Wisconsin Owner Financing Contract for Home

Description

How to fill out Owner Financing Contract For Home?

Locating the appropriate valid document template can be quite a challenge.

Of course, there are numerous templates available online, but how can you find the valid form you require.

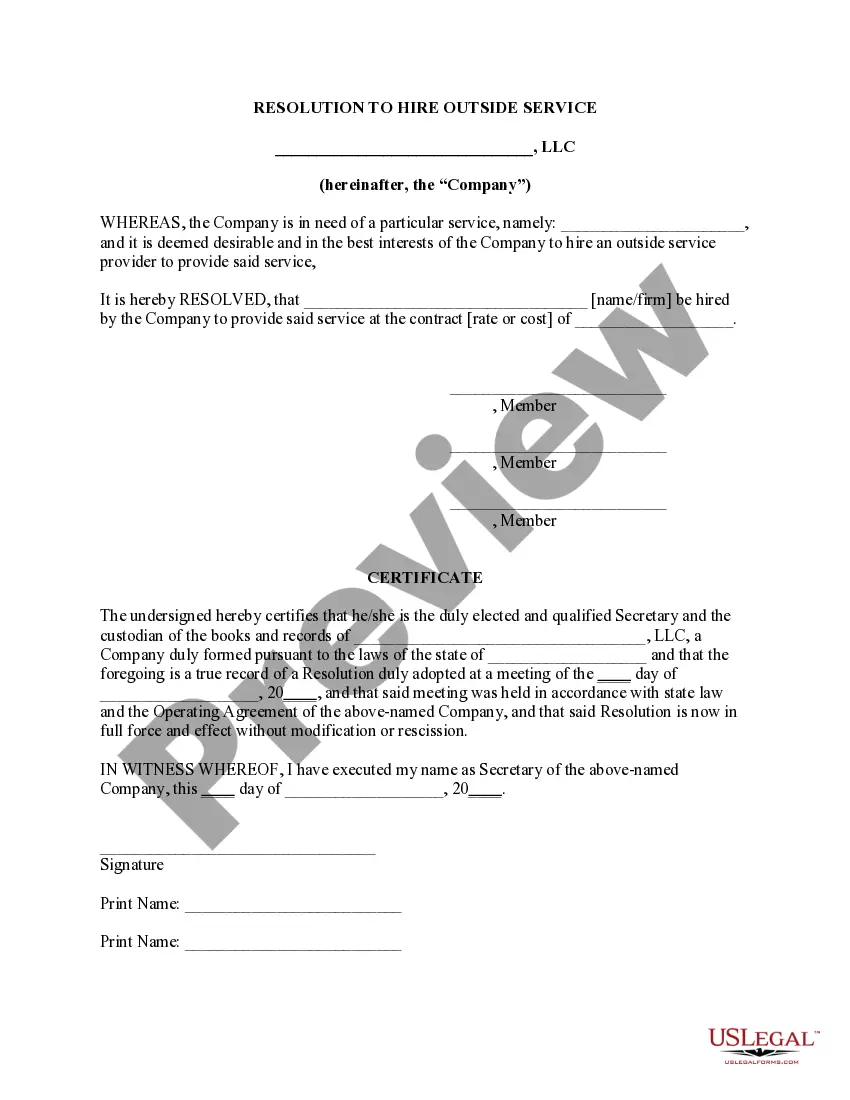

Utilize the US Legal Forms website. This service offers a vast array of templates, such as the Wisconsin Owner Financing Agreement for Home, which can be utilized for both commercial and personal purposes.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Wisconsin Owner Financing Agreement for Home.

- Utilize your account to view the legal documents you have previously ordered.

- Visit the My documents section of your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Review option and read the form details to ensure it is suitable for you.

Form popularity

FAQ

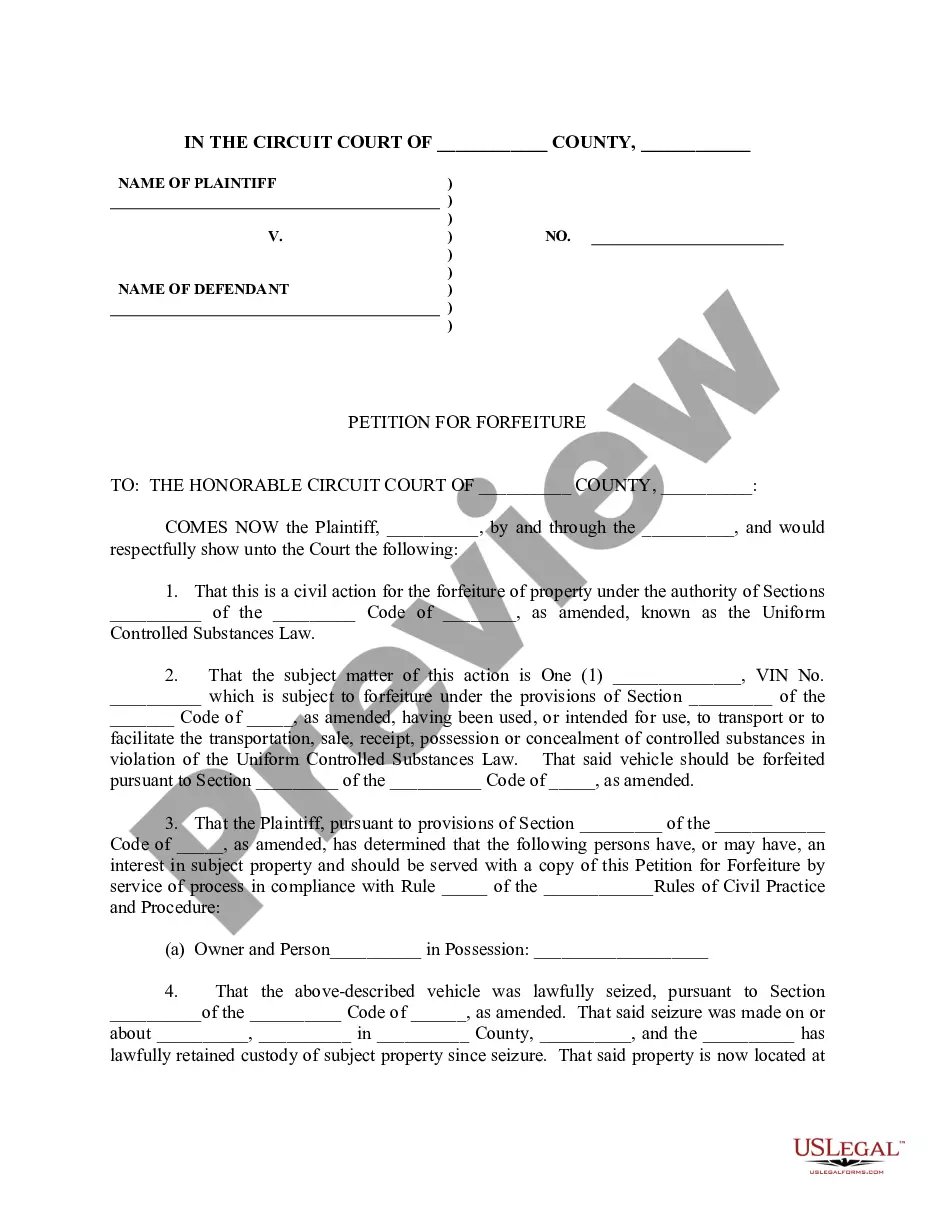

In seller financing, such as a Wisconsin Owner Financing Contract for Home, the seller retains ownership of the deed until the buyer fulfills their payment obligations. This arrangement protects the seller’s investment while allowing the buyer to enjoy the benefits of homeownership. It establishes a clear understanding of ownership rights and responsibilities. For detailed guidance, consider using uslegalforms to draft a solid seller financing agreement.

If a buyer defaults on a Wisconsin Owner Financing Contract for Home, the seller can initiate foreclosure proceedings to reclaim the property. This process may require legal action and can take time, leading to potential financial loss for the seller. It is essential for both parties to clearly outline default terms in the contract to prevent misunderstandings. Utilizing uslegalforms can provide you with resources to draft comprehensive agreements that address these scenarios.

An example of owner financing in a Wisconsin Owner Financing Contract for Home could involve a homeowner selling their property directly to a buyer. Instead of a traditional mortgage, the buyer agrees to make monthly payments over a set term. For instance, if a home costs $200,000 with a 10% down payment, the buyer would finance the remaining balance directly through the seller. This method simplifies the transaction and can offer flexible terms that suit both parties.

In a Wisconsin Owner Financing Contract for Home, the seller typically retains the deed until the buyer fulfills all payment obligations. This arrangement allows the seller to maintain a legal claim on the property, providing security for their investment. Once the buyer completes the payments, the seller will then transfer the deed to the buyer, granting full ownership. This structure helps both parties manage their responsibilities and risks effectively.

Setting up an owner financing contract involves drafting a comprehensive agreement that specifies terms such as the down payment, monthly payment amount, and interest rate. You can use a reliable platform like uslegalforms to access templates specifically for a Wisconsin Owner Financing Contract for Home. This ensures the contract fulfills legal requirements and protects both seller and buyer.

A contract for deed in Wisconsin is a legal agreement in which the seller retains the title to the property until the buyer fulfills payment obligations. This type of Wisconsin Owner Financing Contract for Home allows the buyer to occupy and use the home while making payments. Once the buyer completes the payment terms, the title transfers to them.

The vendor has legal title to the property until the contract is paid in full and then must convey the property by deed to the purchaser. Under Wisconsin law, the seller has conveyed his ownership interest in the property and retains bare legal title as the seller's security interest in the property.

Wisconsin law requires sellers to provide the completed real estate condition report to the buyer no less than ten days after accepting an offer to purchase, but you can certainly provide it earlier. Some sellers provide the condition report to a prospective buyer before even receiving an offer to purchase.

Let's break it down into five simple steps.Step 1: Decide How Much To Offer.Step 2: Decide On Contingencies.Step 3: Decide On How Much Earnest Money To Offer.Step 4: Write An Offer Letter.Step 5: Negotiate The Price And Terms Of The Sale.

A Wisconsin land contract is a legally-binding agreement in which two parties record terms for a real estate transaction involving vacant land.