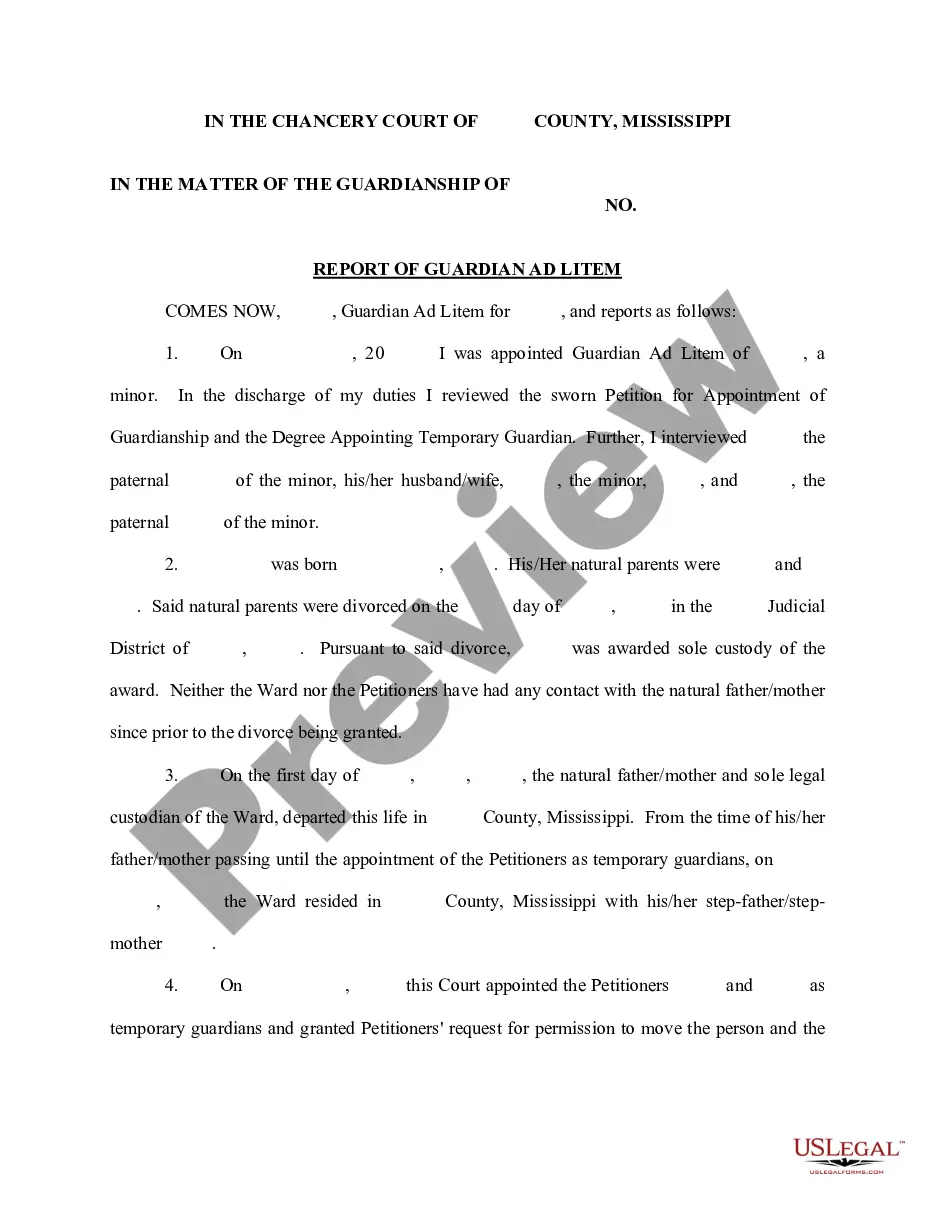

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

Selecting the optimal legal document template can be quite a challenge.

Certainly, there are many templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The platform offers numerous templates, including the Wisconsin Request for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, which can be used for business and personal purposes.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Obtain button to retrieve the Wisconsin Request for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

- Use your account to browse through the legal forms you have obtained previously.

- Visit the My documents section of your account to get another copy of the document you desire.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, make sure you have selected the correct form for the city/state. You can examine the form using the Review option and read the form description to ensure it's the right one for you.

Form popularity

FAQ

In Wisconsin, executors are indeed required to provide an accounting to beneficiaries upon request. This is part of their responsibility to ensure transparency and trust. By utilizing the Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, beneficiaries can effectively request this information. This fosters understanding and helps maintain clear communication regarding the estate's handling.

When a trustee refuses to provide an accounting, beneficiaries have legal options to ensure accountability. They can formally demand documentation through written requests, citing their rights. If necessary, invoking the Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian may be essential. This process helps ensure that the trustee fulfills their legal obligations.

If a trustee fails to provide the required accounting, beneficiaries can take several actions to address this issue. First, they may send a formal written demand, citing their rights for transparency. If the trustee continues to be unresponsive, beneficiaries can pursue the Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian to compel compliance and protect their interests.

Requesting an accounting of an estate generally involves submitting a formal request to the executor or personal representative. Clearly state your relationship to the deceased and your rights as a beneficiary. Using tools and resources available through the Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can guide you through the necessary steps and ensure your demands are heard.

In Wisconsin, a trustee is generally required to provide an accounting within a reasonable time after receiving a demand for it. While there is no strict deadline defined by law, a period of 30 days is commonly considered appropriate. If you feel that the trustee is unresponsive, invoking the Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can be instrumental in enforcing accountability.

To demand an accounting of a trust in Wisconsin, you typically need to submit a written request to the trustee. This request should outline your relationship to the trust, your right to receive information, and specify the required financial details. Utilizing the Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can help streamline this process and ensure your rights are protected.

In Wisconsin, a trustee has a legal obligation to provide a transparent and detailed accounting of the trust's finances. This includes income, expenses, and distributions related to the trust. Beneficiaries can demand this accounting under the Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian. Ensuring proper oversight of trust activities promotes trust and accountability.

Yes, beneficiaries can request an audit if they feel it is necessary for financial transparency. An audit can provide an independent review of the fiduciary's actions and financial management. By filing a Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, beneficiaries can ensure that their assets are managed correctly and that any discrepancies can be addressed promptly.

Yes, beneficiaries are entitled to an accounting as a matter of their rights in fiduciary relationships. This entitlement ensures that beneficiaries can monitor the handling of their assets and verify that their interests are protected. By issuing a Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, beneficiaries can request the necessary financial details to keep informed about their estates.

Guardianship accounting refers to the financial records maintained by a guardian overseeing the affairs of an individual unable to manage their own financial matters. This accounting is essential to ensure that the guardian is acting in the best interest of the ward. A Wisconsin Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian can help beneficiaries access this information, promoting accountability and transparency in guardianship arrangements.