News. ... Step 4: Obtain a New EIN (optional)

James Publishing, 1995). The owners of an LLC are called ?members.? A member can be an individual, partnership, corporation, trust, and any other legal or commercial entity.