This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

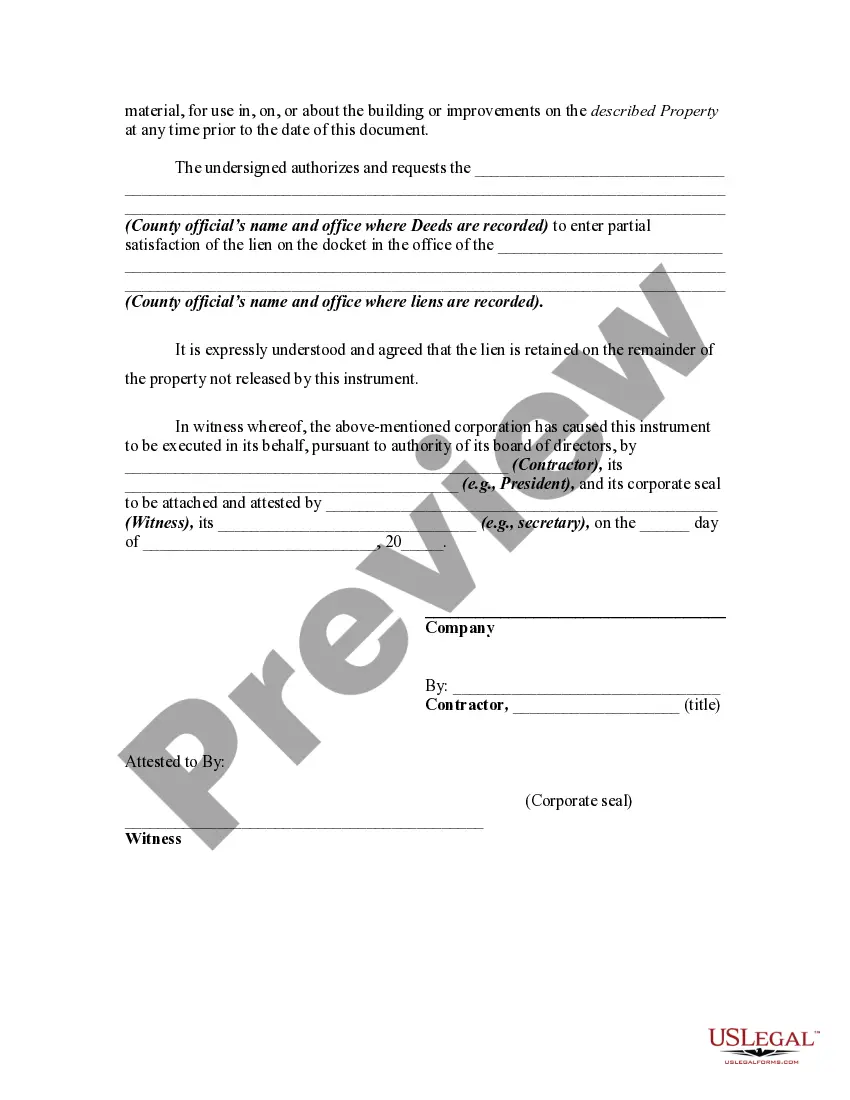

Wisconsin Partial Release of Mechanic's or Construction Lien

Description

How to fill out Partial Release Of Mechanic's Or Construction Lien?

If you wish to comprehensive, down load, or produce legal document themes, use US Legal Forms, the greatest collection of legal types, which can be found online. Use the site`s simple and easy convenient search to find the documents you will need. A variety of themes for business and personal functions are sorted by categories and says, or keywords. Use US Legal Forms to find the Wisconsin Partial Release of Mechanic's or Construction Lien with a number of click throughs.

Should you be already a US Legal Forms customer, log in for your profile and click the Obtain option to get the Wisconsin Partial Release of Mechanic's or Construction Lien. You may also accessibility types you formerly acquired in the My Forms tab of your respective profile.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape to the right city/land.

- Step 2. Use the Review choice to look over the form`s information. Never neglect to read through the information.

- Step 3. Should you be not satisfied together with the develop, take advantage of the Lookup industry towards the top of the display to locate other types from the legal develop format.

- Step 4. Upon having found the shape you will need, go through the Buy now option. Choose the costs plan you choose and put your accreditations to sign up on an profile.

- Step 5. Method the deal. You may use your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Find the file format from the legal develop and down load it on your own system.

- Step 7. Comprehensive, change and produce or signal the Wisconsin Partial Release of Mechanic's or Construction Lien.

Every legal document format you get is yours permanently. You might have acces to every single develop you acquired within your acccount. Go through the My Forms portion and choose a develop to produce or down load again.

Contend and down load, and produce the Wisconsin Partial Release of Mechanic's or Construction Lien with US Legal Forms. There are thousands of expert and status-distinct types you can utilize to your business or personal demands.

Form popularity

FAQ

A Wisconsin construction lien isn't effective forever. After you've filed your lien claim and provided the owner with notice, you have 2 years to enforce the claim, if need be. That means a claimant has 2 years to try and negotiate payment before filing a lawsuit becomes necessary.

Tax liens are involuntary and occur when a homeowner does not pay their federal, state, or local taxes. If this happens, a tax lien is placed against your property. This lien takes priority over all other liens and stays there until the debt is completely paid.

Understanding Mechanic's Lien Priority in Wisconsin Once a lien is properly recorded and enforced, it takes precedence over all other liens, except state and federal taxes, and must be paid in full in order to clear title for the sale or refinancing of the property.

Liens generally follow the "first in time, first in right" rule, which says that whichever lien is recorded first in the land records has higher priority than later recorded liens. For example, a mortgage has priority over a judgment lien if the lender records it before the judgment creditor records its lien.

Wisconsin's construction lien law gives contractors, subcontractors, laborers, and material suppliers the right to file construction liens against the property they have worked on if they are not paid. Placing a lien on a property is one way in which payment can be collected.

In Wisconsin, lien waiver requirements differ from those set by the federal government in that lien waivers must be signed by all parties, copies must be sent to the local government within ten days of payment, and the property owner must provide a lien waiver statement to document any payments and associated dates.

Usually, liens will be paid ing to when each lien holder recorded their lien; the first person to have recorded their lien will be paid first, and so on. However, other lien types, such as property tax liens, may take priority regardless of when they were recorded.

Wisconsin's construction lien law gives contractors, subcontractors, laborers, and material suppliers the right to file construction liens against the property they have worked on if they are not paid. Placing a lien on a property is one way in which payment can be collected.