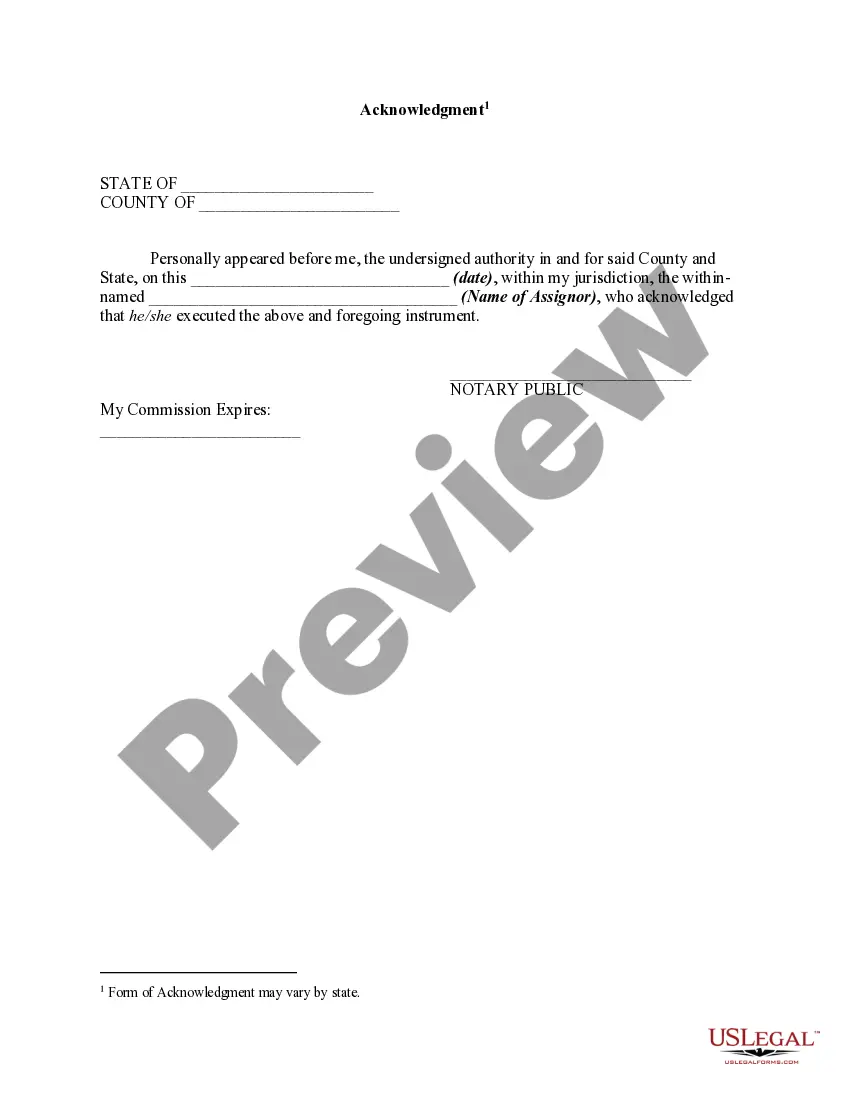

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

You may commit several hours on the web looking for the legal document design which fits the state and federal specifications you want. US Legal Forms provides 1000s of legal forms that happen to be reviewed by pros. You can easily down load or print the Wisconsin Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness from your services.

If you have a US Legal Forms bank account, you may log in and then click the Download switch. Afterward, you may comprehensive, edit, print, or indicator the Wisconsin Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. Every single legal document design you buy is your own property eternally. To obtain yet another backup for any purchased form, visit the My Forms tab and then click the related switch.

If you use the US Legal Forms site the first time, follow the straightforward recommendations below:

- Very first, ensure that you have chosen the best document design to the county/town of your choosing. Look at the form information to make sure you have chosen the correct form. If readily available, use the Preview switch to search with the document design at the same time.

- In order to find yet another model in the form, use the Search area to obtain the design that meets your requirements and specifications.

- Upon having identified the design you desire, click Buy now to carry on.

- Choose the rates strategy you desire, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the transaction. You should use your credit card or PayPal bank account to purchase the legal form.

- Choose the file format in the document and down load it for your system.

- Make adjustments for your document if required. You may comprehensive, edit and indicator and print Wisconsin Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

Download and print 1000s of document web templates utilizing the US Legal Forms Internet site, that offers the biggest assortment of legal forms. Use professional and status-particular web templates to handle your small business or personal requirements.

Form popularity

FAQ

Probate in Wisconsin takes about six months on average. Creditors must be notified, appropriate income tax returns must be filed, and any conflicts must be resolved during the probate process. Creditors have four months from the date of notification to file any claims against the assets.

Wisconsin probate laws require an estate to be settled within 18 months. Generally, some counties in Wisconsin request that an executor settle an estate in 12 months. Executors should work toward completing probate within that time.

A partial distribution, sometimes called a preliminary distribution, is a distribution of some of the trust assets before the trust administration is complete and the trust assets are fully distributed. A trustee is required to complete trust distributions within a reasonable time.

In Wisconsin, the executor must place a class 3 notice in a newspaper published in the settlement county within 15 days of executor appointment, announcing the appointment and notifying creditors that if they wish to make a claim against the estate they have until the deadline set by the court (normally 3-4 months ...

California law does allow creditors to pursue a decedent's potentially inheritable assets.

In Wisconsin, the statute of limitations is six years and begins on the date of the last payment on an account. This also means that if you make a payment on your debt at any time in the six-year span, the clock restarts.

Bank accounts, retirement accounts, and life insurance will automatically transfer an inheritance if beneficiaries are designated. Listing beneficiaries on these accounts can be the easiest and quickest way to transfer those assets outside probate court.

(1) Upon the death of any person having an interest as a joint tenant or life tenant in any real property or in the vendor's interest in a land contract or a mortgagee's interest in a mortgage, any person interested in the property may obtain evidence of the termination of that interest of the decedent by providing to ...