Wisconsin Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

If you want to full, down load, or produce legitimate file web templates, use US Legal Forms, the most important selection of legitimate kinds, that can be found on the Internet. Use the site`s simple and convenient search to find the files you need. Numerous web templates for enterprise and specific functions are categorized by types and suggests, or keywords. Use US Legal Forms to find the Wisconsin Line of Credit Promissory Note with a number of clicks.

In case you are already a US Legal Forms customer, log in in your accounts and click on the Down load button to find the Wisconsin Line of Credit Promissory Note. Also you can gain access to kinds you previously delivered electronically from the My Forms tab of your respective accounts.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for your proper town/nation.

- Step 2. Use the Preview solution to look over the form`s information. Never forget to see the description.

- Step 3. In case you are not happy together with the develop, take advantage of the Look for discipline near the top of the display to find other versions of your legitimate develop template.

- Step 4. Upon having discovered the form you need, click the Get now button. Opt for the pricing program you favor and add your credentials to register to have an accounts.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Find the format of your legitimate develop and down load it in your system.

- Step 7. Complete, edit and produce or signal the Wisconsin Line of Credit Promissory Note.

Each and every legitimate file template you get is your own eternally. You might have acces to each and every develop you delivered electronically with your acccount. Go through the My Forms segment and pick a develop to produce or down load once more.

Be competitive and down load, and produce the Wisconsin Line of Credit Promissory Note with US Legal Forms. There are thousands of expert and condition-particular kinds you can use to your enterprise or specific requirements.

Form popularity

FAQ

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

Statute of limitations in Wisconsin The statute of limitations for open accounts like credit cards and written and oral contracts in Wisconsin is six years under Chapter 893.43. The 10-year statute of limitations applies to promissory notes.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

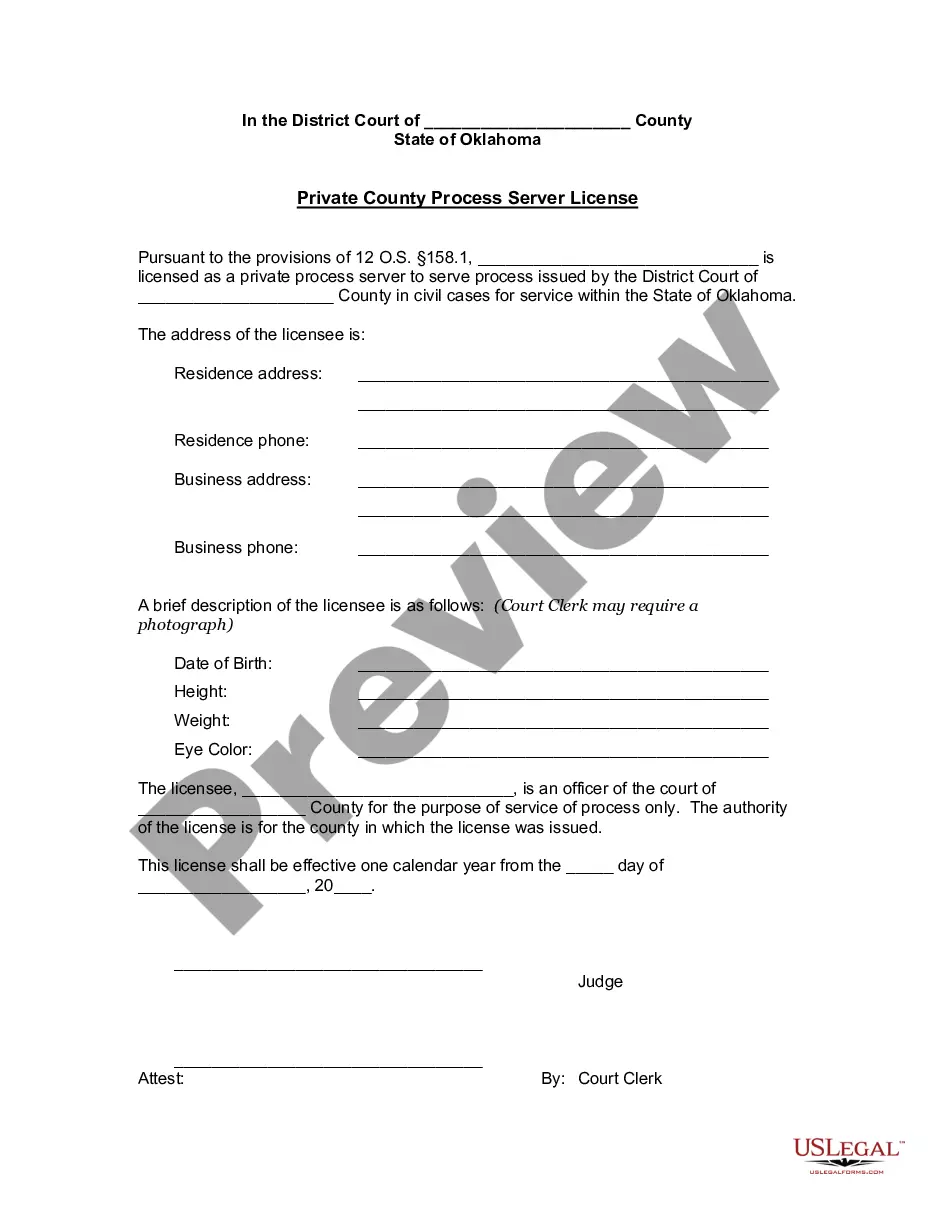

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

Rule #5 - In order to pay off the debt, or what is called "discharging the debt"; all one has to do is write/ (or create) your own certified promissory note (a negotiable instrument under Uniform Commercial Code (UCC) Section 3- 104 paragraph (e)), with your signature on the promissory note in the amount of the ...

If timely payment is not made by the borrower, the note holder can file an action to recover payment. Depending upon the amount owed and/or specified in the note, a summons and complaint may be filed with the court or a motion in lieu of complaint may be filed for an expedited judgment.

Depending on which state you live in, the statute of limitations with regard to promissory notes can vary from three to 15 years. Once the statute of limitations has ended, a creditor can no longer file a lawsuit related to the unpaid promissory note.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.